High Yield Market Weekly Minutes: Strong Performance Across All Ratings as Supply Gets Absorbed (June 30, 2025)

A Brief Recap of Last Week's High Yield Market Performance

🚨 Connect on Twitter | Threads | Instagram | Bluesky | Reddit

🚀 I’m looking to hire an experienced credit analyst (full-time). Get in touch.

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list — limited spots.

Another week, another failed bear thesis. High yield delivered its strongest weekly performance in months with a +0.81% gain, led by CCCs surging +1.02% while the market effortlessly absorbed $9.1 billion of new supply. Even better? Eleven of twelve deals priced at talk or better, with Skechers’ massive PIK-toggle deal surging to 103.75 in the secondary.

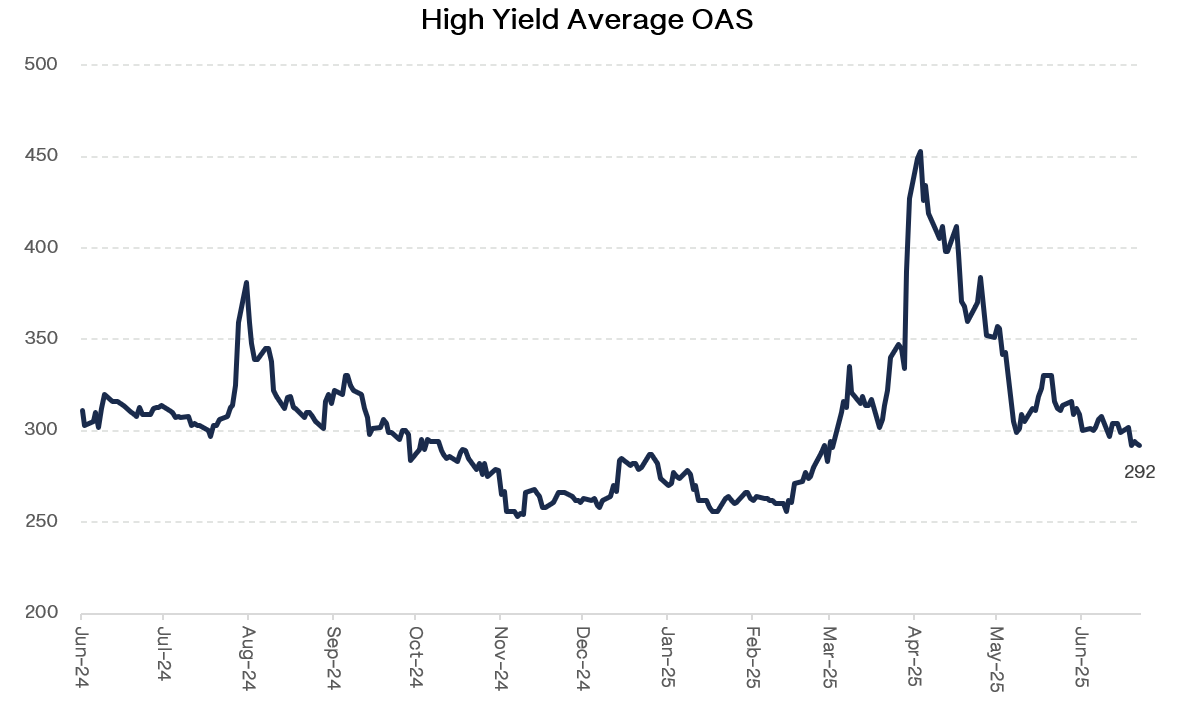

The disconnect couldn’t be more obvious. S&P futures hit all-time highs, the 10-year yield dropped 10bps as rate cut hopes resurged, and high yield spreads tightened 7bps to close at 292bps; yet the bears kept warning about overvaluation and late-cycle risks. Meanwhile, the smart money stepped in with $3.5 billion of inflows, the largest weekly surge since November 2023.

Here’s what most keep missing: when you can print a $2.2 billion PIK-toggle deal in the middle of geopolitical chaos and watch it trade up 3pts+, that’s not fragility, that’s technical dominance. The flow machine is in full effect, and no amount of tariff theater is going to stop it.

Translation? While the tourists debate policy minutiae, real money is putting capital to work at a pace that makes the April selloff look like ancient history. Spreads have now tightened 154bps from the April wide, yields are down 42bps for the month, and we just posted the busiest June since September. That’s not what a broken market looks like.

Weekly Performance Recap

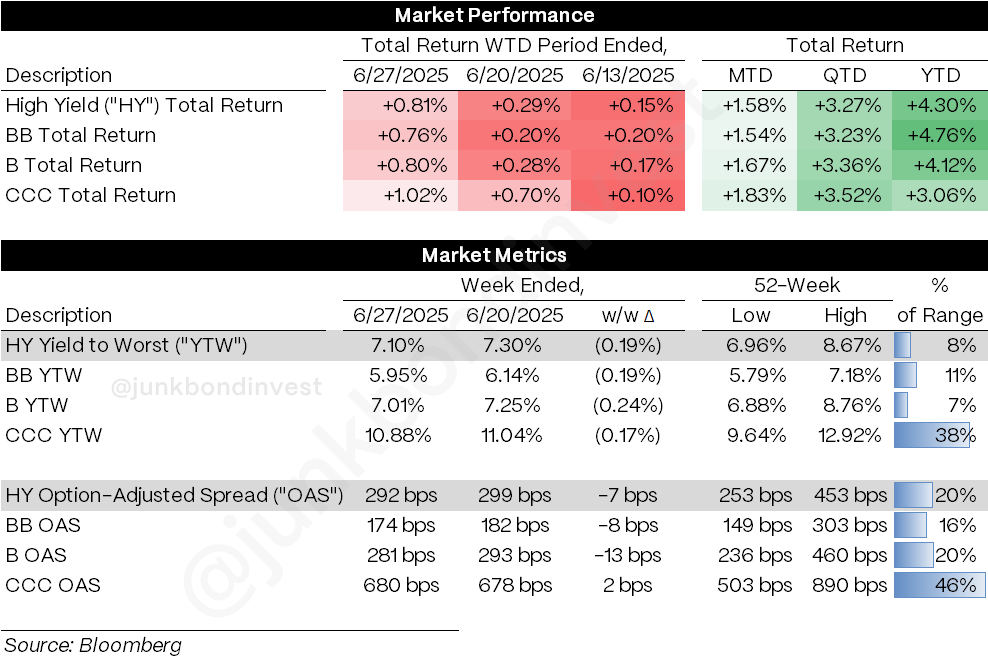

The numbers reveal a market firing on all cylinders. HY gained +0.81% for the week, with remarkable consistency across credit quality:

CCCs led the charge at +1.02%, showing renewed appetite for the riskiest credits

Bs delivered +0.80%, maintaining strong momentum

BBs posted +0.76%, pushing YTD returns to a robust +4.76%

The technical picture strengthened dramatically:

Overall index yields dropped 19bps to 7.10%, now at just 8% of the 52-week range

Spreads compressed 7bps to 292bps, now at 20% of their range with BBs tightening 8bps to 174bps

B spreads narrowed 13bps to 281bps, while CCCs were flat at 680bps after their massive outperformance

Most telling: this rally came despite Treasury volatility and geopolitical noise. When credit markets can post these kinds of gains while absorbing massive new issuance, something fundamental has shifted.

Primary Market Activity

The primary market absolutely exploded, with twelve deals totaling $9.1 billion, making it the third most active week YTD and bringing June’s total to a staggering $33 billion:

Skechers’ restructured deal stole the show: After shifting structure mid-market, they ultimately priced €1.0 billion of senior secured notes at 5.25% (inside talk) plus that monster $2.2 billion PIK-toggle deal at 10.00% (+75bps PIK)

Bain Capital’s Sizzling Platter LBO executed flawlessly with $500 million at 9.50%, tight end of talk for a B3/B credit

Czechoslovak Group demonstrated the market’s hunger for quality, upsizing both USD and EUR tranches to $1.0 billion each and pricing 50bps inside guidance at 6.50%

Radiology Partners and Tidewater both found strong demand, with Radiology upsizing $100 million despite pricing wide of talk

But here’s the real story: eleven of twelve deals priced at talk or better, and recent issuances are trading higher in secondary. When you can execute that kind of primary market success during a week of tariff threats and geopolitical uncertainty, the technical support is undeniable.

Secondary Market Dynamics

The sector rotation tells the real story of where smart money is positioning:

Top Performers:

Consumer Discretionary led the charge despite tariff concerns, with names like MIK (+11.8pts) and ACPROD (+6.0pts) surging

Healthcare showed resilience as hospital risk bounced on parliamentary developments around the tax bill

Financials maintained steady demand across the stack

Other Notable Moves:

Warner Bros Discovery (WBD) dominated headlines as bonds rallied 2-4pts on the first day of HY index inclusion

The uniform strength across sectors suggests this isn’t rotation, it’ genuine risk-on sentiment driving broad-based buying. When even tariff-sensitive names rally during trade war headlines, the technical bid has clearly overwhelmed fundamental concerns.

Looking Ahead

The setup for this week couldn’t be more interesting. With the July 4th holiday creating a shortened week, we’e expecting concentrated activity Monday and Tuesday before the market goes dark Wednesday. The pipeline shows $4 billion of expected supply, manageable given the current technical strength.

But the real catalysts are brewing beyond just new issuance:

Trump’s tax bill moves to the broader Senate today with dozens of amendments, potentially reshaping healthcare and other sectors

The 90-day tariff extension expires July 9th, creating a hard deadline for trade negotiations

A packed macro calendar delivers ISM Manufacturing Tuesday, ADP Wednesday, and NFP Thursday—all with potential to reshape rate cut expectations

Q2 earnings season kicks into gear with over 50 S&P companies reporting this week

Most importantly, the technical picture has never looked stronger. Nine consecutive weeks of inflows totaling have completely offset April’s outflow. ETFs are leading the charge with while even mutual funds are showing signs of life.

The bears keep warning about stretched valuations, geopolitical risks, and late-cycle dynamics. But when the market posts its fastest recovery to new highs in history while absorbing massive new issuance, maybe it’s time to stop fighting the technicals.

The key question ahead: can this momentum sustain itself as we approach historically tight spread levels? With flows hitting post-crisis highs and spreads at just 20% of their range, this week’s shortened calendar provides an interesting test case. Either the market uses the pause to consolidate recent gains, or we see whether there’s enough underlying demand to push spreads even tighter.

The data points both ways. Strong technicals and robust primary execution support the bull case, while valuation metrics and geopolitical uncertainties favor caution.

Find the most recent JunkBondInvestor posts below

Disclosure: The information provided is based on publicly available information and is for informational purposes only. While every effort has been made to ensure the accuracy of the information, the author cannot guarantee its completeness or reliability. This content should not be considered investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release the author from any liability. Always seek professional advice tailored to your financial situation and objectives.