High Yield Market Weekly Minutes: Spreads Resilient as the Macro Fog Thickens (November 17, 2025)

BBs hold, CCCs wobble, AI-linked credit cracks, and next week finally delivers real data.

🚨 Connect on Twitter | Threads | Instagram | Reddit | YouTube

TL;DR

High yield posted a modest weekly gain in a market trading on incomplete information and too many Fed speeches. Yields held flat, spreads tightened a couple bps, and CCCs were the only losers as their yields pushed above 10%. Primary reopened with about $8b of supply, mostly BB paper, while the AI data center complex showed widening cracks. Secondary was defined by dispersion, not direction. With the shutdown ending, the market finally gets real data this week.

Last week felt like driving blind. No payrolls, no CPI, no PCE, no clean macro anchor. Instead, investors were left parsing a steady parade of Fed speakers who sounded noticeably less eager to cut in December. Rate-cut odds fell from near certainty to something closer to a coin toss, and the back half of the week traded like everyone was recalibrating around that shift.

Credit held up better than equities. Stocks had their worst day in a month. Crypto slid. High yield barely moved. With incomplete information, technicals took over. The bid for BBs and Bs held steady, CCCs softened, curves barely shifted, volumes stayed orderly.

It looked like a holding pattern, but it still told you where the market’s head is at: protect quality, price idiosyncratic risk honestly, and avoid adding exposure where earnings visibility is deteriorating.

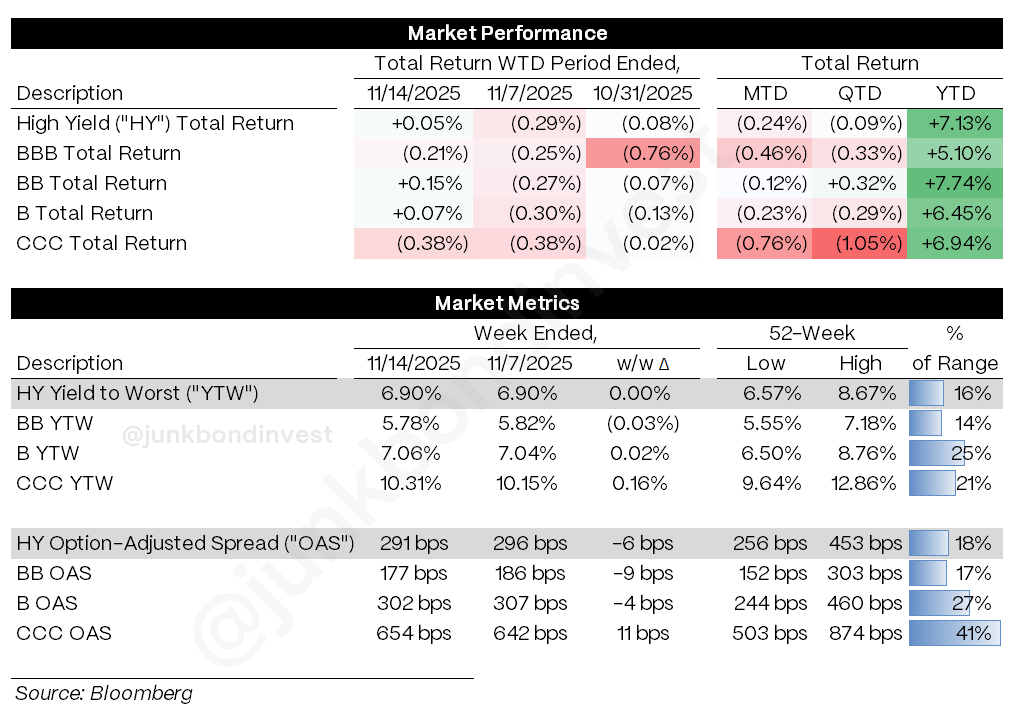

Weekly Performance Recap

High yield ended slightly positive for the week, but it did not get there cleanly. Thursday delivered the sharpest one-day drop in nearly five weeks across risk assets, dragging HY lower intraday before a Friday recovery nudged the index back into the green.

Yields closed unchanged, which is unusual in a week with that kind of equity volatility. The modest 6 bps of spread tightening says more about positioning than conviction. Investors were not chasing risk, just keeping exposure in place until they see real data.

The weak spot was CCCs. Returns were negative, yields climbed to roughly 10.3%, and spreads widened into the mid-650s. Every time the Fed leans more hawkish this fall, CCCs are first to react. That pattern held. The market is not reaching for the bottom rung without macro clarity.

Sector performance was all over the map. Energy remains one of the few places with consistent momentum. Capital goods and tech lagged slightly. Communications is still the top YTD performer but was basically flat this month. That is not broad risk-on; it is investors sorting through fundamentals and waiting for a better signal.

YTD returns north of 7% are the cushion. They let investors be patient rather than forced sellers every time headlines wobble.

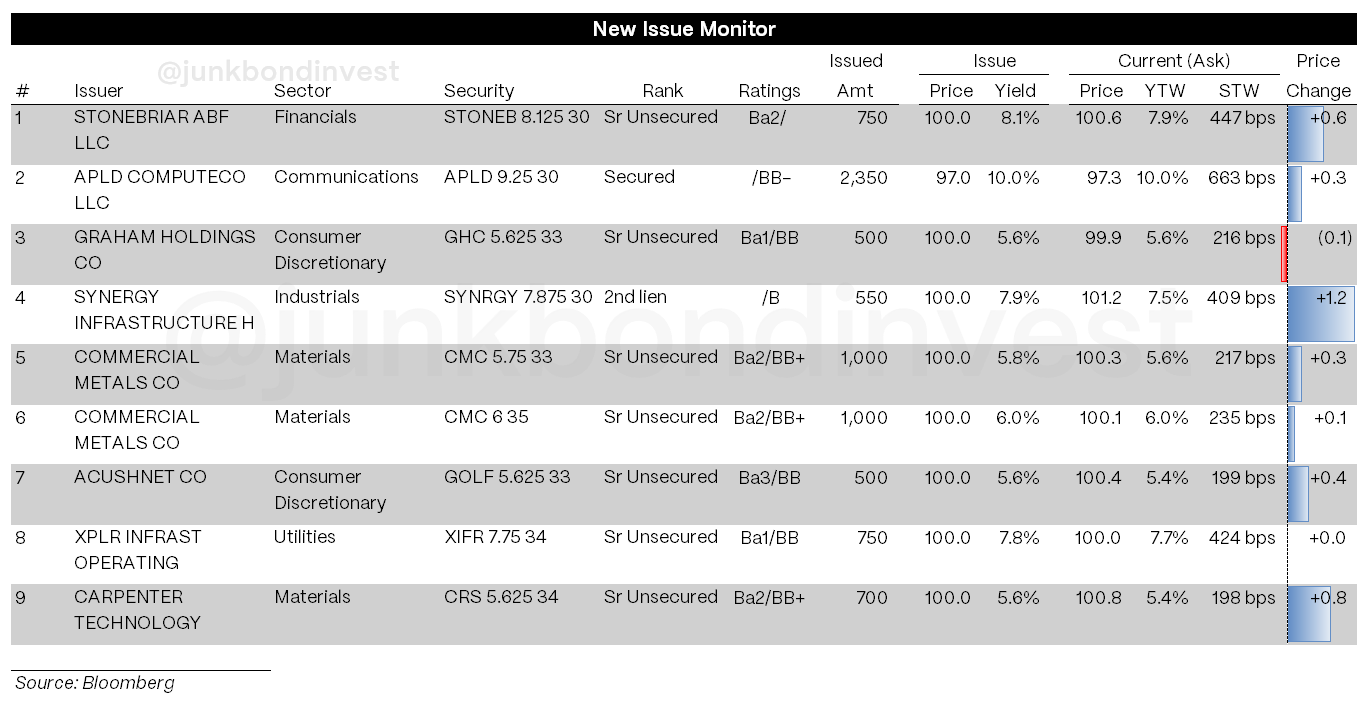

Primary Market Activity

Issuance picked up as soon as shutdown headlines started to fade, with roughly $8b pricing across the U.S. calendar. Not frothy, but healthy. Borrowers with clean refi stories or strong brands priced well. Everyone else paid up.

AI infrastructure stayed in focus. Applied Digital printed a $2.35b secured green bond at roughly a 10% yield and a 97 handle. The deal got done, but the aftermarket told the truth. This is no longer an “AI anything works” tape. It is now a credit selection exercise. Recent Cipher Mining and TeraWulf deals remain in the conversation because investors are starting to differentiate between projects with solid hyperscaler support and situations where execution risk is climbing.

Higher-quality names dominated. Commercial Metals raised $2b across two tranches at 5.75% and 6%. Carpenter Technology refinanced at 5.625%, inside talk. Acushnet printed at 5.625% and traded fine. That is where demand is deepest: BBs tied to real businesses with predictable cash flow.

The market has repriced, but it is not closed. The tone is selective rather than defensive.

Secondary Market

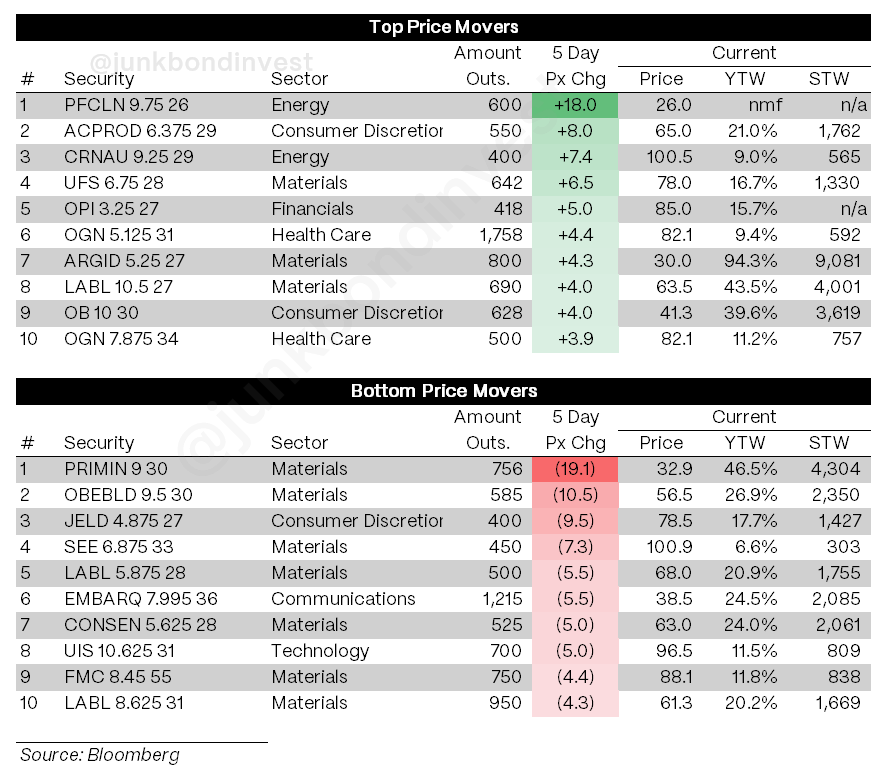

Secondary was driven by issuer moves, not macro direction.

Organon rallied after better numbers and progress on governance concerns. Gray Media bounced on the back of expected political ad revenue. AI-linked credits went the other way. CoreWeave’s 2030s slid after the company cut revenue guidance due to construction delays. The reaction was immediate: more single-name tech CDS hedging and more questions about whether some of the 2024-2025 AI growth stories were priced too far above execution reality.

That shift is not isolated. Trading volumes in Oracle CDS and other mega-cap tech names have jumped as investors hedge indirect AI exposure. HY does not have a lot of big liquid tech issuers, but a meaningful slice of recent high-beta supply is tied to compute buildouts, so the read-across matters.

Elsewhere, packaging stayed heavy. Demand softness and upcoming maturities weighed on sentiment. Consumer finance names like Pagaya traded defensively on low-end credit worries.

The tape is clear: this is a single-name market. Beta is not driving returns. Earnings and execution are.

Looking Ahead

With the shutdown resolved, the backlog of delayed data finally starts to move. The September jobs report is expected early this week. It will be dated, but it may be the only full labor snapshot the Fed has before the December meeting. Consensus sits near +45k jobs and a 4.3% unemployment rate, with risk skewed toward an uptick. Hours worked have been softening, which matters as much as wage growth this late in the cycle.

Fed communication has clearly shifted. Several voting members now argue the bar for further cuts is higher than the market assumed. That explains the CCC underperformance. Investors want real information before adding risk. Without it, caution is the default.

Small-business sentiment has fallen for two straight months. Housing is stabilizing but still historically slow. AI-linked credits are moving from hype to execution tests. Packaging and building products are adjusting to softer demand. Retail earnings begin this week and will give the first clean read on low-end consumer behavior in weeks.

The next two weeks should finally set the tone into year-end. For now, high yield is stable, issuance windows are open, but the market is not extending risk without data.

This is not a chase-the-bid environment. It is a keep-your-head-down environment until the first real macro prints hit the tape.

Find the most recent JunkBondInvestor posts below

Disclosure: The information provided is based on publicly available information and is for informational purposes only. While every effort has been made to ensure the accuracy of the information, the author cannot guarantee its completeness or reliability. This content should not be considered investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release the author from any liability. Always seek professional advice tailored to your financial situation and objectives.