Fossil Group ($FOSL): Baby Bond Hostage Crisis

A dying watchmaker forces retail bondholders to fund new money or face a UK cramdown.

🚨 Connect: Twitter | Threads | Instagram | Reddit | YouTube

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list (limited spots).

Ever wonder what happens when a dying watch company holds retail bondholders hostage? You’re about to find out.

Fossil Group is running one of the most brazen coercive debt exchanges in recent memory, and they’re doing it with $25 par baby bonds that trade like normal stocks but pack the legal complexity of leveraged finance.

Here’s the setup: participate in our debt restructuring, fund new money, or we’ll drag you through a UK court proceeding.

No negotiation. No mercy.

Just financial hardball disguised as a “Transaction Support Agreement” with 59% of bondholders already locked in.

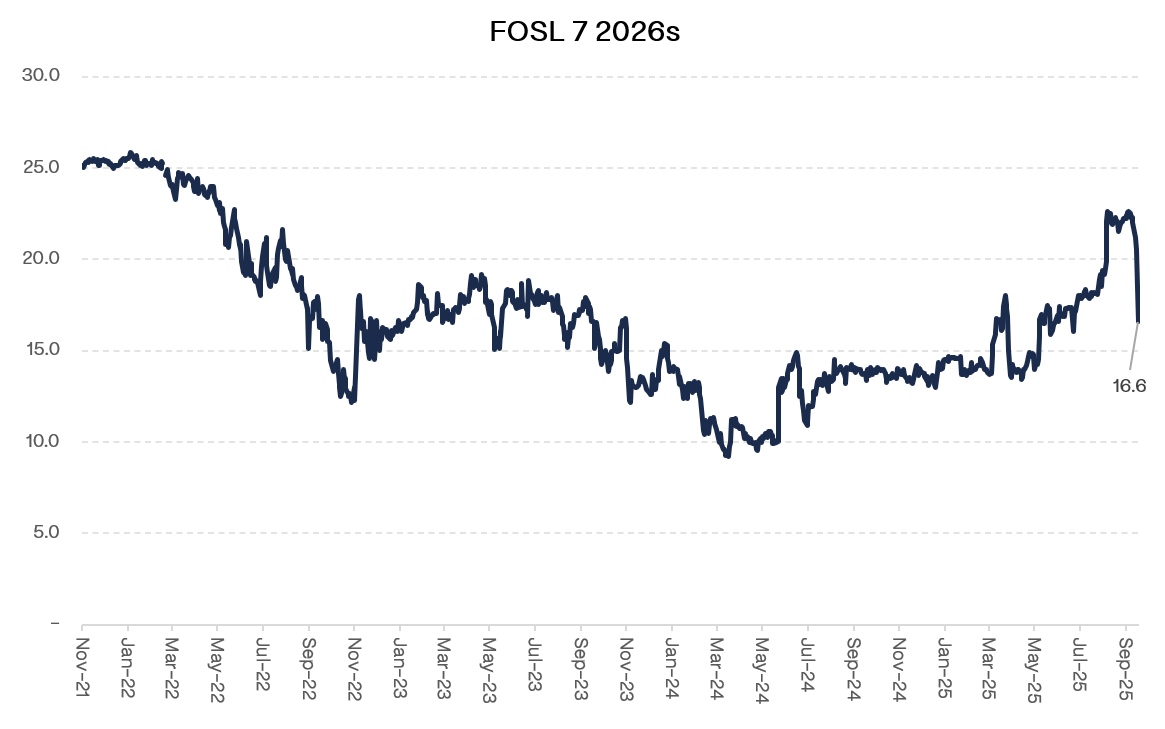

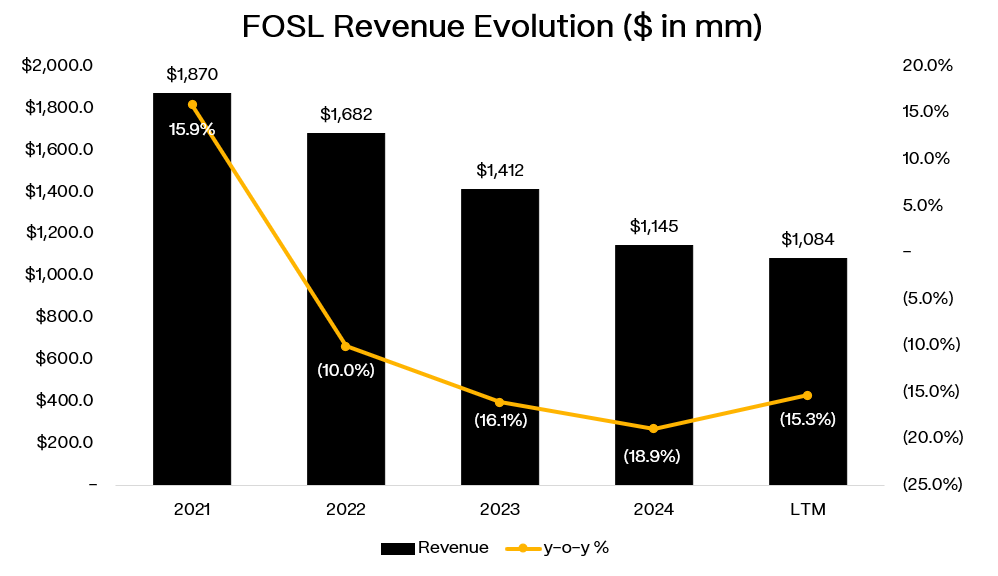

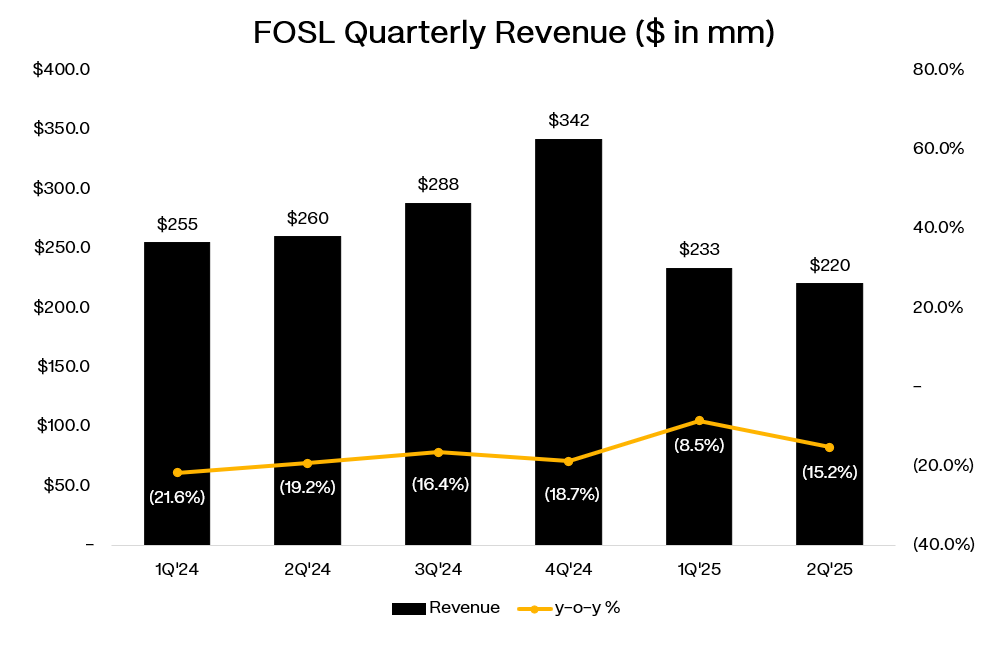

The bonds are trading at $16.6 on $25 par…that’s 66 cents on the dollar for a company whose revenue has collapsed from $1.6 billion to barely over a billion while Apple owns everyone’s wrist.

Management’s turnaround plan?

Nick Jonas as brand ambassador. Because nothing says “heritage timepieces” like a Jonas Brother.

But forget the failing business model. The real story is the exchange mechanics that are about to determine whether retail bondholders get 30 cents or 100 cents on their investment. Fund your pro rata share of new money and get First-Out secured notes. Don’t fund it and get shoved into Second-Out subordinated paper. Hold out entirely and face a UK Companies Act cramdown that forces the deal whether you like it or not.

The math is confusing, the timeline is short, and most retail investors have no idea what they’re really being asked to do. At 66 cents on the dollar, are these bonds cheap or expensive? That depends entirely on understanding the restructuring mechanics, the realistic enterprise value of a melting ice cube, and whether you’re willing to throw good money after bad.

Time’s running out to figure it out.

I. Situation Overview:

Fossil was never Rolex. It was a mid-market fashion watch company that struck gold licensing names like Michael Kors, Armani, and Diesel, then selling them at scale in department stores. For a while, the model worked. A Fossil watch looked like a luxury accessory, cost a fraction of the price, and margins were fat. At its peak, Fossil was the place at Baselworld to grab lunch and watch them print money off handbags-turned-watches.

Then Apple showed up. The smartwatch killed Fossil’s core demographic, and the kids who used to buy $200 fashion watches started saving for Rolex, Omega, or Swatch x Omega collabs. The whole “affordable luxury” positioning collapsed. Fossil tried to fight back with its own connected watch line and a pile of brand extensions, but none of it stuck.

Revenue slid from $3.5bn in 2014 to barely $1bn today. The once vibrant culture devolved into cost cuts, store closures, and license renegotiations at higher royalty rates. Although royalty rates remain elevated, Fossil has negotiated modest reductions in minimum guarantees in 2025 and expects more meaningful relief in 2026.

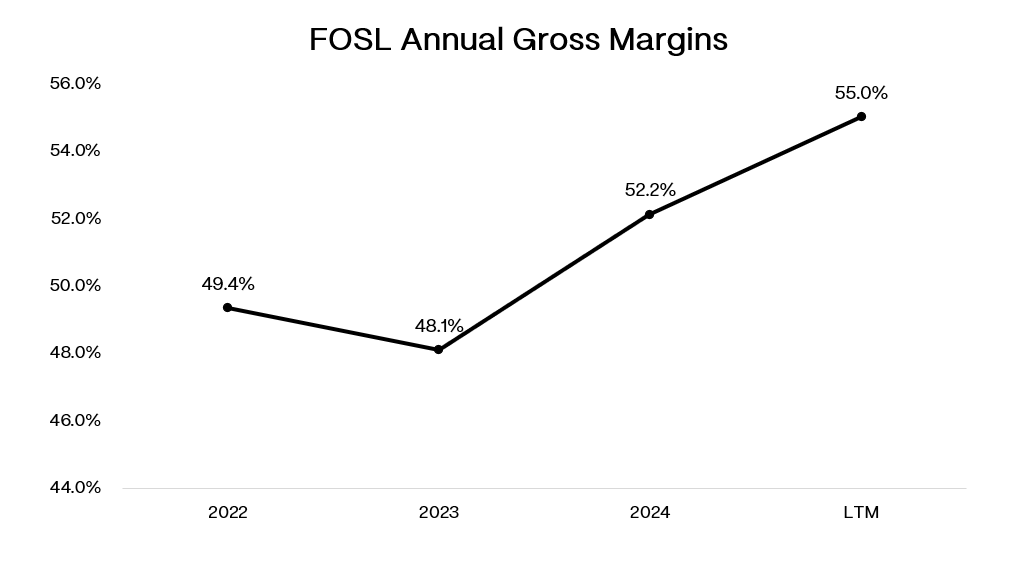

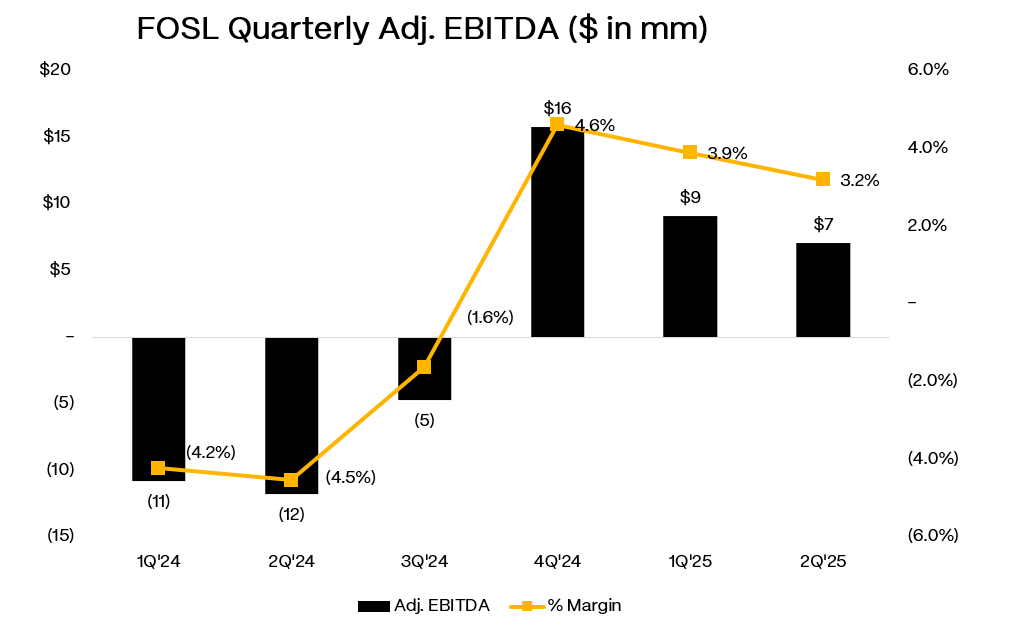

The past two years have been about triage. New management launched a turnaround plan: shrink the store base, slash SG&A by $100mm, and refocus on core brands. They shifted to full-price selling, cutting back on perpetual promotions that destroyed gross margins. It worked. Gross margins hit 57.5% in Q2’25, up nearly 500bps y/y, the best levels in a decade and the third straight quarter of expansion. Inventory is leaner, the wholesale channel is functioning, and some collabs like Minecraft, Superman, and Shelby even sold out online. They have rolled out “store of the future” pilots and hired Nick Jonas as a brand ambassador, hoping to reintroduce Fossil to younger consumers.

But top-line erosion has not stopped. Net sales were down 16% y/y (constant currency) in 2Q’25 to $220mm. By region, the Americas fell 20% and remain the weakest link, while Europe showed early signs of stabilization (-2% constant currency in Q1’25) and Asia’s declines narrowed modestly. Management raised full-year guidance, but “less bad” is the story. Sales will still decline mid-teens this year, helped along by another 45-50 store closures.

EBITDA is positive, but barely: $7mm in Q2, a measley 3% margin. Even in a so-called stabilized scenario, EBITDA runs $20-30mm, too thin to comfortably service the capital structure.

That is why the debt exchange was unavoidable. In August 2025, Fossil signed a Transaction Support Agreement with about 59% of noteholders to push maturities from 2026 to 2029. The deal requires bondholders to fund $32.5mm of new money into 9.5% First-Out secured notes, with equity warrants as a sweetener. If you do not put up cash, you get subordinated Second-Out notes. If less than 90% tender, Fossil will drag everyone through a UK Companies Act cramdown that forcibly cancels the old notes. Either way, the unsecureds are gone.

So Fossil has bought itself time. Liquidity is stable at $110mm cash plus the new $150mm ABL, though actual availability is only ~$46mm with $15mm drawn at launch. Gross margins are healthier, SG&A cuts are real, and minimum royalty relief provides some near-term breathing room.

But the revenue base keeps shrinking, the Americas remain weak, royalty obligations are still heavy, and the fashion watch category is structurally impaired. The story now is whether a declining, low-margin brand can keep shrinking gracefully enough to cover its new capital structure.