High Yield Market Weekly Minutes: The Fed’s Victory Lap Begins...While Smart Money Prints $9.4bn Anyway (September 15, 2025)

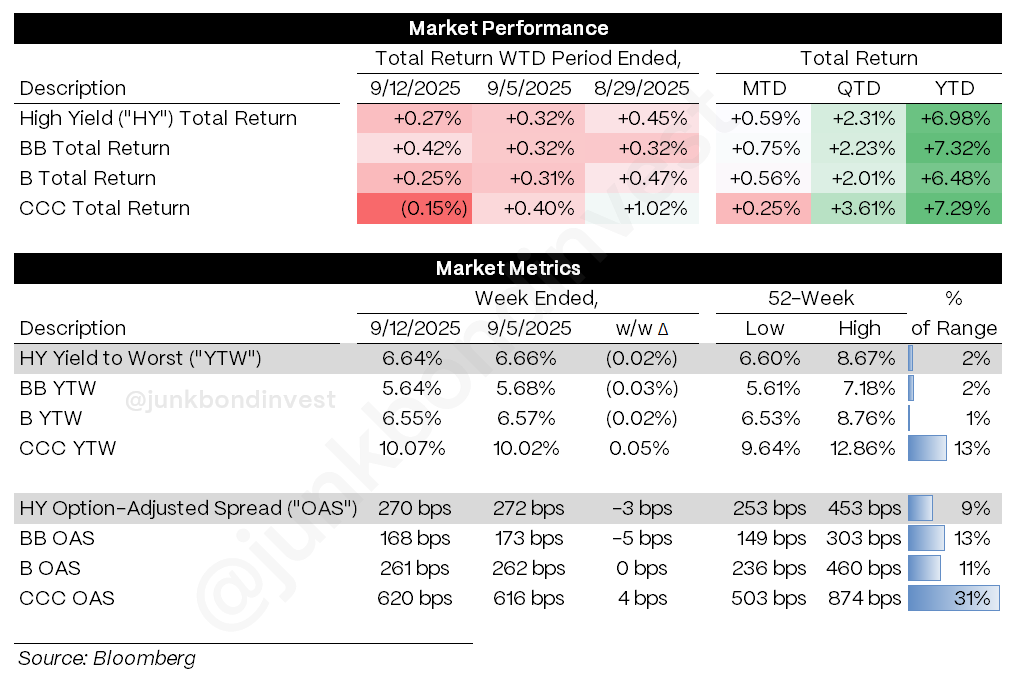

A Brief Recap of Last Week’s High Yield Market Performance

🚨 Connect on Twitter | Threads | Instagram | YouTube

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list — limited spots.

So much for waiting for the Fed.

While everyone positions for Wednesday’s telegraphed rate cut, the primary market just casually absorbed $9.4 billion across 12 deals, all pricing at talk or tighter. That’s not what hesitation looks like.

Even better? Navacord, a CCC-rated Canadian insurance broker, just printed the first sub-7% unsecured high yield deal for a CCC since 2022 at 6.875%. When the lowest-rated credits can price below 7%, it tells you everything about where real money thinks this market is headed.

But here’s what the macro tourists missed while they obsess over geopolitical tensions and CPI decimal points: high yield spreads closed the week at 270bps despite European volatility and a hotter-than-expected inflation print. The market shrugged off a 0.4% monthly CPI increase like it was noise. Meanwhile, three deals managed to achieve 5-handle pricing.

The disconnect between narrative and reality grows more pronounced by the week. While the economists debate whether we get one cut or three by year-end, issuers are locking in financing at multi-year lows and investors keep stepping up to buy the paper. This isn’t about the Fed anymore. It’s about flow.

Weekly Performance Recap

The numbers reveal a market in cruise control. Overall HY posted another solid week with the index closing at 6.64% YTW. More telling is the technical support that continues to build:

Fund flows delivered another massive weekly inflow, pushing YTD totals to new highs

Index spreads compressed to 270bps, showing genuine demand despite macro noise

Three deals achieved 5-handle pricing (NCL, Amkor, and Antero Midstream), marking a breakthrough moment for issuer-friendly conditions

The Treasury backdrop provided mixed signals with the 2-year moving higher while the 10-year stayed relatively stable. Yet high yield kept grinding tighter, confirming that credit-specific demand is overwhelming rate concerns.

Most importantly, the market didn’t skip a beat despite European geopolitical tensions mid-week. When regional volatility can’t derail execution quality, it speaks to the depth of the technical bid.

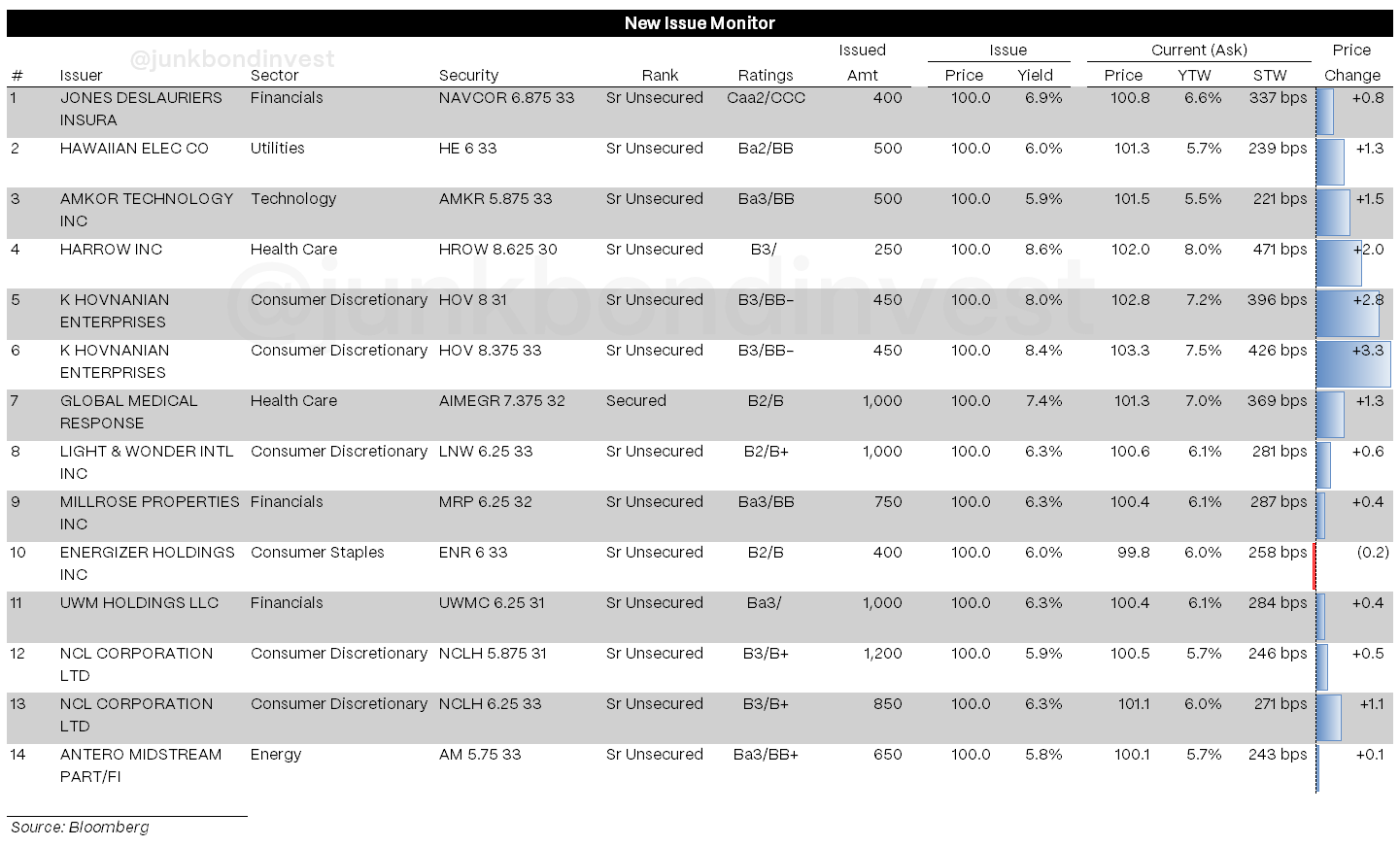

Primary Market Activity

The primary market delivered its most impressive week in months, with 12 borrowers pricing $9.4 billion in what can only be described as a perfect execution environment. The quality of deals tells the real story:

Light & Wonder led the charge with a $1 billion B-rated offering pricing at the tight end of 6.250% guidance, demonstrating appetite for gaming exposure

Antero Midstream achieved the coveted 5-handle with its $650 million refinancing at 5.750%, joining an exclusive club this year

Hawaiian Electric returned after a six-year absence with a $500 million utility deal at 6.000%, the week’s only capex-focused transaction

Global Medical Response (KKR-backed) priced $1 billion of secured notes at 7.375%, showing sponsor-backed deals remain in favor

But the real breakthrough was Navacord’s moment. A CCC-rated insurance broker pricing unsecured notes at 6.875% represents the first sub-7% CCC execution since 2022. When you can clear CCC paper below 7% in this rate environment, it’s confirmation that the hunt for yield has reached new extremes

Secondary Market

The sector rotation continues to favor momentum over fundamentals. Technology credits surged on AI infrastructure demand, while energy names faced selective pressure. The correlation between equity momentum and HY credit performance remains remarkably strong, suggesting cross-asset flows are driving much of the action.

Warner Bros Discovery bonds continued their M&A-driven rally as consolidation themes dominate media credit discussions. Meanwhile, the divergence between infrastructure-oriented credits and commodity-exposed names continues to widen.

Looking Ahead

The Fed delivers Wednesday, but this week’s real catalyst comes from economic data that could reshape the entire rate cut narrative:

Tuesday brings retail sales data that will test whether consumer momentum carried into August

Thursday’s jobless claims could provide the labor market clarity everyone’s seeking

Wednesday’s Fed decision may be telegraphed, but Powell’s tone will matter for the path ahead

But here’s what really matters: the favorable window for opportunistic issuers shows no signs of closing. With spreads at 270bps and three 5-handle deals proving execution quality remains pristine, the technical setup couldn’t be stronger.

The macro backdrop poses interesting questions. Core CPI’s unexpected 0.4% monthly increase barely registered as market noise. When inflation surprises get ignored while CCC credits price below 7%, it suggests investors are betting the Fed’s easing cycle trumps everything else.

Meanwhile, European tensions proved to be just another headline to ignore. The fact that geopolitical volatility couldn’t derail a single execution speaks to the depth of demand supporting this market.

Either the market has this perfectly figured out, or we’re witnessing the final stages of a technically-driven rally that’s lost touch with fundamental reality. The next few weeks will determine which narrative prevails.

For now, the technicals remain firmly in charge. When supply can clear this efficiently with this quality of execution, fighting the trend looks increasingly futile.

Find the most recent JunkBondInvestor posts below

Continue the discussion on Reddit at r/leveragedfinance.

Disclosure: The information provided is based on publicly available information and is for informational purposes only. While every effort has been made to ensure the accuracy of the information, the author cannot guarantee its completeness or reliability. This content should not be considered investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release the author from any liability. Always seek professional advice tailored to your financial situation and objectives.