High Yield Weekly Minutes: Record Supply Ends the Streak...But Execution Held Firm (September 29, 2025)

A Brief Recap of Last Week’s High Yield Market Performance

🚨 Connect on Twitter | Threads | Instagram | YouTube

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list — limited spots.

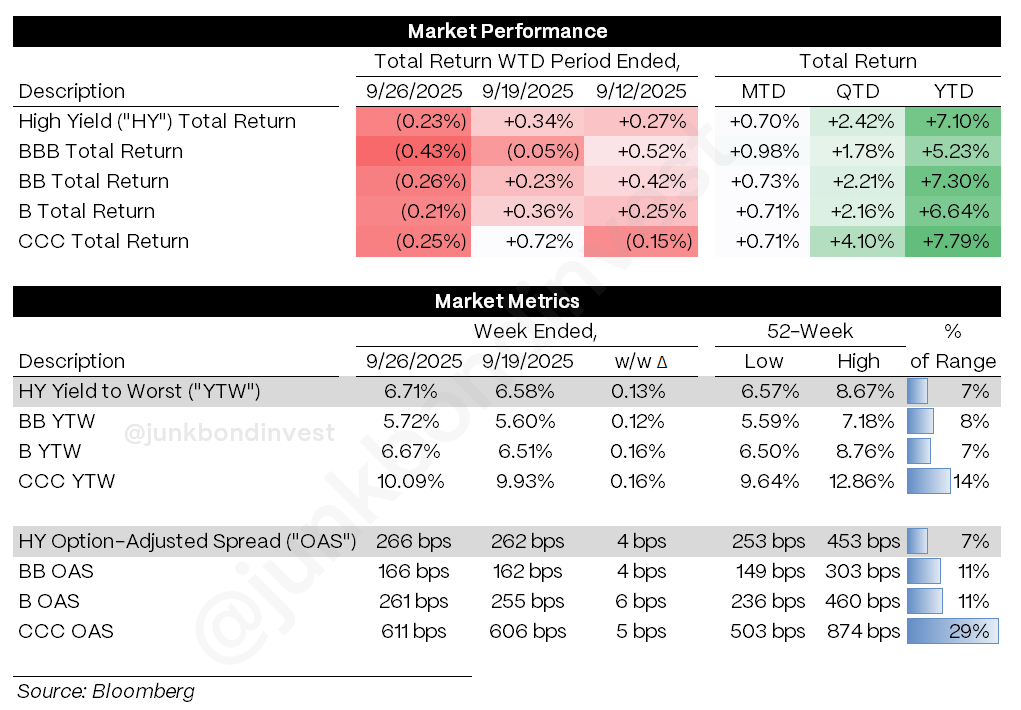

The seven-week rally finally took a breather. High yield posted its first weekly decline since early August with a -0.23% loss, as $17.5 billion of new issuance tested market capacity. Yields rose 12bps to 6.71% while spreads widened a modest 4bps to 266bps. Considering the volume, the technical damage was contained.

But here’s the disconnect: this marked the busiest issuance week in five years, yet nearly every transaction cleared with solid execution. Weatherford doubled its deal size and still priced tight of guidance. CrossCountry Mortgage upsized by half and cleared inside talk. When the market can process this much paper without materially wider spreads, it suggests the underlying bid remains substantial.

What stands out most is the uniform performance across quality. All rating categories declined roughly 0.2-0.25%, confirming this was rate adjustment rather than credit differentiation. When CCCs hold up as well as BBs during peak supply, the structural demand story remains intact.

Weekly Performance Recap

The numbers show a market digesting gains after an extended run. Overall HY delivered -0.23% for the week, snapping the year’s longest winning streak. Performance was remarkably consistent across tiers:

BBs fell -0.26%, maintaining YTD leadership at +5.23%

Bs dropped -0.21%, holding solid YTD gains of +6.64%

CCCs declined -0.25%, continuing to pace the market YTD at +7.79%

The yield movement outpaced spread widening significantly. Index YTW climbed 12bps to 6.71%, driven primarily by higher base rates rather than deteriorating credit views. Spreads widened a comparatively modest 4bps to 266bps.

The consistent decline across ratings confirms this was technical repositioning rather than credit concern. When lower-quality paper performs in line with defensives during a record supply week, it signals investors view the pullback as temporary rather than the start of a broader deterioration.

Primary Market Activity

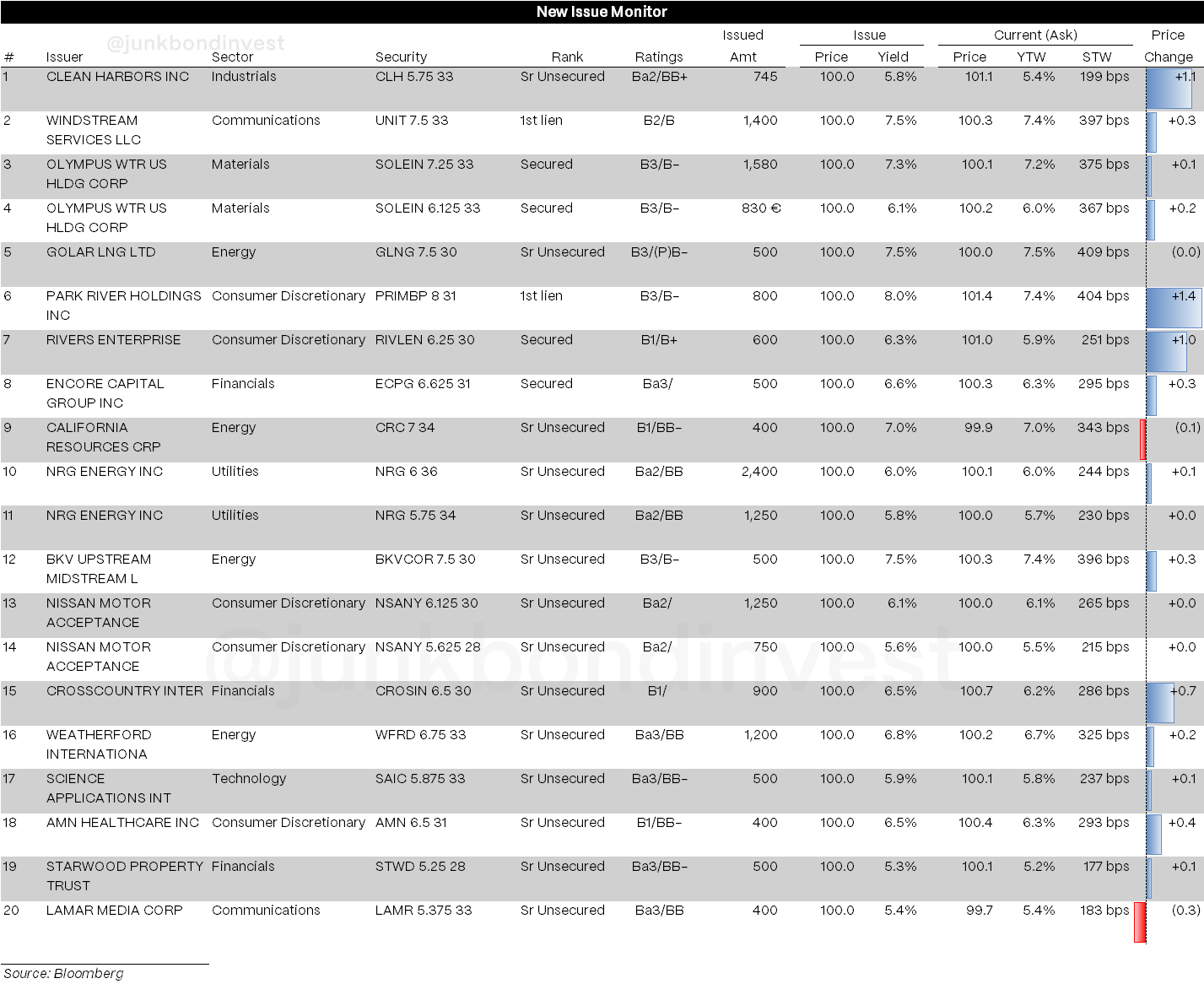

The primary market delivered its strongest week since September 2020. Nineteen deals totaling $17.5 billion pushed September’s monthly volume above $50 billion, the highest monthly tally since September 2021.

Notable transactions demonstrated the market’s absorption capacity:

Weatherford International upsized to $1.2 billion at 6.75% following one-notch upgrades across all agencies, achieving the tightest oilfield services pricing on record

NRG Energy raised $3.65 billion across two tranches at 5.75% and 6.00% to partially fund a $12 billion power plant acquisition from LS Power

Nissan returned just two months post its fallen angel debut, pricing $2 billion across two tranches that settled near par while earlier bonds continue trading above 105

Execution quality across this calendar remained strong. Most deals priced at or inside initial guidance, with several upsizing mid-process. The market’s ability to handle five-year peak volume while maintaining discipline suggests the technical foundation remains solid.

Secondary Market

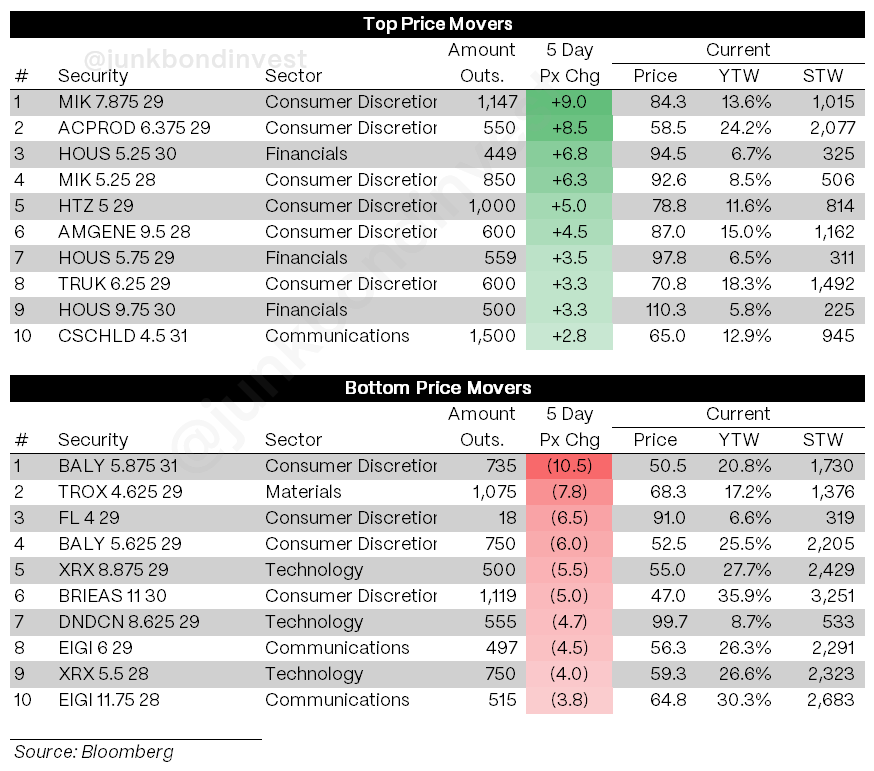

Sector performance diverged based on specific catalysts rather than broad credit concerns. Energy credits generally outperformed despite the market decline, with midstream and select E&P names finding consistent demand.

Chemicals experienced the most volatility, with Tronox bonds declining 7-8 points as TiO2 market fundamentals deteriorated. The sector provided active trading as investors reassessed commodity chemical positioning amid weakening pricing dynamics.

Technology showed relative stability, with CoreWeave bonds holding despite equity declining during the week. The divergence between equity and credit in AI infrastructure continues, suggesting bond investors remain focused on collateral value rather than growth trajectories.

The week’s most significant development came from First Brands’ Chapter 11 filing following extended scrutiny of its off-balance sheet financing arrangements. The automotive supplier’s collapse, with substantial liabilities, sent ripples through the sector but remained largely isolated.

Looking Ahead

Quarter-end concluded with the market having processed record issuance while sustaining limited technical damage. Several catalysts will determine whether this represents a natural pause or something more substantial:

Construction spending Wednesday will indicate whether rate cuts are stimulating capital deployment

ISM Manufacturing and Services could validate whether economic momentum exceeds expectations

Friday’s payrolls remain critical, with consensus around 45K after the three-month average collapsed to 29K

The calendar likely brings another $8 billion of supply this week. After absorbing $17.5 billion successfully, the market faces another capacity test. With flows turning modestly negative, the technical setup presents more uncertainty than a week ago.

Notably, the Electronic Arts $55 billion LBO announced today represents the largest leveraged buyout on record. The consortium including Silver Lake, Saudi Arabia’s PIF, and Affinity Partners secured $20 billion of debt financing from JPMorgan, the largest commitment for a buyout transaction. The deal confirms that mega-LBOs remain viable in current conditions, potentially encouraging other large sponsor-backed transactions waiting for market receptivity.

Despite this, the macro picture presents contradictions. Q2 GDP was revised up substantially to 3.8% from 3.3%, indicating stronger underlying momentum. Consumer spending advanced 0.4% in real terms during August. Yet labor market conditions continue softening, with unemployment at 4.3% and hiring activity subdued.

Last week’s decline likely represents profit-taking following an extended rally rather than fundamental deterioration. Spreads widening just 4bps during record issuance suggests credit concerns remain limited. When the market handles this level of supply without material stress, it confirms underlying demand remains substantial.

With September closing as the busiest month since 2021 and large LBOs returning to the pipeline, issuance momentum shows no signs of slowing. The market has demonstrated its capacity. Now it needs to prove it has the stamina.

Find the most recent JunkBondInvestor posts below

Continue the discussion on Reddit at r/leveragedfinance.

Disclosure: The information provided is based on publicly available information and is for informational purposes only. While every effort has been made to ensure the accuracy of the information, the author cannot guarantee its completeness or reliability. This content should not be considered investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release the author from any liability. Always seek professional advice tailored to your financial situation and objectives.