Victoria’s Secret ($VSCO): Bonds Trade Wide for a Reason

Tariffs, fashion risk, and digital fragility cloud the outlook—but the capital structure can take the hit

🚨 Connect on Reddit | Twitter | Threads | Instagram | Bluesky

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list (limited spots).

The fashion show is back. The customer? Still questionable.

Victoria’s Secret is still trying to find its footing three years into the spin. The cost structure is leaner. The balance sheet is clean. But the core business (lingerie built on mall traffic) is harder to defend in a world that moved on. Comps are choppy. Bras are still missing. And now tariffs, cyberattacks, and activist pressure are crowding the margins.

I first wrote about this credit when the bonds were in the 80s over a year ago. Those levels were briefly retested during the April tariff-driven sell-off, but have since recovered. The 2029s now trade in the low 90s. Not distressed. Not even stressed. But still wide of retail peers like Gap.

The question now is whether that discount is still justified.

I. Situation Overview:

Victoria’s Secret is trying to do two things at once: rebuild a brand and fix a business. Neither is easy. Now try doing both while tariffs eat margin, fashion misses kill comps, and an activist circles the boardroom.

The FY24 print showed real progress. Comps turned positive in Q4. Gross margin expanded year over year. SG&A operating leverage kicked in. The $250 million cost program is largely completed ahead of schedule with over $200 million realized in 2024.

Operating income and EPS beat the top end of guidance. Beauty, sleepwear, and PINK apparel all posted solid growth. On a trailing basis, the stablization is no longer theoretical.

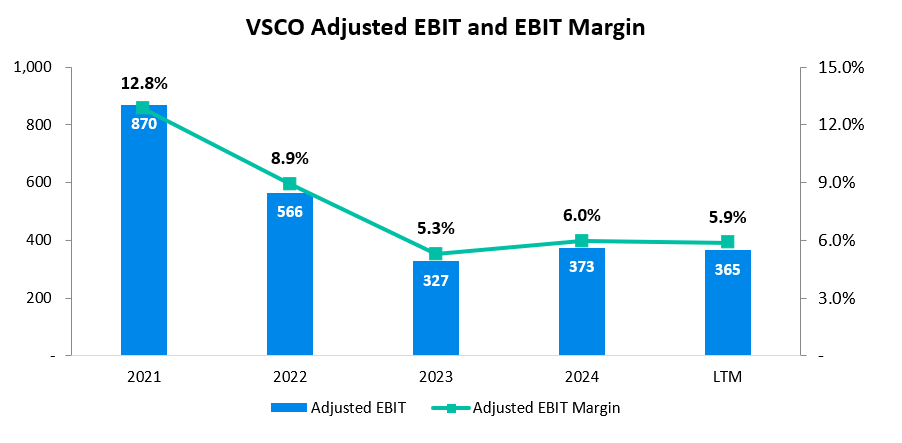

But FY25 is already off to a messy start. The company lowered full-year EBIT guidance to $270–320 million (from $300–350 million), citing ~$50 million of incremental cost from reinstated section 301 tariffs.

Then came the May 2025 ransomware attack, which shut down the e-commerce platform and corporate systems for several days, including Memorial Day weekend, a peak digital selling period. While stores remained operational, online transactions, fulfillment, returns, and BOPIS were suspended. Management postponed the Q1 earnings call and expects $10 million in one-time remediation costs to flow through Q2 SG&A.