Herbalife ($HLF): Follow the Debt, Not the Discourse

Separating the narrative from the numbers, one maturity at a time.

🚨 Connect: Twitter | Threads | Instagram | Reddit | YouTube

Note: Starting January 15, 2026, subscription prices will be increasing. Anyone who subscribes before then will be locked into today’s pricing indefinitely.

Herbalife is still here, which tells you everything you need to know about MLMs.

Bill Ackman bet a billion dollars it was a fraud. He lost. Not because he was wrong about the business model, but because he underestimated the power of willful blindness. People don’t want to know. They want to believe. And Herbalife sells belief.

And that’s the problem with Herbalife as an investment. The narrative is so loud you can’t hear the numbers. Bill Ackman screaming on CNBC. The FTC investigation. Your weird cousin with the nutrition club in her garage. It all blends together into one big “stay away” signal.

Meanwhile the world is obsessed with GLP-1s. Ozempic. Wegovy. The weight loss drugs that are supposed to kill every diet company on the planet. Meal kits. Protein bars. Gym memberships. All toast, according to the narrative.

But that noise is exactly why this could be interesting. Bondholders don’t get paid to be right about the vibe, they get paid to map cash flow to the maturity stack, and Herbalife’s story today is less “is this cringe” and more “what sits where in the capital structure, what’s callable, and what gets refinanced first.”

So what happens to the shake company? The one that’s been selling weight loss for forty years through a network of true believers working out of nutrition clubs in strip malls?

We can keep arguing about whether it’s a scam. The bond market is asking a simpler question. And the next answer is on a specific date.

Situation Overview:

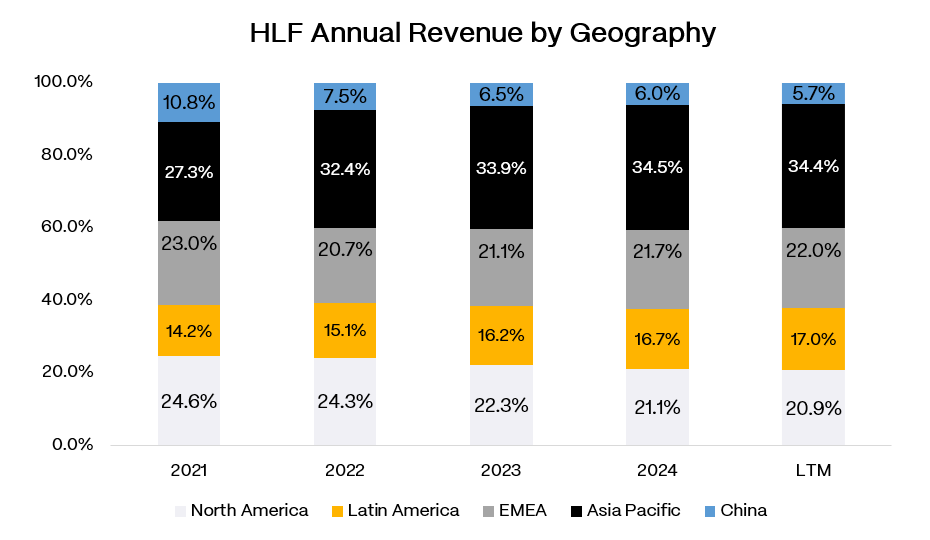

Herbalife is a global direct-selling nutrition business. Still an MLM but with real scale and a very non-US centric revenue base. 2024 sales were about $4.9bn, roughly 80% generated outside the U.S., and weight management is still the engine, about 55% of 2024 sales. The company reports five segments, sells through a distributor network, and leans heavily on the “nutrition club” channel as the on-the-ground consumption and community layer that keeps the flywheel spinning when the recruiting narrative gets stale.

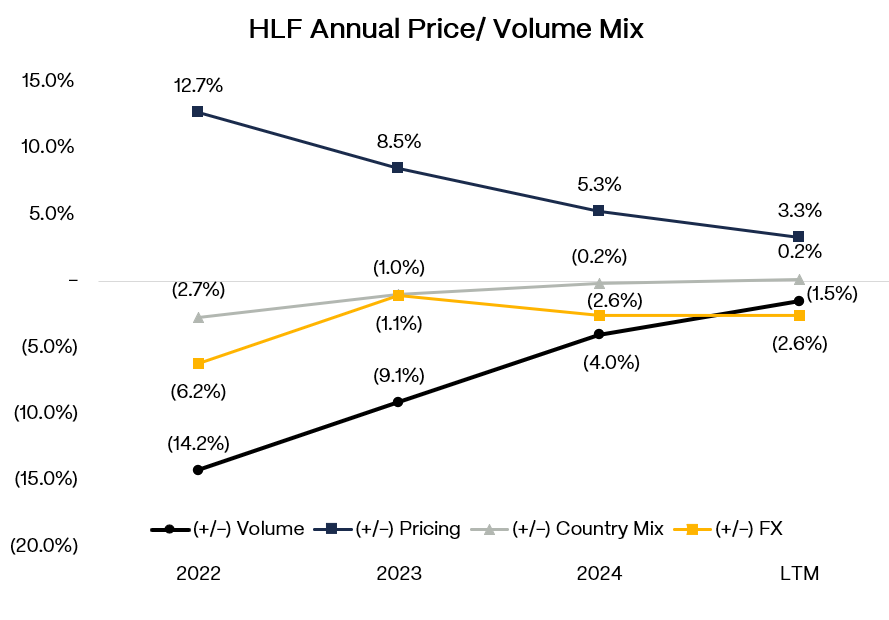

The recent top line is best described as “price doing the work while volume stops bleeding.” Over the last few years, price has carried reported growth while volumes have been negative, improving, but still not consistently positive, which is why every “win-back” quarter comes with a footnote. With the business so international, FX translation can also make the reported P&L look better or worse quarter-to-quarter without telling you anything about demand, which is why constant currency and volume trends matter more than the headline reported revenue print.

The credit setup is pretty straightforward, Herbalife is a cash flow story first, a leverage story second, and a “can the top line stop bleeding” story third. Management has been explicit that the priority is debt paydown, not financial engineering, with share repurchases framed as “maybe later” if they are ahead of their deleveraging plan, but the market will require proof because this company has historically been willing to lean into shareholder returns when it has breathing room. They also run the business with meaningful liquidity, calling out about $300mm of operational cash needs and a preference to keep closer to $400mm on hand.

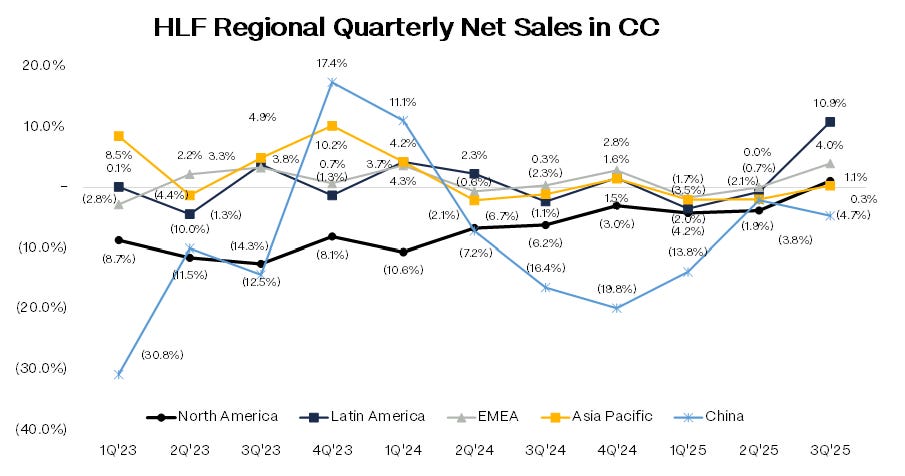

Operationally, the tone has shifted from “stabilization” to “early inflection,” but the evidence is still mixed. Regional constant currency trends have improved sequentially, with North America finally turning positive again recently while China remains a clear drag, and the rest of the footprint looks like low-growth noise around flat. The right way to interpret this is not “growth is back,” it’s “the decline has slowed, and one or two regions are no longer a disaster,” which is a meaningful difference when you are underwriting a refinancing.

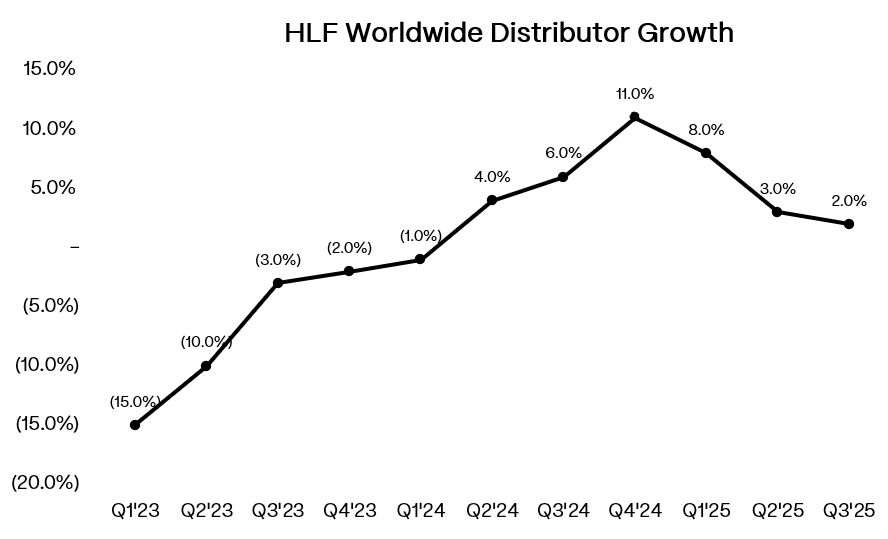

The field metrics matter because this is still a distributor productivity business. Worldwide distributor growth rebounded sharply off the lows and then decelerated again, which is consistent with an organization that can re-energize the base through training, events, and incentives, but still has to prove the improvement is durable without continuously turning the dials. If those metrics fade, Herbalife can keep revenue from rolling over by spending more, but that just turns the “stabilization” story into a margin protection exercise instead of a real fundamental inflection.