The Kodak Moment That Could Make or Break $KODK

A fallen photo giant turned meme stock now hinging on retiree pension gains

🚨 Connect: Twitter | Threads | Instagram | Reddit | YouTube

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list (limited spots).

Everyone wants this to be a comeback story.

I get it. Kodak is America’s industrial heartland in miniature. Rochester, New York. Over 130 years of manufacturing. The company that put a camera in every household and made “Kodak Moment” part of the language.

Jim Continenza has been CEO for five years, and revenue keeps sliding. $1.2 billion in 2022, $1.1 billion in 2023, $1.0 billion in 2024. That’s not a turnaround, that’s managed decline. And now they’re sitting on a disclosure that there’s “substantial doubt about their ability to continue as a going concern.”

Traditional printing is dying. Film photography is a niche hobby. Even the motion picture film business that everyone gets excited about (because Oppenheimer and a few other directors still shoot on celluloid) represents a tiny fraction of what this company used to do.

So Continenza pivots. “Advanced Materials and Chemicals,” he calls it. It’s the same playbook every dying industrial company uses. When your core business evaporates, you talk about “leveraging your unique capabilities” and “expanding into adjacent markets.”

They’re building pharmaceutical clean rooms. Coating battery materials. Making reagents for diagnostic tests. All fine businesses, but we’re talking about millions, not billions.

The real story is financial engineering. They’re terminating the employee pension plan and grabbing $500 million to pay down debt. Why? Because they’ve got term loans and preferred stock all maturing in May 2026, and they don’t have the cash flow to refinance.

But here’s the thing (and this is where it gets interesting), maybe that’s not the worst strategy. Look around. How many legacy industrial companies are thriving? GE broke itself up. Xerox is a shadow of its former self. Polaroid is a brand name slapped on products made in China.

At least Kodak is still manufacturing in America, trying to find new applications for chemistry and coating technologies that took decades to develop. At least they’re not just selling off assets to private equity.

The question isn’t whether Kodak will ever be what it was. It won’t. The question is whether there’s a viable business in what’s left.

And honestly? The jury’s still out.

I. Situation Overview:

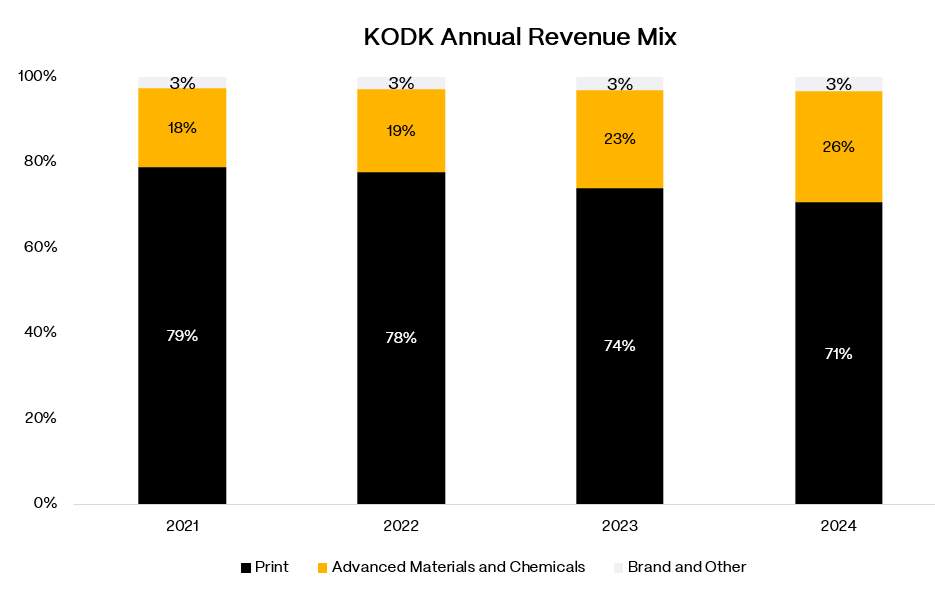

Eastman Kodak Company isn’t the film giant that put cameras in everyone’s hands. That company died with the digital revolution. What’s left is a $1 billion industrial manufacturer split between three main businesses: printing solutions, specialty chemicals, and brand licensing.

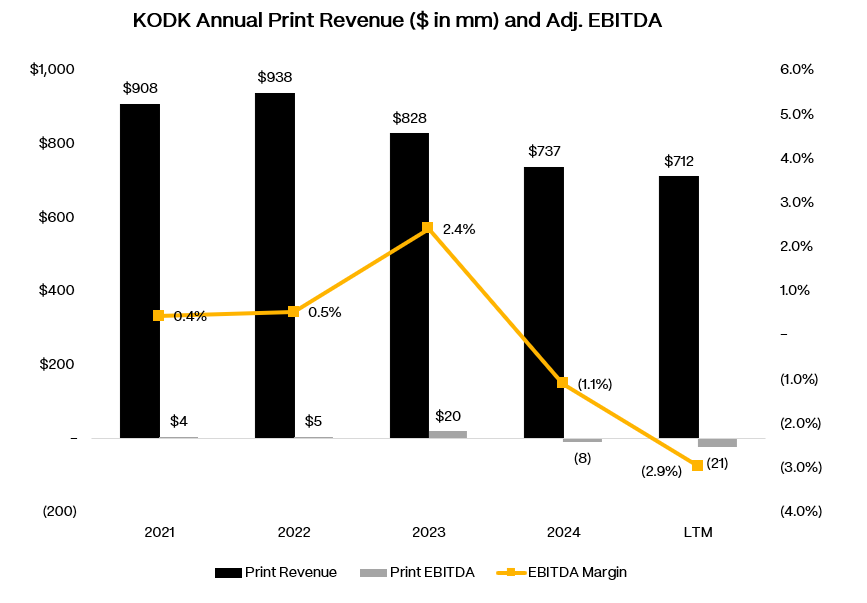

The Print Graveyard ($712MM Revenue, -8% Growth)

The printing side makes lithographic plates for offset printing presses: the big machines that print newspapers, magazines, and commercial materials. They also manufacture digital inkjet presses that can supposedly print 1,345 pages per minute. The dirty secret? This entire market is shrinking as everything goes online.

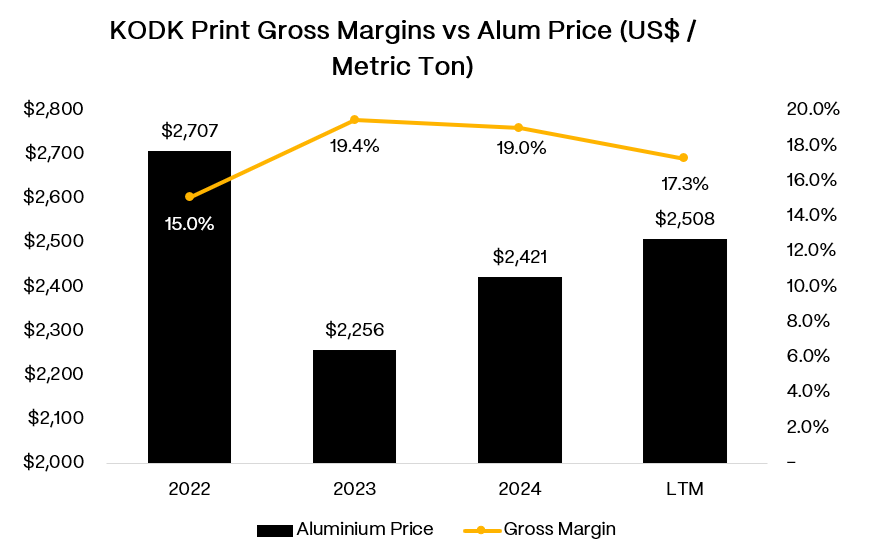

Here’s what’s actually killing the print business: Aluminum costs have spiked 30-40% since 2020, and Kodak can’t pass through the increases fast enough. Energy inflation compounds the problem given coating and processing plates is energy-intensive.

Meanwhile, commercial printers are consolidating or shutting down as advertising dollars flee to digital platforms. The result? Print generated negative $21 million EBITDA (LTM) despite being ~70% of total revenue.

Kodak talks up being “the last U.S. manufacturer of lithographic plates” like it’s a competitive advantage. More accurately, it’s proof that everyone else saw this iceberg and got out. They did win tariffs against Chinese and Japanese plate imports (rates ranging from 91% to 353%), which provides some pricing protection. But you can’t tariff your way out of structural decline.

The digital inkjet press business (PROSPER systems) shows some promise, with installations picking up at European customers. But these are million-dollar machines sold to a shrinking customer base. Even if Kodak doubles digital press sales, it won’t offset the plates business melting away at 7-10% annually.

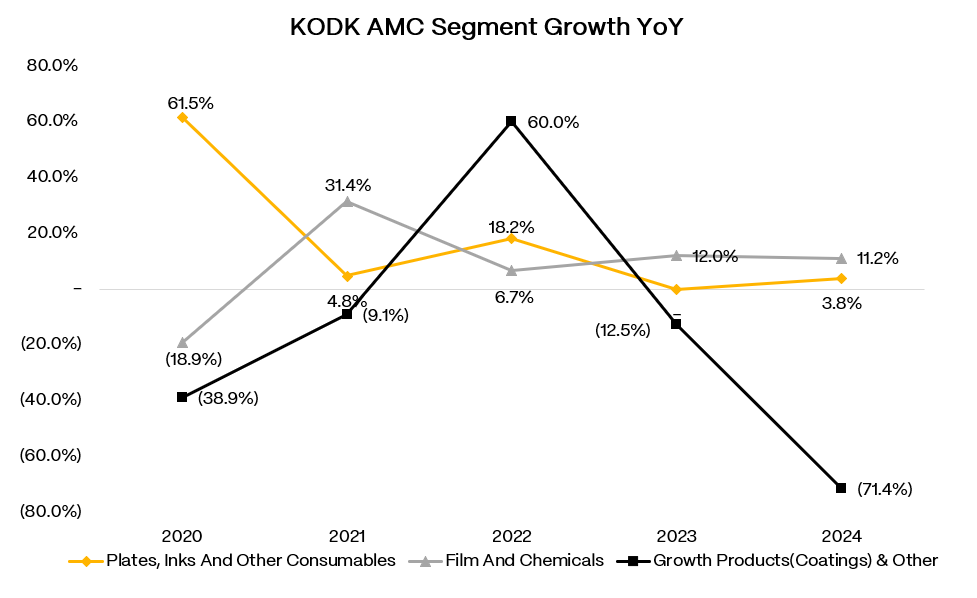

Advanced Materials & Chemicals: The Science Experiment ($288MM Revenue, +13% Growth)

This is where CEO Jim Continenza claims the future lives. They make motion picture film for the handful of directors who still shoot on celluloid, specialty coatings for battery applications, and they’re building clean rooms to manufacture pharmaceutical reagents. It’s a grab bag of niche industrial

applications that leverage their century-old expertise in chemistry and coating technologies.

The film business is surprisingly resilient. Motion picture film actually grew in 2024 as directors like Christopher Nolan and filmmakers shooting for Netflix keep the medium alive. Still photography film has found a hipster renaissance. But we’re talking tens of millions in revenue, not hundreds. It’s a nice margin business that helps absorb fixed costs in the Rochester manufacturing complex, but it’s not scaling to move the needle.

The real bet is on specialty coatings and substrates. Kodak’s Rochester facilities can precision-coat materials for EV battery applications, display films, and medical devices. The infrastructure advantage is real: few companies have idle large-scale coating lines sitting around. They’re also building an FDA-certified pharmaceutical facility to produce reagents and saline solutions, tapping into the “onshoring” trend.