Mativ Holdings Inc ($MATV): Merger Hangover and 5x Leverage

The SAS segment works. FAM is a mess. And the bondholders are doing the math.

🚨 Connect on Reddit | Twitter | Threads | Instagram | Bluesky

❗Prices are increasing tomorrow. If you’re thinking about subscribing, now’s the time to lock in the current rate before it increases.

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list (limited spots).

They’re trying to reinvent themselves, but the market isn’t buying it.

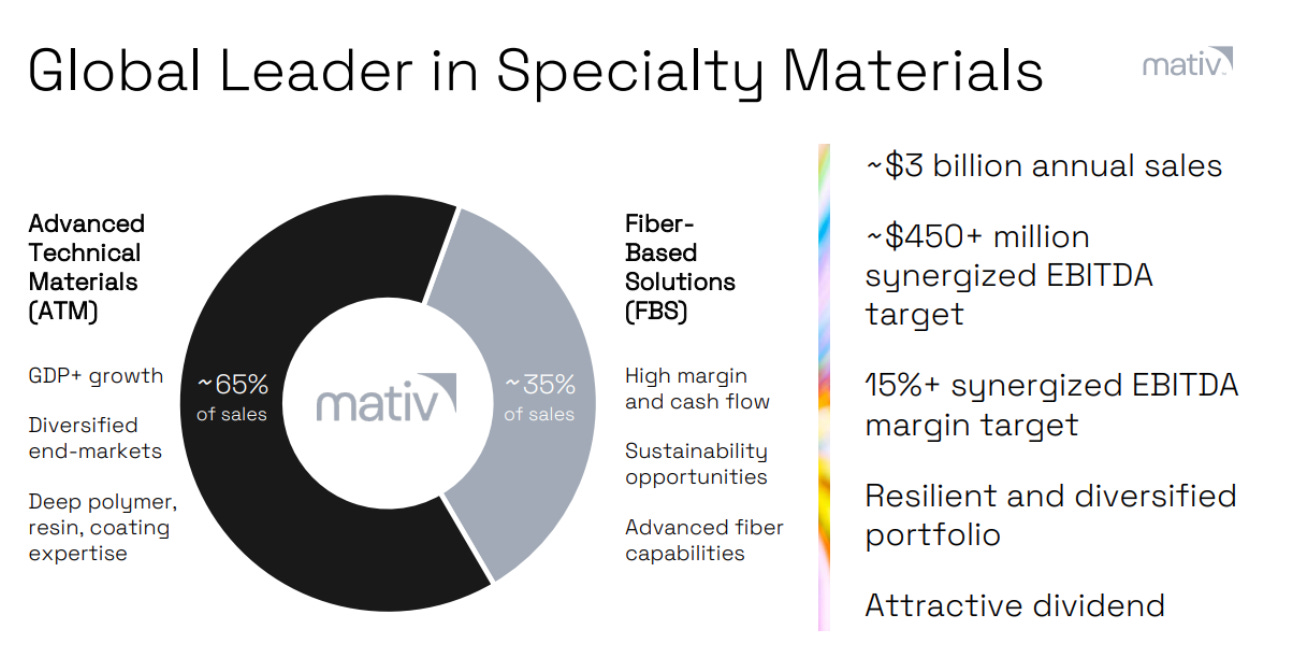

Mativ merged Schweitzer-Mauduit and Neenah in July 2022, promising $450 million in EBITDA with mid-teens margins. They’re delivering EBITDA well below that while now sitting at 5x+ leverage vs. a target of 2.5x-3.5x.

The CEO got the boot in March 2025. Julie Schertell out, turnaround specialist Shruti Singhal in. The board’s stated reason: “accelerate execution, lower costs, reduce leverage.” Their unsecured bonds trade in the mid-80s - even the debt market is skeptical.

They keep reorganizing segments every quarter. Advanced Technical Materials became Filtration & Advanced Materials. When the strategy isn’t working, shuffle the org chart. It’s the classic playbook when management can’t deliver the numbers.

The new CEO promises $10-15 million in cost cuts and inventory reductions. But this isn’t a turnaround story, it’s a specialty materials company trying to serve filtration, healthcare, transportation, and construction markets simultaneously.

Here’s what’s interesting: They actually have decent market positions (50%+ share in some high-value products) and exposure to long-term trends like clean air/water and automotive aftermarket recovery. The question is whether new management can execute without destroying what actually works.

The market’s pricing in failure. Maybe that creates opportunity.

I. Situation Overview:

Let’s start with the basics, because even that’s complicated with Mativ.

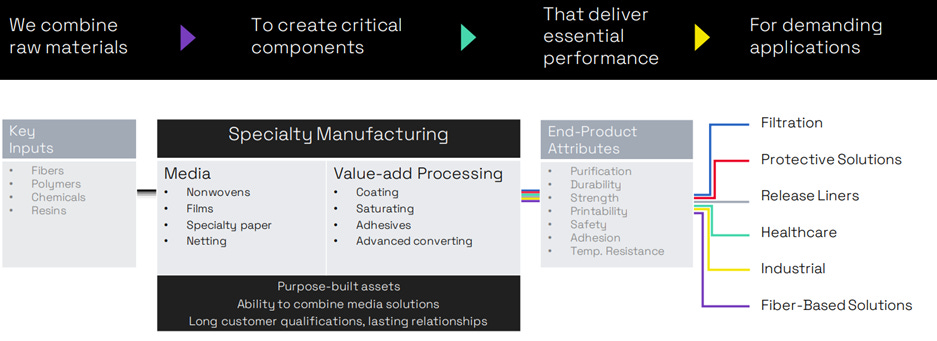

This is supposedly a “specialty materials company,” one of those corporate descriptions that tells you absolutely nothing about what they actually do. In reality, they make the stuff that goes into other stuff. Filtration materials for air and water. Films that protect car paint. Release liners for adhesive products. Industrial tapes. Healthcare materials. It’s the B2B world where nobody knows your name but your products are everywhere.

The company exists today because of a decades-long acquisition binge. Starting in 2013, the legacy Schweitzer-Mauduit International went on a shopping spree, buying six companies for ~$1.3 billion. Meanwhile, Neenah was playing the same stupid game: acquisition fever, including disasters like the Coldenhove Paper purchase and the poorly-timed ITASA deal in 2021.

Both companies were essentially doing the same thing: grow through M&A, worry about integration later.

Then came the masterstroke of financial engineering: in July 2022, these two acquisition-heavy companies decided to merge with each other. Because apparently, when you can’t make one complex portfolio work, the solution is to combine it with another complex portfolio.

The timing was spectacularly awful. Just as they’re trying to integrate two already-complex businesses, the world exploded. Supply chain chaos. Massive inflation. Energy crises. Customer destocking events that lasted months longer than anyone predicted. It’s like performing surgery on two patients who are already bleeding out.

So what did this brilliant merger create? A company with significant debt and no coherent identity. Today they operate two segments: Sustainable & Adhesive Solutions (60% of revenue) and Filtration & Advanced Materials (40%). SAS makes release liners for tapes and labels, healthcare materials like wound care products, and industrial adhesives - steady, recurring demand businesses. The SAS business actually works - it’s posted five consecutive quarters of organic EBITDA growth.

FAM produces filtration media for air and water systems, plus advanced films for automotive and construction applications. But FAM is a disaster. The Advanced Films unit is still reeling from quality issues that destroyed customer trust, while the broader segment gets hammered by weak automotive and construction markets.