Weight Watchers ($WW): Cleaned Up Capital Structure, Messy Business

90 cents 1L paper (13% YTW), simple structure, can Clinical grow faster than Behavioral shrinks?

🚨 Connect: Twitter | Threads | Instagram | Reddit | YouTube | Job Board

Note: Starting January 15, 2026, subscription prices will be increasing. Anyone who subscribes before then will be locked into today’s pricing indefinitely.

Nobody wants to own this paper.

Weight Watchers. The name alone makes people run. Diet company in the age of Ozempic? Pass. Legacy brand that just went bankrupt? Hard pass. Distressed funds dumping their positions into a thin market? No thanks.

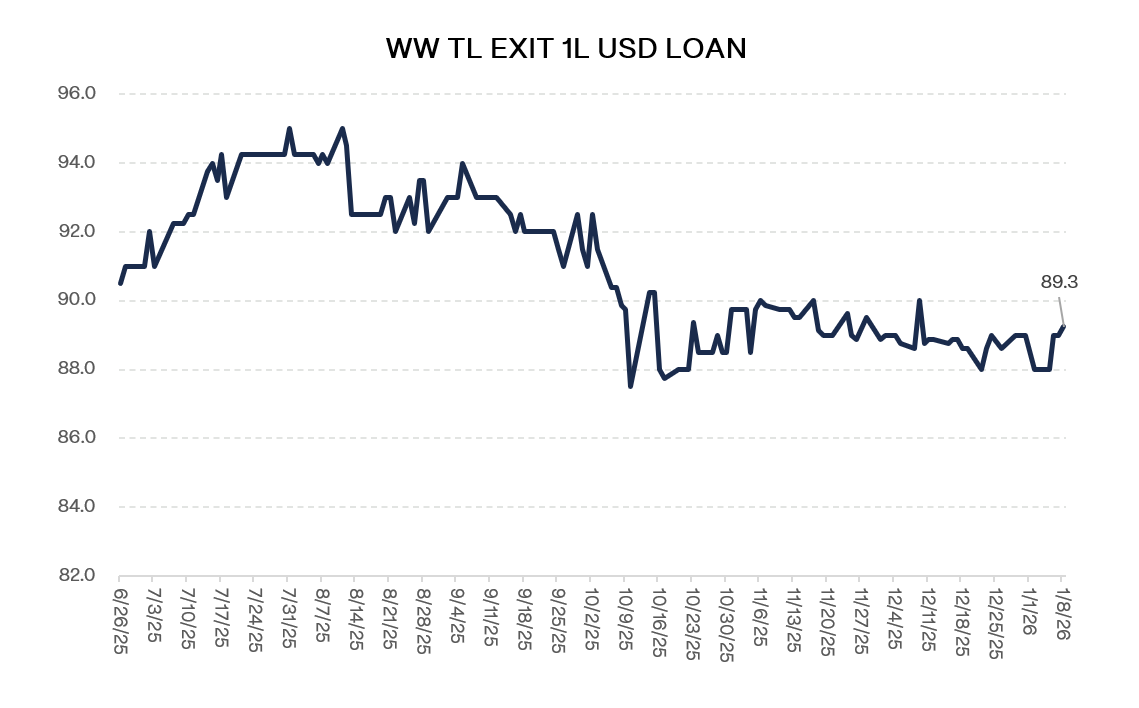

That’s why the exit term loan currently trades at 90 cents.

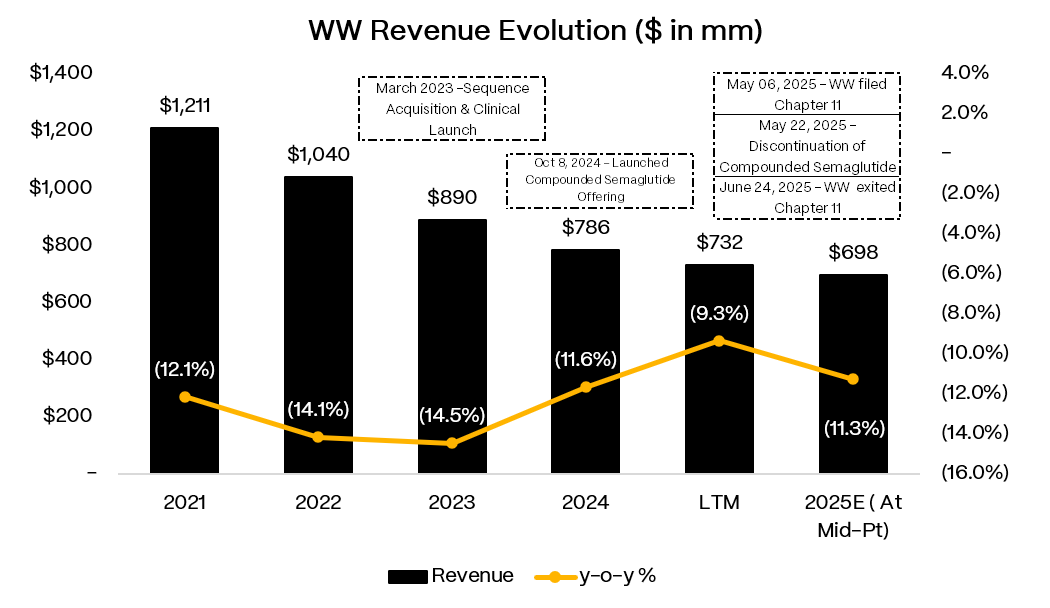

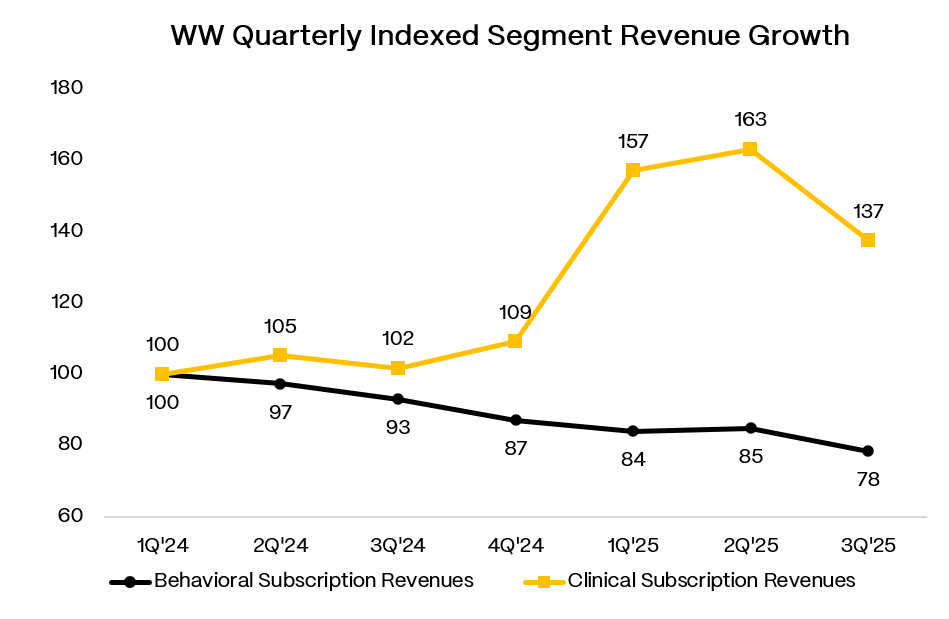

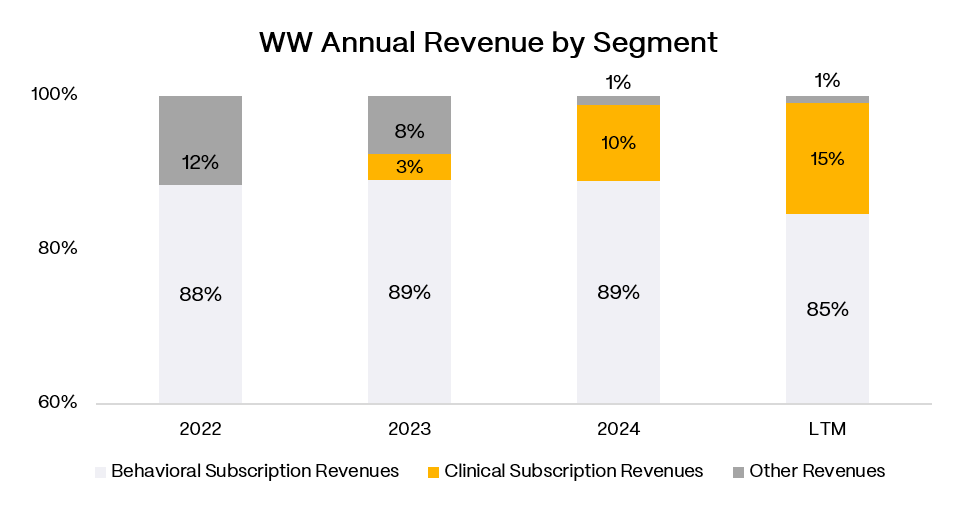

Weight Watchers is not a growth story by any means. Behavioral subscribers are down 20% y/y. The points business, the meetings, your aunt’s diet plan. Cooked. Not coming back. GLP-1s changed everything and WW was standing in the wrong spot when the wave hit.

But the company didn’t die. It adapted.

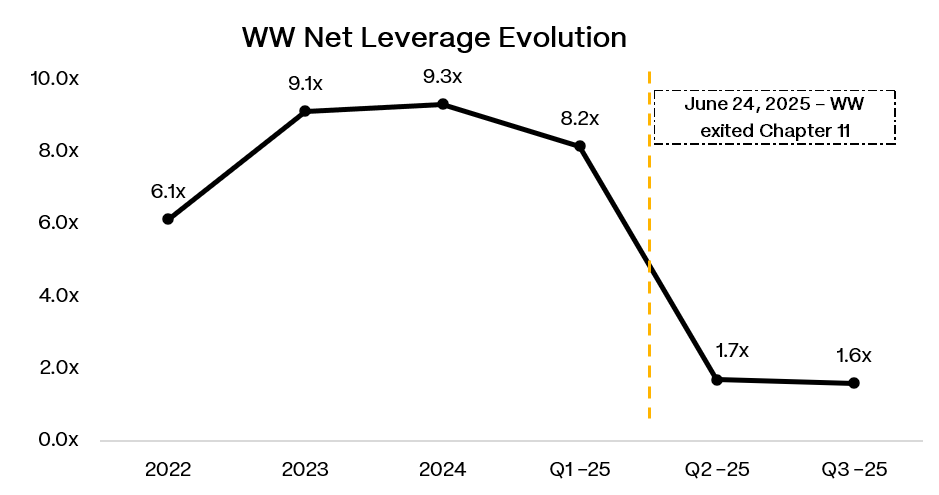

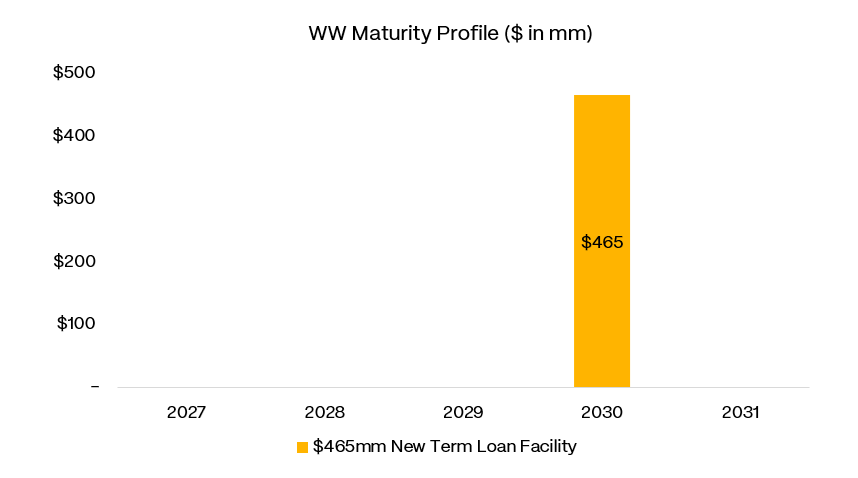

Filed Chapter 11 in May. Out by June. $1.6 billion of debt became $465 million. Old equity got a 9% kicker, which was quite the gift. They usually take everything. This time they didn’t.

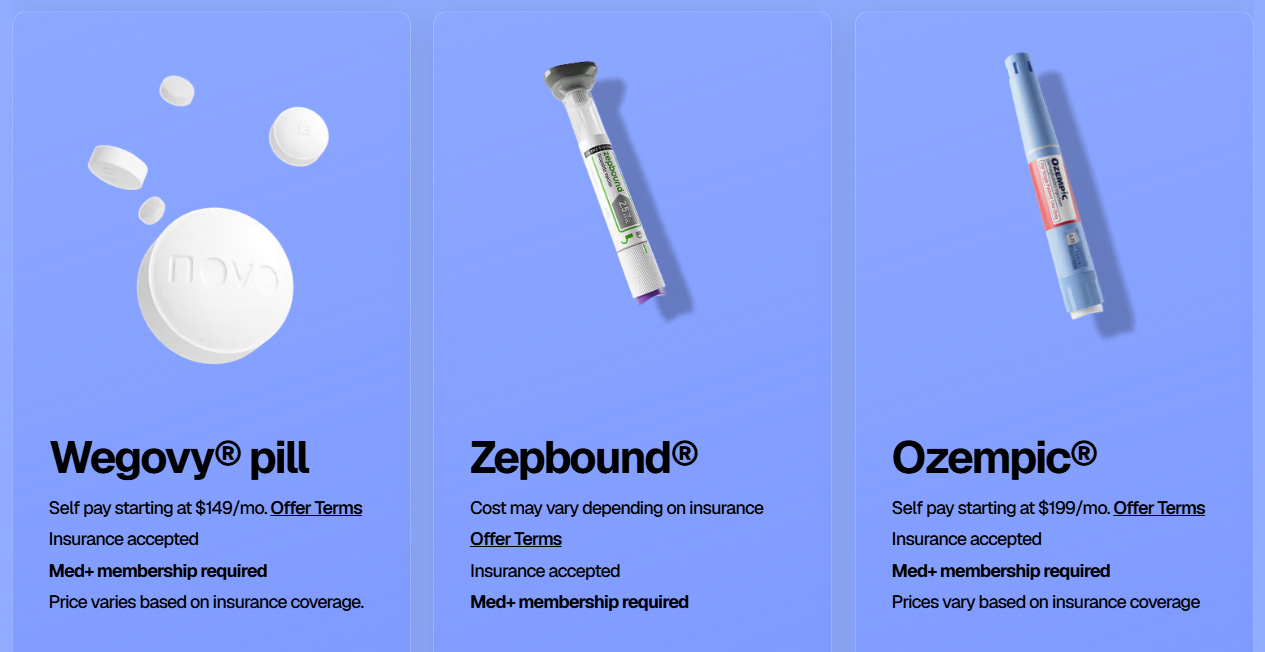

Recall WW bought a telehealth company in 2023. Pivoted into the GLP-1 business. Not fighting Ozempic. SELLING it. Insurance navigation. Prior auth. Pharmacy logistics. All the stuff that makes getting these drugs a nightmare.

So now there’s a first lien. $465 million. SOFR plus 680. Due 2030. Net leverage under 2x. Yielding ~13%.

Behavioral is still 24x larger than Clinical. One shrinking double digits. One just lost its growth engine when the FDA shut down compounded semaglutide.

Clean capital structure. Messy business. The question is which one matters more.

Situation Overview:

WW International is a 60-year-old diet brand trying to convince the market it can become a healthcare services company. The company filed Chapter 11 on May 6, 2025 and emerged six weeks later on June 24, 2025 with a dramatically cleaner balance sheet. The reorg swapped roughly $1.6bn of secured debt for a single $465mm senior secured term loan due 2030 (SOFR + 680), handed 91% of the new equity to creditors, and left legacy shareholders with 9%. Cash at 3Q’25 was $170mm, putting net leverage around 1.6x against FY’25 EBITDA guidance of $145-150mm.

The business now runs on two tracks that are moving in opposite directions.

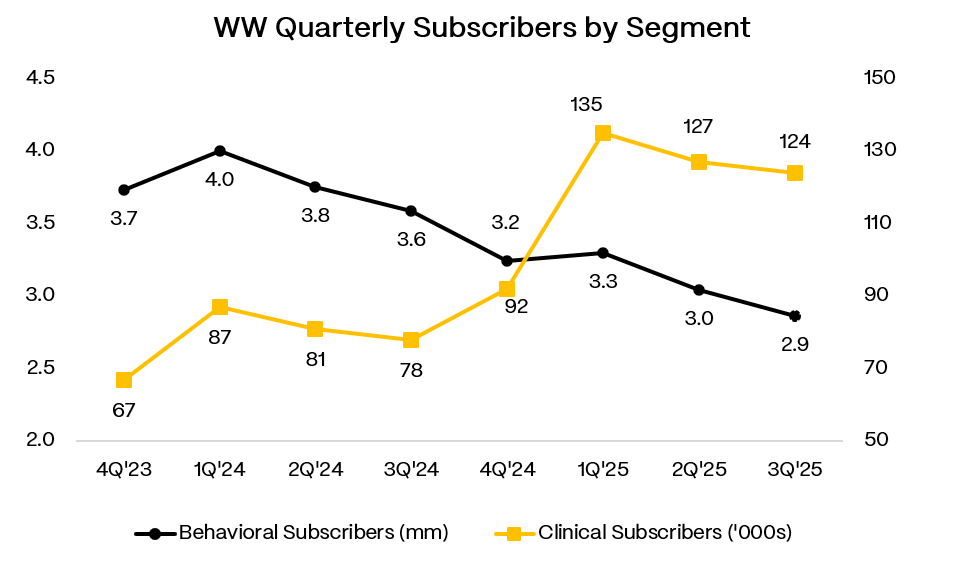

Behavioral is the legacy WW product: a digital subscription plus coaching plus workshops. This is the business people think of when they hear “Weight Watchers.” It has been shrinking for years, and the rise of GLP-1 medications made that decline a headline problem. When consumers believe the answer to weight loss is a prescription, paying $15-20/month for food tracking and accountability groups becomes a tougher sell. Behavioral subscribers ended 3Q’25 at 2.9mm, down 20% y/y, with segment revenue falling 16% y/y to $145mm.

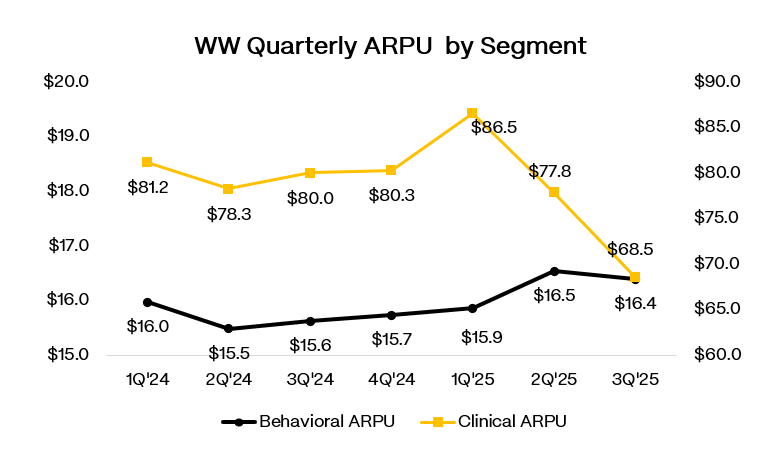

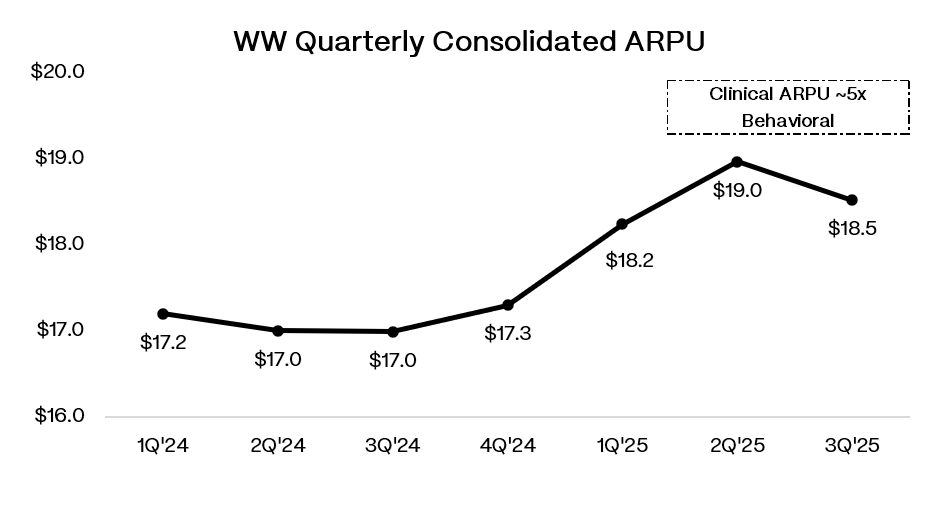

Clinical is the telehealth offering WW built through its 2023 acquisition of Sequence for roughly $106mm (net). This business provides medical evaluations, prescription access, and insurance navigation for members seeking anti-obesity medications. Clinical ended 3Q’25 with 124k subscribers, up 60% y/y, generating $26mm of revenue, up 35% y/y. Management says Clinical subscribers monetize at roughly 5x the ARPU of Behavioral members, which is why consolidated ARPU rose 9% y/y to $18.52 even as total subscribers declined.

The problem is that Clinical’s growth story over the past 18 months is messier than the headline numbers suggest. Most of it came from compounded semaglutide.

“Compounding” refers to medications prepared by specialty pharmacies that create customized versions of branded drugs at significantly lower cost. WW added compounded semaglutide to its formula in October 2024, and subscriber growth took off. Management has been explicit that the “vast majority” of Clinical subscriber gains from 4Q’24 through 1Q’25 came from this channel. It was a cheap, easy access point that pulled in demand.

Then the FDA shut it down. After declaring the semaglutide shortage resolved in February 2025, the agency began restricting outsourcing facilities from compounding the drug. WW stopped prescribing compounded semaglutide on May 22, 2025 and started transitioning members to branded GLP-1s or oral alternatives. Management’s own operating assumption is that the majority of the compounding cohort will churn off the platform. These members are less likely to have insurance coverage, and the price gap between what they were paying for compounded access and what branded cash-pay costs is substantial. By 3Q’25, WW said roughly 20% of previously compounded members had transitioned to branded or oral medications, retention was “better than expected,” and 3Q’25 should represent the low point for Clinical subscribers.

So the segment mix math is straightforward but uncomfortable. Behavioral is still roughly 24x larger than Clinical in subscriber count. Even with Clinical growing 30-60% y/y, it cannot immediately offset a Behavioral base that is declining 15-20% y/y. In 3Q’25, total revenue fell 11% y/y to $172mm. The ARPU lift from Clinical mix helps, but it does not solve the subscriber math.

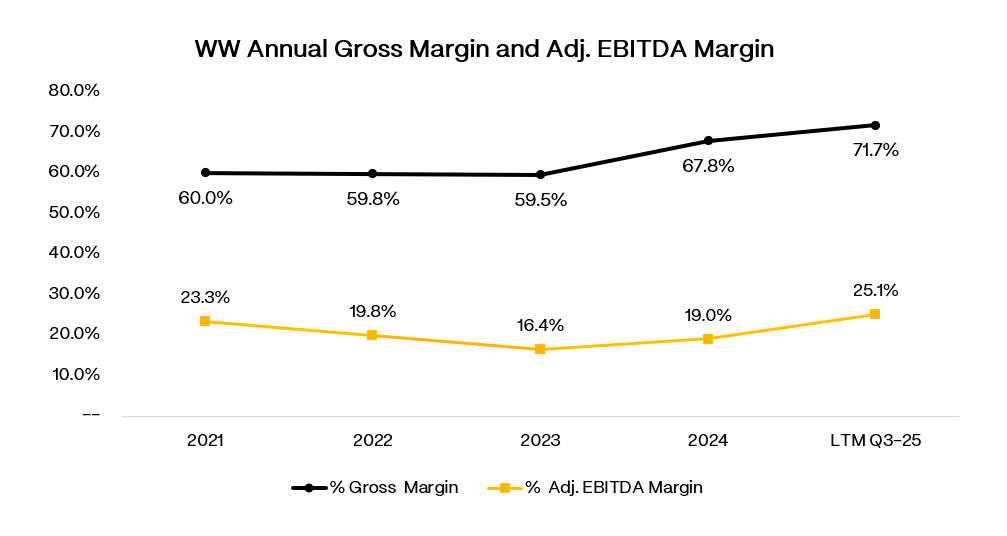

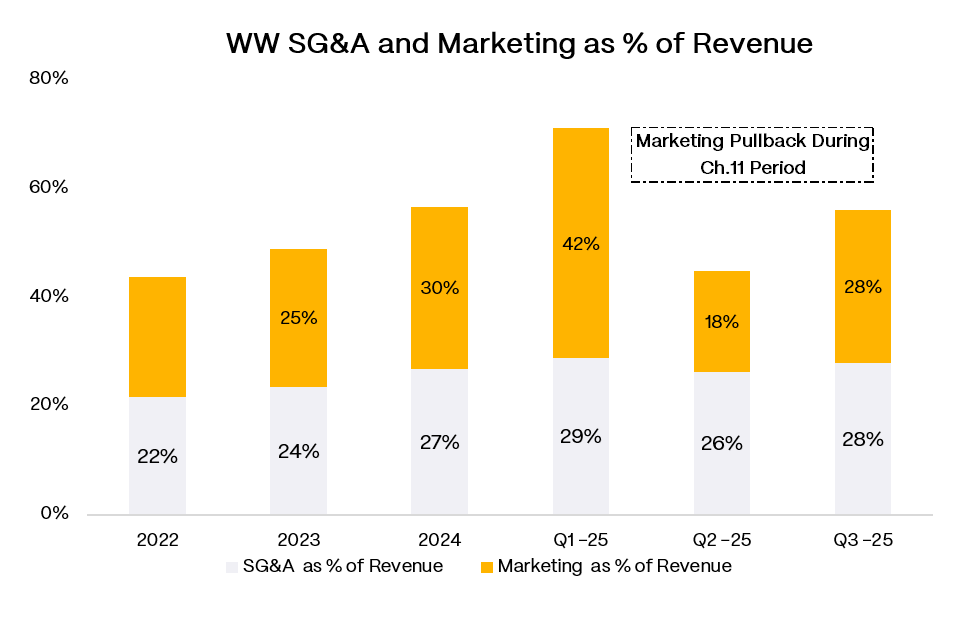

Profitability looks fine on paper. Adjusted gross margins sit in the mid-70s, and 3Q’25 adjusted EBITDA was $43mm at a 24.9% margin. But some of that is timing. Management flagged that 4Q’25 EBITDA will step down sequentially as marketing ramps into peak season, seasonal staffing costs hit, and an accounting change pulls some advertising expense forward. FY’25 guidance of $145-150mm EBITDA implies a full-year margin around 21%.

The post-reorg capital structure is simple. One term loan, $465mm, due June 2030, SOFR + 680. No revolver (though the docs permit up to $125mm that could sit senior). The credit agreement includes an annual excess cash sweep above $100mm, measured during the last 10 calendar days of 1Q, effective starting June 2026.

Management’s pitch is that WW can become an “integrated weight health” platform that pairs medication access with behavioral support and community. They are rebuilding the app to remove barriers between Clinical and Behavioral, refreshing the brand for the GLP-1 era, and stacking partnerships with Novo Nordisk, Lilly, and Amazon Pharmacy to reduce friction on medication access. In December 2025, WW launched a standalone GLP-1 Success program for members whose prescriptions come from outside providers, positioning the company as the “support layer” around GLP-1s regardless of where the script originates.

Whether any of this works depends on three things. First, can Behavioral decline rates moderate from the current double-digit pace, or does the melt accelerate as the brand loses relevance? Second, can Clinical re-establish growth post-compounding through insurance-enabled branded access and oral alternatives, or was cheap compounded semaglutide the only demand catalyst that actually worked? And third, does the integrated model produce better retention and unit economics, or is WW just running two subscale businesses under one roof?

Why Would Anyone Use WW Instead of Just Getting a Prescription?

This is the right question to ask, because the honest answer is: you do not need WW to get a GLP-1. You can go to your PCP, an endocrinologist, or any of a dozen telehealth platforms. The question is whether WW offers enough incremental value to justify the subscription.

WW’s pitch rests on three things: access friction, insurance navigation, and the behavioral wrapper.

Start with access friction. For a lot of people, the hard part is not convincing a doctor to write the script. It is everything that happens after. Finding a pharmacy with supply. Figuring out which manufacturer coupon applies. Dealing with prior authorization paperwork. Getting refills on time during titration. WW is trying to be the operating system that handles all of that. They have built pharmacy integrations with Amazon Pharmacy, partnerships with Novo Nordisk and Lilly that include preset cash-pay pricing, and a formulary that spans branded injectables and oral alternatives. The value prop is: you pay the subscription, and we make the medication journey less annoying.

Insurance navigation is where WW claims a real differentiator. Management repeatedly describes a “proprietary AI-enabled” prior authorization engine that facilitates coverage at scale. If that actually works, it matters. Getting a branded GLP-1 covered by insurance is genuinely painful for many patients. PCP offices are not staffed to run prior auth workflows efficiently for obesity meds. Telehealth-first competitors like Hims have historically been cash-pay models that sidestep insurance entirely. WW is betting that as the market matures and more people want branded access at lower out-of-pocket cost, the ability to navigate insurance becomes a competitive advantage. They explicitly positioned this capability as a “key lever” in retaining members during the post-compounding transition.

The behavioral layer is the softest part of the pitch but also the one WW leans on hardest. The argument is that medication alone produces weight loss, but medication plus structured behavior change produces durable weight loss. WW points to data showing their Clinic members hit 19.4% weight loss at 12 months vs. 15.8% for the next highest competitor in their dataset. They bundle the GLP-1 prescription with access to dietitians, the legacy WW food tracking and points program, coached communities, and ongoing clinical support through titration and side effect management. The theory is that this combination improves adherence, reduces regain risk, and justifies a higher willingness to pay.

Is any of this a real moat? Not really. The insurance navigation piece is probably the most defensible because it requires operational build-out that takes time to replicate. The pharmacy partnerships are helpful but not exclusive. The behavioral wrapper is valuable if it actually improves outcomes and retention, but competitors can build coaching content and telehealth interfaces too.

The honest framing is this: WW is not selling access to a drug. They are selling a smoother, more supported pathway through a system where access, coverage, and adherence are the real obstacles. For someone with a responsive doctor, easy insurance approval, and no interest in coaching, WW is redundant. For someone facing prior auth friction, supply headaches, or a desire for structured support alongside medication, WW is trying to be the one-stop solution.

Whether enough people fall into the second bucket, and whether WW can serve them profitably, is the whole bet.