High Yield Market Weekly: Single-B Surge Powers Market Higher...July Sets New Record as Refinancing Wave Peaks

Quality Rotation Accelerates: HY Up +0.35% as Single-Bs Lead $9.5bn Supply Absorption

🚨 Connect on Twitter | Threads | Instagram | Bluesky | Reddit

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list — limited spots.

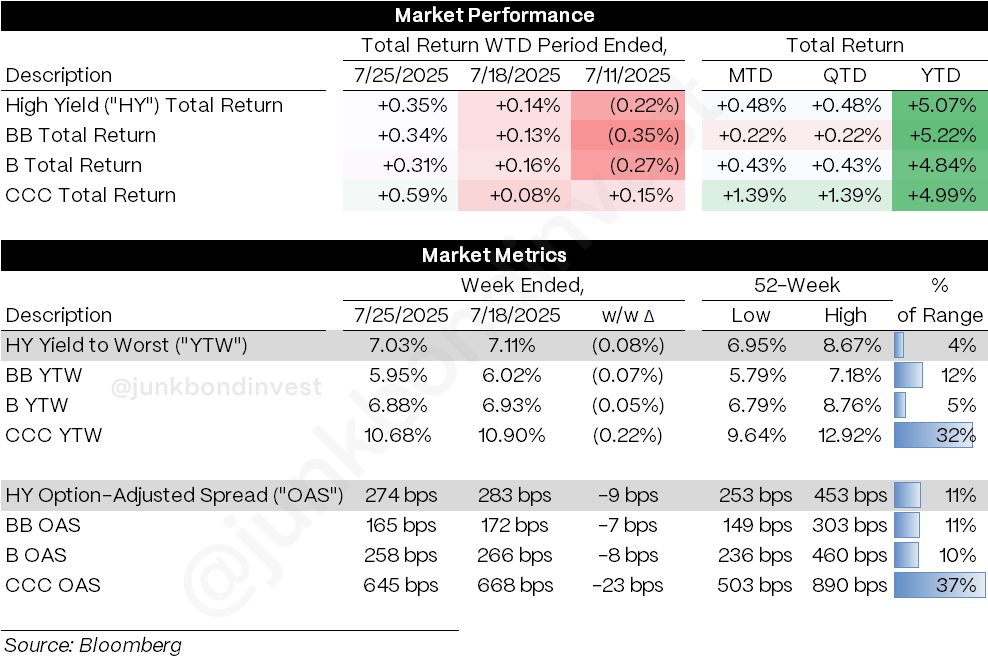

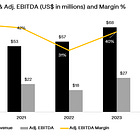

The quality shift is accelerating. High yield posted another solid +0.35% gain last week, with CCCs leading at +0.59%, followed by BBs at +0.34% and Bs at +0.31%. While CCCs topped weekly performance, the primary market told a different story as the majority of new tranches carried single-B ratings, reflecting both issuer positioning and investor appetite for this credit segment.

July is on track to shatter records. Month-to-date issuance has reached ~$28 billion, making this the busiest July since 2021. More remarkably, this marks the sixth consecutive week of substantial volume. When markets can sustain this pace while consistently accommodating single-B focused issuance, it signals the refinancing cycle has reached full maturity.

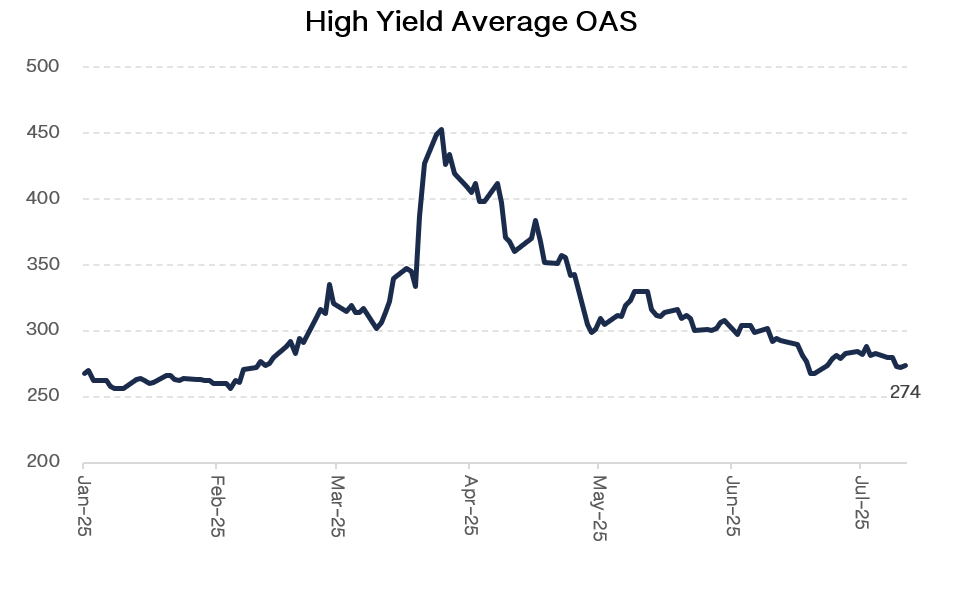

Spreads tightened 9bps to 274bps, bringing consistent weekly compression and reinforcing the technical strength that’s defined this summer rally. When companies like CoreWeave can return to market just two months after their debut and Gray Media (a TV broadcaster!) can price a second deal within weeks of their first, the primary machine isn’t just functioning but operating at peak efficiency.

Weekly Performance Recap

The numbers reveal a market showing clear performance leadership from the riskiest credits. HY gained +0.35%, extending the summer’s consistent performance:

CCCs dominated at +0.59%, continuing their volatile but ultimately rewarding trajectory with MTD gains now at +1.39%

BBs posted +0.34%, solid performance but trailing single-Bs in month-to-date returns

Bs delivered +0.31% weekly, though their MTD performance significantly outpaces BBs, reflecting institutional preference for this rating tier

The overall picture showed continued momentum:

Overall index yields declined to 7.03%, maintaining the steady grind lower that’s characterized recent weeks

Spreads compressed to 27bps, now well into the lower portion of the 52-week range as the tightening cycle continues

Rating-specific moves favored all categories: BBs, Bs, and CCCs all saw meaningful spread compression with CCCs posting the largest move

The month-to-date single-B preference is notable. While CCCs led weekly performance, the longer-term trend shows institutional investors favoring single-B credits over BBs on a month-to-date basis. This reflects strategic positioning toward credits offering attractive risk-adjusted returns as spreads compress across the quality spectrum.

Primary Market Activity

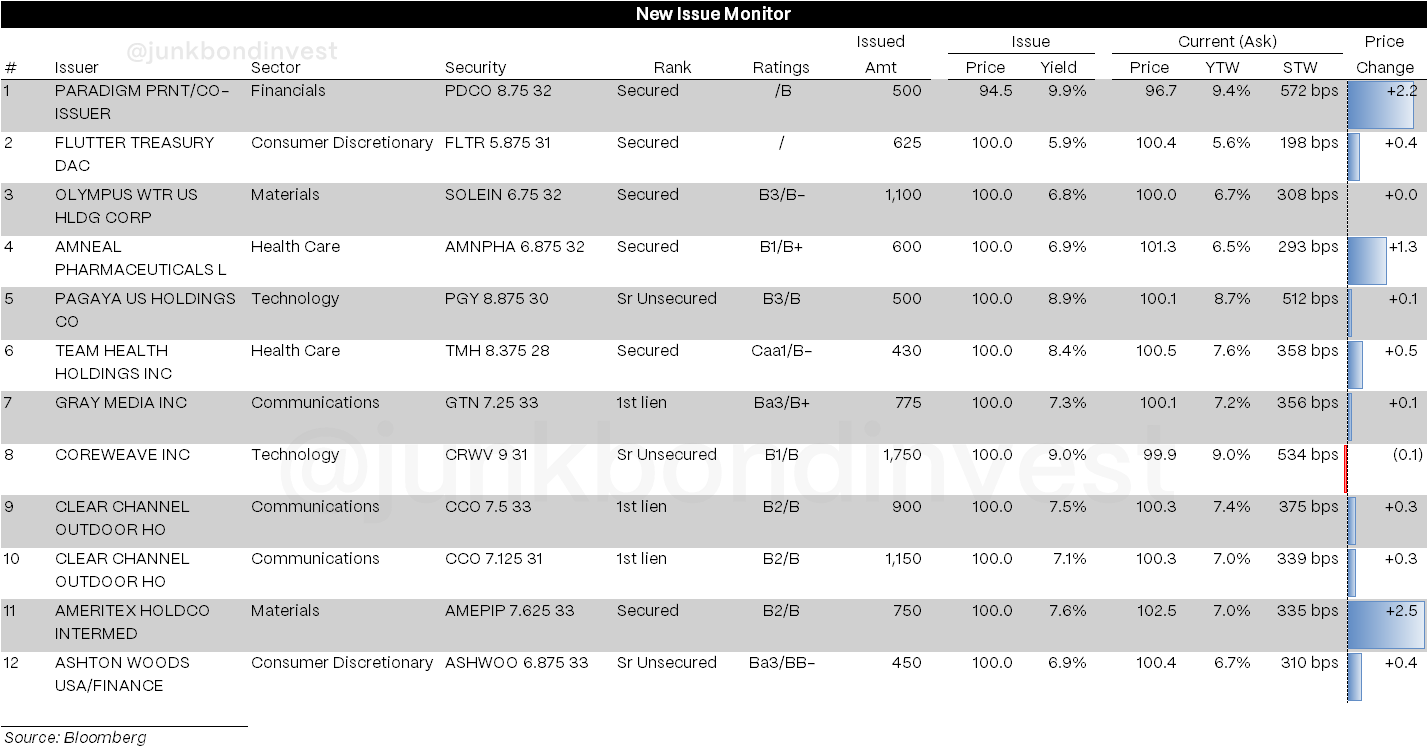

The week’s issuance reflected strong single-B demand, with the majority of tranches finding eager reception:

CoreWeave demonstrated market receptivity for repeat issuers, successfully pricing roughly $1.75 billion of medium-term notes at 9.00% just two months after their initial market entry

Gray Media completed their refinancing strategy with approximately $775 million of first-lien secured notes priced attractively, following their recent second-lien transaction

Clear Channel Outdoor addressed their maturity wall with a comprehensive dual-tranche refinancing totaling over $2 billion across different maturity profiles

Solenis funded strategic expansion with a substantial combined bond-and-loan package supporting their recent acquisition

The execution quality remained exceptional. Multiple deals upsized and priced at or inside guidance, while several issuers made swift return trips to market. When companies can successfully execute follow-on deals within weeks of initial offerings, it signals both issuer confidence and investor appetite.

Secondary Market

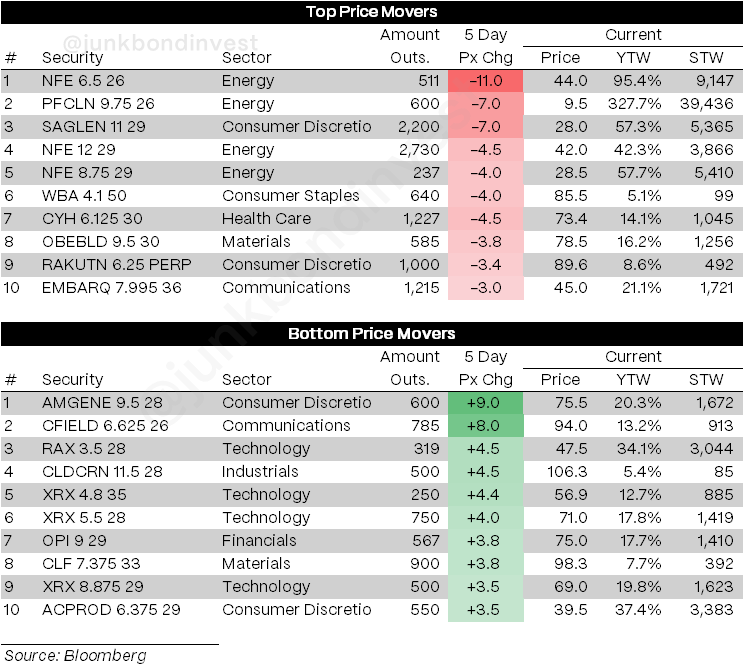

Secondary trading revealed the ongoing energy sector volatility alongside broader technical strength:

Top Performers:

Technology showed unexpected strength with AMGENE (+9.0pts), CFIELD (+8.0pts), and multiple XRX issues gaining 4-4.5pts as the sector found its footing

Materials benefited from specific situations with CLF (+3.8pts) rallying on interest from foreign competitors

Financials maintained steady demand with OPI (+3.8pts) leading the sector

Bottom Performers:

Energy faced significant pressure across multiple NFE tranches, with declines of 4-11pts reflecting ongoing uncertainty around Puerto Rico gas supply negotiations

Consumer Discretionary showed mixed signals with SAGLEN (-7.0pts) declining while other names like RAKUTN (-3.4pts) gave back recent gains

The energy sector volatility particularly around New Fortress Energy bonds reflects ongoing uncertainty around contract negotiations. When a single company can dominate the weekly decliner list across multiple issues, it highlights both the opportunity and risk in credit-specific situations.

Looking Ahead

This week brings an unprecedented concentration of catalysts that could reshape market dynamics heading into August. With a signfiicant portion of the S&P 500 reporting earnings between Wednesday and Friday, plus an FOMC decision, PCE data, and NFP, the macro calendar couldn’t be more packed.

Key developments to monitor:

FOMC meeting Wednesday with minimal rate change expectations, focus shifts to Powell’s commentary on the economic outlook and policy impacts

Q2 GDP Wednesday expected to show modest annualized growth, with trade dynamics playing a major role

PCE Thursday will provide the Fed’s preferred inflation gauge ahead of policy discussions

July NFP Friday expected to show hiring deceleration from June’s levels

Primary calendar remains robust with substantial volume expected despite the heavy macro calendar

Most importantly, the early August tariff deadline approaches with potential for additional trade policy developments. The combination of heavy earnings, Fed policy, and trade uncertainty creates a challenging backdrop for markets to navigate.

The refinancing wave shows no signs of slowing. With companies like Team Health, CoreWeave, and Gray Media successfully addressing their maturity profiles, and conditions remaining favorable despite recent rate volatility, issuers continue taking advantage of receptive markets.

Single-B positioning reflects evolving strategy by investors seeking optimal risk-adjusted returns as the market matures. The month-to-date outperformance (+0.43% vs +0.22% for BBs) suggests institutions are finding value in this rating tier despite weekly performance variations.

The week ahead tests whether technical momentum can withstand the heaviest fundamental calendar in months. Given the consistency of recent execution and continued refinancing needs, the primary market foundation appears solid even as secondary markets brace for potential volatility from the macro onslaught.

Find the most recent JunkBondInvestor posts below

Disclosure: The information provided is based on publicly available information and is for informational purposes only. While every effort has been made to ensure the accuracy of the information, the author cannot guarantee its completeness or reliability. This content should not be considered investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release the author from any liability. Always seek professional advice tailored to your financial situation and objectives.