KOHL’S ($KSS): The Retailer is Toast, But Someone's Getting Paid

The math on billions in unencumbered assets vs. the reality of Swiss cheese indentures and desperate management

🚨 Connect: Twitter | Threads | Instagram | Bluesky | Reddit

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list (limited spots).

They own billions in real estate but can’t figure out how to sell clothes…

Come on, does anybody really believe Kohl’s has a future?

The company sits on billions of unencumbered property that’s likely worth more than the entire business. Think about that for a second. The land and buildings are more valuable than the company that operates on them. What does that tell you about the actual retail operation?

It tells you it’s broken.

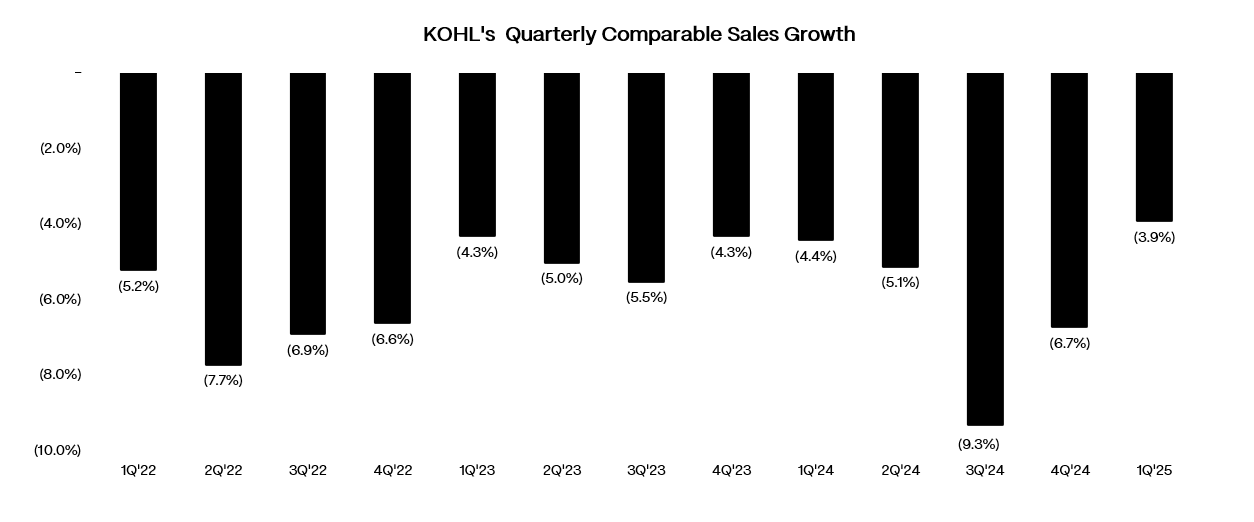

Thirteen straight quarters of declining sales. Thirteen! And management keeps shuffling things around like deck chairs on the Titanic.

Speaking of management, they’ve had five CEOs in the past seven years. Five! The latest guy lasted FOUR months before getting fired for ethics violations. You can’t even learn where the nice bathroom is in four months, never mind turn around a $16 billion retailer.

But here’s the real issue: they’re stuck in the middle of nowhere. Too expensive for value shoppers who flock to TJX and Ross. Not cool enough for younger demographics. Not convenient enough to compete with Amazon and Target.

Their core customer is a suburban woman in her 50s who still clips coupons. Meanwhile, everyone under 40 is shopping online or at specialty retailers that actually understand trends.

The dirty secret is that department stores were always middlemen, and the internet eliminated the need for middlemen. Nike doesn’t need Kohl’s anymore, they can sell direct to consumers.

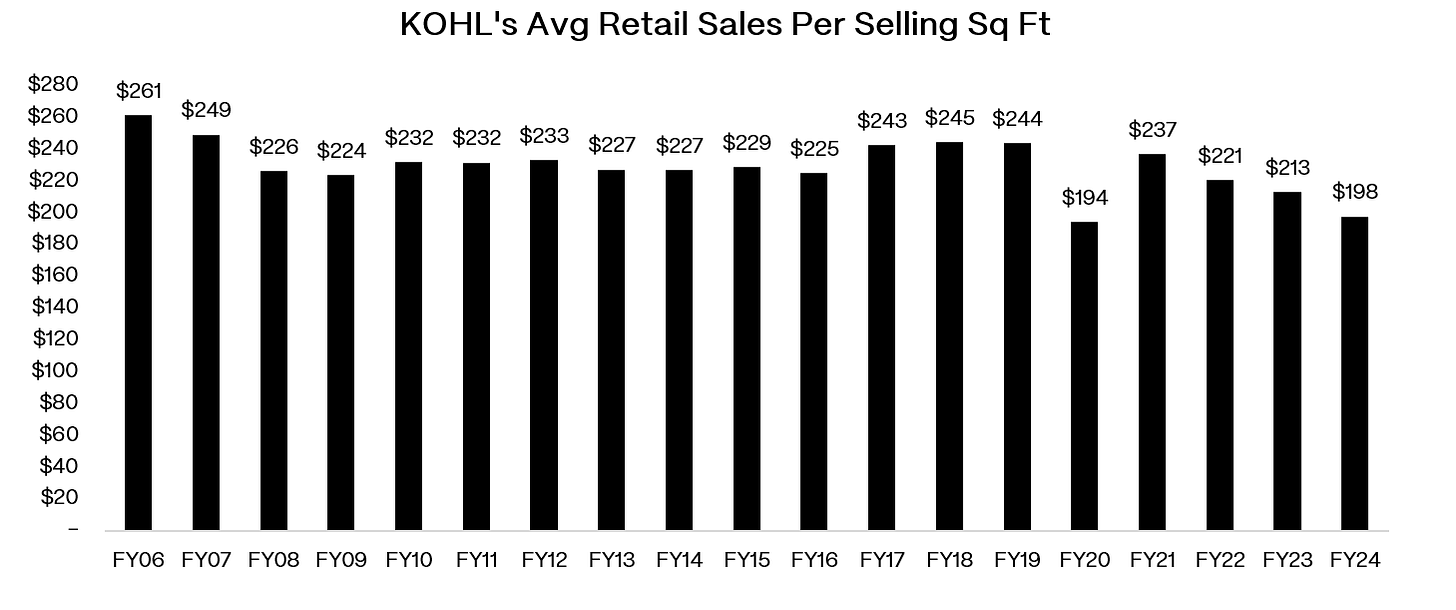

The most telling statistic? Sales per square foot have collapsed from $261 in 2006 to $198 today. That’s not inflation, that’s structural decline. The productivity of their physical footprint has been cut by nearly 25%.

Yet somehow they think they can turn this around with “back-to-basics merchandising.” Come on. This isn’t an execution problem, it’s an existential problem.

So the retailer is toast. But maybe there’s still money to be made in the capital structure. With 30+ million square feet of unencumbered real estate and bonds trading at massive discounts, somebody’s going to get paid.

The question is who. And how much.

Background

Kohl’s was supposed to be the smart money’s favorite department store play. Off-mall locations, middle America convenience, and a customer base that actually shopped there regularly. For nearly two decades, the formula worked.

The company built its empire on a simple promise: national brands at reasonable prices in stores where you could actually park. Unlike mall-based competitors getting crushed by foot traffic declines, Kohl’s operated over 1,100 standalone locations in suburban strip centers and power centers. The model was textbook retail efficiency: 80% of sales were recurring, driven by a loyal base of suburban women in their 40s and 50s who knew exactly how to game the Kohl’s Cash rewards system. Private labels like Sonoma Goods for Life and Croft & Barrow delivered superior margins while exclusive partnerships with Nike and Under Armour drove traffic.

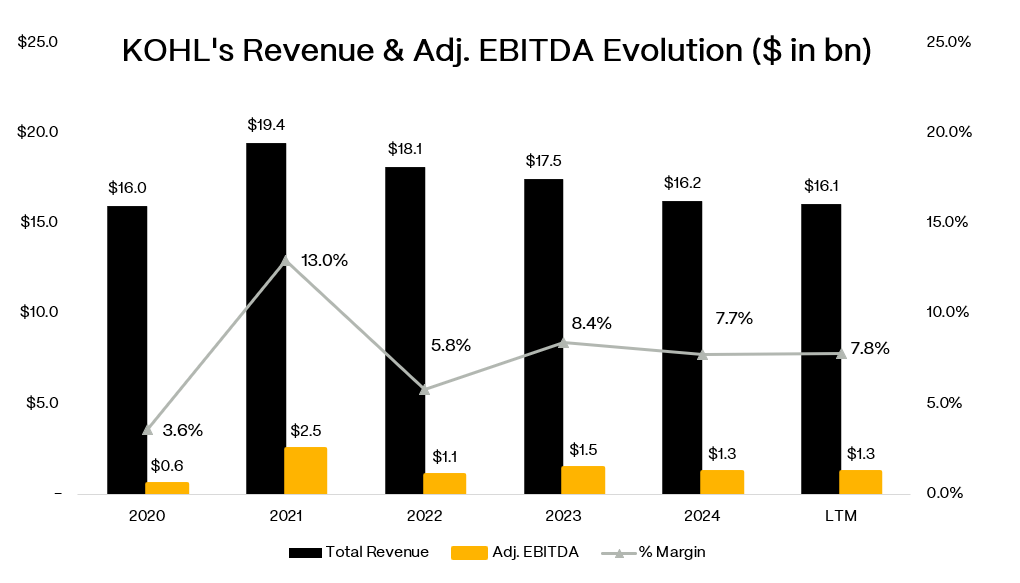

Post-COVID initially looked like validation of the model. When stores reopened in 2021, pent-up demand and stimulus spending drove a massive rebound. Comps surged 20.3% that year as revenue recovered to $18.5 billion. Management talked about emerging stronger, digital capabilities, and strategic partnerships. For a moment, it looked like Kohl’s had cracked the code.

Then reality set in, and it’s been ugly ever since. Starting in 2022, comparable sales have declined for 13 consecutive quarters. Revenue has fallen from that $19.4 billion 2021 peak to just $16.2 billion in fiscal 2024. EBITDA margins collapsed from historical levels of 13% down to under 8% as promotional intensity ramped up and fixed costs ate into a shrinking base.

The core problem is demographic. Kohl’s customer base is aging out without replacement. The suburban mom who built weekend shopping trips around stacking Kohl’s Cash with percent-off coupons either can’t afford it anymore or has discovered that Target and Amazon are simpler. Younger consumers expect transparent pricing and seamless digital experiences, not gamified promotional complexity.

Meanwhile, the competitive landscape shifted permanently. Off-price retailers perfected the treasure hunt model with cleaner pricing. Amazon captured the boring replenishment business. Even Target upgraded its private labels and omnichannel capabilities to compete directly with Kohl’s core value proposition.

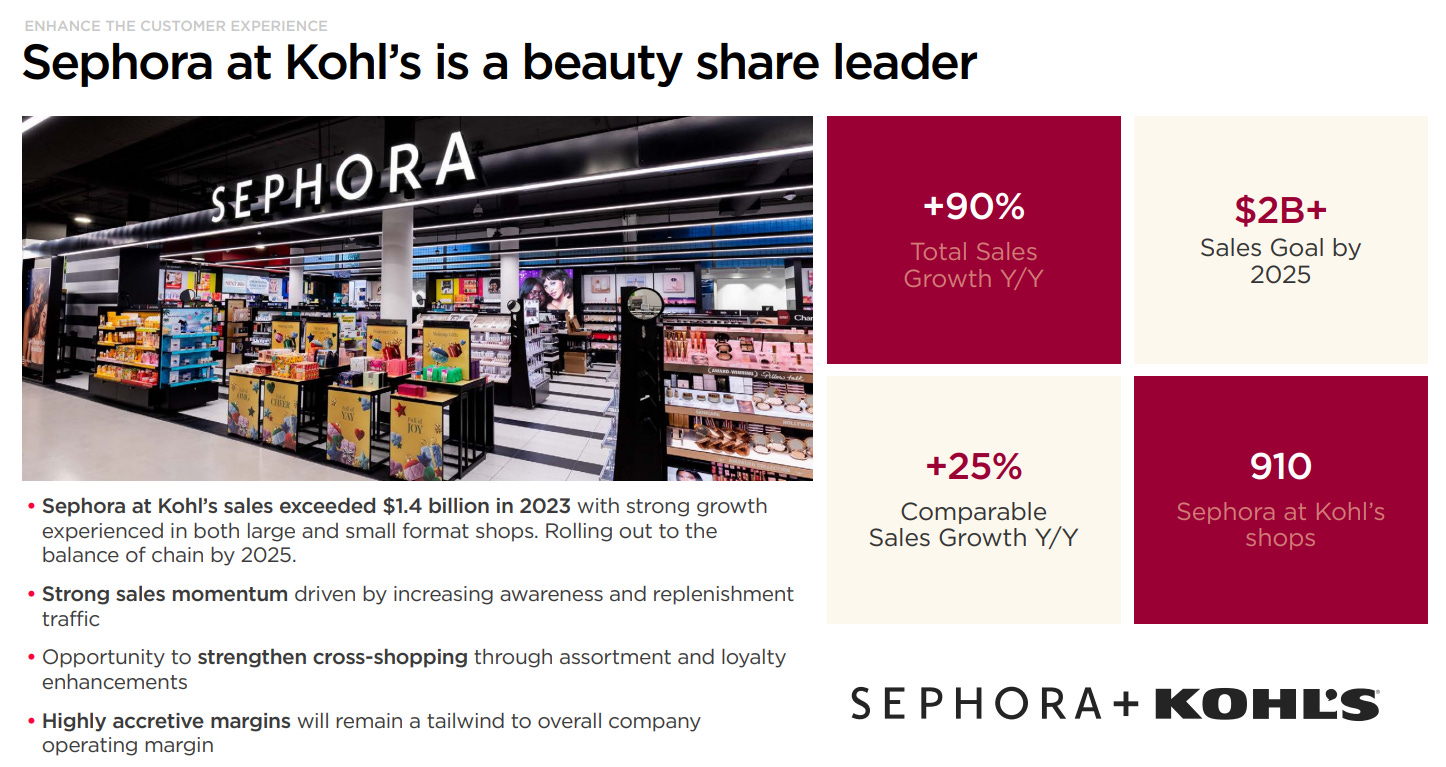

Management’s response has been a series of band-aids. The Sephora partnership drives incremental beauty traffic but limited cross-shopping.

Amazon Returns brings bodies into stores but conversion remains weak. Leadership has cycled through three CEOs in as many years, most recently Ashley Buchanan’s four-month tenure that ended with an ethics violation.

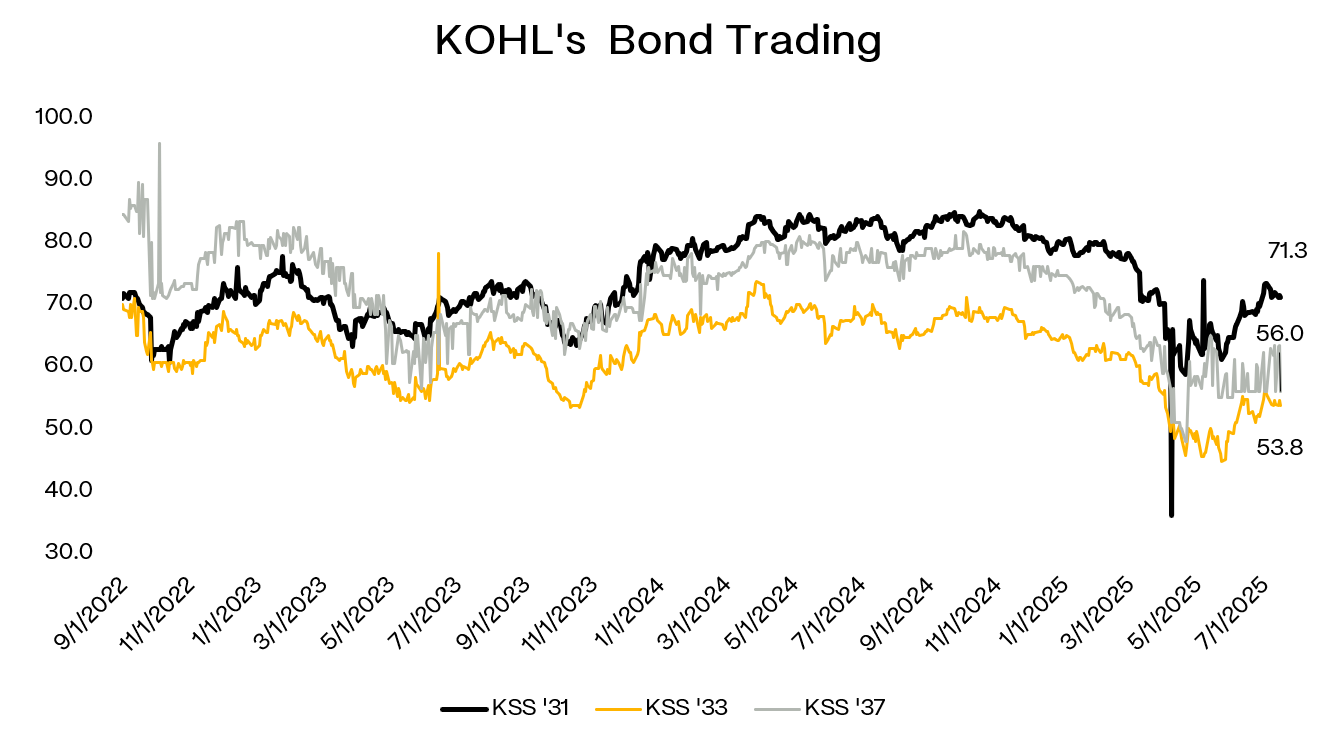

Today, the math is stark. Kohl’s sits on billions of unencumbered real estate while unsecured bonds trade in the 50s. The company maintains a $55 million annual dividend as creditors wonder whether management will monetize the assets before the operating business destroys what’s left of enterprise value.