Semler Scientific Inc. ($SMLR): The Busted Bitcoin Convert Play Nobody's Talking About

Sometimes the real opportunity is trading at a discount in the credit markets.

🚨 Connect: Twitter | Threads | Instagram | Bluesky | Reddit

A failing medical device company just said “**** it” and bet everything on Bitcoin…and Wall Street is eating it up like idiots.

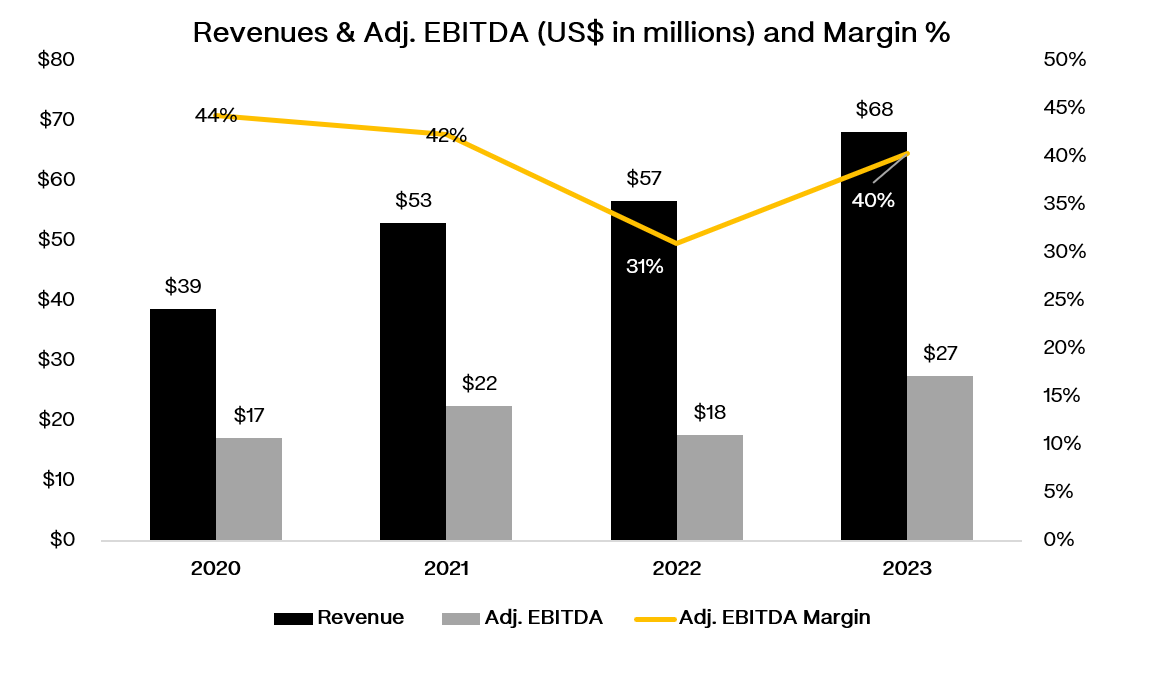

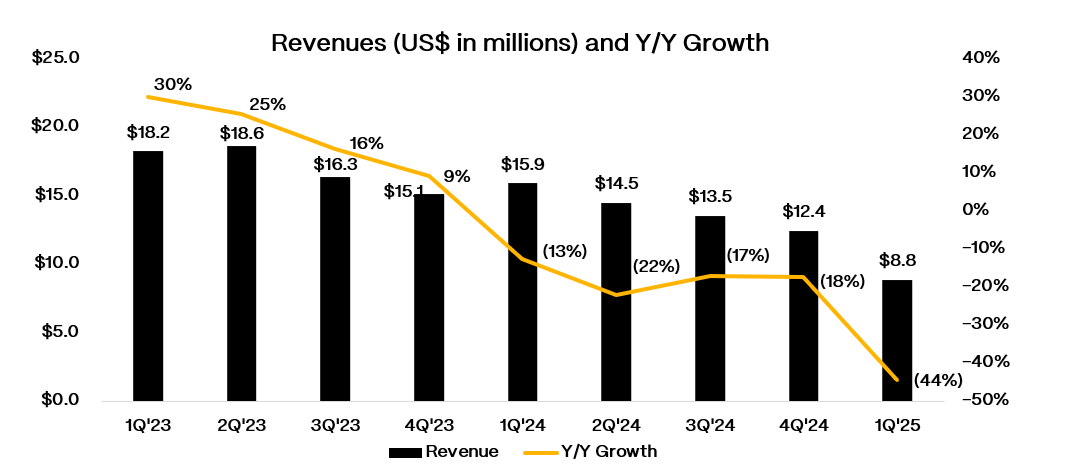

Here’s a company that spent fifteen years in the medical device business, detecting peripheral artery disease in aging patients with their QuantaFlo gadget. Classic healthcare play: high margins, Medicare reimbursements, the whole nine yards. They were pulling in $27 million in EBITDA by 2023, margins hitting 40%, living the good life selling to insurance giants like UnitedHealth.

Then everything changed.

May 28, 2024: SMLR said screw it, we’re going full Bitcoin.

Not just adding crypto to the balance sheet like some corporate treasury diversification. No, they went nuclear and adopted the “Bitcoin Standard” as their PRIMARY treasury reserve asset. Only the second U.S. public company after MicroStrategy to bet the farm on orange coin.

And here’s the kicker…it worked. At least initially.

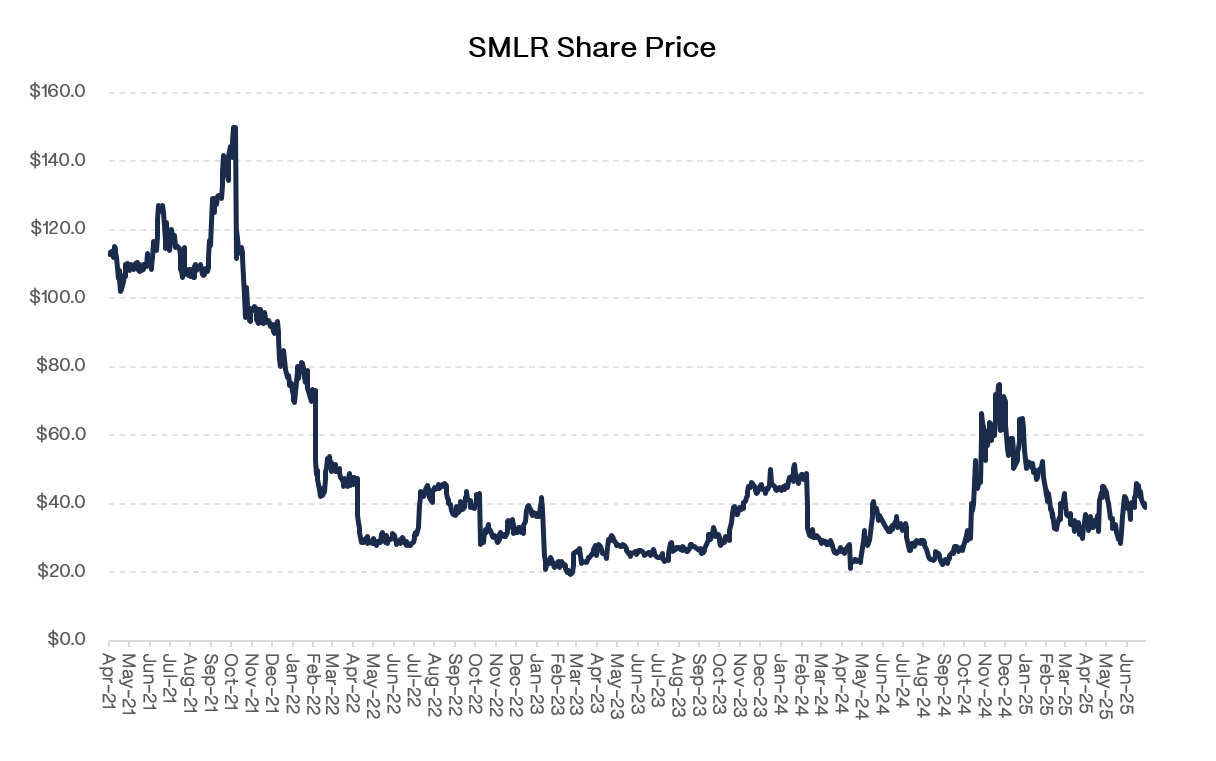

The stock that had cratered ~70% in the three years before the Bitcoin pivot? It rocketed over 100% in the six months after. From medical device wallflower to crypto darling overnight. They’ve accumulated 5,021 bitcoins for $476 million, posting a “BTC Yield” of 31.3% YTD. That’s their metric for how efficiently they’re converting dollars into digital gold.

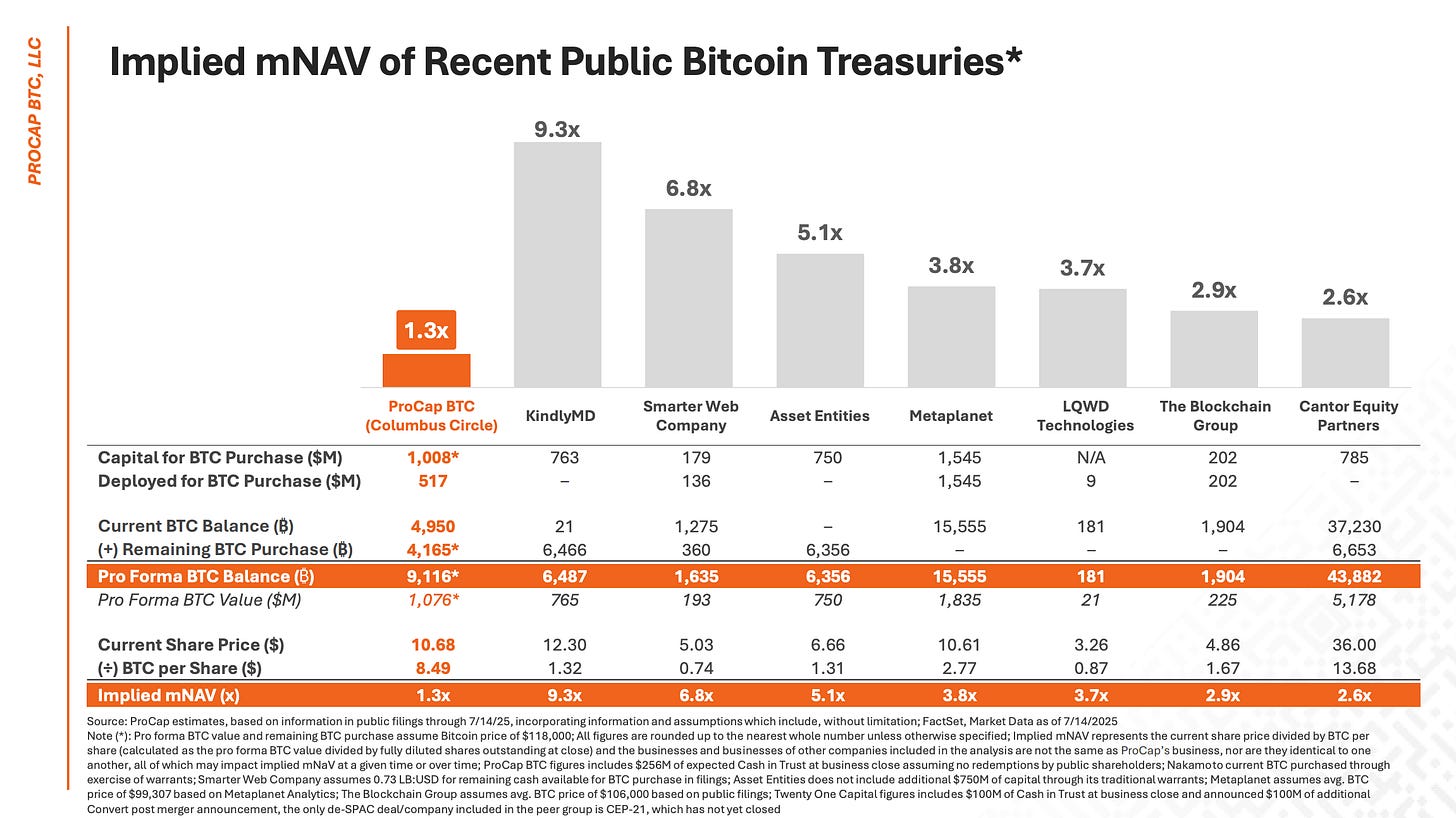

Funnily enough, SMLR is trading at a “huge discount” to other Bitcoin treasury companies…and by huge discount, I mean they’re only trading at 1.11x the value of their actual bitcoin holdings instead of the completely insane premiums their peers command. Metaplanet trades at 3.8x mNAV and KindlyMD at 9.3x mNAV, because apparently paying $9.3 for every dollar of bitcoin makes total sense.

Look, I wrote in November about why MSTR in THEORY could trade above NAV: they’ve got the scale, the execution, the credibility. But here’s the dirty secret: there’s only room for one MicroStrategy in this game. Everyone else is just expensive beta, and the market knows it.

SMLR’s “discount” isn't a problem. It’s reality. Why? Because this isn’t a clean story.

The legacy healthcare business is falling apart. Revenue collapsed 44% in Q1 2025. They’ve got a Department of Justice investigation hanging over their heads with a potential $30 million settlement for alleged False Claims Act violations. Medicare reimbursement headwinds. Customer concentration issues.

And how are they funding this Bitcoin fantasy? A mix of equity and debt.

In January 2025, they issued $100 million in convertible bonds at 4.25% to buy more Bitcoin. The converts are trading (if you can call it that) at 83 cents on the dollar with a 8.5% YTM. Busted, not converting, just sitting there as debt.

And now they’re promising to accumulate 105,000 bitcoins by 2027. That’s going from 5,021 to over 100,000 in less than three years. You’re talking about buying $20+ billion worth of Bitcoin at today’s prices. For a company that made $34 million in revenue last year.

Are you kidding me?

This is the new American corporate story: pivot to Bitcoin when your core business hits the wall. It’s not about fundamentals anymore, it’s about narrative. About betting everything on number-go-up technology when you can’t figure out how to sell medical devices without getting sued by the feds.

This is what passes for strategy now? A company that can’t keep the Department of Justice off its back thinks it can execute the most aggressive Bitcoin accumulation in corporate history? They’re going to dilute shareholders into oblivion while chasing digital moonshots.

Wake up and smell the desperation. This isn’t innovation. It’s a Hail Mary from a management team that ran out of ideas. The transformation is real, sure. But so was Blockbuster’s attempted pivot to streaming.

The execution? That’s where this whole fantasy falls apart…unless you’re smart enough to play it differently.

While everyone’s focused on the equity story, there’s another way to play this mess that nobody’s talking about. Those busted converts trading at 83 cents on the dollar?

They might just be the best risk-adjusted bet in this entire circus.