Wolfspeed Inc. ($WOLF): Post-Reorg, Pre-Rerate.

Clean balance sheet, scarce SiC capacity, execution is the fulcrum.

🚨 Connect: Twitter | Threads | Instagram | Reddit | YouTube

Post-reorg equity is usually a place you exit, not a place you stay.

You make your money in the debt, flip out at emergence, and let the equity guys deal with whatever operational mess is left behind. The capital structure is cleaned up but the business is still broken. Management is still incompetent. The reason the company filed in the first place hasn’t been fixed. You take your recovery and move on.

But Wolfspeed might be different. Might.

The company emerged from Chapter 11 three months ago. Old equity kept 5% (3% with dilution). The converts got 56%. Renesas, the largest creditor, took 39% plus warrants. Standard distressed playbook. Except Renesas isn’t a vulture fund. They’re a $20 billion semiconductor company that supplies chips to Toyota and Honda. They converted $2 billion of customer deposits into equity because they literally cannot source silicon carbide wafers anywhere else.

This is not financial engineering but strategic dependency.

Wolfspeed operates the largest 200mm silicon carbide fab in the US with full vertical integration from crystal growth to finished devices. The Department of Defense has funded SiC industrial base programs. China is spending billions trying to dominate this supply chain. The company just wiped $4.6 billion of debt in 90 days.

The bankruptcy wasn’t an operational failure. Management built two mega-fabs assuming CHIPS Act money would arrive on schedule. It didn’t. The timing destroyed the capital structure while the underlying assets remained intact. Now the debt’s gone. The fabs are built. The customers are locked in. And you can buy it at a fraction of what it cost to build.

Most post-reorg equity doesn’t look like this. The assets usually aren’t strategic. The government usually isn’t involved. The customers usually aren’t staying. The replacement cost usually isn’t multiples of enterprise value.

This one might be different.

The Technology That Broke the Bank

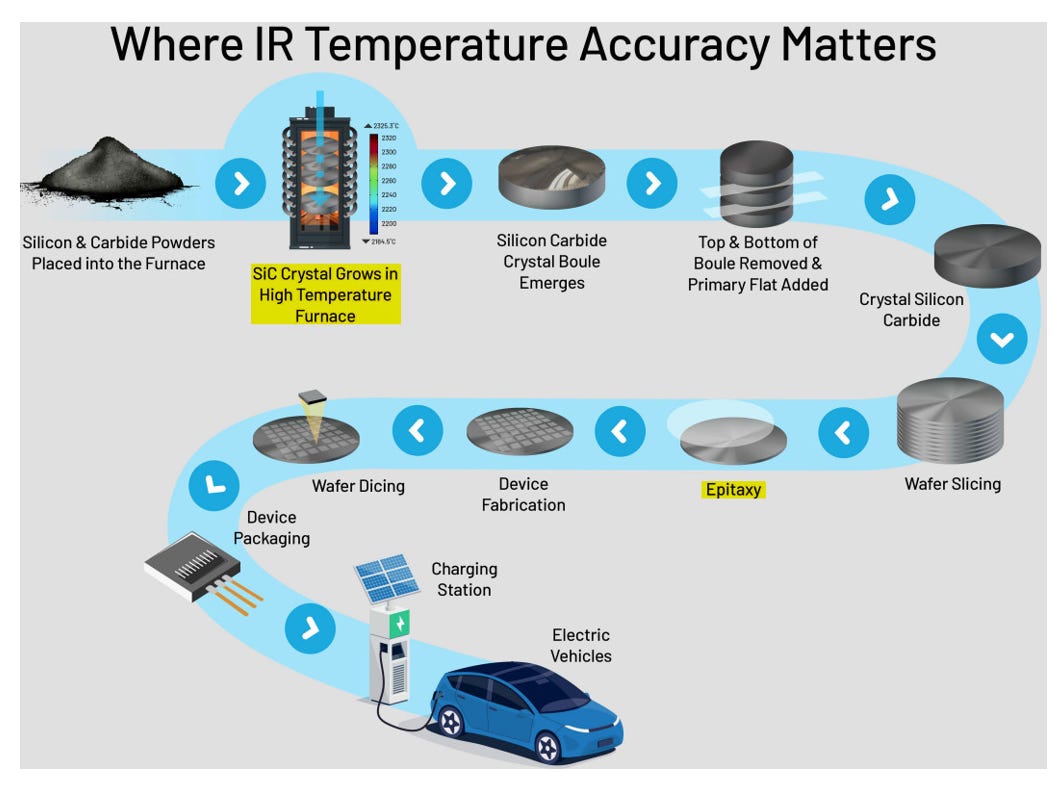

Silicon carbide doesn’t sound sexy, but it’s what makes modern electrification possible. Traditional silicon chips melt down or lose efficiency under high voltage and extreme temperatures. SiC handles both. EV powertrains need it. Data center power management depends on it. Renewable energy inverters, defense electronics, aerospace systems; all run through silicon carbide.

Wolfspeed doesn’t just make SiC devices. They control the entire supply chain, from growing bulk crystals in specialized furnaces to slicing wafers to fabricating finished power modules. Growing high-quality SiC crystals is brutally difficult. You need proprietary technology, years of process refinement, and equipment you can’t just order. Only a handful of companies globally can do it at scale. Wolfspeed operates the world’s first purpose-built, fully automated 200mm SiC fab with major operations on US soil.

Their two flagship facilities in Mohawk Valley, New York and Siler City, North Carolina represent over $5 billion in replacement cost. You can’t replicate that overnight. The specialized furnaces are supply-constrained, the engineering talent is scarce, and the know-how takes decades to accumulate. That technical moat is part of what makes this bankruptcy so unusual. The assets are genuinely world-class. Everything else fell apart.

How a $130 Stock Became a Bankruptcy Filing

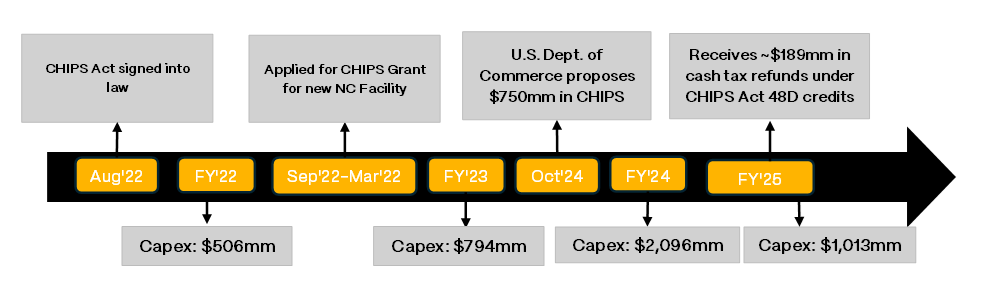

Wolfspeed’s collapse wasn’t about bad technology or disappearing customers. Management made a catastrophic bet on government timing that went sideways. They spent 2022 through 2024 building out two enormous manufacturing facilities simultaneously, assuming federal subsidies would arrive in time to cover the bills. The subsidies didn’t show up.

The expansion plan assumed CHIPS Act funding by mid-2024. Construction started well before any money arrived, financed with debt and customer deposits. The CHIPS Act funding got stuck in bureaucratic review. By early 2025, Wolfspeed had burned through billions and was still waiting.

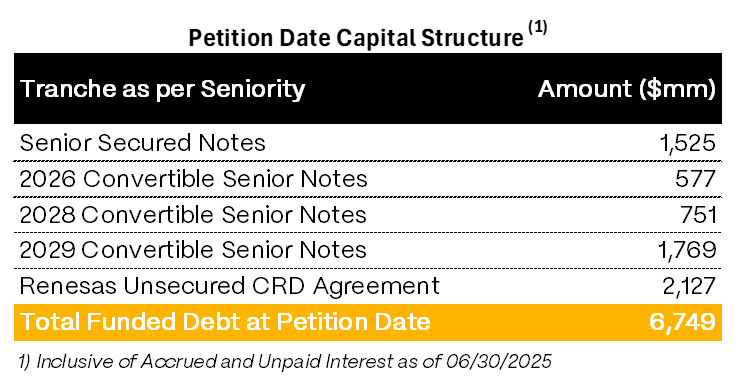

By spring 2025, the balance sheet looked catastrophic. Over $6 billion in obligations. $3 billion of unsecured convertible notes maturing in 2026. $1.5 billion of secured notes. Roughly $2 billion of refundable deposits from Renesas Electronics, their largest customer. Renesas had advanced those deposits to lock in long-term wafer supply, but the structure was more debt than deposit. If Wolfspeed missed delivery milestones, Renesas could demand their money back immediately.

The new fabs weren’t performing either. Wolfspeed built two facilities at once before the first one had hit stable production yields. Utilization at Mohawk Valley remained low. They were spending roughly $47 million per quarter on underutilization costs. Revenue barely budged while fixed costs exploded. The company sustained heavy cash burn.

The stock cratered from over $130 in 2021 to under $20 by early 2025. Equity markets slammed shut. The convertible notes trading distressed. Rating agencies downgraded them to CCC. There was no path to refinance. The only option left was bankruptcy.

A Prepackaged Restructuring That Actually Worked

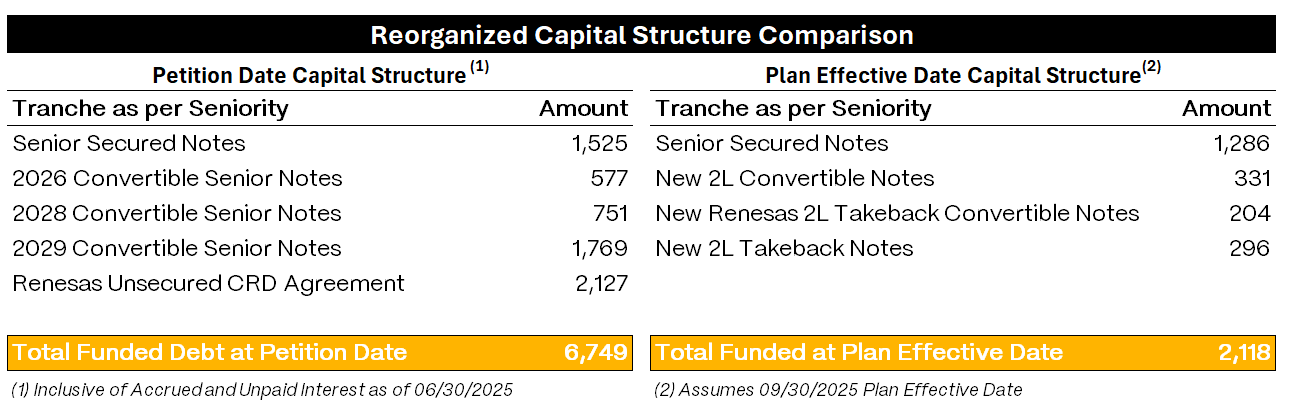

Wolfspeed’s bankruptcy was remarkably efficient. Management spent months negotiating a restructuring support agreement with creditors before filing. Walking into Texas bankruptcy court on June 30th, they already had support from 97% of secured noteholders, 67% of convertible noteholders, and Renesas. This wasn’t a contested fight but a coordinated recapitalization.

The plan was straightforward: eliminate $4.6 billion of debt by converting most of it into equity. Senior secured noteholders got $275 million in cash plus new secured notes. Convertible noteholders received 56% of the new company plus $296 million of new second-lien take-back notes. Renesas traded its $2 billion claim for $204 million of convertible debt, 39% of the equity, and 5% in warrants. Old shareholders got crushed, left with just 3% to 5% of the reorganized company.

Judge Christopher Lopez confirmed the plan in mid-September. Wolfspeed emerged on September 29, 2025, issuing new common stock and carrying roughly $1.5 billion of net debt. The whole process took less than three months. Operations continued during the case and the process was orderly. As far as bankruptcy goes, this was textbook clean.