Who's Next: Three Names Where the EA Bond Trade Could Repeat (Part I)

Finding Change-of-Control Optionality in a Market That’s Begging You to Borrow

🚨 Connect: Twitter | Threads | Instagram | Reddit | YouTube

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list (limited spots).

The mega-deal era is BACK.

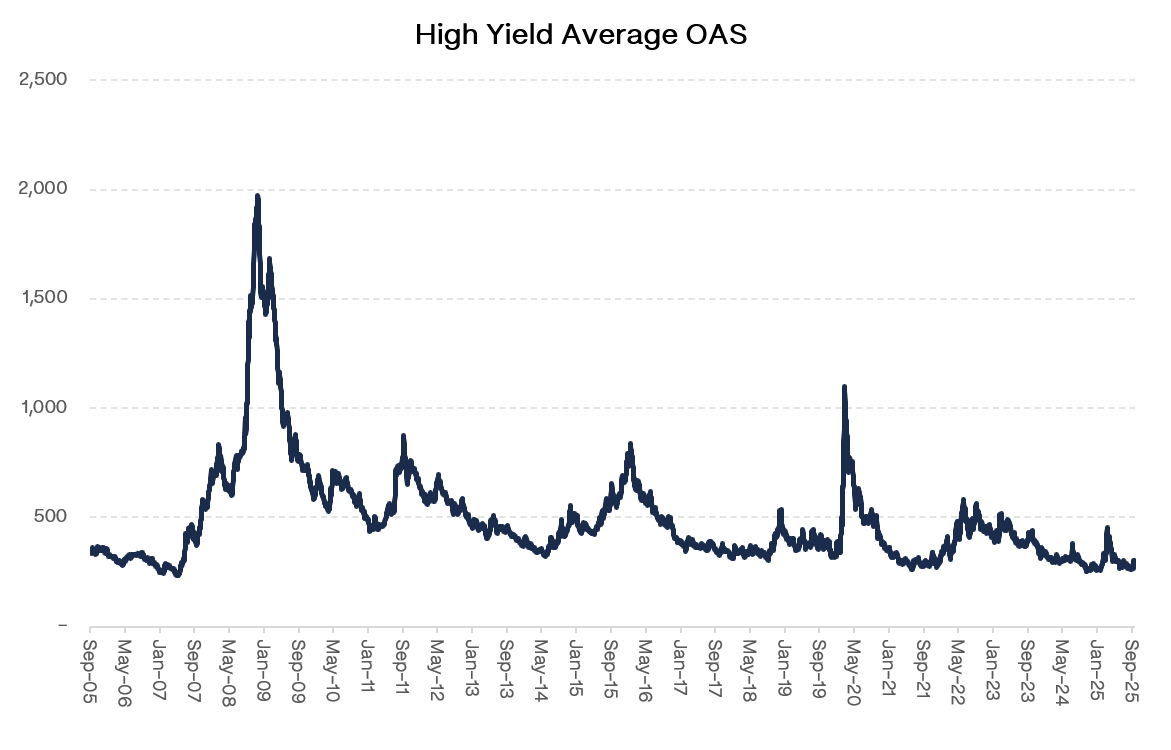

High-yield issuance is surging, financing terms are looser than they’ve been in years, and private equity sponsors are sitting on mountains of cash they’re desperate to deploy. Don’t believe me? Look at high-yield spreads hovering around 20-year lows. The market is practically BEGGING issuers to borrow.

At the same time, private equity is sitting on $2.5+ trillion in dry powder. Private credit funds are sitting on another $500+ billion. And all of it needs to go somewhere. Nobody’s talking about the real pressure point: the LPs are getting restless. Funds raised are still largely undeployed. That was supposed to be deployment capital, not parking capital. When you’re sitting on billions and the cost of debt is dropping, the pressure to write checks becomes overwhelming. And if you’re going to take the execution risk, you might as well write a BIG check.

EA just proved it works. JPMorgan committed $20 billion in financing. You don’t do that as an experiment. Every other sponsor watching from the sidelines just got their answer.

Which brings us to the obvious question: who’s next?

We already saw what happened with EA bonds. Long-duration paper trading at 65 ripped to 87 the day the LBO was announced. Sleepy IG bondholders sitting on paper with change-of-control provisions made 35% overnight, with more upside coming if the deal closes at the contractual 101 (big IF). The setup was simple: duration killed the bonds, not credit risk, and the indenture had protection that became valuable the moment sponsors showed up to take it private.

What I Went Looking For

While the size was surprising, the EA setup wasn’t complicated. Stable business, predictable cash flows, long-duration bonds issued in 2020-2021 now trading at a discount because of rate moves, not credit risk. And change-of-control provisions that meant bondholders could get paid at par if someone took the company private.

That’s the template. So I built a screen: S&P 500 names with market caps above $15 billion, businesses throwing off consistent FCF, bonds trading below par for duration reasons, and covenant structures that favor bondholders in a buyout scenario. The kind of businesses PE knows how to operate and banks know how to finance.

Then I pulled the indentures and checked whether bondholders have the right to put the bonds back at or near par if the company gets taken private. Not every bond has this protection. Many do.

Three names jumped out. Each one has a credible private equity angle. Each one has the debt capacity to support a leveraged take-private. And each one has bonds trading below par.

How This Breaks Down

For each company, I’ll walk through several things.

Why would sponsors want this business? That’s the PE angle. Maybe it’s cost cuts, maybe it’s multiple arbitrage, maybe it’s just taking a public company private and running it without quarterly earnings pressure.

Then there’s the capital structure. What’s the existing debt stack look like? How much more leverage could you realistically add? Where do the bonds trade? Do the covenants work for or against a buyer?

Next, the pushbacks: what makes an LBO difficult? Execution risk, competitive dynamics, deal complexity, anything that could blow up the thesis.

Finally, the bond trade itself. What do you make if a deal happens? What are you stuck with if it doesn’t? Is this a call option on an LBO, or is there downside protection even if nothing materializes?

This isn’t about predicting deals. It’s about finding where duration-driven discounts meet change-of-control optionality that the market hasn’t priced. EA proved the trade could work. Bondholders who understood the setup made serious money when the deal hit. The structure was sitting there in plain sight, trading like it didn’t matter.

I’m betting there are more of those out there. And when private equity has this much capital to deploy and financing costs are this low, the deals start coming faster than people expect.

The window’s open. Let’s see who walks through it.