The Definitive Guide to MicroStrategy's ($MSTR) Capital Markets... Strategy

Why the Premium Matters More Than the Bitcoin

🚨 Connect: Twitter | Threads | Instagram | Reddit | YouTube

MicroStrategy isn’t actually long Bitcoin.

I know, that sounds insane. The company holds billions in BTC. Saylor won’t shut up about it. The entire narrative is nothing but Bitcoin.

But the reality is MicroStrategy is long something far more fragile. They’re long the market’s willingness to pay more than NAV for their stock.

That premium is the entire business model. Without it, MSTR (rebranded as Strategy) is just a leveraged ETF with overhead. With it, the company becomes a compounding machine that can outpace any passive vehicle.

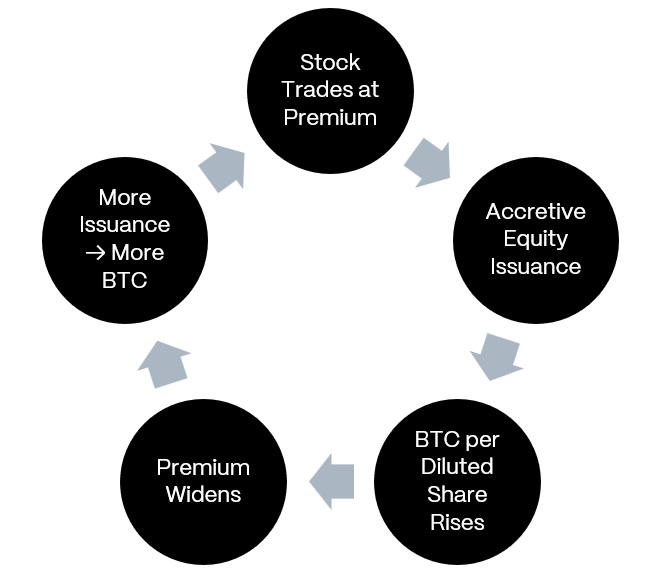

The mechanic is straightforward. When the stock trades above the value of its Bitcoin holdings, Saylor can issue equity at attractive valuations. He takes those proceeds and buys more Bitcoin than the dilution he just incurred. BTC per diluted share goes up. The premium expands. He issues more equity. Buys more Bitcoin. The flywheel spins.

This only works when the market believes that BTC per share will keep rising, MSTR can accumulate Bitcoin better than an ETF, and the flywheel will not stop.

It’s reflexive. Perception drives economics. The premium holds, the machine grows stronger. The premium breaks, the machine loses its edge.

And that’s the fragility nobody prices correctly. You can look at the balance sheet and count the Bitcoin. What you cannot see is the intangible that actually matters: the market’s willingness to pay a premium for a promise of relentless Bitcoin accumulation.

That intangible is the real asset.

Why This Matters Now

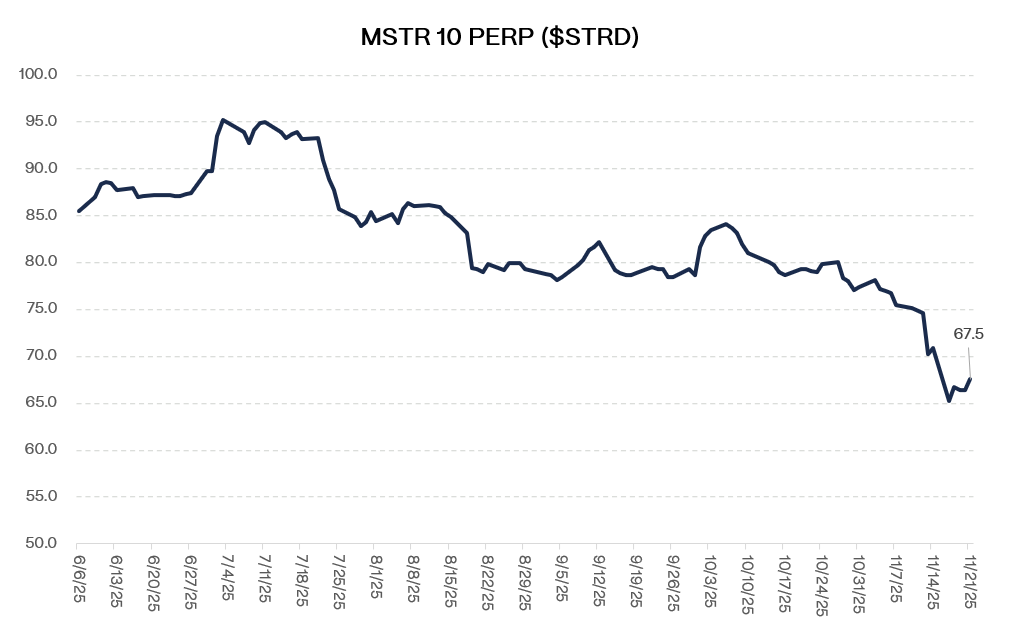

Bitcoin is down roughly 30% from its highs, and MSTR’s entire capital structure has traded off with it. The converts are wider. The preferreds are cheaper. The equity premium has compressed hard. The market is starting to price MicroStrategy like a balance sheet.

That raises an obvious question for anyone who thinks in terms of credit: is there a trade here?

Are the preferreds now yielding a whopping 15% attractive if the company survives but the equity premium stays dead for a while? What about the converts yielding 8%? Where does the real risk sit if this turns into a grind instead of a quick rebound? Can the company comfortably handle $700mm+ of fixed obligations? Under what conditions?

You need to know what happens when the premium breaks, what tools Saylor still has when equity issuance stops being accretive, and how the hierarchy behaves when the structure tightens. Who gets protected. Who gets diluted. Who gets paid.

This is part one of a two-part series.

This piece lays out the mechanics, the downcycle playbook, and the structural dynamics that matter when MicroStrategy trades near or below NAV.

The next piece will walk the capital stack by instrument (common, converts, preferreds) and show where the asymmetry sits if you believe the company survives but the equity story is path-dependent.