High Yield Weekly Minutes: The Fed Finally Delivered...And Smart Money Printed $12bn to Celebrate (September 22, 2025)

A Brief Recap of Last Week’s High Yield Market Performance

🚨 Connect on Twitter | Threads | Instagram | YouTube

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list — limited spots.

Well, that was easy.

The Fed delivered its telegraphed 25bp cut to 4.00-4.25% last Wednesday, and high yield responded exactly as the technicals predicted. Spreads crushed 8bps tighter to 262bps while yields plunged to 6.58%, the lowest level since April 2022. Not exactly what you’d call a surprise.

At the same time, CCCs roared back to life, posting +0.7% weekly returns and reclaiming their position as the market’s risk leaders after last week’s defensive rotation. The reversal was swift and decisive, with the riskiest credits surging as investors abandoned quality bias and raced back into maximum beta plays. CCC yields dropped below 10% for the fifth time in three weeks, demonstrating just how aggressively risk premiums have compressed.

The primary market responded with explosive volume, absorbing $12 billion across 15 deals in the fifth-largest weekly supply of 2025. From Lucky Strike’s bowling alley refinancing to Service Properties Trust launching the first zero-coupon high yield bond since December 2023, borrowers capitalized on euphoric conditions with remarkable execution quality.

The bigger question: with spreads at seven-month lows, yields matching 2022 levels, and YTD returns hitting fresh peaks at 7.3%, how much more Fed accommodation can this rally absorb before physics takes over?

Weekly Performance Recap

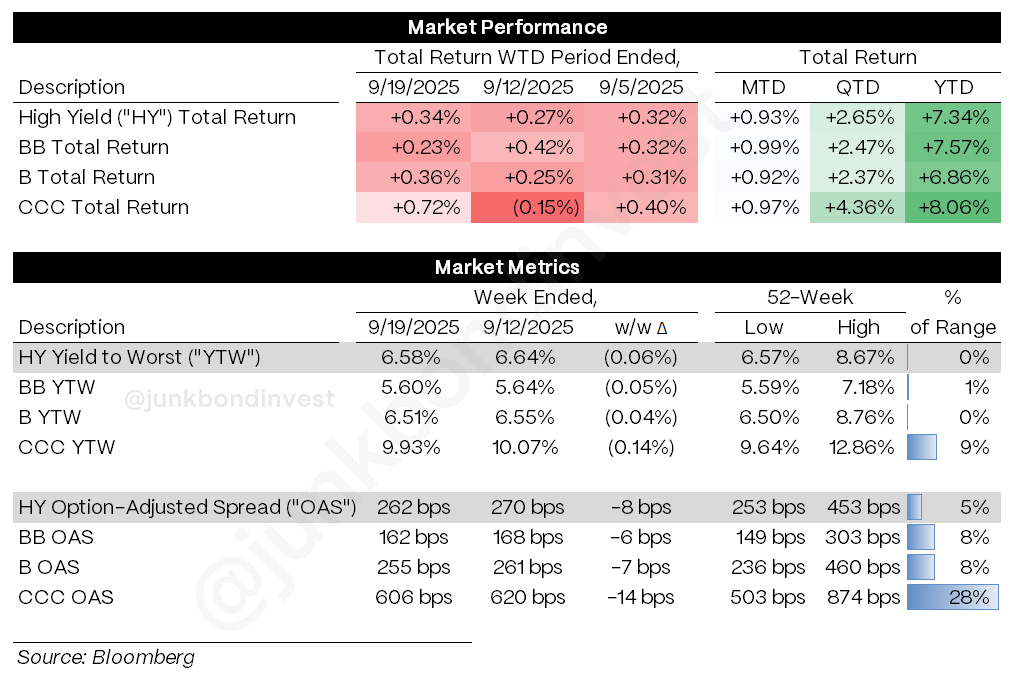

The numbers paint a picture of a market hitting its stride. Overall HY delivered +0.34% for the week, bringing YTD returns to a fresh peak of 7.34%. The quality rotation that defined recent weeks finally reversed in classic risk-on fashion:

CCCs dominated with +0.72%, reclaiming leadership after weeks of lagging

Bs followed at +0.38%, showing solid middle-market demand

BBs posted a more modest +0.23%, as defensive positioning unwound

The spread compression was dramatic across the board. Overall index spreads tightened 8bps to 262bps, with CCCs leading the charge at 14bps of tightening to 606bps. BBs and Bs each compressed 6bps to 162bps and 255bps respectively.

Most significantly, yields plummeted across all rating categories. The index YTW fell 6bps to 6.58%, while CCC yields crashed 14bps below the 10% threshold to 9.93%. When the riskiest credits can rally this hard on a 25bp Fed cut, it confirms the hunt for yield has reached new extremes.

Primary Market Activity

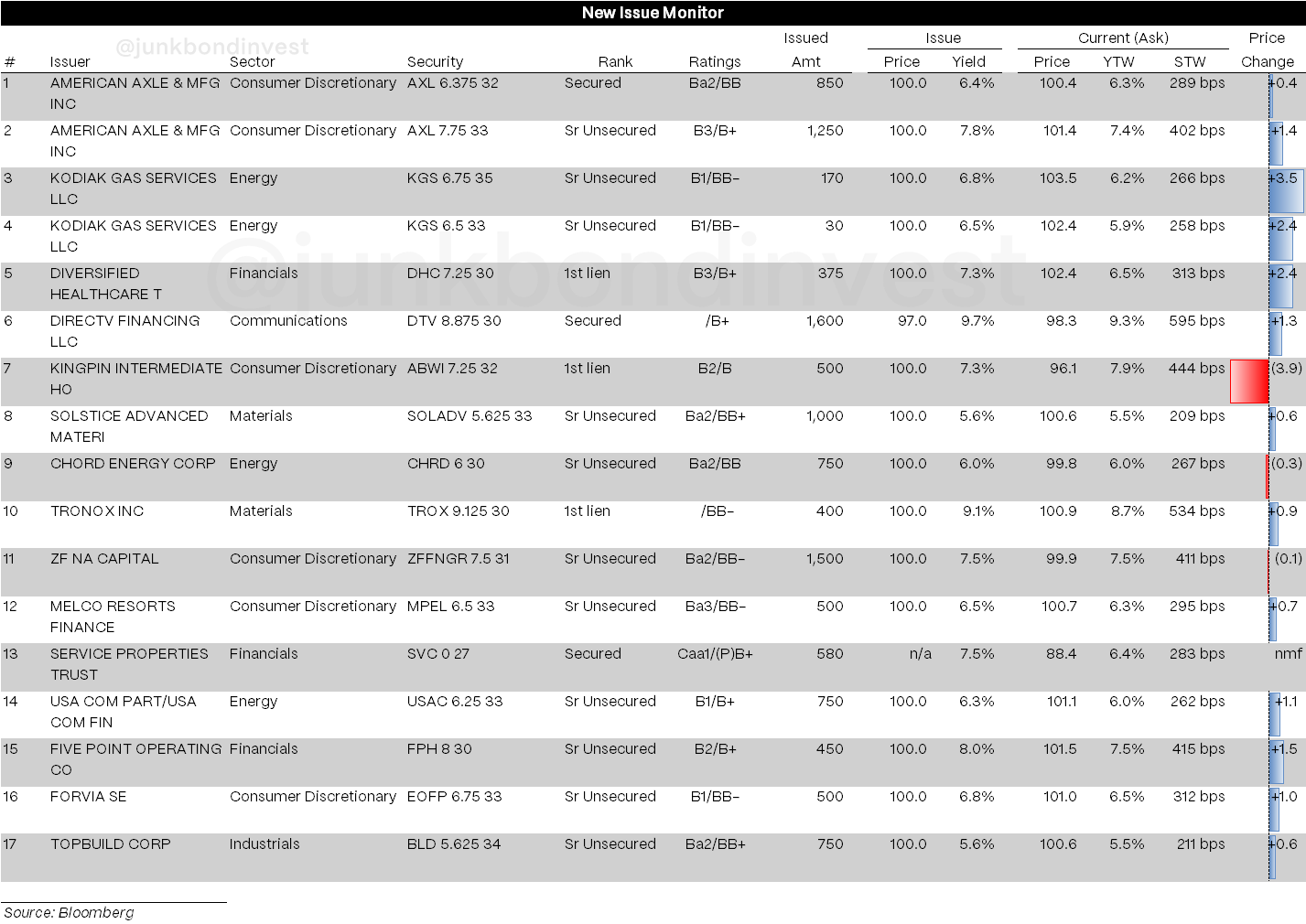

The post-Fed euphoria triggered a supply surge that tested market capacity at $12 billion across 15 transactions. Execution quality remained exceptional, with all but one deal pricing at or better than initial guidance, demonstrating the depth of demand in the new rate environment.

Service Properties Trust made history by launching the first zero-coupon high yield bond since December 2023. The $580 million deal priced to yield 7.50%, representing innovative structuring in the current yield environment

September’s issuance momentum continues building. However, this week’s activity may moderate given the holiday tomorrow, creating a shortened trading week that could temporarily slow new issue flow.

Secondary Market

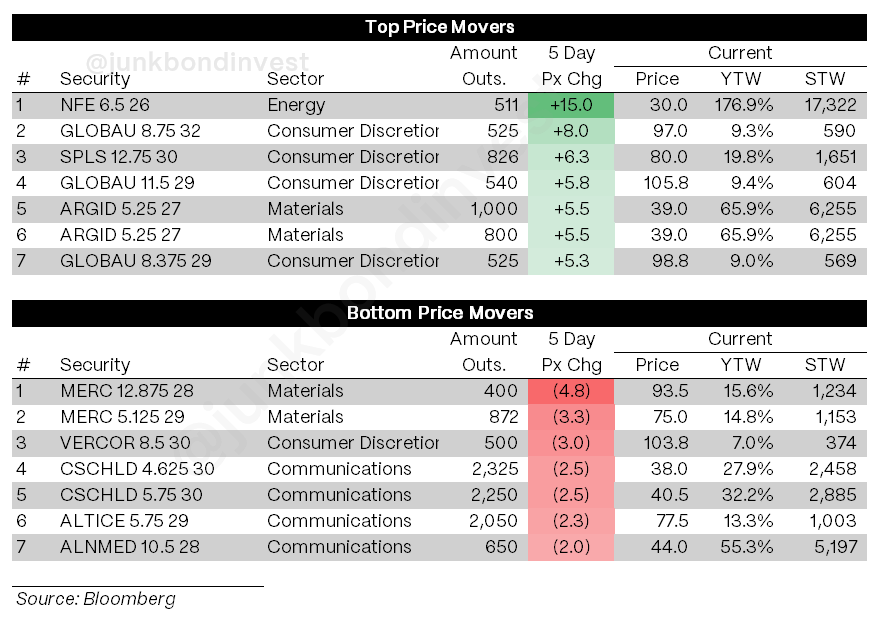

The sector rotation was swift and decisive. Energy led weekly returns as commodity-sensitive names rallied on the Fed’s easing signal. New Fortress Energy dominated the top movers with a 15-point surge following news of a new 7-year gas supply agreement with Puerto Rico.

Consumer discretionary names also surged, with Global Auto bonds adding 5-8 points after constructive earnings commentary. The correlation between equity momentum and credit performance remains remarkably strong, suggesting cross-asset flows continue driving much of the price action.

On the downside, materials faced pressure with Mercer International declining on tariff-related concerns affecting pulp markets. The divergence between domestic-focused and trade-sensitive credits continues to widen as policy uncertainty persists.

Looking Ahead

Powell delivered, but the real test comes from economic data that will determine whether this easing cycle has legs:

Tuesday and Wednesday bring new and existing home sales that will test whether rate cuts can revive housing demand

Thursday’s durable goods data will reveal if manufacturing sentiment is finally turning

Friday’s PCE deflator could provide the inflation clarity markets need for further easing bets

But here’s what really matters: the technical picture has never looked stronger. Spreads at 262bps represent the tightest levels since February, while yields at multi-year lows confirm the structural demand shift. With YTD flows remaining strong, the bid for paper shows no signs of exhaustion.

The macro backdrop provides the perfect cover story. The Fed’s 25bp cut to 4.00-4.25% with hints of further easing gives credit investors exactly the narrative they need to justify chasing yield. Core PCE inflation running at 2.9% should be concerning, but when CCC yields can drop below 10%, fundamental concerns take a back seat to technical realities.

Housing remains frozen with starts down 8.5% in August, but credit markets couldn’t care less. Manufacturing stays muted outside of high-tech sectors, yet primary issuance just hit its busiest week since early August. The disconnect between real economy data and credit market performance continues to widen.

Either the Fed’s easing cycle will prove transformative for growth, or we’re witnessing the final stages of a technically-driven rally that’s completely divorced from economic fundamentals. The next month of data will determine which narrative wins.

The smart money made its choice weeks ago. When CCCs can rally 14bps in a single week and primary markets can absorb $12 billion without flinching, the path of least resistance remains clear. The technicals are in complete control, and fighting them looks increasingly futile.

Find the most recent JunkBondInvestor posts below

Continue the discussion on Reddit at r/leveragedfinance.

Disclosure: The information provided is based on publicly available information and is for informational purposes only. While every effort has been made to ensure the accuracy of the information, the author cannot guarantee its completeness or reliability. This content should not be considered investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release the author from any liability. Always seek professional advice tailored to your financial situation and objectives.