Ferrellgas Partners ($FGPR): The Equity’s Up 2x...Can It Double Again?

The litigation’s settled, the refi’s done, and the operating business keeps chugging along.

🚨 Connect: Twitter | Threads | Instagram | Reddit | YouTube

I wrote about Ferrellgas a little over a year ago. The idea was simple: a steady propane business trapped in a messy capital structure that needed a refinancing to unlock value. The refi piece somewhat played out but not exactly and the path wasn’t clean. Operations were mixed, the litigation dragged on longer than anyone wanted, and the equity sat dead for months before suddenly ripping higher.

Now? The Class A units have more than doubled over the past year. The refinancing is done. The Eddystone litigation that tied up liquidity for years is finally settled. The operating business keeps printing cash, leverage is coming down, and the market is slowly waking up to the fact that this thing isn’t blowing up.

So here’s the question: can the equity 2x again from here, or more?

That depends entirely on what happens with the next set of capital structure moves. Ferrellgas is still a leveraged, post-reorg story with more than $2bn of debt and preferred equity sitting on top of the Class A. It’s deeply subordinated and extremely volatile. At the same time, the newly issued bonds are trading well wide of the index.

In this note, I’ll walk through where the company stands today, break down the recent refinancing, and lay out how I’m thinking about both the unsecured bonds and the equity in this next phase.

Situation Overview

Over the past twelve months, Ferrellgas has gone from post-reorg cleanup mode to something resembling normalcy. Last year, the company was still dealing with legacy messes. The Eddystone litigation, a 2026 note maturity, and a capital structure that left management with zero room to maneuver.

Those problems are mostly solved now. The litigation is settled, the 2026 notes are gone, and Ferrellgas enters FY’26 on the firmest footing it’s had in nearly a decade.

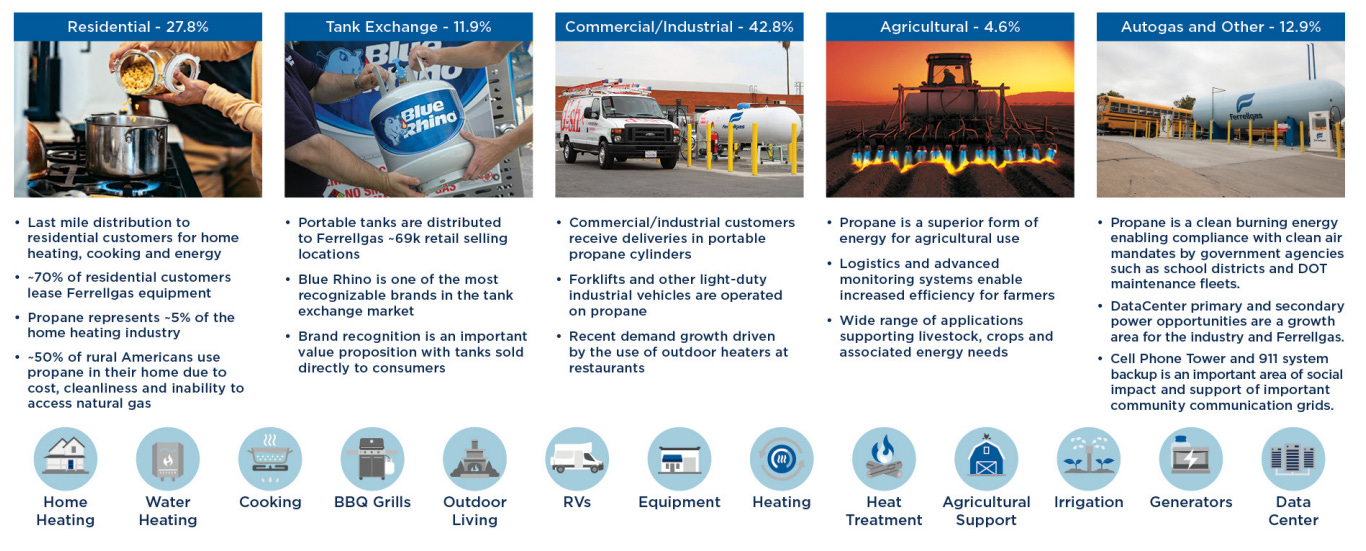

Meanwhile, the propane distribution business remains exactly what it’s always been. Boring, predictable, and cash-generative. Demand tracks long-term averages. Degree days drive seasonal swings. Consolidation among regional distributors continues at a steady clip. Ferrellgas sits as the 2nd-largest player in the U.S. market, benefiting from scale, logistics reach, and brand equity through Blue Rhino.

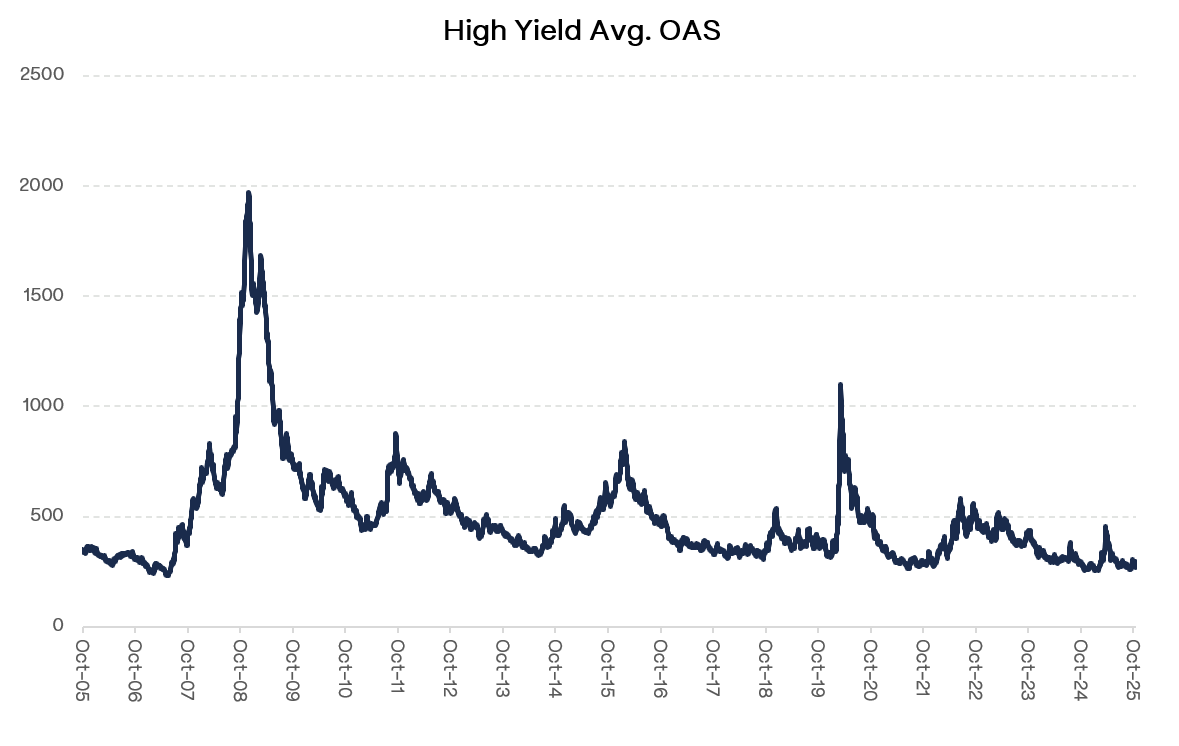

The high-yield market has also been cooperative. With high yield spreads near all-time tights, lower quality issuers like Ferrellgas can access capital at reasonable pricing, even with higher base rates. That’s what made the recent refinancing in October possible.

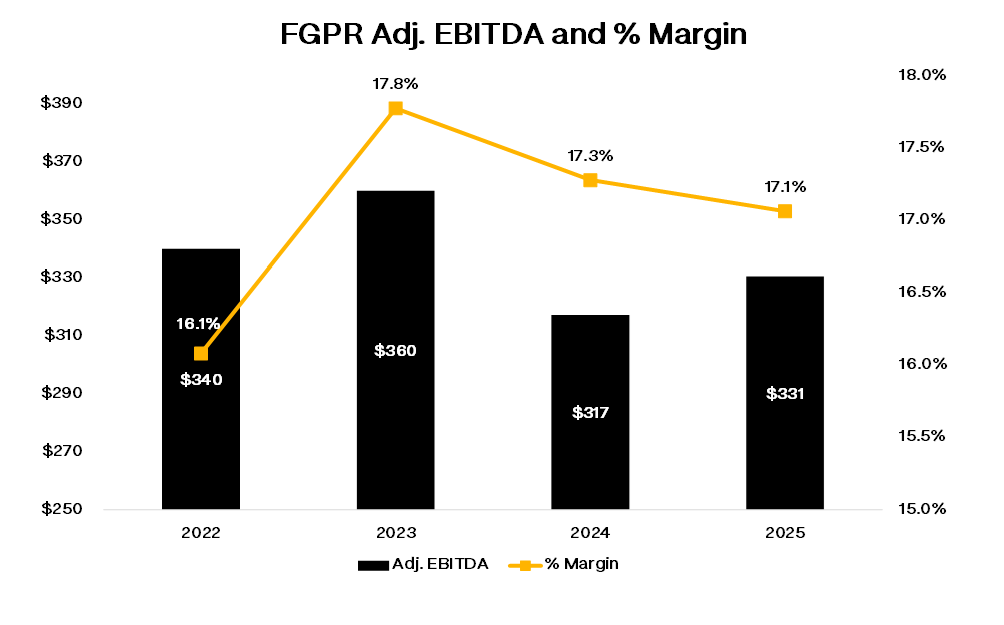

Overall, FY’25 (period ending July 2025) results were fine. Despite mixed weather and modest gallon growth, Ferrellgas generated record gross profit of $1bn+ and increased Adj. EBITDA 4% y/y to $331mm. Margins down slightly despite disciplined pricing and continued cost control across fleet, fuel, and labor.

Telematics and route optimization kept delivering measurable efficiency gains. Blue Rhino expanded its vending network and national accounts base, which matters because it provides more stable, weather-agnostic earnings. Something you want in a propane business that lives and dies by winter temperatures.

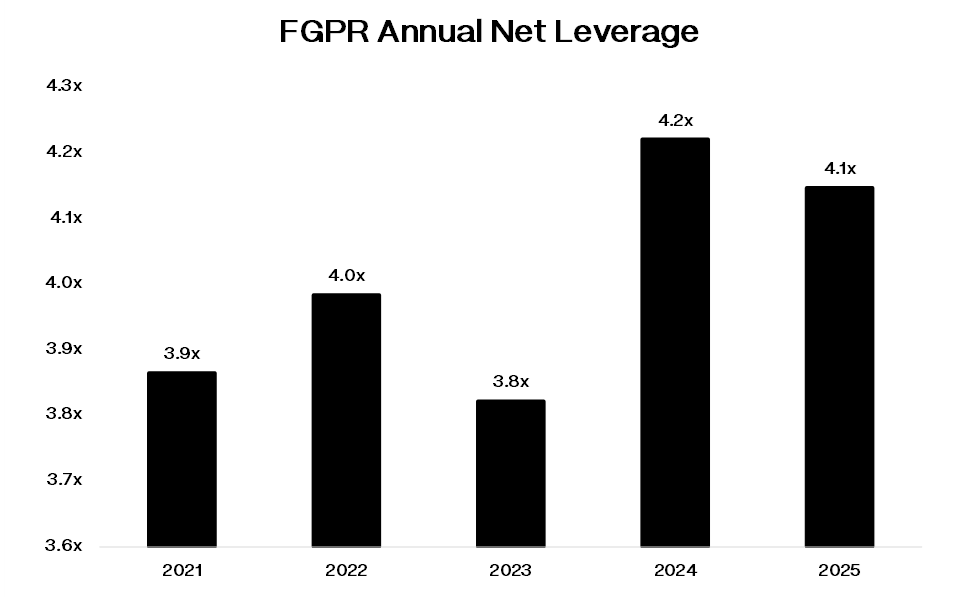

Importantly, FY’25 marked the shift from “fix the balance sheet” to “manage the balance sheet.” Net leverage ended the year around 4.1x, roughly flat y/y as growth in levered FCF offset higher interest expense.

The most significant event over the past year was closing the book on the Eddystone litigation. The lawsuit that had been hanging over this company like a dark cloud since 2017.

In 2014, Bridger Logistics (which Ferrellgas acquired in 2015) signed a take-or-pay agreement with Eddystone Rail Company for a crude-by-rail terminal in Pennsylvania. When oil prices collapsed in 2016 and Bridger defaulted on minimum volume commitments, Eddystone sued. They eventually won a $190mm judgment that Ferrellgas secured with an LC-backed appeal bond, effectively tying up revolver capacity for years.

In January 2025, Ferrellgas finally settled for $125mm: $50mm upfront plus two $37.5mm installments due in June 2025 and January 2026. The settlement released the $190mm appeal bond and associated LCs, freeing up borrowing base capacity and removing the last major contingent liability from the balance sheet.

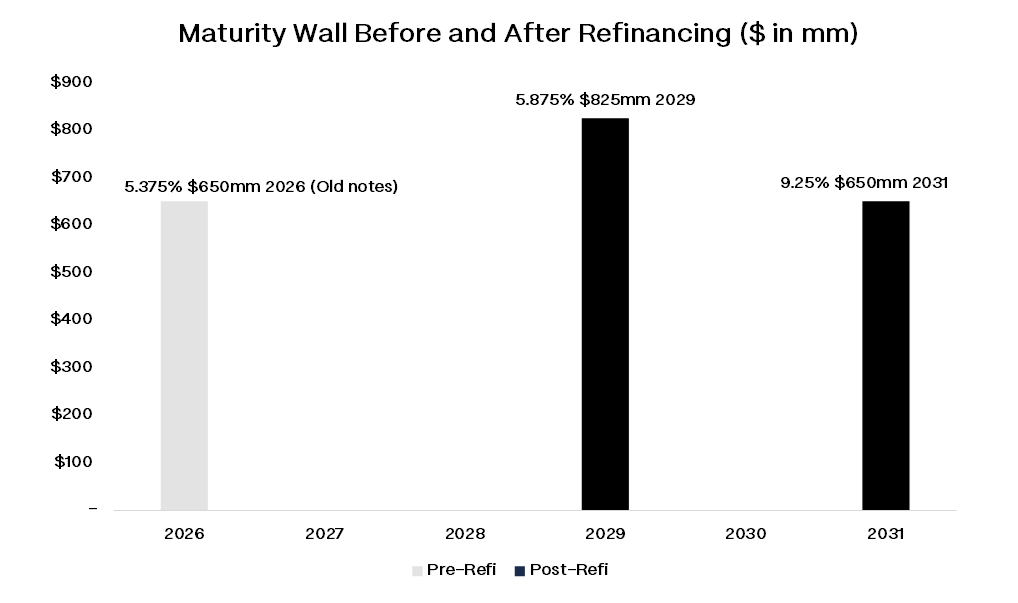

With the legal overhang gone coupled with hot credit markets, management moved quickly. In October 2025, Ferrellgas refinanced the entire $650mm 5.375% 2026 notes, issuing $650mm of new 9.25% senior notes due 2031 and amending the RCF to extend to 2028, increase capacity to $350mm, and restore full borrowing base flexibility. Together with the existing $825mm 5.875% notes due 2029, Ferrellgas now has no material maturities until 2029.

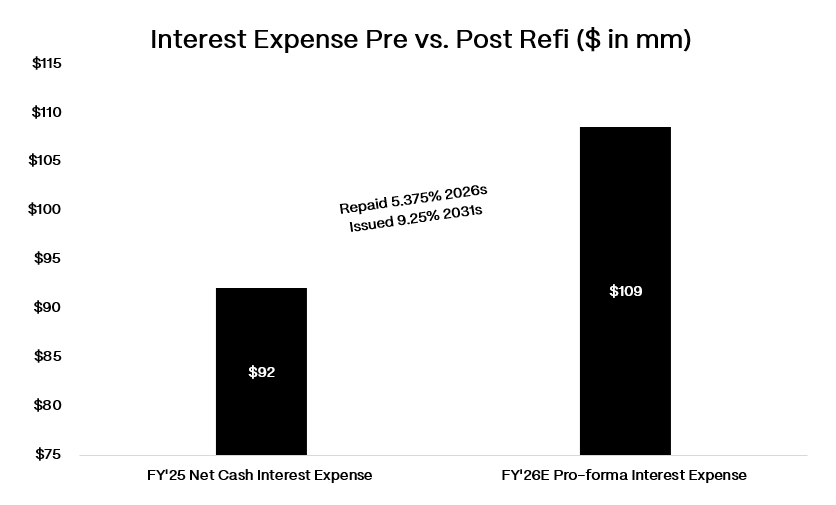

The problem? They’re now paying 9.25% on $650mm of debt vs. 5.375% previously. Interest expense just went up significantly, which will pressure FCF and limit how fast they can deleverage.

Even with all this progress, the capital structure remains a mess. The preferred units at the operating company and the Class B units at the holding company represent significant layers of subordination that will need to be addressed.

The next phase centers on simplifying the remaining layers of the capital structure, preserving FCF, and positioning the business for further credit improvement. Whether the equity can double again depends entirely on how, and how quickly, management executes on those next moves.

With those fixes complete, Ferrellgas is no longer a distressed refi story but a capital-structure optimization trade.

Here’s what I think happens next: