Wolfspeed, Inc. ($WOLF): Silicon Dreams and Cash Flow Nightmares

Reviewing Wolfspeed's Bet on America's Silicon Carbide Future

🚨 Connect with me on Twitter / Instagram / Threads / Bluesky | Estimated Read Time: 16 Minutes

The Silicon Carbide story is crumbling right before our eyes.

Wolfspeed was supposed to be THE play on electric vehicle adoption. THE leader in silicon carbide (SiC) wafers and devices that would power the EV revolution.

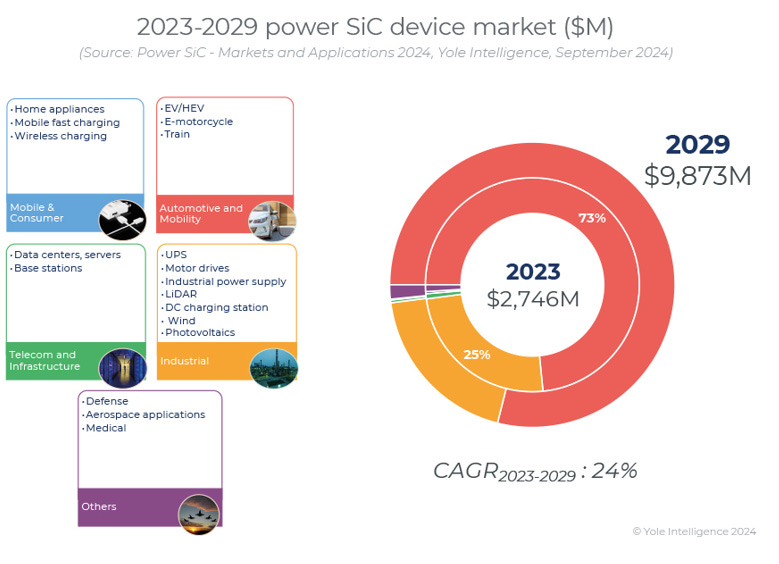

They had the first-mover advantage in 200mm wafers, the key partnerships, the massive capacity expansion plans. Wall Street was practically drooling over the TAM projections showing the SiC device market growing to $10 billion by 2030.

But executing is a whole different ballgame.

The latest quarter tells everything. Revenues of just $181 million, down -13% y/y. Gross margins in the toilet at 2% (non-GAAP by the way). The Durham fab is operating below cost, industrial/energy demand has fallen off a cliff (especially in Asia), and the ballyhooed Mohawk Valley facility ramp is moving at a snail’s pace.

Meanwhile, the balance sheet is getting absolutely torched. They’re burnt nearly $3 billion in FCF last year. The recent $200 million ATM equity raise shows they’re desperate for capital, even with the $750 million CHIPS Act grant supposedly coming. They need to refinance $575 million in convertible debt by 2026.

The market’s saying “show me” because they’ve missed targets before. The long-dated converts trading at 30-40 cents tell you the smart money’s not convinced they make it through this transition without a restructuring.

And the competition isn’t standing still. STMicro, Infineon, ON Semi—the big boys are plowing ahead with their own SiC capacity. The Chinese are coming too. While Wolfspeed struggles to hit 20% utilization at Mohawk Valley, their rivals are stealing market share and customer relationships.

For all the fancy talk about design wins and long-term agreements, the financials tell the truth—this is a company that can’t seem to translate potential into profits. The activist investors smell blood in the water. Even the CEO jumping ship speaks volumes.

The true believers will point to the EV megatrend, the technical advantages of SiC, the potential CHIPS funding. But at some point, you have to actually execute and make money.

The silicon carbide revolution may indeed be coming, but the question that matters for stakeholders is brutally simple: Will Wolfspeed survive long enough to profit from it? Wolfspeed keeps telling us prosperity is just around the corner. The market is tired of waiting.

Disclaimer: This content is an opinion piece and should be read for entertainment purposes only. The information provided should not be considered investment advice. Any investment decisions made based on this content are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release me from any liability. Seek professional advice tailored to your financial situation and objectives.