Dye & Durham ($DND): Legal-Tech Utility or Broken Roll-Up?

A credit investor’s guide to the debt stack everyone is watching

🚨 Connect: Twitter | Threads | Instagram | Reddit | YouTube

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list (limited spots).

Nobody knows what Dye & Durham actually does.

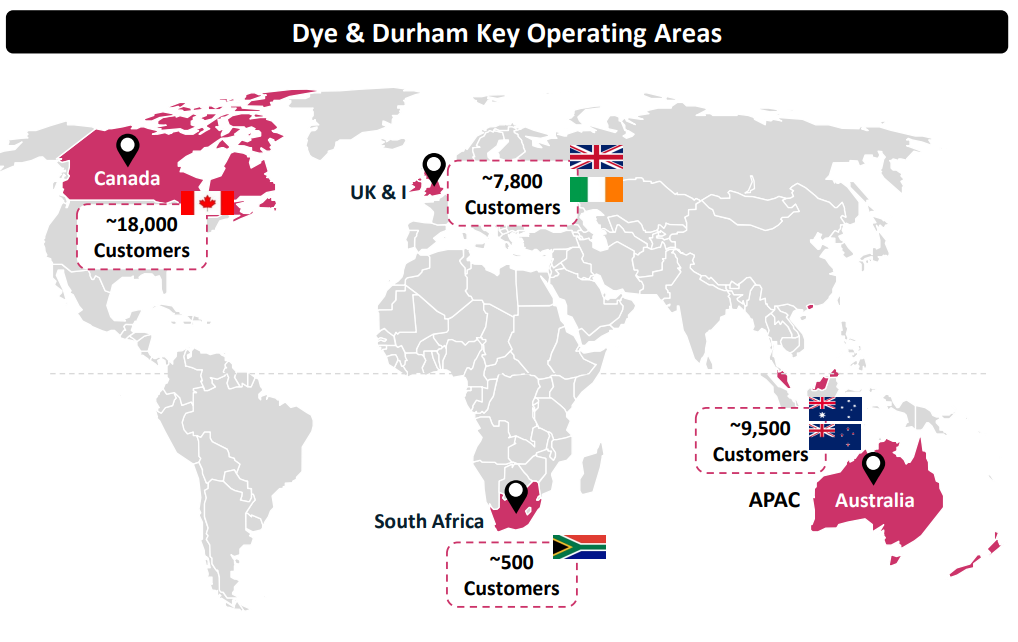

That’s the first problem. You mention DND to most people and they think it’s some government agency or a chemical company. But this is a legal software outfit out of Toronto that’s been on a buying spree for years, gobbling up law firm software companies across Canada, the UK, and Australia.

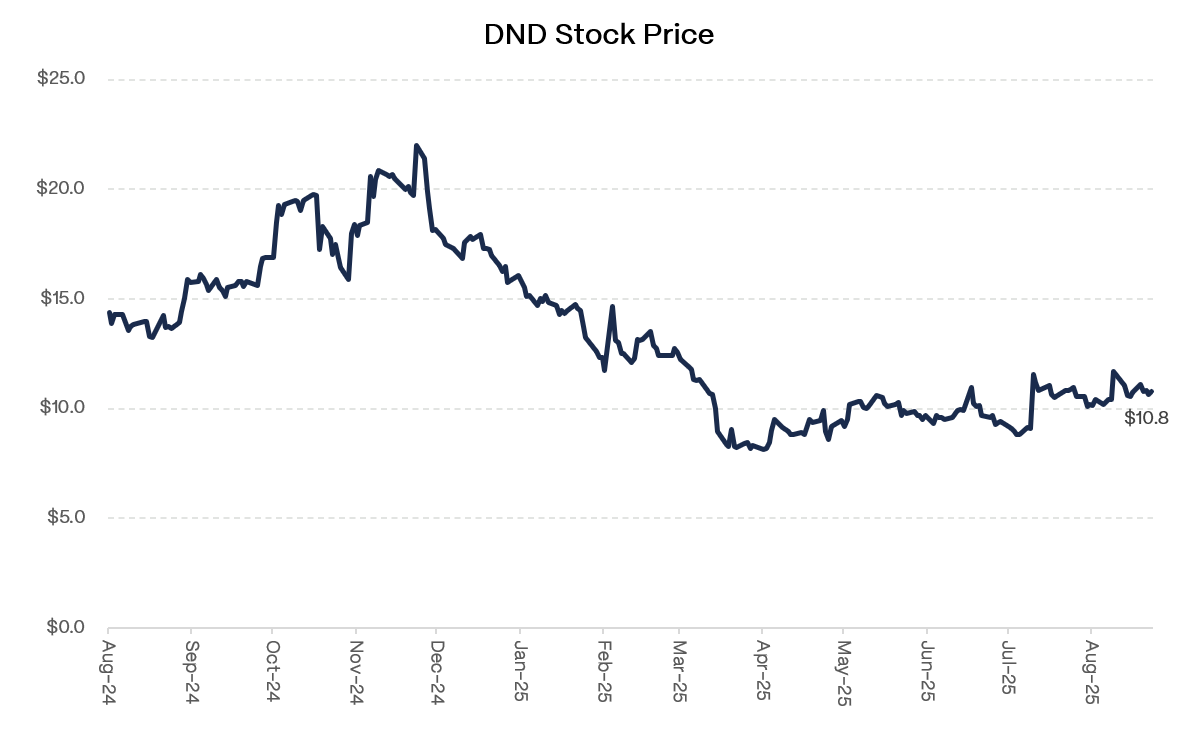

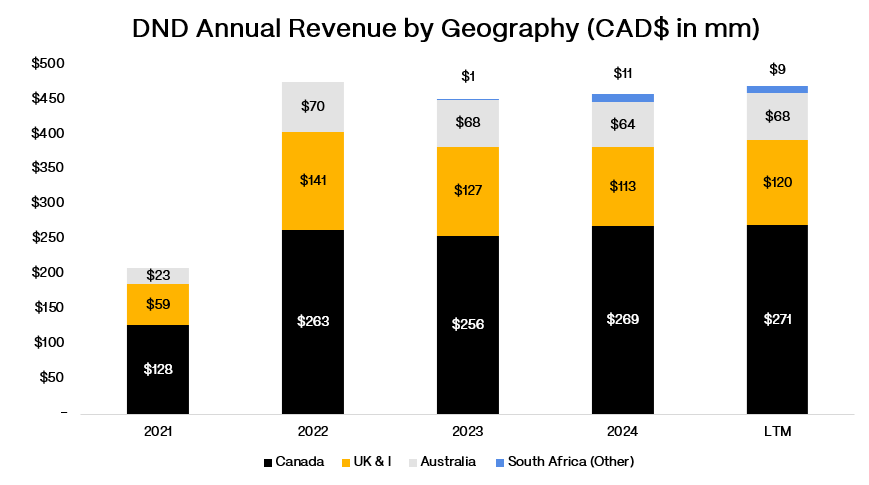

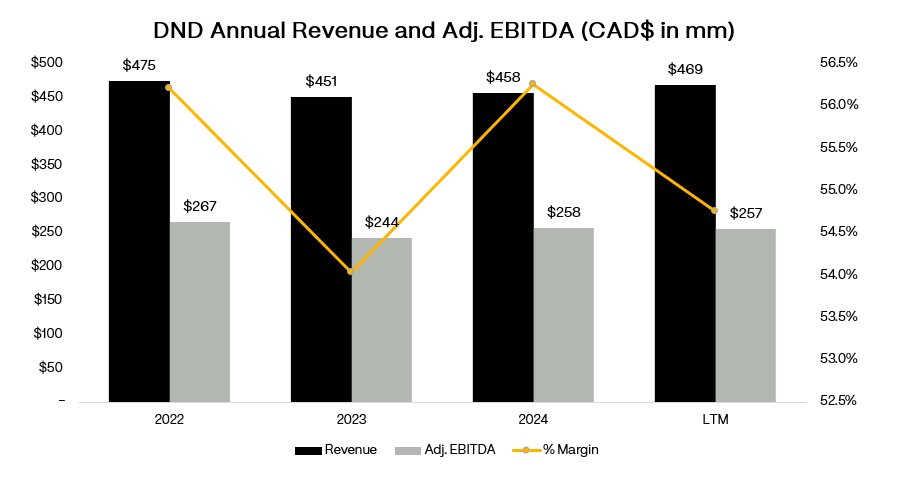

They’ve done 22 acquisitions since 2020! TWENTY-TWO! The balance sheet is now sitting on ~C$1.6 billion of debt against ~C$250 million of EBITDA, while the stock limps along at ten bucks, just above their $7.50/share IPO price.

DND is a story about what happens when you prioritize Wall Street over Main Street. They’ve been so busy doing deals and managing leverage ratios that they forgot about the fundamentals, using financial engineering to masquerade as growth. And now? Well, their revenue is tied to real estate transactions… you know, that market that’s been getting hammered by interest rates. When lawyers aren’t closing deals, they’re not using DND’s software as much. Pretty simple.

The Canadian Competition Bureau is also investigating them for anti-competitive practices. Because when you own most of the conveyancing software in a market, people start asking questions. This is the natural evolution of roll-up strategies…you buy everything in sight until someone says “wait a minute...”

Still, there’s probably a decent business buried in there somewhere. Legal software for law firms is not a bad business. Lawyers need technology, they’re not price-sensitive, and once they’re using your system they don’t want to switch. But instead of building an organic growth machine, they turned it into a financial engineering exercise.

That’s what makes DND interesting for credit. The equity is stuck, activists are circling, and regulators are probing. Yet the company still throws off nearly ~C$200 million of unlevered FCF. Credit investors don’t need to believe in the software vision, they just need to underwrite the debt stack, the cash flows, and the refinancing path.

Which leaves credit investors with the only question that matters: is this a levered utility that survives, or the next broken roll-up that cracks at the refinancing wall?

I. Situation Overview:

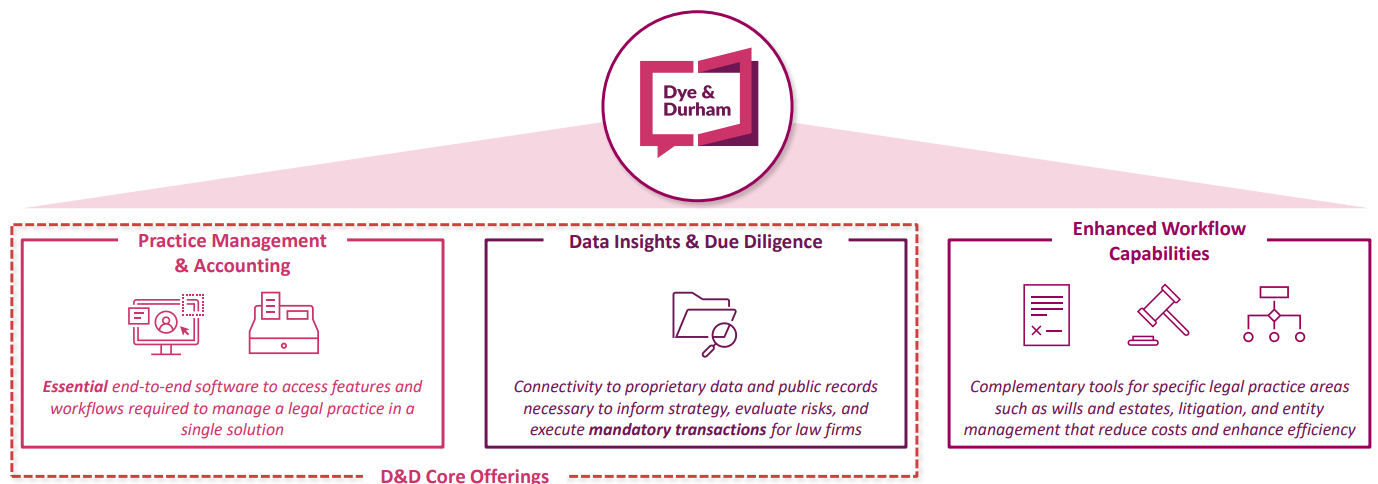

Dye & Durham was sold as a legal-tech utility: software law firms need to file mortgages, corporate registrations, and court documents. Think of it as the plumbing behind real estate deals and corporate transactions. When a lawyer registers a property transfer or searches title records, they are probably using DND’s portals tied into government databases and financial institutions.

The pitch was simple: recurring demand, high margins, and predictable cash flow. Law firms cannot function without this software. Once wired in, switching was painful. It looked like the kind of business that should print money, boring, essential, and sticky.

Since its 2020 IPO, the company has spent ~C$2 billion on acquisitions across Canada, the U.K., Ireland, and Australia. The strategy was classic roll-up: buy fragmented vendors, strip costs, and push everything through the Unity platform. On paper it made sense. In practice it created a patchwork of systems branded as one product but never fully integrated.

The flaw was obvious: ~50% of revenue is tied to property transactions. When Canadian and U.K. housing volumes slowed as rates rose, DND’s growth story cracked. EBITDA margins that once topped 60% slid into the mid-50s, cash conversion weakened, and the roll-up math became challenging.

Regulators piled on. The U.K. Competition and Markets Authority forced DND to unwind the £91.5m acquisition of TM Group, selling it two years later for ~£50m upfront plus an earnout. In Canada, the Competition Bureau opened an investigation into DND’s conveyancing practices. Instead of synergies, the company ended up fighting inquiries and selling assets under pressure.

Customer stickiness also eroded. Renewal cohorts that once renewed automatically now require negotiation. In 3Q’25, gross retention was 85%, rising to 90% only after discounts and bundled giveaways. Small firms have already defected to rivals like Closer and Realty Web. What was once sticky is now negotiable.

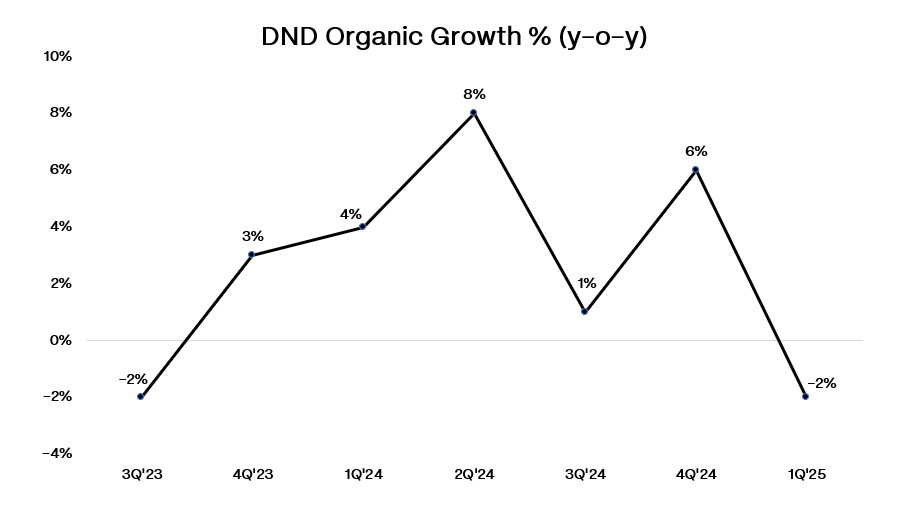

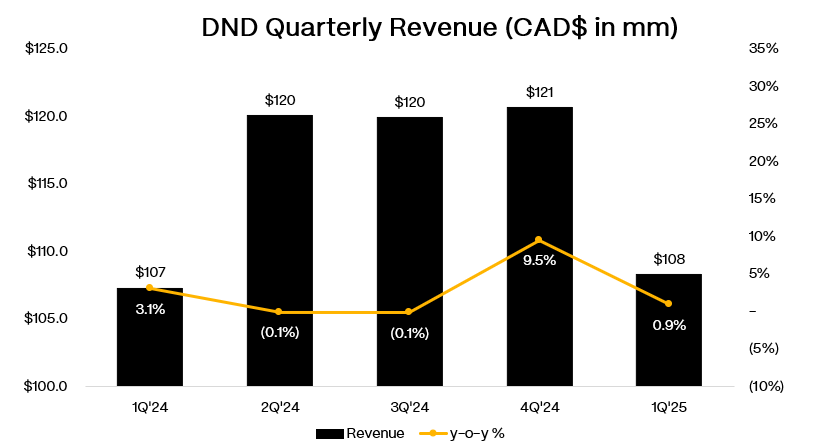

Financials reflect the pressure. In 3Q’25 (i.e., March 31, 2025), revenue was C$108m, up 1.0% y/y but that’s due to acquisitions. Organically, revenues were down -2.0% y/y, whereas Adj. EBITDA was down 7.5% y/y.

Management and governance have been equally unstable. Four CEOs rotated in six months. Whistleblower complaints alleged directors pressured finance to misstate results. Activists control the board. Former CEO Matt Proud’s vehicle Plantro (12% stake) has floated C$20 per share bids while simultaneously selling stock. Advent International and others were also reported to have circled. Yet with no binding offer or financing package, the equity trades well below those levels. The board is now on its third strategic review in two years.