High Yield Market Weekly Minutes: Spreads Hit Post-GFC Tights, Then Greenland Happened (January 20, 2026)

Five-Week Winning Streak Meets NATO Tariff Standoff

🚨 Connect: Twitter | Instagram | Reddit | YouTube | Jobs

TL;DR

High yield returned +0.17% last week, extending the winning streak to five weeks. Spreads compressed 6bps to 251bps, the tightest since 2007. Yields ticked higher to 6.57% as Treasuries sold off. Primary slowed to $2.7 billion across five deals; Bristow upsized on a multiple-times oversubscribed book. Fund flows flipped negative. Then this weekend happened. S&P futures down 1.4% on the Greenland tariff standoff, VIX above 20, and the forward calendar may be on ice.

Five weeks of gains. Spreads at two-decade tights. And now a potential rupture in the NATO alliance over an island in the Arctic.

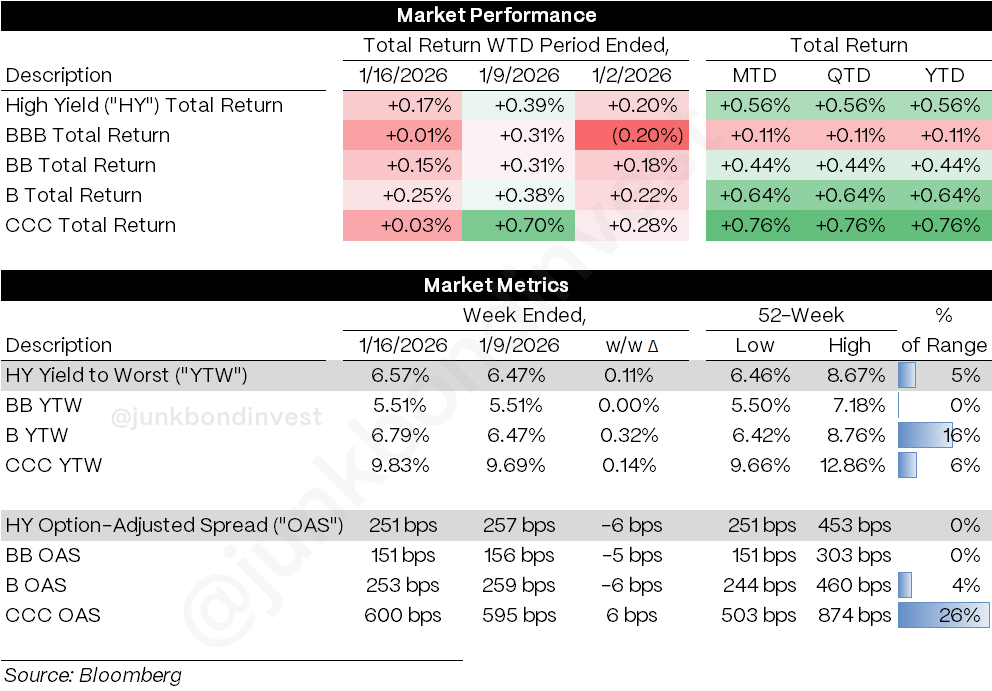

High yield spent last week grinding tighter despite rising Treasury yields and a sharp slowdown in supply. The index returned +0.17%, pushing YTD gains to +0.56%. Spreads compressed 6bps to 251, a level not seen since 2007. BB spreads hit 151, sitting at the 52-week low. B spreads tightened to 253. The market shrugged off DOJ probes of Powell, geopolitical noise out of Iran, and proposed credit card interest caps. Nothing stuck.

The macro data cooperated. December CPI came in at expectations with core holding at 2.6%, reinforcing the slow disinflation narrative. Bank earnings were strong. Existing home sales rose for a fourth straight month. Retail sales showed underlying consumer resilience. The data painted a picture of orderly cooling.

Then the weekend arrived. Trump announced 10% tariffs on eight NATO countries starting February 1, rising to 25% in June unless they agree to sell Greenland. S&P futures are down 1.4% this morning. The VIX topped 20 for the first time since November. Japanese 30-year yields spiked ~25bps overnight.

The five-week winning streak is about to be tested.

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list.

Weekly Performance Recap

Bs led at +0.25%, BBs returned +0.15%, CCCs lagged at +0.03%. Spreads tightened 6bps to 251, now at the 52-week low. Yields rose 11 bps to 6.57% as Treasuries sold off. Fund flows flipped negative, the first outflow since mid-November. The tape held firm despite the rate backup, though this morning’s futures point to a different story.

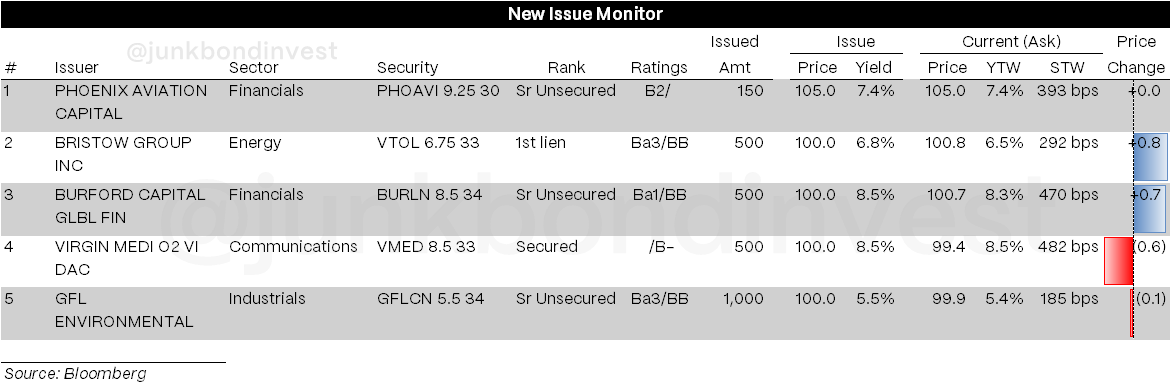

Primary Market Activity

Supply slowed to $2.7 billion across five deals, down from $9.4 billion in the opening week. The lighter calendar partly fueled the rally, with buyers competing for limited paper. Execution stayed strong. All but one deal priced at talk or better, with two upsizing on oversubscribed books. Secured paper cleared well inside whispers. The lone exception priced at the wide end of guidance.

The forward calendar had been building with several deals expected this week for LBO financing and refinancing. That was before this weekend. With futures down and the VIX above 20, issuers may stay on the sidelines until conditions stabilize.

Secondary Market

Broad gains extended across the risk spectrum before Friday’s late weakness. BB spreads closed at a 14-month low. Nearly all YTD new issues traded higher as street inventory stayed light.

Building materials led early on M&A speculation after a prominent venture upsized its equity raise, though momentum faded as the rally met resistance. Energy was well bid despite midweek oil volatility; credits held in even as crude reversed on political headlines. Gas-exposed names shook off front-month weakness. Midstream traded well throughout.

Financials saw headline-driven volatility around the proposed 10% credit card APR cap. Consumer finance was hit hardest early, with bonds off a few points, but both recovered as investors discounted the legislative odds. The sector ended firmer than the initial shock implied.

Chemicals were generally better, though European levered names traded poorly. Healthcare saw persistent idiosyncratic pressure, with M&A speculation supporting select names.

Looking Ahead

I will be honest: the Greenland situation is bizarre, and I have no idea how to handicap it.

The base case is that cooler heads prevail. Some face-saving compromise gets reached, tariffs get delayed, markets move on. Probably right. But markets are not priced for any other outcome. A lot of complacency is meeting a genuinely unpredictable situation.

Macro data actually looks fine. CPI behaved. Retail sales showed resilience. Existing home sales are at the fastest pace since early 2023. Housing is finding a footing as financing costs modestly retreat. The consumer is hanging in there, at least at the upper end of the income distribution. None of this screams recession.

Fed math has shifted though. Kevin Warsh looks like the pick to replace Powell, the more hawkish candidate. Rate traders now price fewer than two cuts for all of 2026, with the first not fully priced until June. January is a hold. March is increasingly uncertain. If inflation proves stickier than expected in Q1 due to early-year price resets, even June could slip.

Spreads at ~250bps are pricing a perfect world. Soft landing, steady disinflation, Fed easing on schedule, no policy accidents. The data have broadly supported that view, which is how we got here. But you are getting paid 250bps over Treasuries to own a market with geopolitical uncertainty, hawkish Fed repricing, and stretched positioning.

The forward calendar will tell us how issuers read the tape. Several deals are expected this week for acquisition financing and refis. If they press forward despite this morning’s selloff, issuers see the weakness as noise. If they pull back and wait, even borrowers think conditions are fragile.

Upside from here is another 10-20 bps of tightening. Downside if something breaks is 50-100 bps wider in a hurry. That is not a bet I want to make with size. Let the dust settle.

Find the most recent JunkBondInvestor posts below

Disclosure: The information provided is based on publicly available information and is for informational purposes only. While every effort has been made to ensure the accuracy of the information, the author cannot guarantee its completeness or reliability. This content should not be considered investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release the author from any liability. Always seek professional advice tailored to your financial situation and objectives.