High Yield Market Weekly Minutes: Spreads Hit 299bps as June Volume Explodes (June 23, 2025)

Primary Volume Hits $9bn in Holiday Week as Market Momentum Continues

🚨 Connect on Twitter | Threads | Instagram | Bluesky | Reddit

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list — limited spots.

The market held together through a week of Fed reality checks and then woke up to bombs over the weekend. High yield posted a solid +0.29% gain as Jerome Powell finally admitted what everyone knew about tariffs while ten deals totaling $9 billion kept the primary market humming. Then over the wekeend, the U.S. dropped bunker busters on Iranian nuclear sites, yet oil barely flinched (+1% this morning) and credit futures are holding steady.

Ten deals totaling $9 billion hit the market in a shortened holiday week, led by the much-anticipated xAI spectacle that finally priced $3 billion of unrated notes at 12.50%. Meanwhile, Powell’s Wednesday performance was the week’s real showstopper. The Fed Chair finally acknowledged what everyone already knew: “Ultimately the cost of the tariff has to be paid, and some of it will fall on the end consumer.” His admission that tariff impacts will show up “later this summer” sent junk bond rallies into pause mode, but didn’t derail the broader momentum that’s carried high yield to four straight weeks of gains.

Fund flows stayed relentlessly positive with another inflow, marking the eighth consecutive weekly gain. That brings year-to-date totals to nearly $6 billion, proving once again that retail money doesn’t care about your macro theories: they just want yield and they’re getting it in spades with the HY index now yielding 7.30%.

The real story? June issuance has exploded to nearly $22 billion, already 23% more than the entire month of June 2024 and up almost 70% vs. June 2023. While Powell talks tough about inflation and bombs drop in the Middle East, issuers keep lining up to refinance and investors keep writing checks. That’s not fragility, that’s market dominance.

Weekly Performance Recap

High yield delivered another solid week despite geopolitical fireworks and Fed hawkishness. Overall HY gained +0.29% for the week, extending the positive streak across most rating categories:

BBs climbed +0.20%, driven entirely by yield movement (5bps to 6.14%)

Bs advanced +0.28%, showing continued appetite for mid-tier credit with yields falling 8bps to 7.25%

CCCs led the charge at +0.70%, finally breaking out with yields declining 4bps to 11.04% as investors chased higher returns

Spreads tightened meaningfully across the board despite macro uncertainties:

Overall index spreads compressed 9bps to 299bps, approaching the critical 300bp threshold that marks psychological support

BB spreads narrowed just 1bp to 182bps, already trading near historically tight levels with limited room to compress further

B spreads tightened 2bps to 293bps, while CCCs saw the largest move at -39bps to 678bps as lower-quality credits caught a bid

The HY index yield dropped 12bps to 7.30%, now sitting at just 20% of its 52-week range and approaching levels that suggest either exceptional value or dangerous complacency. Friday’s +0.15% session capped a week where credit markets proved once again they march to their own drummer.

Primary Market Activity

The primary market delivered impressive volume despite a shortened holiday week. Ten deals totaling $9 billion demonstrated continued strong execution, with issuers taking advantage of favorable conditions:

Lumen Technologies (Level 3) dominated with a $2 billion secured offering that started at $1 billion and upsized twice amid overwhelming demand. The 8NC3 senior secured notes priced at 6.875%, in line with talk, proving that even troubled telecom names can access capital when the structure makes sense.

Beacon Mobility brought a $550 million debut offering at 7.250%, tight of talk. The Audax-backed deal represents another successful sponsor recapitalization, proving private equity can still access the bond market for portfolio company refinancing.

Several other deals cleared successfully, including Cvent, Rithm Capital, Anywhere Real Estate, and other refinancing transactions. The fact that lower-rated credits continue finding strong reception speaks to the market’s risk appetite

Secondary Market Dynamics

The sector breakdown revealed clear winners and losers amid the week’s cross-currents:

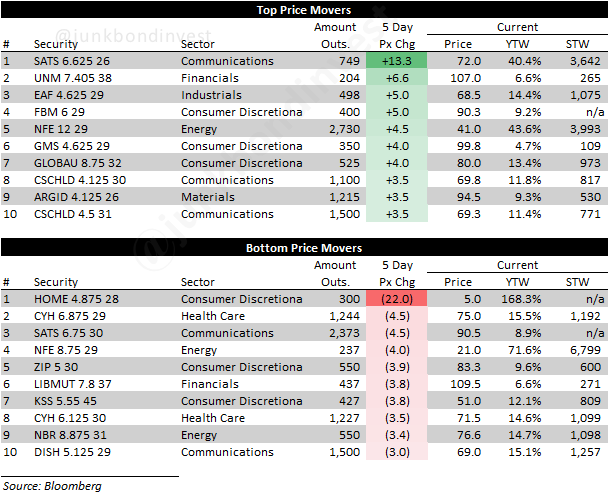

Communications dominated both ends of the performance spectrum. SATS bonds surged +13.3 points, while other satellite names like CSCHLD posted solid gains. The sector’s volatility continues to create both opportunities and disasters.

Consumer discretionary saw mixed results, with some distressed names like HOME posting massive -22 point declines after filing Chapter 11 while others found support. The divergence reflects the market’s increasingly selective approach to retail exposure.

Healthcare names showed resilience, with CYH posting solid gains as investors positioned for potential regulatory clarity from ongoing policy debates.

Looking Ahead

This week brings a perfect storm of macro catalysts that could reshape market dynamics. All eyes remain on Middle East developments after weekend bombing runs that somehow failed to spike oil prices or rattle credit markets. The muted reaction suggests either dangerous complacency or genuine conviction that conflict won’t escalate to supply-disrupting levels.

Powell’s tariff reality check continues reverberating through markets as investors digest his admission that consumer price impacts are coming “later this summer.” The Fed’s updated projections showing weaker growth, higher inflation, and higher unemployment paint a stagflationary picture that credit markets haven’t fully priced in.

The economic calendar packed several potential market movers:

S&P PMIs today will test whether manufacturing momentum can sustain geopolitical shocks

Existing home sales expected to show continued housing market weakness

New home sales Wednesday likely to confirm builder distress amid elevated rates

Durable goods Thursday could reveal whether capex spending is finally rolling over

PCE deflator Friday represents the week’s most critical release, with consensus expecting 0.1% monthly gain that could validate or challenge Fed inflation concerns

Primary market momentum shows no signs of slowing with June volumes already exceeding full-month 2024 totals. Sizzling Platter’s $500 million deal launches this week, while the massive Skechers LBO financing from 3G Capital looms with an expected secured bond component.

The fundamental disconnect between macro deterioration and market resilience grows more pronounced each week. Retail sales crashed 0.9% in May, industrial production fell for the third time in five months, and housing starts plunged 9.8% to pandemic-era lows. Yet credit spreads sit at 299bps and issuance volumes reach multi-year highs.

Either this market has developed supernatural resilience, or it’s setting up for a spectacular recalibration when reality finally catches up with technicals. With spreads one basis point from 300 and yields at just 20% of their range, there’s little room for error if the macro backdrop deteriorates further.

For now, the eighth straight week of fund inflows suggests investors are betting on the former. But when bombs barely move oil prices and Fed Chairs admit tariff pain is coming, normal market relationships have broken down.

The summer doldrums are supposed to bring stability. This feels more like the calm before something much more interesting.

Find the most recent JunkBondInvestor posts below

Disclosure: The information provided is based on publicly available information and is for informational purposes only. While every effort has been made to ensure the accuracy of the information, the author cannot guarantee its completeness or reliability. This content should not be considered investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release the author from any liability. Always seek professional advice tailored to your financial situation and objectives.