High Yield Market Weekly: The Summer Selloff Finally Arrives...As Job Market Cracks & Fed Stays Stubborn (August 4, 2025)

When Early-Week Issuance Met Friday's Employment Shock

🚨 Connect on Twitter | Threads | Instagram | Bluesky | Reddit | YouTube (*New*)

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list — limited spots.

Turns out the job market actually matters after all.

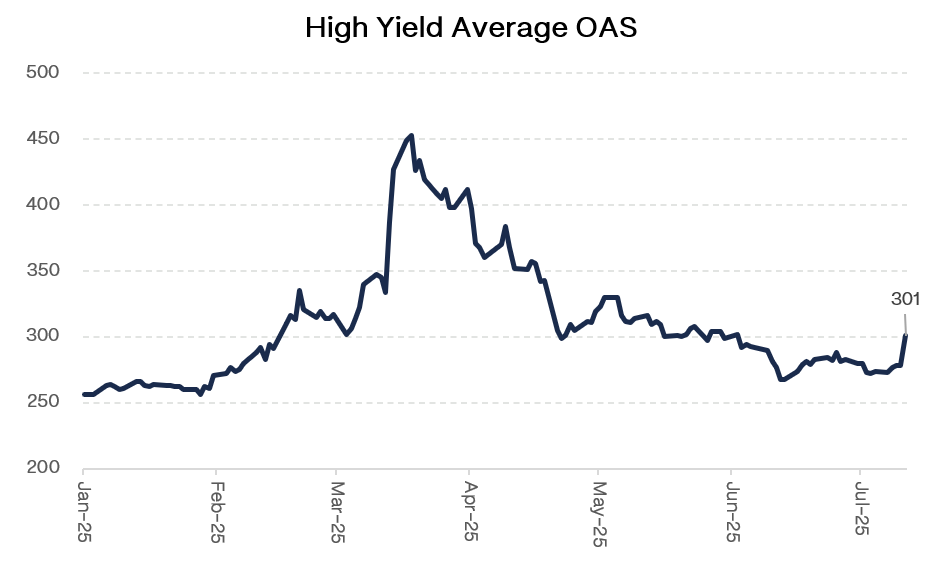

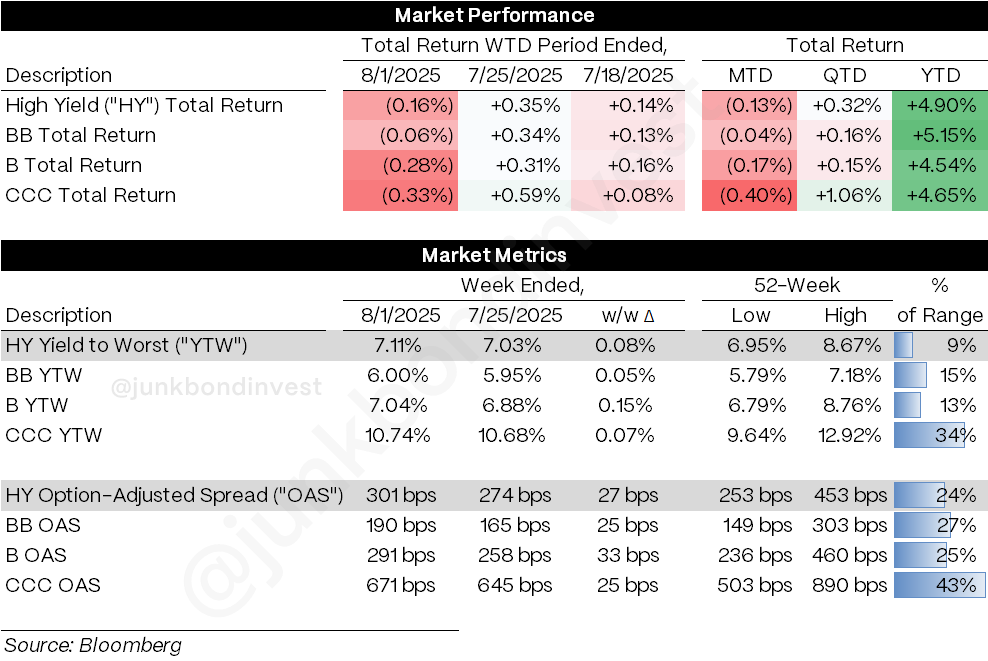

High yield suffered its worst weekly decline in 10 weeks, returning -0.16% as spreads widened by 27 bps to 301 bps, with Friday delivering the sharpest single-day blowout since the tariff sell-off.

The culprit? A jobs report that sent unemployment to 4.2% while payrolls managed just 73k vs. 105k expected. Add in downward revisions that wiped out 258k jobs from prior months, and suddenly everyone’s singing a different tune.

The technical damage was notable across rating buckets. CCCs declined -0.33% for the week, posting their biggest one-day loss in three months. Spreads widened uniformly, with CCCs moving out 25bps to 671bps while even defensive BBs widened 25bps to 190bps amidst Treasury yields plunging.

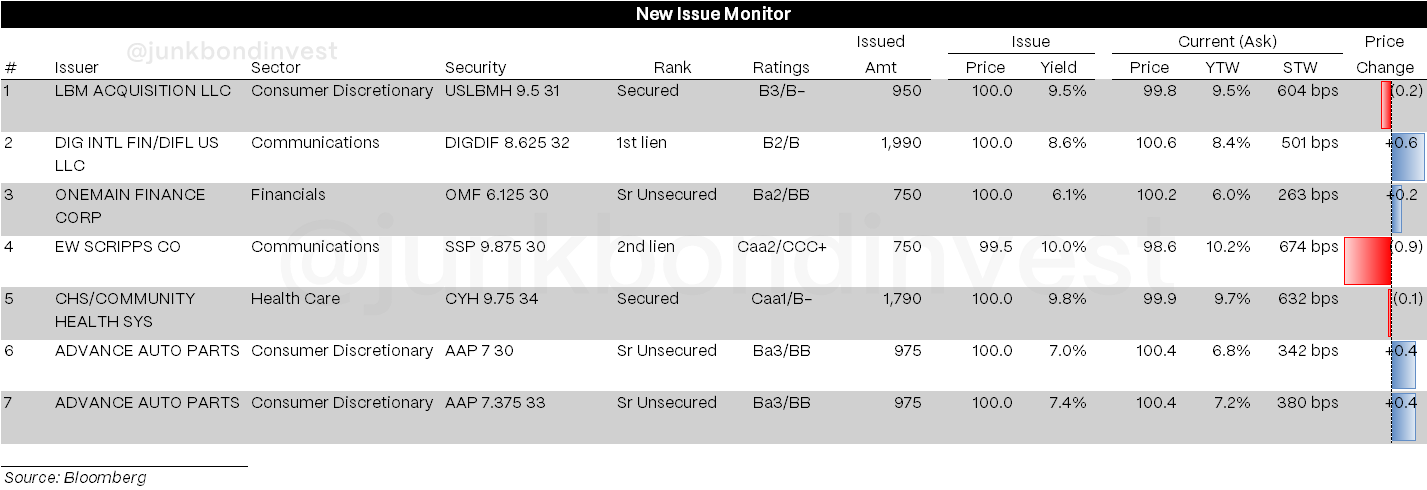

But here’s the week’s real story: the primary market was firing on all cylinders early in the week, with $8.2 billion pricing across multiple tranches before Friday’s jobs report changed everything. Community Health priced $1.8 billion at 9.75%, Digicel printed nearly $2 billion of secured notes, and Advance Auto Parts brought dual tranches totaling $1.9 billion. All of this cleared smoothly until payrolls hit and the narrative flipped overnight.

With deals pricing smoothly early in the week before Friday’s jobs shock triggered the Russell’s 4%+ weekly decline, we’re seeing how quickly sentiment can flip in 2025.

Weekly Performance Recap

The numbers reveal a market under genuine pressure for the first time in months. Overall HY lost -0.16% for the week, with the damage accelerating as quality deteriorated:

BBs held up best at -0.06%, benefiting from the flight to quality trade

Bs declined -0.28%, showing the middle market couldn’t escape

CCCs got crushed at -0.33%, posting their worst weekly performance since May

The technical picture deteriorated dramatically:

Overall index yields jumped 8bps to 7.11%, now at 9% of the 52-week range

Spreads exploded 27bps to 301bps, with Friday’s 23bp move the largest single-day widening since April

CCC spreads blew out 25bps to 671bps, while even defensive BBs widened 25bps to 190bps

The YTD picture remains strong at +4.90% overall, but Friday’s action marked the first time since early Spring that technical support failed to hold. With spreads now at 24% of their 52-week range versus just 6% a month ago, the complacency trade may officially be over.

Primary Market Activity

The primary market had a tale of two halves, with multiple deals totaling $8.2 billion pricing early in the week before Friday’s jobs report soured sentiment:

Community Health Systems led the charge with $1.79 billion of secured notes at 9.75% to refinance 2027 maturities

Digicel brought a massive $1.99 billion first-lien offering at 8.625%, finding strong demand despite the company’s leveraged profile

Advance Auto Parts executed dual tranches totaling $1.95 billion, with the 5-year printing at 7.0% and 8-year at 7.375%

EW Scripps priced $750 million of CCC-rated second-lien notes at 9.875%, the week’s riskiest deal yet still clearing the market

This caps off what's been a record-setting period for issuance. July’s $35.0 billion in total volume marked the busiest month since September 2021. Year-to-date issuance now stands at $181.3 billion, slightly ahead of last year’s pace.

Secondary Market

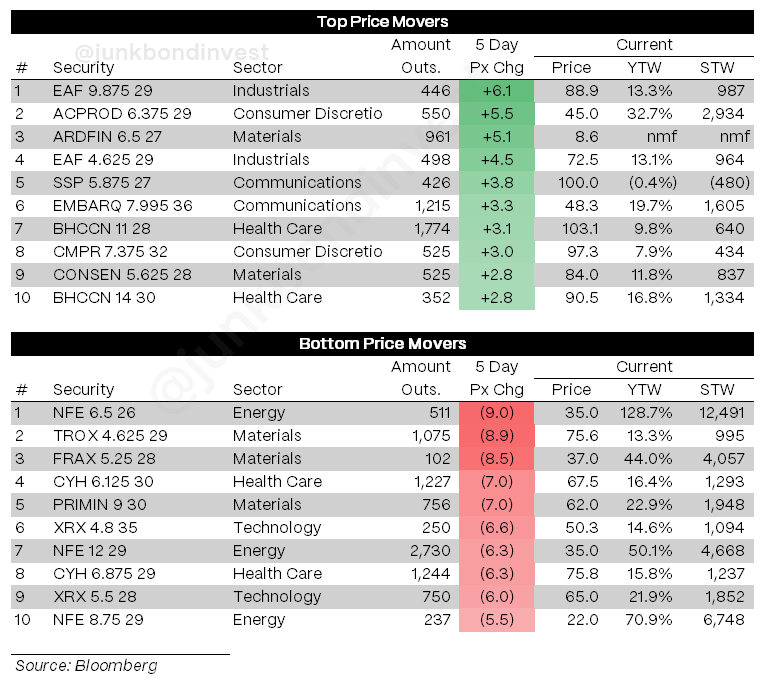

The sector carnage was broad but predictable, with cyclicals leading the decline:

Top Performers:

Industrial names like EAF Holdings (+6pts) and ACPROD (+5.5pts) bucked the trend

Communications credits found selective support despite broader weakness

Bottom Performers:

Energy got hammered as oil dropped 3% on recession fears, with NFE bonds down -9pts

Materials collapsed across the board, led by TROX (-8.9pts) after terrible earnings

Healthcare credits like CYH (-7pts) suffered despite successful refinancing

The Tronox story epitomizes the week’s tone. Bonds plunged 5 points after the company swung to a loss, hitting yields of 12.75% as investors questioned how long cost cuts could offset the demand slump. Meanwhile, JetBlue provided one of the few bright spots, jumping 3 points after narrowing losses and securing DOT approval for its United partnership.

Most telling was the broad-based nature of Friday’s selloff. This wasn’t about individual credit stories (it was about systematic derisking as recession fears crept back into the narrative).

Looking Ahead

The economic data convergence is impossible to ignore. Since the Spring tariff implementations, the cumulative impact is finally showing up across multiple data points simultaneously. Manufacturing activity weakened to 48.0 in the latest ISM reading, construction spending faces pressure from elevated financing costs, and now employment growth has decelerated sharply.

This week brings the real test of whether Friday’s selloff was a one-day panic or the start of something bigger:

Tuesday’s Trade Balance could show the deficit narrowing as import demand collapses

ISM Services will reveal if the weakness is spreading beyond manufacturing

Durable Goods Orders and PMIs round out a packed economic calendar

The technical picture has shifted dramatically. Dealer inventories are back near highs, fund flows are slowing, and we’re entering the historically weakest months for risk assets. August and September seasonal patterns suggest more volatility ahead.

But here’s the contrarian take: $35 billion cleared in July before anyone saw that jobs number coming. The technical support was there when it mattered for issuers. Friday’s panic may have been violent, but it was also sudden and news-driven rather than a slow credit deterioration.

Friday’s action felt like the first real shakeout since Spring. Whether it becomes something more depends on how quickly recession fears take hold. With the market pricing in a Fed cut in September and spreads finally outside of 300 bps, this week’s weakness might be providing the moment of stability before the real fireworks begin.

The summer selloff everyone’s been predicting has finally arrived. The question is whether you’re buying the dip or joining the stampede for the exits.

Find the most recent JunkBondInvestor posts below

Disclosure: The information provided is based on publicly available information and is for informational purposes only. While every effort has been made to ensure the accuracy of the information, the author cannot guarantee its completeness or reliability. This content should not be considered investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release the author from any liability. Always seek professional advice tailored to your financial situation and objectives.