Macy's ($M): The Walking Dead of Retail

Why bondholders might get paid while equity holders get burned

🚨 Twitter | Threads | Instagram | Bluesky | Reddit | YouTube (*New*)

Macy’s is dying, but it refuses to lie down.

The company keeps talking about transformation and customer service… but department stores are retail’s Blockbuster, and that model is dead

When was the last time you got excited about going to Macy’s? When was the last time anyone under 40 even mentioned the place?

Kids are shopping on TikTok, parents are hitting Target, and the fashion-conscious are buying direct from brands online. Macy’s is stuck in the middle with a model that made sense when people dressed up to go shopping and considered it entertainment.

New CEO Tony Spring thinks he can save the company with “elevated customer service.”

Really?

In a world where I can get anything delivered to my door in two hours, where I can virtually try on clothes, where algorithms know what I want before I do? The whole premise is flawed. They’re trying to compete on service when the game has moved to convenience, price, and experience.

But here’s the thing about dying businesses: the equity story and the credit story are two completely different animals.

While the stock reflects secular decline, the bonds tell a different tale, one of a company flush with cash, billions in real estate assets, and enough liquidity to weather years of managed decline.

The question for credit investors isn’t whether Macy’s can reinvent retail. It’s whether the company can generate enough cash flow to service its debt.

How We Got Here

To understand where Macy’s is today, you need to see how they got here…and it’s been a steady march toward higher leverage and lower profitability.

For years, Macy’s operated under the delusion that department stores just needed better execution. Previous management kept talking about “omnichannel excellence” and “customer experience improvements” while the business hemorrhaged market share to Amazon, TJX, and direct-to-consumer brands. The strategy was essentially polishing the Titanic: making incremental improvements to a fundamentally broken model.

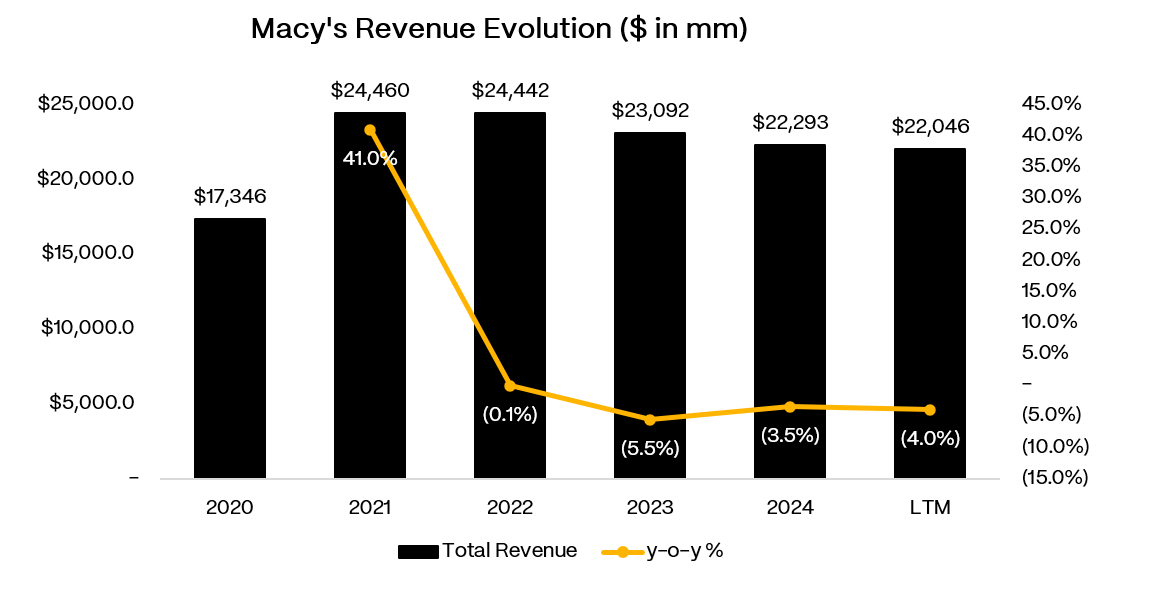

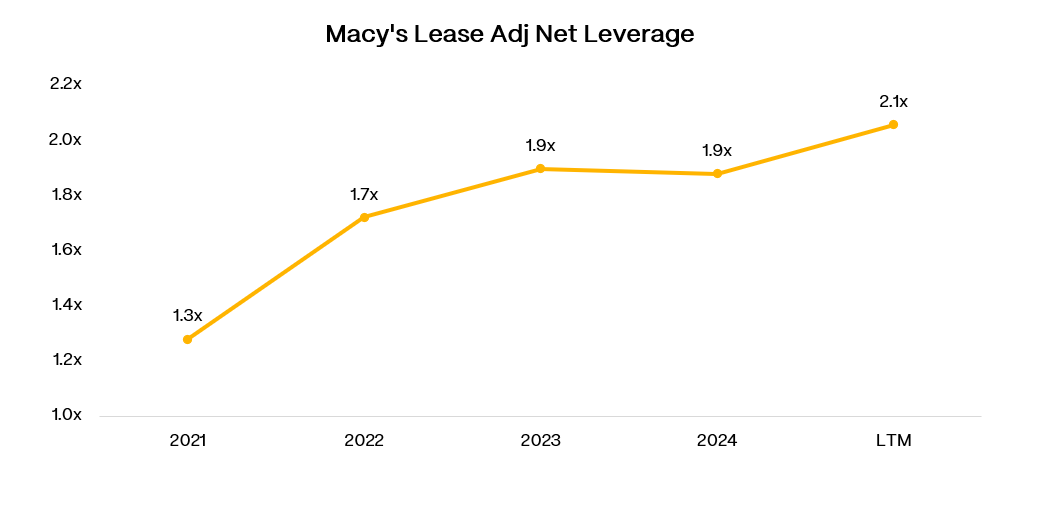

The leverage profile tells the story of a company in credit deterioration. Net debt-to-EBITDA has doubled from 0.5x to 1.0x. But the real concern is lease-adjusted leverage, which jumped from 1.3x to 2.1x. This reflects the harsh reality that EBITDAR collapsed from $3.7 billion in 2021 to $2.3 billion today while debt levels have declineid slightly.

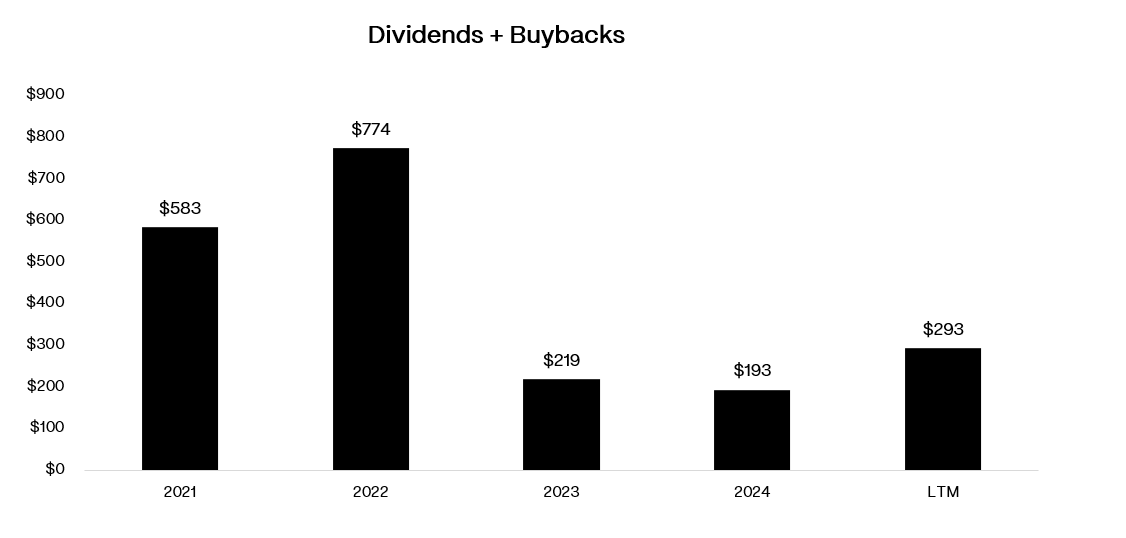

Here’s the problem: instead of using FCF to delever during the good times, management kept paying dividends and buying back stock. They were returning cash to shareholders while the earnings base eroded and leverage ratios deteriorated. It’s exactly the opposite of what you want to see in a secular decline scenario.

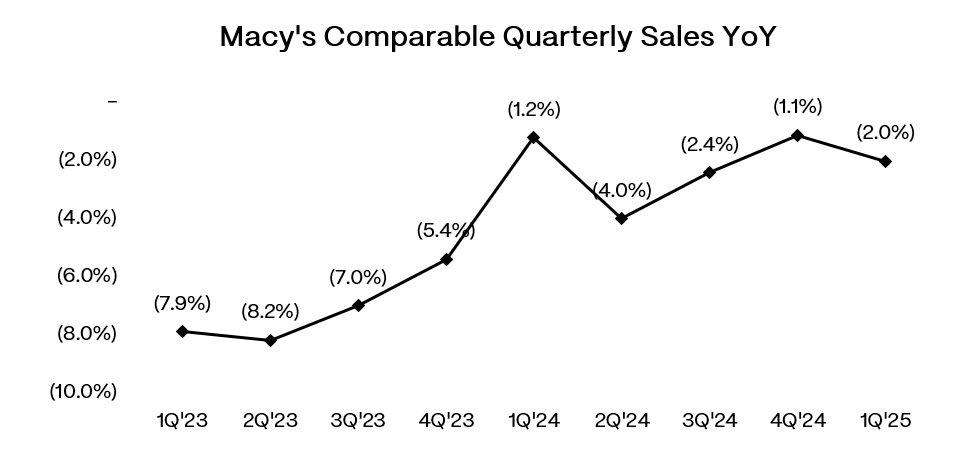

The COVID pandemic accelerated trends that were already underway. While other retailers bounced back post-reopening, department store traffic never fully recovered. Customers who were forced to shop online discovered they didn’t need the mall experience. Macy’s response was to double down on digital, but by then they were competing against Amazon with a 20-year head start.