High Yield Weekly Minutes: Government Shuts Down, High Yield Shrugs It Off (October 6, 2025)

A Brief Recap of Last Week’s High Yield Market Performance

🚨 Connect on Twitter | Threads | Instagram | YouTube

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list — limited spots.

The government shut down. Payrolls got delayed. High yield? Posted its fifth consecutive week above $10 billion of issuance while delivering +0.23% returns.

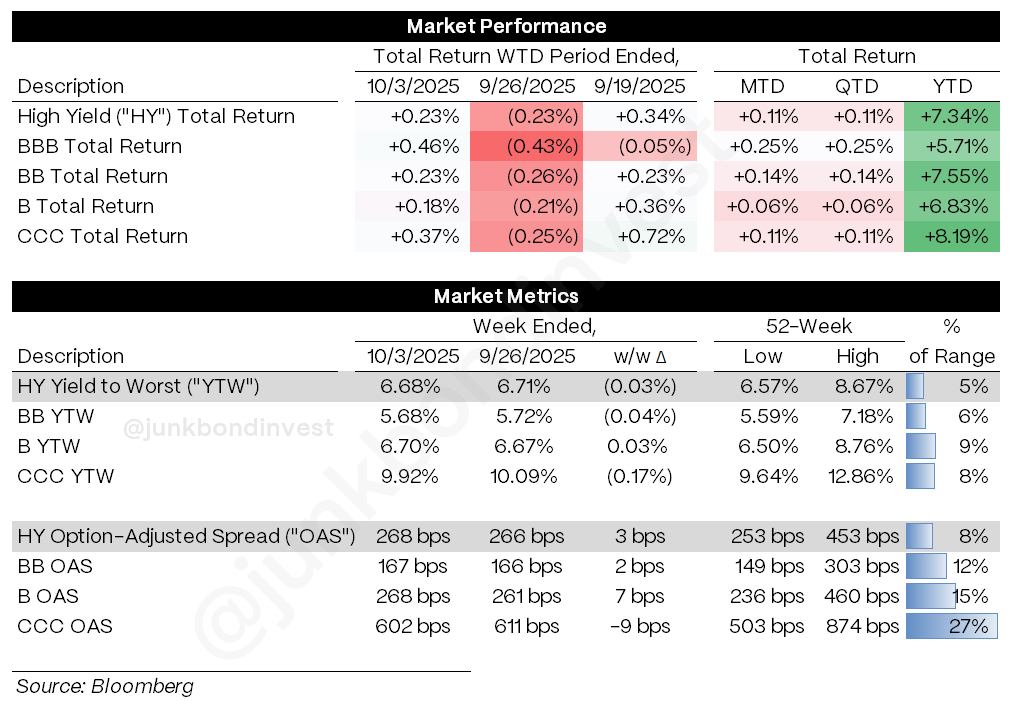

The market absorbed $11.2 billion across 14 deals in a front-loaded week that wrapped before Yom Kippur and the shutdown took hold. Yields ticked 3bps tighter to 6.68% while spreads widened 3bps to 268bps. Last week’s -0.23% loss got completely erased despite Washington falling apart.

Two stories are dominating every conversation: First Brands filed for Chapter 11, sending auto suppliers with similar off-balance sheet financing into freefall. And the Electronic Arts $55 billion LBO keeps generating more questions than answers. If you missed my weekend piece breaking down EA’s controversial bond defeasement debate, read it here.

Beyond those individual names, sector dispersion came roaring back. Communications rallied several points while packaging and financials collapsed. Cyclicals getting crushed, defensives holding firm. The VIX spiked to a two-month high yet overall spreads barely moved. When sectors are moving 5-10 points in opposite directions, you better know what you own.

Weekly Performance Recap

Overall HY delivered +0.23%, exactly reversing the prior week’s decline. The quality rotation continued its recent pattern:

CCCs led at +0.37%, rebounding from previous weakness to push YTD returns to +8.19%

BBs gained +0.23%, matching the index with YTD performance of +7.55%

Bs returned +0.18%, slightly lagging but maintaining strong YTD gains of +8.83%

CCC spreads tightened 9bps to 602bps while yields fell 17bps. Notably, yields now sit below 10% again, closing at 9.92%. The CCC move matters because it signals risk appetite returning after last week’s pullback. When the lowest-quality paper leads and yields break back under 10%, investors are chasing again.

Primary Market Activity

Fourteen issuers priced USD$11.2 billion with some notable issuances last week:

Viking Cruises led the week with $1.7 billion of Ba3/BB senior unsecured notes at 5.9%, pricing at par and trading slightly better in secondary. The leisure sector continues finding strong demand despite macro headwinds.

ION Platform brought the week’s most complex structure with $1.5 billion across multiple secured tranches. The package included $875 million of USD notes at 8.0% plus EUR 500 million at 6.5%, all pricing in line with guidance and holding par in aftermarket trading.

The calendar wrapped by Wednesday with most issuers pricing Monday through Wednesday morning. Nobody wanted to sit through a potential extended shutdown. Execution quality stayed strong across the board, with deals pricing at or inside initial guidance and trading flat to better in secondary.

Secondary Market

The sector moves were extreme by any measure. Communications credits dominated gainers, with multiple bonds up 2-5 points on M&A speculation and operational updates. As for the underperformers:

Packaging collapsed as Multi-Color (LABL) bonds dropped double digits. Consumer-exposed packaging is seeing real demand weakness combined with upcoming maturities.

Financials weakened across the board. Pagaya bonds hit new lows around 90. Goeasy and other consumer finance names followed lower.

Office Properties Income Trust entered grace on its 2027 and 2029 bonds, with Nasdaq delisting coming and credit agreement defaults potentially following.

Looking Ahead

The government shutdown creates an unusual data void heading into the critical October FOMC meeting in two weeks. Without September payrolls, the Fed will rely more heavily on alternative data sources and private sector indicators to assess labor market conditions.

What we do know from pre-shutdown releases paints a concerning picture:

JOLTS showed job openings falling below unemployed workers, confirming demand weakness

ADP reported a 32K decline in private sector employment for September

ISM Services activity dropped to contraction levels, the lowest since the pandemic

Manufacturing remained in contraction for the sixth consecutive month

The macro crosscurrents pose interesting questions for credit markets. Consumer resilience appears to be fading as uncertainty takes its toll, yet layoffs remain contained. The labor market sits in a “no hire, no fire” dynamic that could shift quickly in either direction.

Tariff uncertainty continues building with new announcements on pharmaceuticals, semiconductors, and lumber adding to the existing patchwork. The Supreme Court will rule on challenges to over half of current tariffs in coming months, creating some binary risk around trade policy.

For high yield specifically, the sector rotation suggests investors are shifting toward defensive positioning. The underperformance in cyclicals like packaging, autos, and consumer finance relative to communications and food indicates growing caution about demand trends heading into year-end.

This week’s calendar remains uncertain given the shutdown’s impact on data releases. Trade balance and consumer credit may or may not publish as scheduled. The market will likely lean more heavily on corporate earnings and guidance as Q3 results begin flowing.

High yield ignored Washington completely. With First Brands fallout potentially spreading and the EA deal dominating every conversation, investors have bigger things to worry about than a temporary data blackout. The sector dispersion is back, and it’s separating those paying attention from those riding index beta.

Find the most recent JunkBondInvestor posts below

Continue the discussion on Reddit at r/leveragedfinance.

Disclosure: The information provided is based on publicly available information and is for informational purposes only. While every effort has been made to ensure the accuracy of the information, the author cannot guarantee its completeness or reliability. This content should not be considered investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release the author from any liability. Always seek professional advice tailored to your financial situation and objectives.