Community Health ($CYH): Time Extended

Asset sales, Medicaid inflows, and refinancing push the next real test to 2029

🚨 Connect: Twitter | Threads | Instagram | Reddit | YouTube

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list (limited spots).

Tim Hingtgen picked a hell of a time to retire. After 18 years at Community Health Systems, the CEO announced he’s stepping down at the end of September, right after reporting earnings that left Wall Street confused about whether to celebrate or panic.

The confusion makes sense when you see what he’s leaving behind. CYH runs roughly 70 hospitals across rural and suburban America, and they’re hardly alive. Not the patients, but the business. They’ve got ~$11 billion of debt hanging over their heads with leverage sitting at ~7x, which is creditor-speak for “we’re technically breathing but barely.”

Meanwhile, fewer people are walking through the doors. Management blames “weakening consumer confidence,” but what they really mean is customers cannot afford healthcare anymore. These are middle-class folks with $5,000 deductibles choosing between rent and a hip replacement.

The board’s solution? Hand the keys to CFO Kevin Hammons, now interim CEO. It is a familiar distressed playbook where the finance guy inherits the mess and has to explain to creditors why this time will be different.

CYH’s hospitals sit in communities where closing isn’t just a business decision, it’s a public health crisis. But serving America’s forgotten towns with a capital structure that would impress PE is a dangerous game.

The question now: can the balance sheet hold out long enough for the patients to keep coming through the doors?

I. Situation Overview:

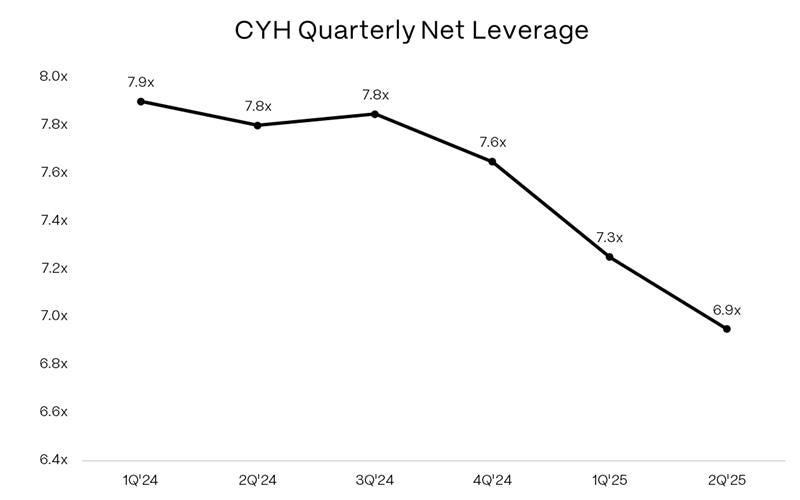

Community Health has spent the past year fighting the clock. The company entered 2025 with ~$11 billion of gross debt and leverage above 7x. Management’s focus has been simple: sell assets, refinance near-term maturities, and hope volumes stabilize long enough to make the math work.

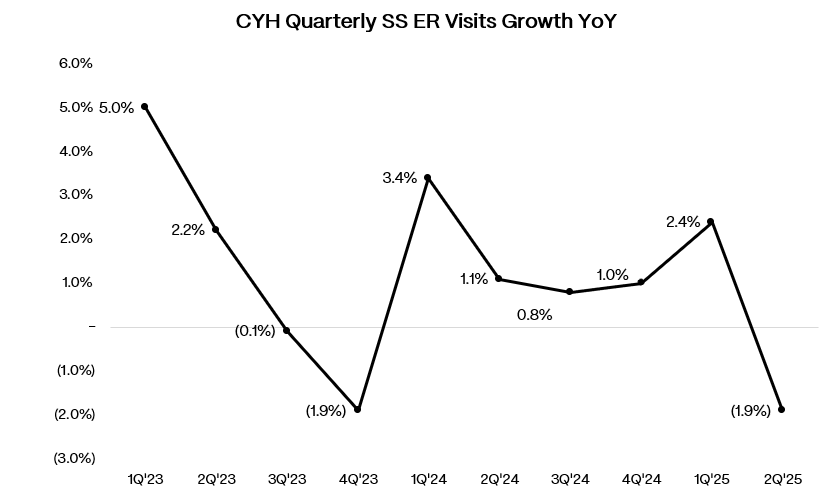

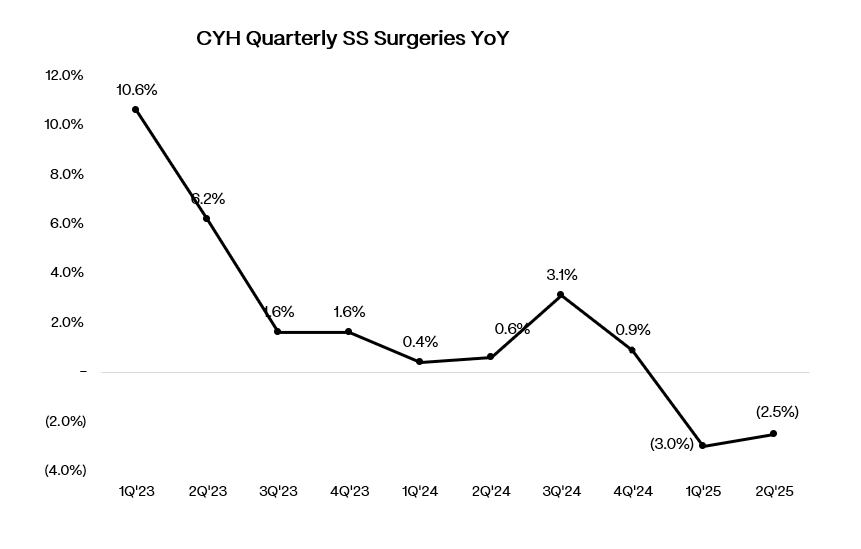

Operationally, volumes have been soft across key metrics. Same-store adjusted admissions fell 0.7% y/y in Q2’25 with ER visits down 1.9% and surgical volumes down 2.5%.

The pain was concentrated where it hurts most: commercial Blue Cross patients deferring elective orthopedic procedures, representing about half of the surgical decline. Management attributed this to consumer confidence hitting COVID-era lows, with high-deductible patients choosing between healthcare and other expenses.

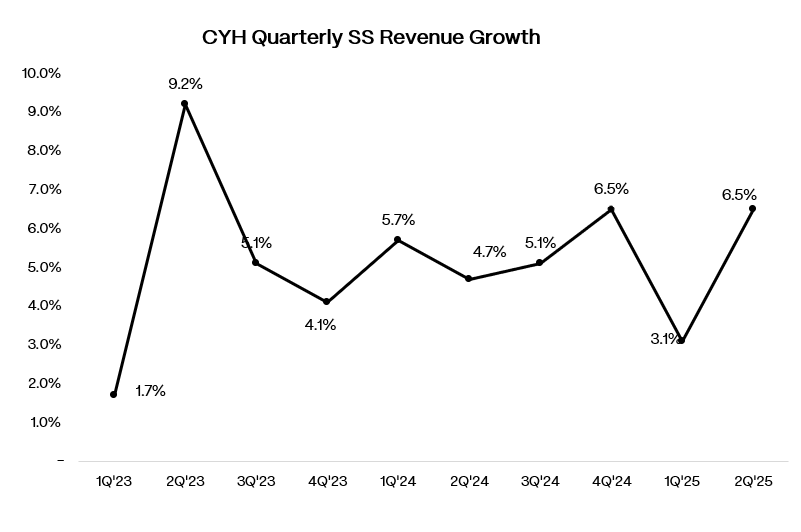

Immigration policy may be adding regional pressure. In markets with larger immigrant populations like Arizona, Texas, and Florida, hospitals are no longer considered sanctuary sites, potentially deterring even legal residents from seeking care. Management admits it’s hard to quantify what happens when patients simply don’t show up.

Same-store revenue still grew 6.5% y/y, but only because state-directed Medicaid payments contributed an extra $120 million to the quarter. Adj. EBITDA of $380 million looked acceptable against consensus, but $75 million came from new direct payment programs (DPP) in New Mexico and Tennessee, meaning the core was closer to $305 million. Of course, management pushed back on this figure, arguing the true run rate is $360-375 million after adjusting for what they call “really depressed” Q2 volumes, but that still represents a meaningful step down from historical levels.

There are some early signs of stabilization however: volumes recovered to prior-year levels in the final week of June and showed some stability in early July, though still below original expectations. Whether this represents genuine recovery or seasonal noise remains unclear.

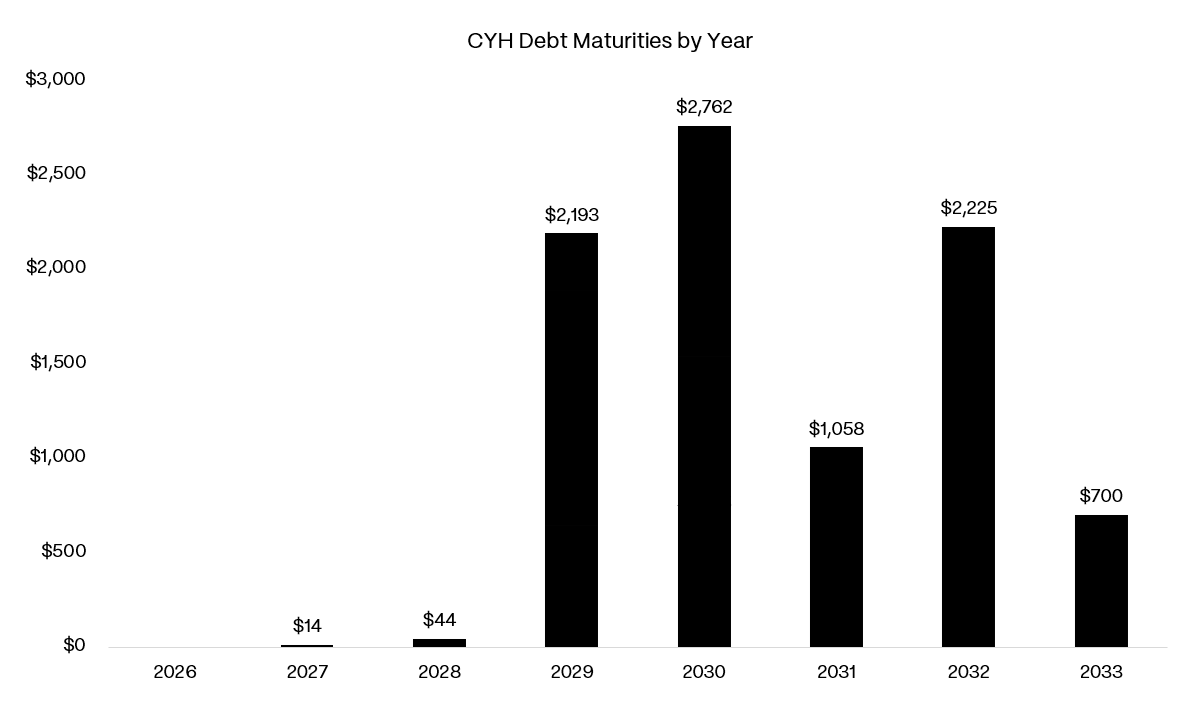

To their credit, CYH has been aggressive on the liability side. In May 2025, the company refinanced $700 million of 8.0% 2027 notes into 10.75% 2033 paper and launched a tender for $626 million of 2028 unsecureds at 75 cents, ultimately retiring $584 million. Asset sales provided additional ammunition: the $436 million Cedar Park hospital divestiture and $195 million LabCorp transaction helped chip away at debt. These moves successfully pushed out the 2027 maturity wall, leaving the next real test in 2029 when $2.2 billion of debt comes due.

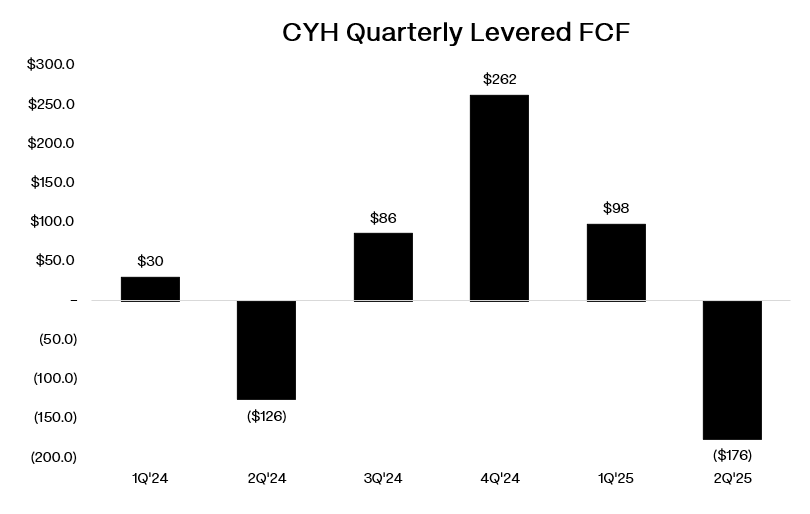

The balance sheet remains stretched despite the refinancing activity. Net leverage improved modestly to 6.9x from 7.3x, but gross debt is still ~$11.1 billion against just $456 million of cash at quarter end. Free cash flow (including NCI distributions) was negative $176 million in Q2’25, though this included $74 million in one-time divestiture tax payments.. Liquidity continues to depend on asset sales and supplemental Medicaid inflows.

DPP cash receipts remain lumpy and delayed. The New Mexico and Tennessee programs were approved in the final days of Q2, but actual cash won’t flow until Q3. Management expects ~$300 million in additional inflows from the Labcorp sale ($195 million) and Tennova Cleveland contingent payment ($100 million) in the back half of 2025.

Markets have priced in the elevated risk profile. The 6.875% 2028 notes trade in the low 80s for a yield near 14%. The secured 2030s are around 86, yielding ~8%. Equity is down 5% YTD, trading around $3 per share.