High Yield Market Weekly Minutes: Grinding Tighter Into The Fed (December 8, 2025)

Four straight weekly gains, spreads near tights, Fed about to cut, and the market is still trading carry, not fear.

🚨 Connect on Twitter | Threads | Instagram | Reddit | YouTube

Note: Starting January 1, 2026, subscription prices will be increasing. Anyone who subscribes before then will be locked into today’s pricing indefinitely.

TL;DR

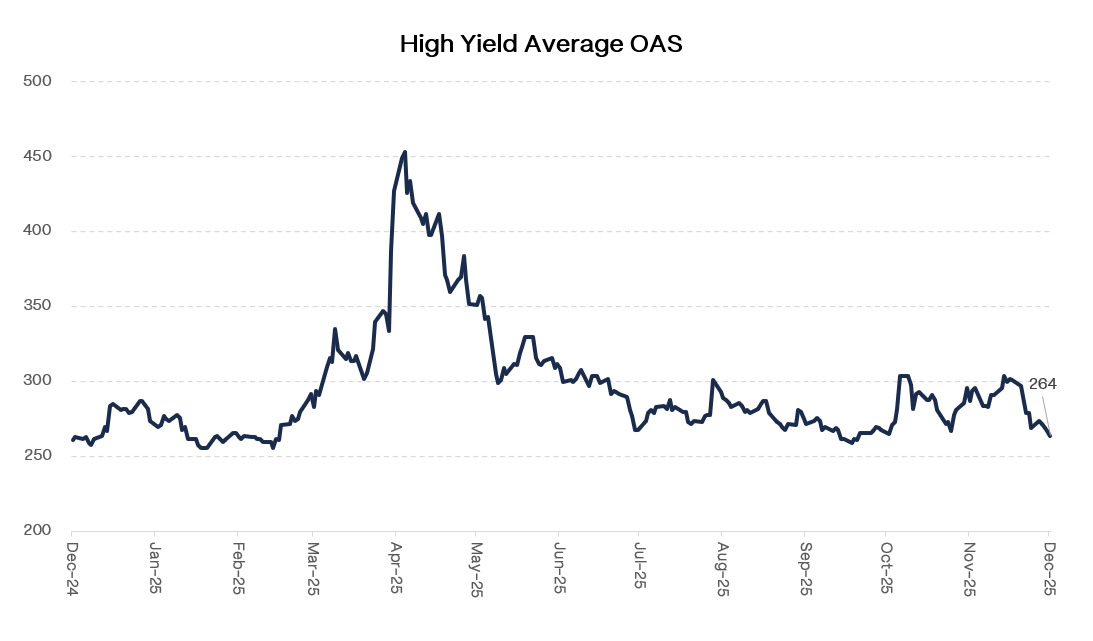

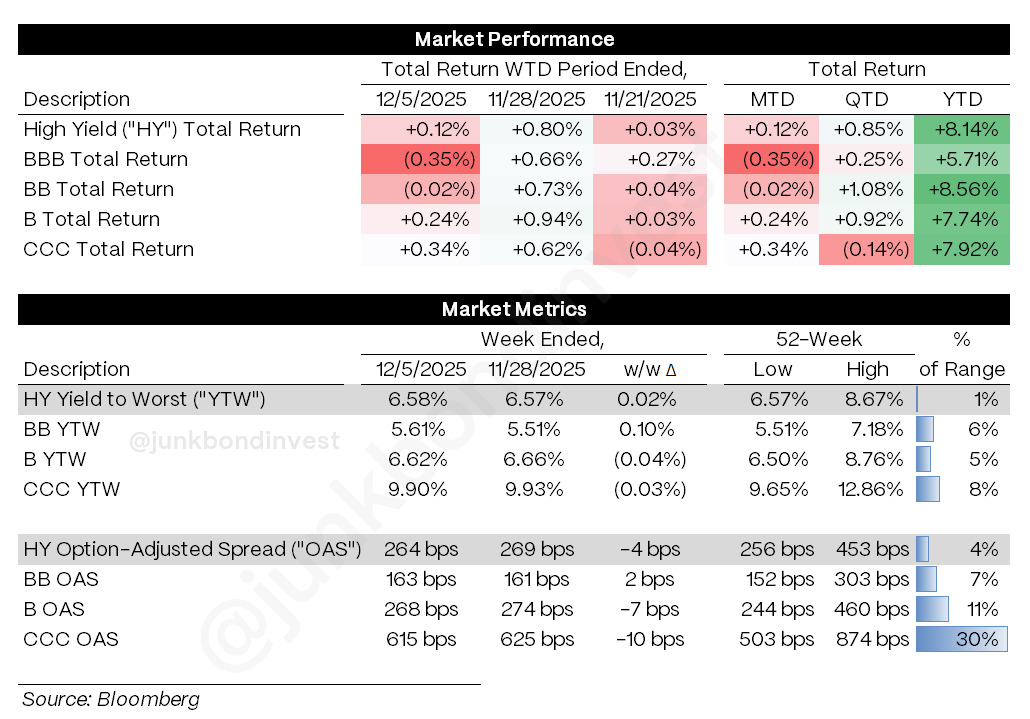

High yield quietly put up a fourth straight weekly gain, +0.12%, with YTW at 6.58% and spreads at 264bps. CCCs led and the primary market printed 17 deals for $13.4bn, the busiest week since September. Treasuries actually sold off, volatility collapsed, and spreads tightened anyway. The Fed is about to cut again into a mixed but still functional macro backdrop. HY is not trading fear, it is trading carry.

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list — limited spots.

Equities eased higher, the VIX fell into the mid teens, and traders spent most of the week staring at the Fed calendar waiting for Wednesday. For all the talk about delayed data, opaque growth, and how many cuts we get next year, the actual credit tape was simple: buyers were there, sellers were not, and the street was more worried about getting deals finished before year end than about anything in Washington.

We are now in classic December mode. Liquidity is thinning, nobody wants to blow up a year of decent returns in the last three weeks, and the easiest decision in most portfolios is to do nothing. Yet high yield refuses to sit still. Flows turned positive again, the new issue machine went into sprint mode, and spreads edged closer to 12 month tights. Anyone waiting for an obvious inflection point is already late.

Weekly Performance Recap

High yield did what it has been doing all year: moved a little higher and refused to break. The index returned +0.12% on the week, making it four in a row and +0.99% over that run. MTD you are already up +0.12%, quarter to date +0.85%, with YTD at +8.14%. That is not a market pricing recession risk any time soon.

The quality split was predictable as CCCs led at +0.34%. Bs followed at +0.24% and BBs slipped 0.02% after a strong late November. On a YTD basis, BBs are still top of the table at +8.56%, with CCCs at +7.92% and Bs at +7.74%. You did not need to dive into the worst balance sheets to make money, but you got paid for taking some duration.

Yields barely twitched. HY YTW finished at 6.58%, essentially flat vs. last week and only 1bp above the 52-week low of 6.57%. BB yields are at 5.61%, up 10bps on the week. Bs tightened to 6.62% from 6.66%. CCCs are at 9.90%, 3bps tighter. Treasuries were the ones that moved, with the 10yr up double digits in bps, yet HY yields barely noticed. Spreads and flows are running this market, not rates.

Boring, but boring in the way bulls like. Modest positive returns, yields pinned near the bottom of the range, spreads grinding in, and flows quietly turning back to positive. Bears do not have much to work with here.

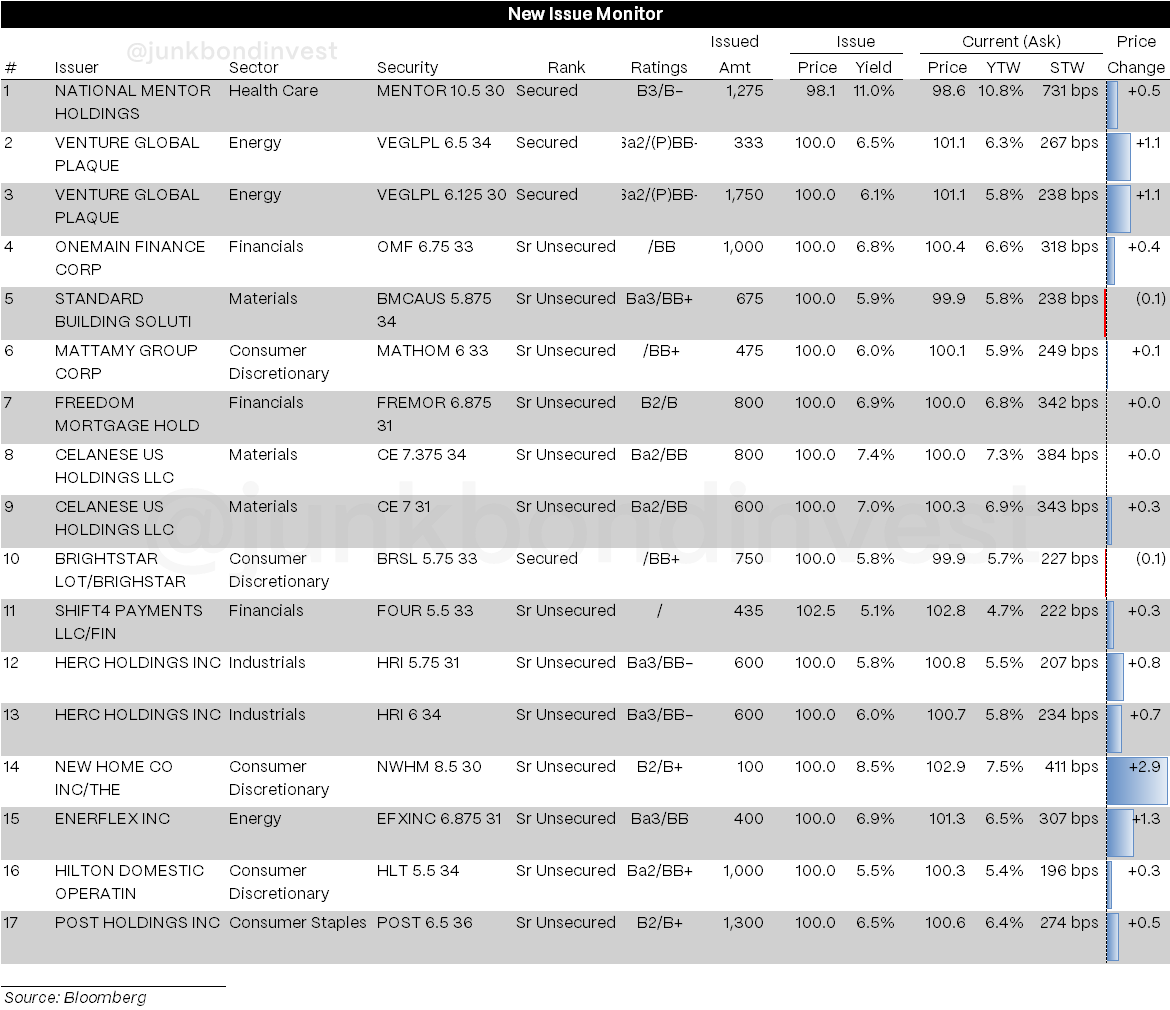

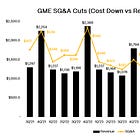

Primary Market Activity

If there was any doubt about how investors feel, the primary calendar cleared it up. Following the Thanksgiving pause, HY supply jumped to $13.4bn across 17 deals, the biggest weekly haul since late September. All but one transaction priced at talk or better. Issuers clearly got the memo that this is the last real window before the holiday freeze, and investors were more than happy to play.

The deal mix checked every box: health care, energy, financials, materials, consumer, industrials. Coupons spanned from mid 5s for higher quality unsecureds into the low double digits for smaller, more leveraged stories. The consistent themes were refinancing 2027-2028 paper, terming out bank debt, and topping up liquidity in front of another Fed cut.

Execution quality was strong. Deals generally came at reasonable concessions and walked tighter in secondary, especially in sectors where the Street had been underweight. The underperformer was a more chemicals credit where new paper priced wide to the existing curve and struggled to get a solid bid. That is more a reminder that structure and leverage still matter than any sign of systemic fatigue.

Secondary Market

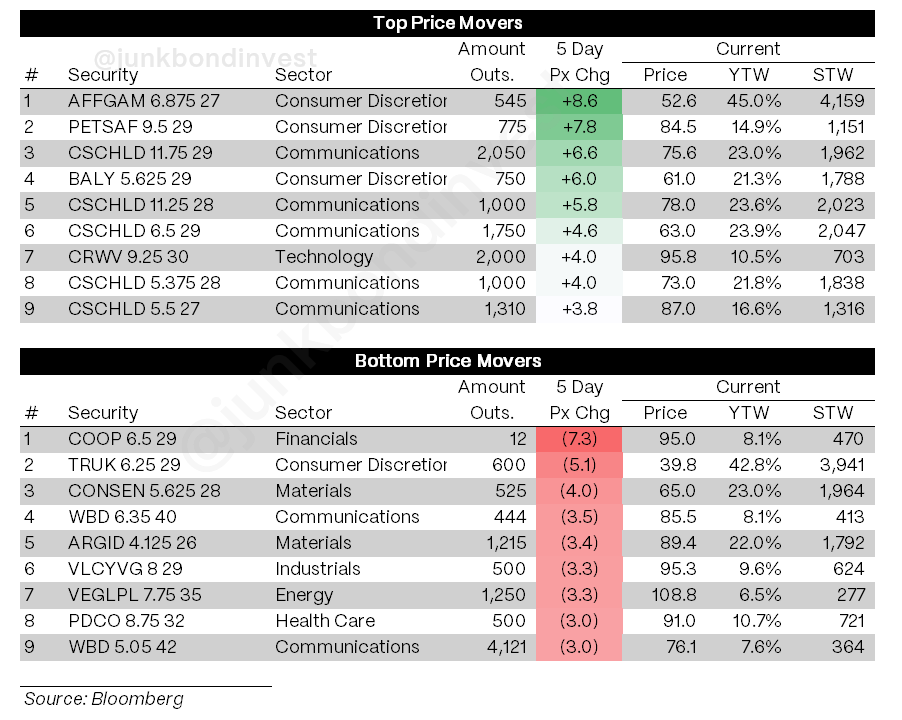

Secondary trading started the week soft and finished firm. Early on, spreads drifted as investors digested the rate back up and another batch of macro noise. As the probability of a clean Fed cut solidified and equities stayed calm, buyers stepped back in and pushed index spreads tighter into Friday’s close.

By sector, the story was familiar as higher beta credit outperformed, particularly in cyclical sectors where investors had been underweight. Some building products and chemicals names traded heavy on company specific headlines, but the better balance sheets in those spaces continued to grind higher. Energy remained well bid across E&P, services, and select midstream as the complex stayed in favor. More defensive, very tight BB utilities and metals saw some profit taking as accounts rotated into single Bs and fresh new issue supply that offered more coupon for similar risk.

Moves in the top and bottom price movers list were almost entirely driven by idiosyncratic stories, not by any top down shift in risk appetite. When credit can shrug off a meaningful move higher in the 10yr and still finish tighter on spreads, that tells you where the demand-supply balance sits.

Looking Ahead

The macro spotlight now moves fully to the Fed. Markets are pricing a 25bp cut at this week’s meeting with ~99% probability. That decision is not the debate. What matters is the message around 2026. Futures still embed almost 60bp of additional easing next year, but Fed officials have been anything but aligned. The dots and Powell’s press conference will tell us whether the Committee is leaning toward a quick return to neutral or a slower, data dependent path.

Underlying data are noisy but not disastrous. The shutdown delayed key releases, so policymakers are working with an odd mix of September and November information. ISM surveys show services still expanding, manufacturing still contracting. Consumer spending has cooled from the breakneck pace of early 2025 but remains the main engine of growth. Labor indicators like JOLTS and the employment cost index should start catching up as the backlog clears, giving the Fed a cleaner look at whether the labor market is merely cooling or actually weakening.

Rates markets have already done a lot of work. Treasuries just logged their worst week since June, yet credit spreads tightened and equities barely flinched. The VIX is down more than 40% from its mid November spike. That is not what you see in front of a policy shock. It is what you see when the market assumes the Fed will deliver exactly what is priced and that growth will muddle along.

For high yield, unless Powell goes out of his way to push back on 2026 cut expectations or the incoming data suddenly roll over, the path into year end is more of the same: modest positive returns, an active but shrinking primary calendar, and spreads that drift toward the tight end of the range as investors chase carry and position for next year. The real macro debate probably belongs to 2026. Right now the market is telling you it is not worried.

Find the most recent JunkBondInvestor posts below

Disclosure: The information provided is based on publicly available information and is for informational purposes only. While every effort has been made to ensure the accuracy of the information, the author cannot guarantee its completeness or reliability. This content should not be considered investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release the author from any liability. Always seek professional advice tailored to your financial situation and objectives.