The CoC Case for Dentsply Sirona ($XRAY) Investment Grade Bonds

PE is circling dental. Credit markets are wide open. Does Dentsply make the cut?

🚨 Connect: Twitter | Threads | Instagram | Reddit | YouTube | Jobs

Back in October I wrote a piece looking at investment grade credits that could be change of control candidates through M&A. The EA deal had just proven the trade works. Long-duration bonds trading at 65 ripped to 87 overnight when the LBO was announced. Sleepy IG bondholders made 35% while they slept. The setup was sitting there in plain sight, and most of the market missed it.

I went looking for more of those. Companies where duration killed the bonds, not credit risk, and where change of control provisions could bail you out if a sponsor showed up.

After that piece went out, a reader flagged Dentsply Sirona. The world’s largest dental products company, ticker XRAY 0.00%↑, stock down 75% from its highs, bonds yielding more than they should for an IG credit. And there’s been real PE activity in dental lately. Patterson last year. Envista has been rumored as a target. Henry Schein too. The consolidation logic exists. The financing environment is WIDE open.

So I pulled the filings and dug into the capital structure.

What I found was messier than I expected.

Situation Overview

Dentsply Sirona is the world’s largest dental products company. If you have ever sat in a dentist’s chair, there is a good chance some of the equipment pointed at your mouth came from them. The company traces its roots back 130 years to the first dental electric drill. Today it sells everything dentists need to run their practices: the consumables they burn through every day (composites, cements, endo files, restorative materials), the imaging systems that diagnose problems, the CAD/CAM equipment that mills crowns chairside, and the implants that replace what cannot be saved.

Dentists do not stop drilling because the economy softens. Offices burn through consumables every day. That is the pitch. And it is not wrong. Dental is a genuinely good end market. Demand is stable. Reimbursement is predictable. The customer base is not going anywhere.

The problem is that Dentsply has spent nearly a decade turning a decent end market into an execution story. Not an existential story where people stopped going to the dentist. An execution story where the company’s own machine stopped converting demand into revenue and profit. The issues are not mysterious. They are concrete, operational, and self-inflicted. Every quarter comes with the same subtext: the franchise is still there, but the company keeps getting in its own way.

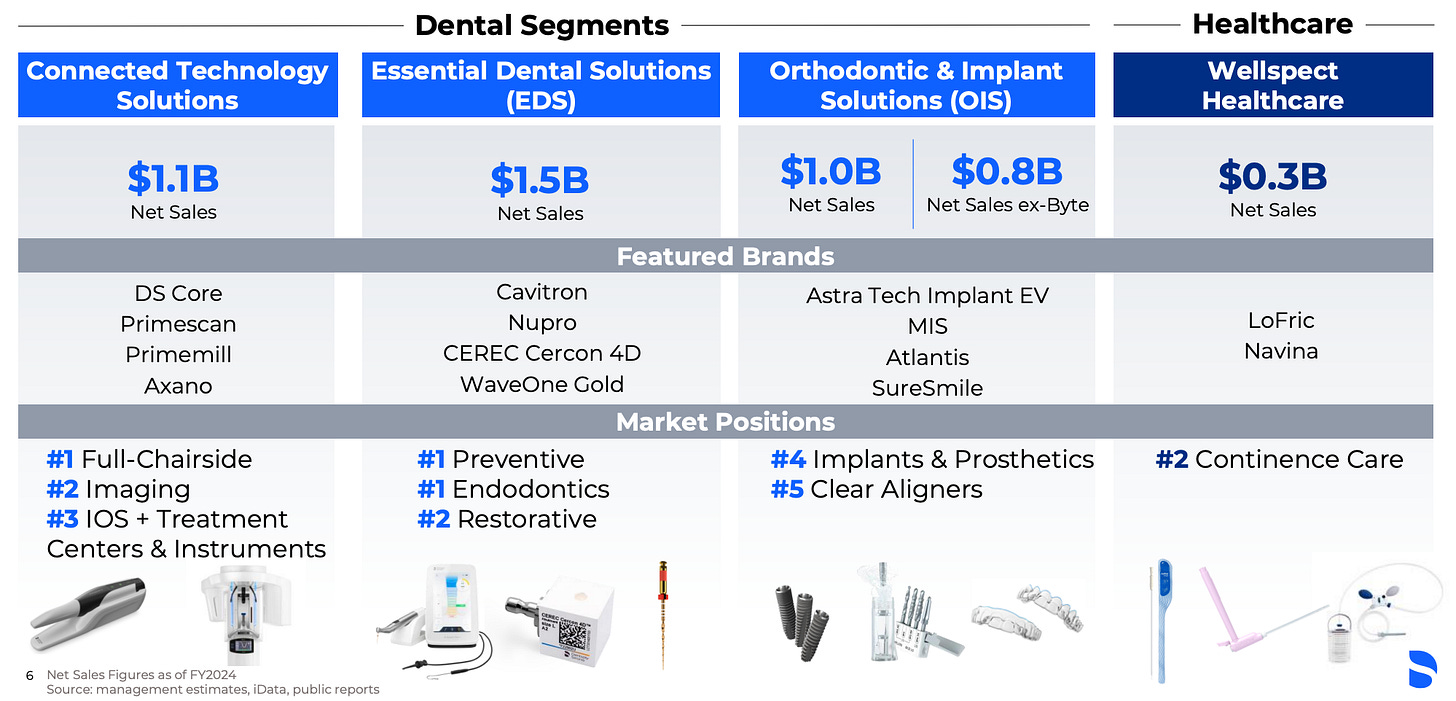

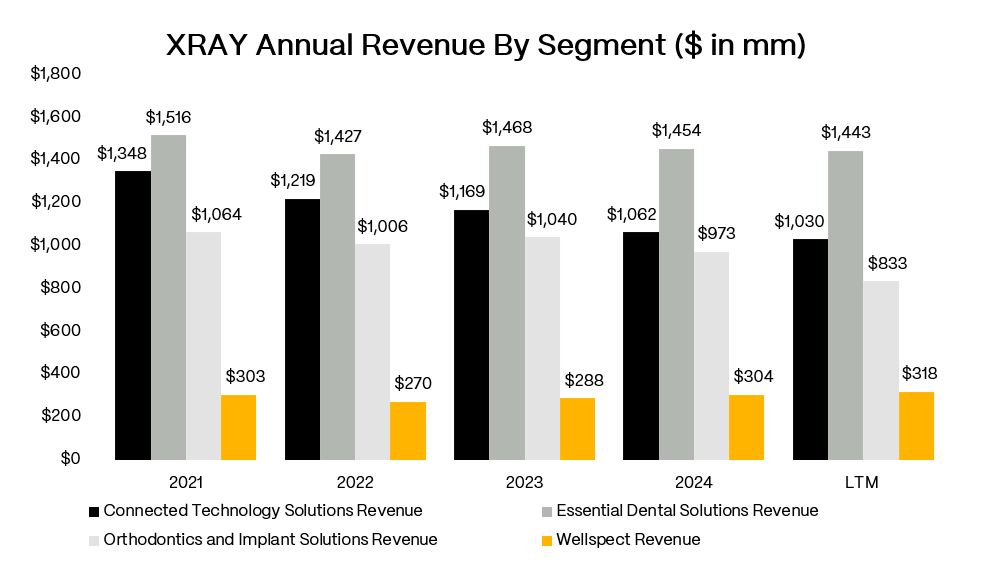

Start with what the business actually is. Dentsply is a portfolio. The boring, recurring side is Essential Dental Solutions, about $1.4 billion of consumables that should be the ballast keeping you from blowing up when equipment cycles soften. The sexier side is Connected Technology Solutions, another billion dollars of digital dentistry, scanning, CAD/CAM, imaging, integrated systems that are sticky once installed. Then you have Orthodontics and Implant Solutions, more procedure-driven, more competitive, higher margin when you are winning, painful when you are not. Finally there is Wellspect, a $300 million continence care business that has nothing to do with teeth but looks steadier and more defensive than the rest of the portfolio.

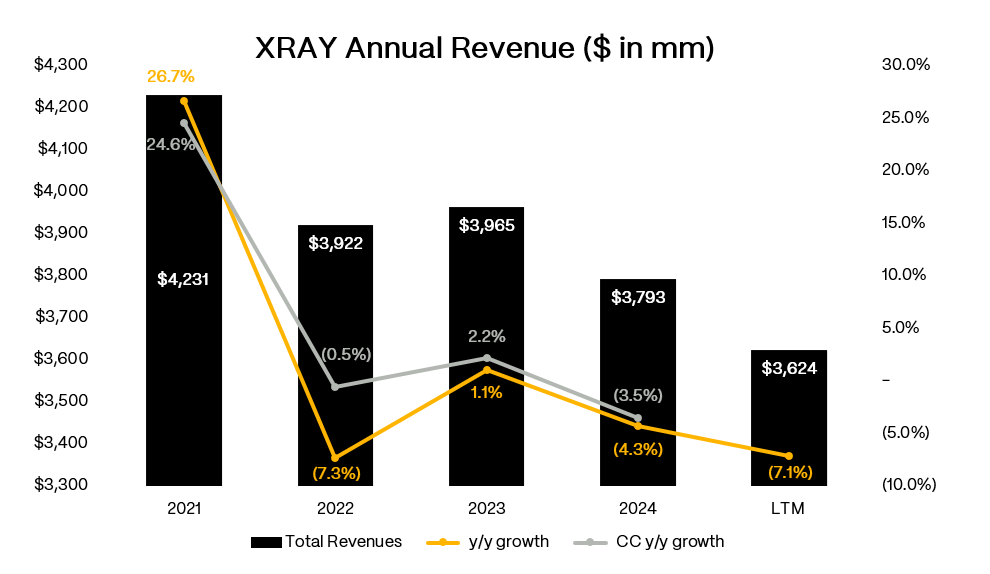

The portfolio came together in 2016 when Dentsply merged with Sirona. The deal was supposed to create a dental powerhouse. Combine high-margin consumables with cutting-edge technology. Cross-sell everything to the same dentist customers. Accelerate innovation. Extract synergies. Nearly a decade later, none of it has worked. The cultures never meshed. The product portfolios never cross-sold. Margins still trail peers by 500 to 700 basis points. The promised innovation acceleration never materialized. Revenue peaked at $4.2 billion in 2021 and has declined every year since. LTM revenue sits at $3.6 billion, down 14% from the peak.

Then in 2022, the company blew itself up. An internal investigation found issues around sales incentives and revenue recognition in late 2021, leading to financial restatements and ongoing litigation alleging improper sales practices. CEO Don Casey and CFO Jorge Gomez were terminated. The Gomez situation was particularly embarrassing. He had already jumped ship to become Moderna’s CFO, and lasted exactly one day in that job before getting fired when Dentsply disclosed the probe. The SEC launched an investigation that dragged on before concluding with no enforcement action, but by then the damage was done. Investor trust was shattered. The company has taken over $2 billion in cumulative goodwill impairments across 2022 and 2024. The stock collapsed and has not recovered.

What followed was a management carousel that still has not stopped spinning. Dan Scavilla is now the fourth CEO since 2022, promoted from the board in July 2025. In November he announced a “deeper, faster, bolder” transformation plan, which is exactly the kind of language that should make investors nervous. Even more concerning is what happened to his CFO. Matt Garth resigned after just five months in November 2025. For a company that just emerged from an accounting scandal, this level of instability in the finance function is about the last thing you want to see.

The operational problems run deeper than the executive suite. In 2020, Dentsply paid a billion dollars for Byte, a DTC clear aligner business competing with SmileDirectClub (went bankrupt by the way). The bet failed spectacularly. Byte suspended sales in late 2024 following an FDA regulatory review, leaving a $50-60 million quarterly revenue hole and validating every skeptic who questioned why a B2B dental company thought it could win in consumer marketing. The Ortho and Implant segment has been in freefall ever since, posting organic declines of 17% to 20%.

But the real failure point is the U.S. commercial engine. In dental, you do not just ship product into a void and hope dentists find it. You need a functioning go-to-market system. Distributor alignment. Field sales coverage. DSO contracting. Training. Service. The whole ecosystem. When that system is healthy, the recurring consumables keep flowing and the larger-ticket categories steadily convert. When that system is unhealthy, you do not just miss a quarter. You lose placements. You lose mindshare. The decline becomes self-reinforcing.

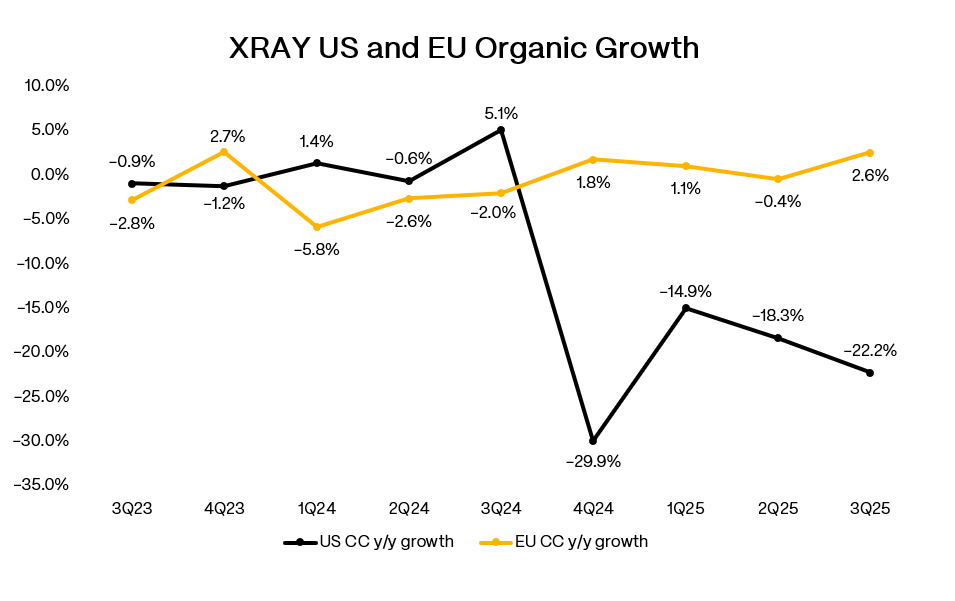

3Q'25 organic sales in the U.S. declined 22.2%. That number is inflated by one-timers - the Byte shutdown and there was a $24 million headwind from lapping pre-buy activity ahead of the 2024 ERP implementation. Back those out and you’re still looking at a low-to-mid teens decline, which is bad but not catastrophic. The divergence from Europe is stark. While the U.S. business has cratered, posting negative 15% to negative 30% organic growth for the past year, Europe has held steady, bouncing around flat to slightly positive. Same company. Same products. Completely different execution. Management describes dealer relationships with Henry Schein and Patterson as “somewhat strained,” which in corporate speak means the relationships are a mess. DSO customers have pulled back. The company is losing share across consumables and equipment to competitors who did not spend the last three years distracted by accounting scandals and CEO searches.

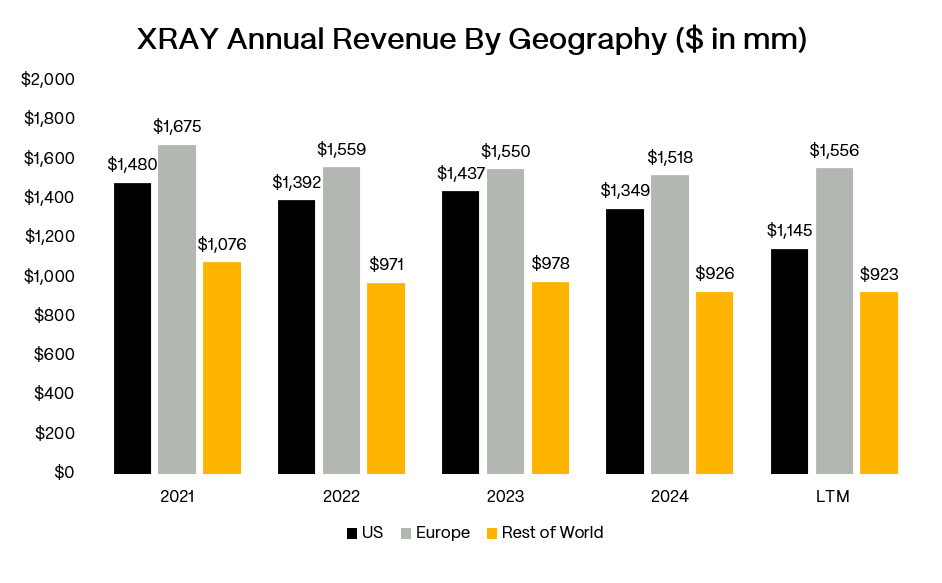

The geographic split tells a similar story. U.S. revenue has fallen from $1.7 billion in 2021 to $1.1 billion LTM. Europe has held up better, declining from $1.6 billion to $1.5 billion over the same period. Rest of World has been roughly flat. The U.S. is where the franchise is broken, and the U.S. is where the turnaround has to happen.

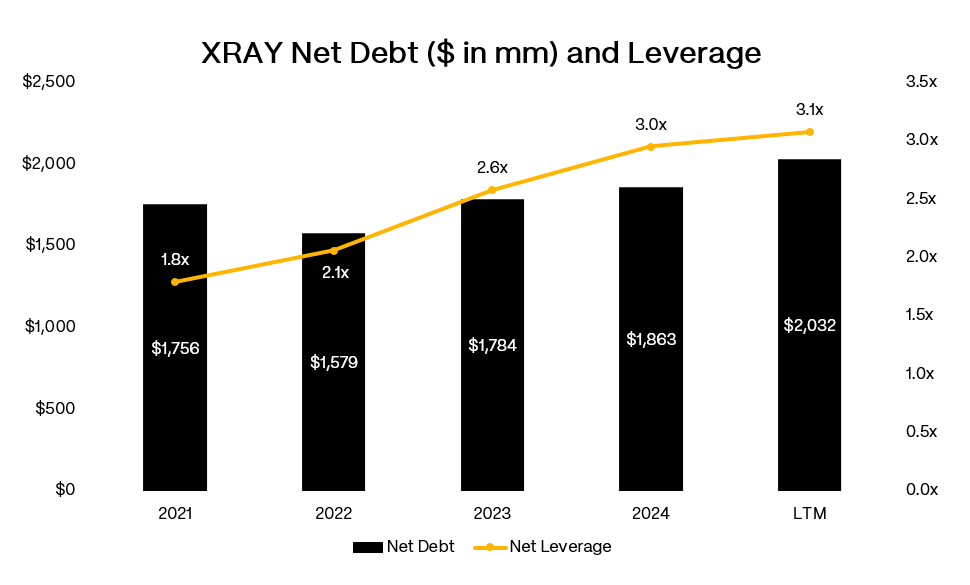

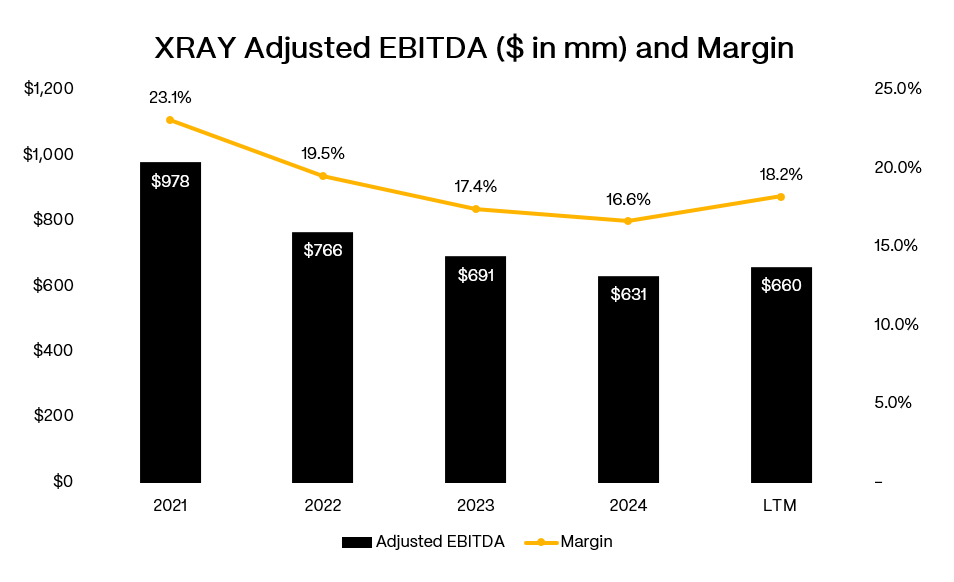

The balance sheet tells the story of a company trying to hold things together while the turnaround takes shape. Total debt sits around $2.1 billion against roughly $660 million of trailing EBITDA, putting leverage around 3.1x. That does not sound alarming until you see the trajectory. Leverage has crept up from 1.8x in 2021 to 3.1x today, not because the company loaded up on debt, but because EBITDA collapsed.

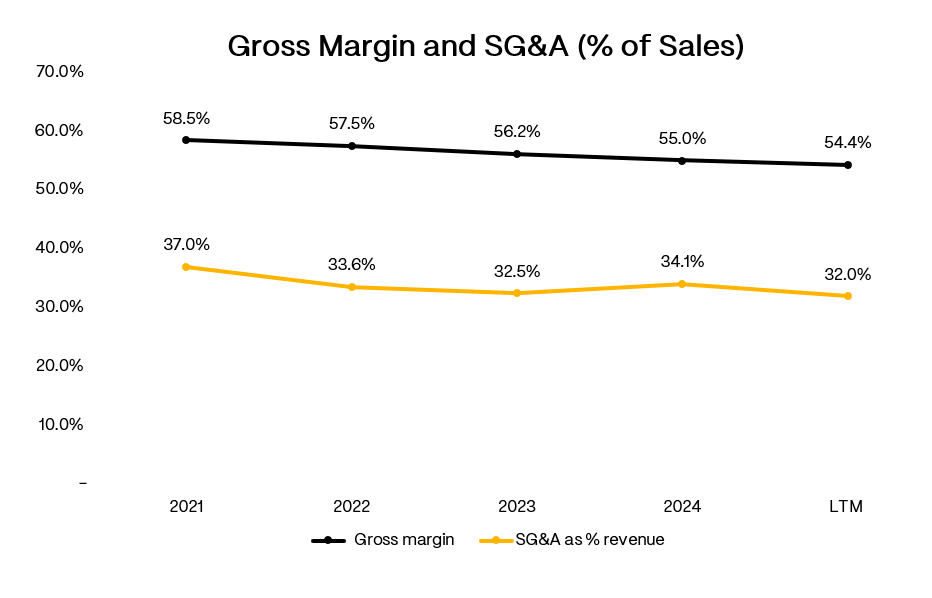

Adj. EBITDA margins have compressed from 23% to 18% over the same period. Gross margins have eroded 400bps. The math is straightforward: higher-margin equipment and implant sales collapsed, lower-margin consumables held steady, and fixed costs got spread over a shrinking revenue base.

Ratings are BBB- at S&P and Baa2 at Moody’s, with Moody’s on negative outlook. In June 2025, the company issued $550 million of junior subordinated notes at 8.375%. Expensive paper, but the hybrid structure gets partial equity credit from the rating agencies and helps manage leverage metrics. It is the kind of capital you issue when you need balance sheet flexibility and want to protect your IG rating.