Decoding the Paradox of MicroStrategy's ($MSTR) Premium to NAV

How Compounding Effects and Platform Economics Could Validate Wall Street's Most Controversial Premium

MicroStrategy presents one of the more fascinating case studies in today’s market. The company, which has transformed from a sleepy enterprise software provider into the world’s largest corporate Bitcoin holder, currently trades at a staggering 180% premium to its Bitcoin net asset value (NAV). Put simply, investors are paying almost $2.80 for every $1.00 of Bitcoin on MSTR’s balance sheet. Traditional financial theory suggests this premium should be arbitraged away—after all, institutional investors can now easily buy Bitcoin directly through spot ETFs or the futures market. Unsurprisingly, many naive short sellers, along with well-respected investors, have prematurely called for this “premium” to revert.

Yet MSTR’s premium has actually expanded from the start of the year to ~180%, seemingly defying financial gravity. What makes this situation particularly interesting is that unlike most cases of public market premiums, which typically reflect technical factors or market inefficiencies, MSTR’s premium appears to be a deliberate market verdict on the company’s Bitcoin accumulation strategy and future value creation potential. Of course, the verdict on MSTR’s strategy is still out there, and if Bitcoin prices collapse, this premium will end up looking foolish in hindsight. Regardless of the outcome, a company with a market cap nearing $70 billion warrants deeper analysis.

In this post, I’ll dive deep into the math, psychology, and strategic factors behind this perplexing premium, and explore whether it represents market irrationality or prescient recognition of MSTR’s unique position in the Bitcoin ecosystem. This post will not debate the merits/risks of Bitcoin as an asset class (I’ll leave that up to you), delve into the company’s enterprise software business (let’s be honest, who cares?), or make a buy/sell recommendation on MSTR (also this is on you). Rather, think of this write-up as a thought exercise that explores how markets price long-term compounding potential and whether today’s premium can be justified by any measure.

I. Situation Overview

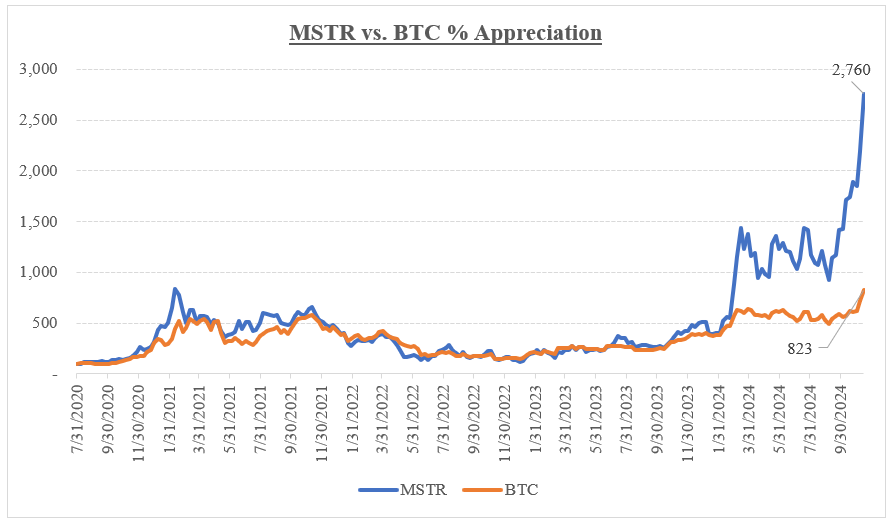

Founded in 1989 and headquartered in Austin, Texas, MicroStrategy Inc. (“MSTR”) is a traditional enterprise analytics software provider that has transformed into what is effectively the world’s first Bitcoin development company. While MSTR still maintains its legacy business intelligence and analytics software operations, the company’s valuation and strategic direction are now entirely driven by its Bitcoin accumulation strategy. As of 3Q’24, MSTR held 252,220 Bitcoin (worth ~$16.0bn at quarter-end), representing ~1.2% of all Bitcoin that will ever be mined. Even more notable, since first purchasing Bitcoin in August 2020, MSTR has delivered a staggering ~2,760% return vs. Bitcoin’s ~823% appreciation over the same period.

The Bitcoin Pivot

The company’s transformation began in 2020 when management, led by Executive Chairman Michael Saylor, concluded that holding U.S. dollar-denominated assets in a zero-rate environment posed greater risk than adopting Bitcoin as the primary treasury reserve asset. What started as a defensive capital preservation strategy has evolved into an opportunistic arbitrage between U.S. capital markets and Bitcoin. The company effectively raises low-cost capital through convertible notes and equity issuance to systematically accumulate Bitcoin, operating under the thesis that Bitcoin will appreciate significantly against fiat currencies over time.