Array Technologies ($ARRY): Subsidized, Second-Tier, and Still Standing

The 2028 converts trade at 77. No rating. No coupon. No audience.

🚨 Connect: Twitter | Threads | Instagram | Bluesky | Reddit

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list (limited spots).

Array was handed a layup and still missed the rim. IRA subsidies. Utility-scale demand. No exposure to China or residential solar. All they had to do was ship steel and follow the sun. Instead, they cut guidance multiple times, fumbled international expansion, and turned a macro tailwind into a slow-motion trust collapse. You didn’t need a short report, management wrote it themselves. One earnings call at a time.

Now the converts due 2028 trade at 77 cents, sitting in an orphaned part of the credit market. No rating. No coupon (1.0% doesn’t count). Not distressed, just unwanted. Because the story stopped working.

But the business? Still standing. Still generating cash. Still sitting on a pile of policy incentives with a real order book and EBITDA.

The narrative is undoubtedly broken. But sometimes that’s where the opportunity may begin.

I. Situation Overview:

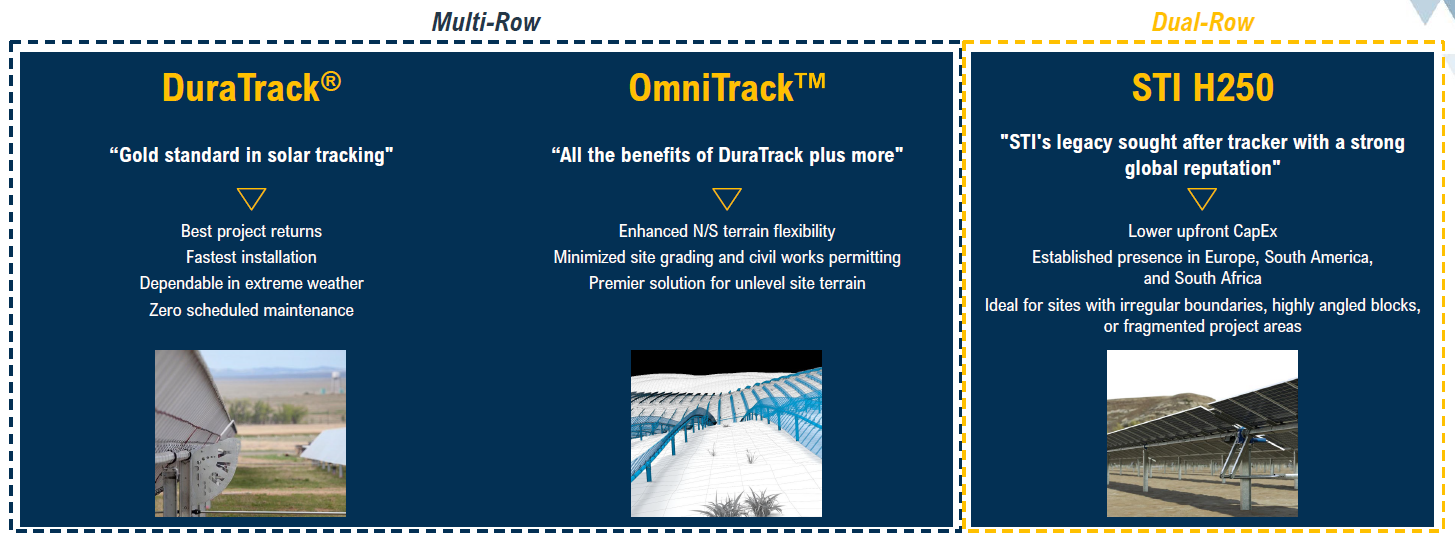

Array Technologies makes the mechanical systems that tilt solar panels to follow the sun throughout the day. Think of them as the hardware guys behind utility-scale solar farms. Their trackers boost energy output by 15-20% compared to fixed panels, which should be a compelling value proposition in a growing market. The Albuquerque-based company holds the #2 spot globally in solar trackers, behind Nextracker, selling the DuraTrack linked-row system with a patented architecture that drives up to 32 rows with a single motor.

The problem?

Array has spent two years proving they can’t execute what should be a straightforward growth story. Missed expectations, guidance cuts, and self-inflicted wounds have turned this into a show-me situation where even Blackstone’s preferred equity injection hasn’t been enough to smooth out the operational hiccups. Execution hasn’t kept pace with the market.

The deterioration started almost immediately after going public in 2020. Steel inflation crushed margins in 2021. Then came order delays, procurement bottlenecks, and a disastrous STI Norland acquisition that added exposure to Brazil and Europe just as those markets turned volatile. Revenue guidance was reduced multiple times in 2023–24, with 2024 reported revenue of $916 million, down from early targets above $1.3 billion. The company cited permitting, interconnection, and supply chain delays and developers waiting for IRA clarity.