Unisys Corporation ($UIS): The IT Services Pivot That Isn't Pivoting

Unisys bought time with a refinancing but the real problems haven’t changed.

🚨 Connect: Twitter | Threads | Instagram | Bluesky | Reddit

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list (limited spots).

Remember when IT services companies actually grew? Unisys doesn’t seem to.

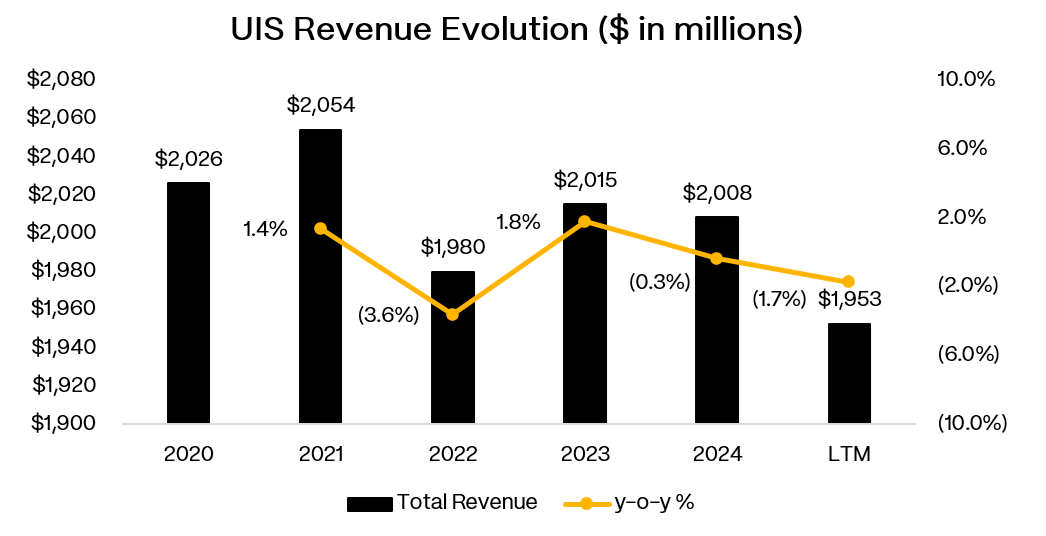

Three years running, they’ve posted revenue around $2 billion while spinning stories about “Next-Gen” transformation and digital workplace innovation. The transformation talk is real. The revenue growth? Not so much.

What they have managed to do is refinance their way out of a 2027 maturity wall, swapping $485 million of 6.875% notes for $700 million of 10.625% secured paper. Smart liability management that roughly doubled their interest expense. Because nothing says “healthy business” like secured debt at double-digit yields.

The operational story has some bright spots. Free cash flow finally turned positive at after years in the red. Operating margins expanded through aggressive cost-cutting. They even tackled their pension nightmare, transferring $769 million of liabilities to insurers.

But scratch beneath the surface and you’ll find a company caught between two worlds. Legacy mainframe revenues are declining while cloud services can’t scale fast enough to replace them. The backlog looks impressive but Unisys has struggled for years to convert contracts into profitable revenue.

The question for credit investors: are you getting paid enough to bet on a mainframe company’s cloud pivot? With LTV elevated and the transformation story three years behind schedule, that’s becoming a harder sell.

I. Situation Overview:

Unisys is a legacy IT services provider desperately trying to convince anyone who’ll listen that it’s actually a cutting-edge cloud company. The numbers tell a different story. Revenue has been dead flat around $2 billion for five years running, despite endless transformation talk and “Next-Gen” buzzword bingo. This isn’t digital disruption, it’s managed decline with better PowerPoints.

The 2020 Federal business sale was the corporate equivalent of selling the family silver. Sure, the $1.2 billion gave them cash to pay down debt and fund bloated pension plans, but it also ripped out their most stable, profitable revenue stream. What’s left? A subscale commercial business getting its lunch eaten by Accenture, IBM, and every hyperscaler with a consulting arm. Smart money says they traded long-term stability for short-term survival.

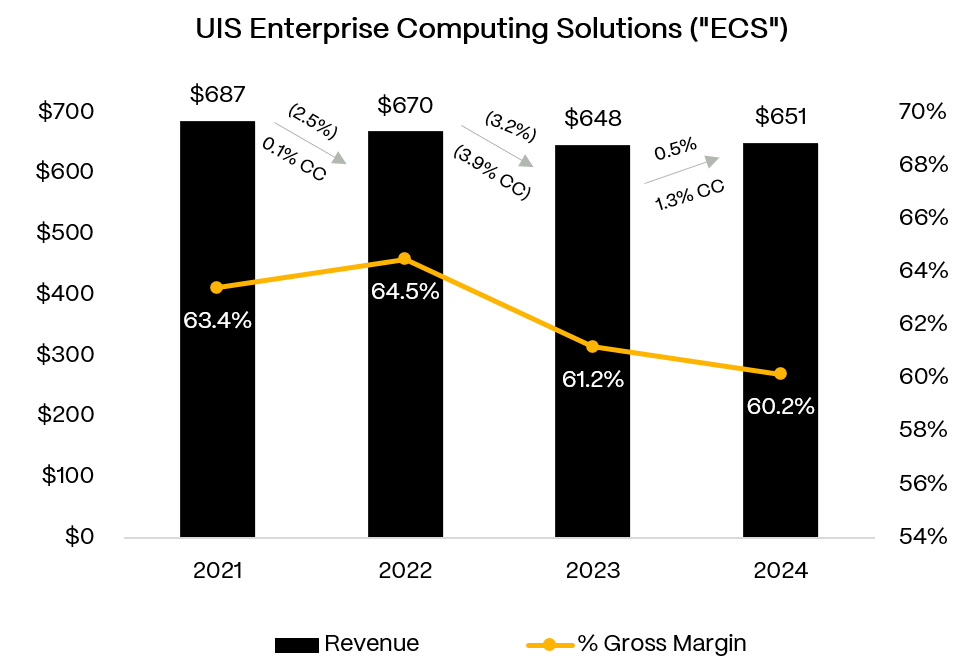

Their three-segment structure reads like a case study in corporate schizophrenia. Enterprise Computing Solutions (38% of revenue) is basically a mainframe life-support business. Profitable but shrinking.

Digital Workplace Solutions and Cloud Infrastructure are supposed to be the growth engines, except they’re lower margin and also competing against everyone from Microsoft to random startups.

The margin story is impressive until you realize it’s built on a foundation of layoffs and real estate closures. EBITDA margins improved slightly to 14.5% in 2024 from 14.2% in 2023, but this came from cutting ~20% of the workforce since 2022, not from brilliant operational leverage. They finally generated $55 million in free cash flow—their first positive year in recent memory—but good luck repeating that trick without actual revenue growth.

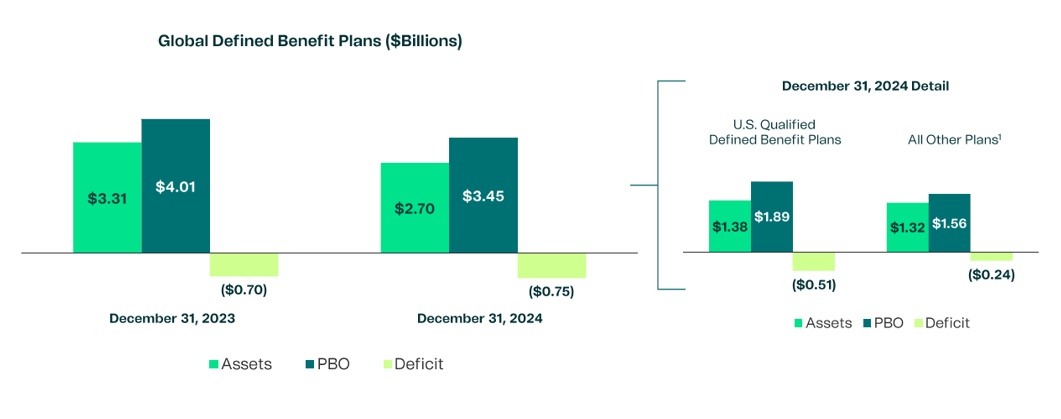

The pension nightmare got smaller but didn’t disappear. The 2023 annuity transfer dumped ~$769 million of liabilities onto insurance companies, which was brilliant financial engineering that cost them $349 million in settlement charges and obliterated shareholder equity. They still face annual cash outflow and remain underfunded by roughly $600 million.

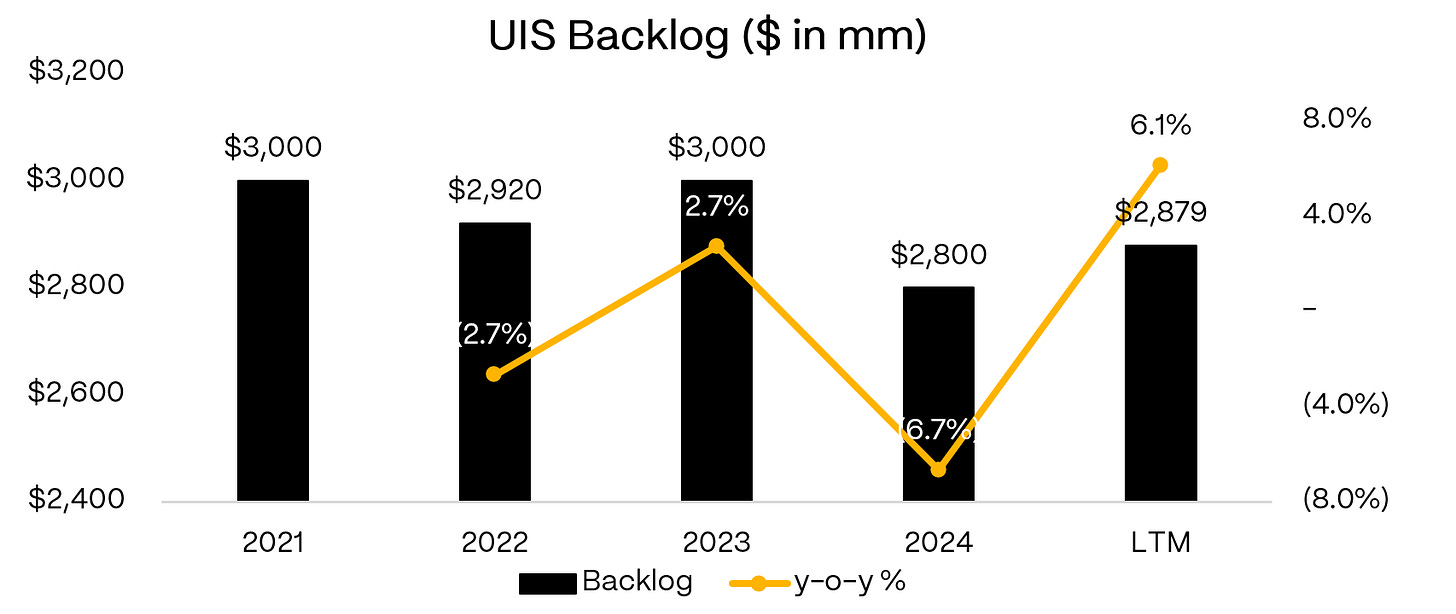

The sales metrics look encouraging if you squint hard enough. Backlog hit $2.9 billion in 1Q’25, new logo signings more than doubled, and new business TCV jumped 29% in 2024. Problem is, Unisys has been terrible at converting backlog into profitable revenue for years.

April’s CEO handoff from Peter Altabef to Mike Thomson was the ultimate inside-baseball move. Thomson’s been there since 2015 and architected the current strategy as CFO, so don’t expect any dramatic pivots. This was management saying “steady as she goes” at exactly the moment when investors might have preferred “blow it up and start over.”

June’s refinancing was a necessary evil that came at a brutal price. They swapped $485 million of 6.875% notes for $700 million of 10.50% secured debt, roughly doubling annual interest expense to ~$70 million. The extra $215 million in proceeds? Needed to fund a pension contribution in 2025—essentially borrowing expensive money to meet obligations they couldn’t cover from operating cash flow. The fact that lenders demanded secured paper and double-digit yields tells you everything about market confidence in this turnaround story.

Today, Unisys trades like a company that’s run out of easy answers. The stock sits around $4 (down from $30+ at IPO), while their new bonds yield nearly 10%. Credit ratings of B2/B+ reflect what everyone knows but nobody wants to say: this is a stressed credit with limited room for error.

The fundamental question isn’t whether Unisys can cut costs or manage liquidity (they’ve proven they can do both). The question is whether a legacy IT services provider can reinvent itself as a growth company while servicing heavy debt and pension obligations. So far, the transformation exists mainly in investor presentations, not financial statements.