Sotherly Hotels ($SOHO) Distressed Preferreds: Still Paying, Somehow

A small-cap REIT tries to refinance its way out of a corner

🚨 Connect: Twitter | Threads | Instagram | Reddit | YouTube

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list (limited spots).

The preferred shares trade at 45 cents on the dollar. That’s all you need to know about Sotherly Hotels, but here’s the story anyway.

They just cut earnings guidance in half. Management blames government spending cuts and tariff fears. Because hotels were packed before DOGE showed up, right?

The stock trades under a dollar. They need a reverse split to stay on NASDAQ. But here’s the kicker: they owe $22 million in back dividends to preferred shareholders while somehow still making current payments. Make sense of that.

The real problem is simple. They borrowed cheap money to buy hotels. Now money isn’t cheap. Every property is leveraged to the hilt. When rates double, the math stops working.

And the travel business changed while they weren’t looking. Business trips became Zoom calls. Leisure travelers found Airbnb. Government contracts got slashed.

Sotherly’s brilliant solution? Refinance the few properties that aren’t already maxed out.

Management says they have a plan. The market says otherwise.

I. Situation Overview:

Sotherly Hotels is a highly levered, small-cap lodging REIT that owns ~2,800 rooms across 10 hotels in Southeastern and secondary U.S. markets under Hilton, Hyatt, and Marriott flags. This is not a portfolio of trophy assets. It is Savannah, Wilmington, Jacksonville, Arlington, Atlanta, Tampa, Philadelphia Airport, and Houston. The model worked in a low-rate world. Occupancy and group business were stable, cash was paid out as dividends, and leverage was tolerated.

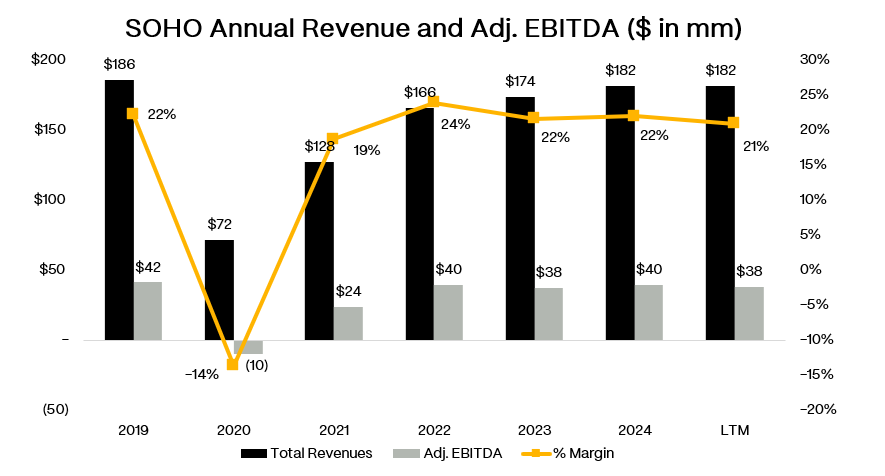

COVID broke that model. EBITDA collapsed, distributions were suspended, and the company survived only through lender forbearance and liability management. Since then, EBITDA has recovered to ~$38mm, close to pre-pandemic levels of ~$42mm.

But occupancy remains 2-3 points below 2019 across the portfolio, and margins are structurally lower due to labor, insurance, and tax inflation. The stronger assets like Wilmington, Arlington, and Savannah produce decent cash. The weaker assets (Georgian Terrace in Atlanta, Whitehall Houston, and Laurel) drag consolidated results.

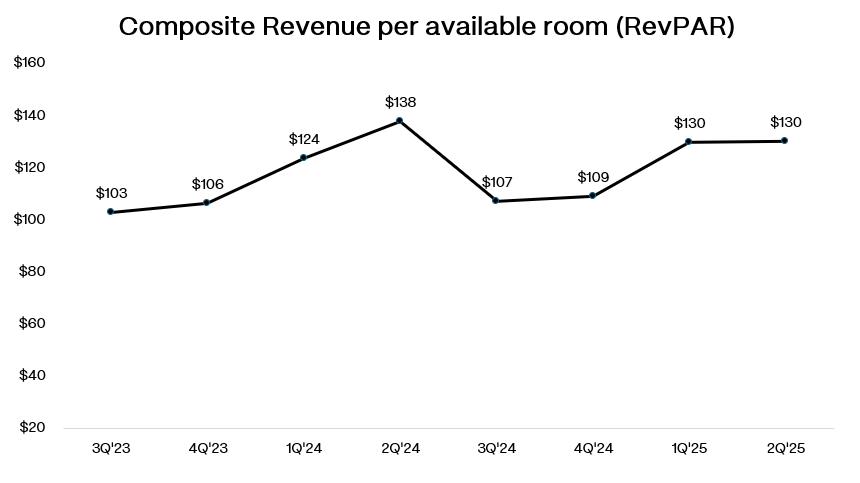

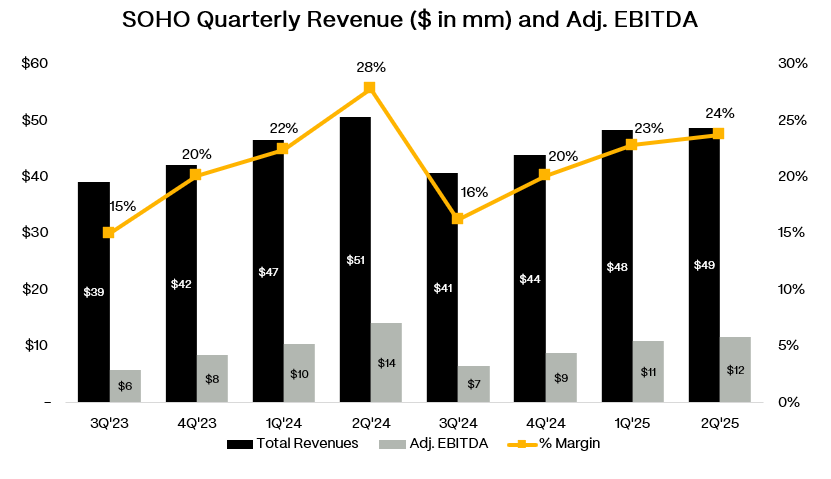

The cracks are now showing up. ADR growth flattened, leisure travel peaked, and government-related business dropped off. Spending cuts hit not only Washington but also Savannah, Atlanta, and Jacksonville, where associations tied to federal dollars pulled back. Tariff uncertainty pressured corporate travel. Inflation kept consumers cautious. In Q2’25, RevPAR fell 5.4% y-o-y, EBITDA dropped 11.5%, and FFO guidance was cut again.

Then came the hurricanes. Hotel Alba in Tampa took flood damage from Hurricane Helene in late 2024. Elevators were out for months. Insurance proceeds made EBITDA appear “whole” but the operational hit exposed how vulnerable this portfolio is to climate risk. At the same time, $20mm+ of PIPs in Jacksonville and Philadelphia are underway as part of new Hilton franchise agreements, pulling liquidity when cash generation is weak.

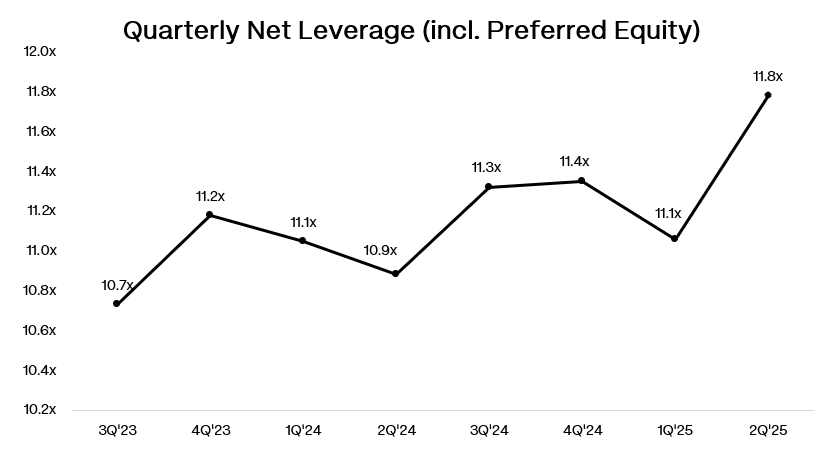

The balance sheet is the real problem. Sotherly carries ~$330mm of secured mortgage debt (pro forma) plus $24mm of finance leases. In addition, 3 series of preferred equity add another $99mm to the overall balanace.