The Rise, Fall, and Resurgence of Ferrellgas Partners ($FGPR)

Exploring a Post-Reorg Special Situation with a Potential Near-Term Catalyst

Follow me on Twitter / Instagram / Threads 🚨 Read time below = 16 minutes 👇

This week, I’ll be reviewing Ferrellgas—the 2nd-largest propane distributor in the US. The company recently went through a prepack bankruptcy and emerged with a complex capital structure that now includes Class A units (OTC:FGPR) and Class B units (OTC:FGPRB) as well as a hefty slug of preferred equity at the OpCo level. On top of that, the company remains decently leveraged with two outstanding bond tranches. I think this situation is interesting due to the prospect of a near-term catalyst, which I’ll delve into and elaborate on in this week’s write-up.

Situation Overview:

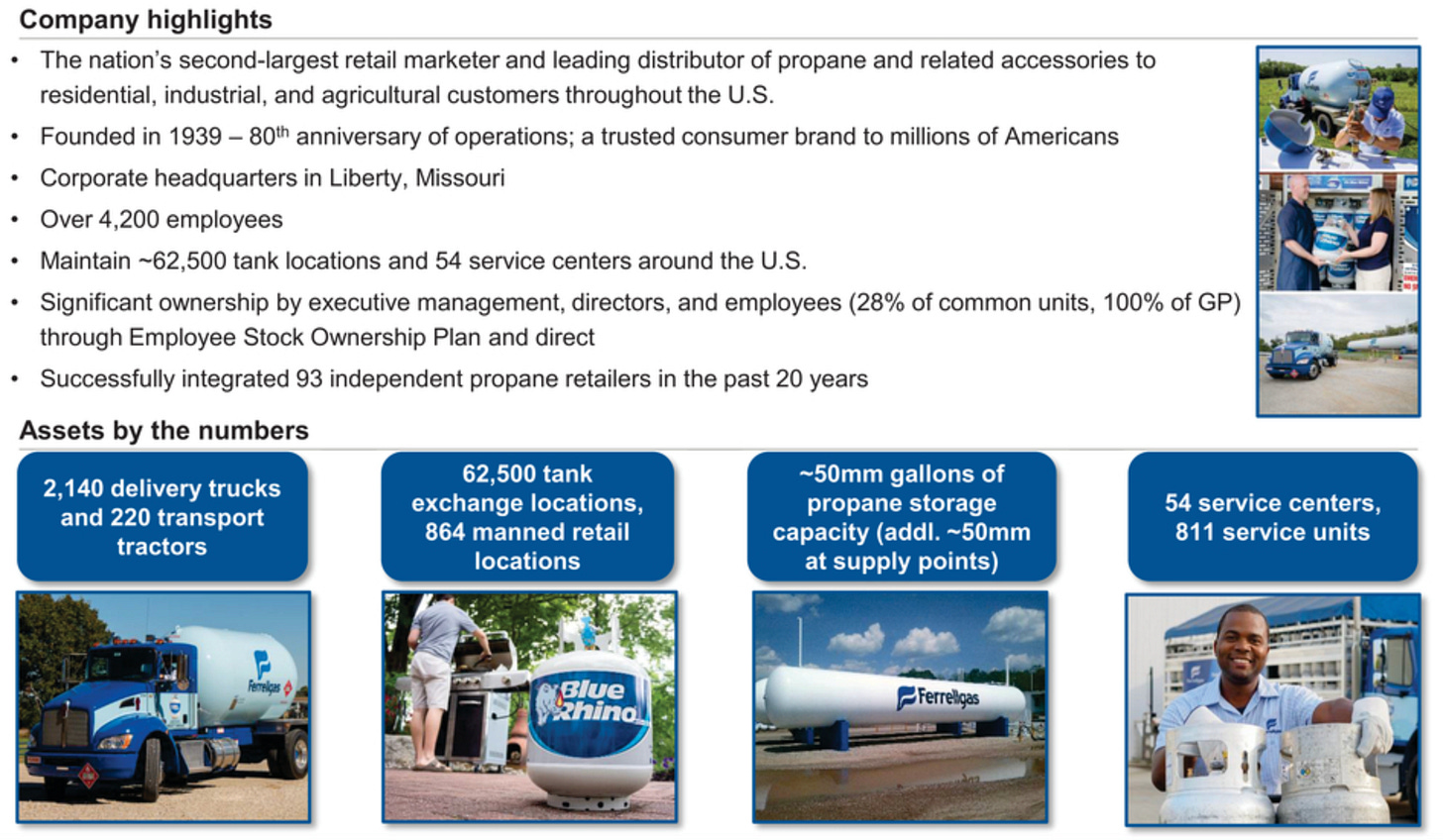

Founded in 1939 as Butane Gas Company, Ferrellgas Partners L.P. (“FGPR” or “HoldCo”) is the 2nd largest propane distributor in the US, operating through its subsidiary Ferrellgas L.P. (“OpCo”). The company’s fleet delivers over 800 million gallons of propane annually across all 50 states, serving residential, commercial, agricultural, and wholesale customers. Ferrellgas also owns Blue Rhino, the nation’s largest propane tank exchange brand. The business is highly seasonal and weather-dependent, with peak demand occurring during the November to March heating season.

Where Things Went Wrong

In 2014 and 2015, FGPR embarked on an aggressive expansion into midstream oil operations under the guidance of former CEO Steve Wambold, acquiring Sable Environmental and Bridger Logistics for a combined total of just under $1 billion. These acquisitions, largely debt-funded, significantly increased the company’s leverage. The subsequent downturn in oil prices in 2016 led to substantial losses in the midstream segment, forcing Ferrellgas to divest these assets and record significant impairment charges. These acquisitions ultimately left Ferrellgas heavily levered, with net leverage increasing to 9.0x in FY’19 from 7.2x in FY’17. The strain on the balance sheet and deteriorating financial performance led to Ferrellgas being delisted from the NYSE in December 2019.

Financial Restructuring

In June 2020, Ferrellgas defaulted on its $357 million of senior unsecured notes at the HoldCo level. This led to a series of forbearance agreements as the company negotiated with creditors. In January 2021, Ferrellgas announced a comprehensive restructuring plan resulting in HoldCo filing for a prepackaged Chapter 11 bankruptcy to restructure the 2020 notes, while OpCo remained out of court. The restructuring, completed in March 2021, resulted in a significantly altered capital structure. The $357 million of HoldCo 2020 notes were exchanged for 1.3 million new Class B units. OpCo issued $1.475 billion of new senior unsecured notes, comprising $650 million 5.375% notes due 2026 and $825 million 5.875% notes due 2029. OpCo also issued $700 million (liquidation value) of senior preferred units with an 8.956% coupon.

Post-Reorg Operations and Recent Performance

Following the restructuring, Ferrellgas has refocused on its core propane distribution business. The company has implemented cost reduction initiatives, optimized its asset base, and worked to improve operational efficiencies. These efforts have yielded some positive results, with adj. EBITDA margins improving from 13.7% in FY’19 to 17.0% on an LTM basis. While the company’s restructuring significantly de-levered the balance sheet, with net leverage improving to 3.9x post-emergence, the complex capital structure, particularly the Class B units at HoldCo and the preferred equity at OpCo, continues to create ongoing challenges for the company.

In its most recent quarter, FGPR reported disappointing results due to unseasonably warm weather across its key markets. Revenues declined by 12.2% y/y, driven by a 10.5% decrease in gallons sold, and Adj. EBITDA fell 17.2% y/y to $104 million. Despite the volume headwinds, the company managed to expand margins, with gross profit per gallon increasing 4% y/y due to segment mix, pricing improvements, and cost management initiatives. Management reaffirmed its commitment to diversifying into weather-agnostic business lines, highlighting growth in its Blue Rhino tank exchange segment. Notably, Ferrellgas made a $99.9 million distribution to Class B unitholders during the quarter, bringing total Class B distributions to $250 million to date.

Disclosure: The information provided is for informational purposes only and should not be considered as investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release me from any liability. Seek professional advice tailored to your financial situation and objectives.