Is MicroStrategy ($MSTR) Quietly Becoming a Distressed Credit Story?

A full breakdown of MicroStrategy’s converts, preferreds, and how Saylor actually funds the machine

🚨 Connect: Twitter | Threads | Instagram | Reddit | YouTube

Can MicroStrategy actually afford $736mm of preferred dividend payments?

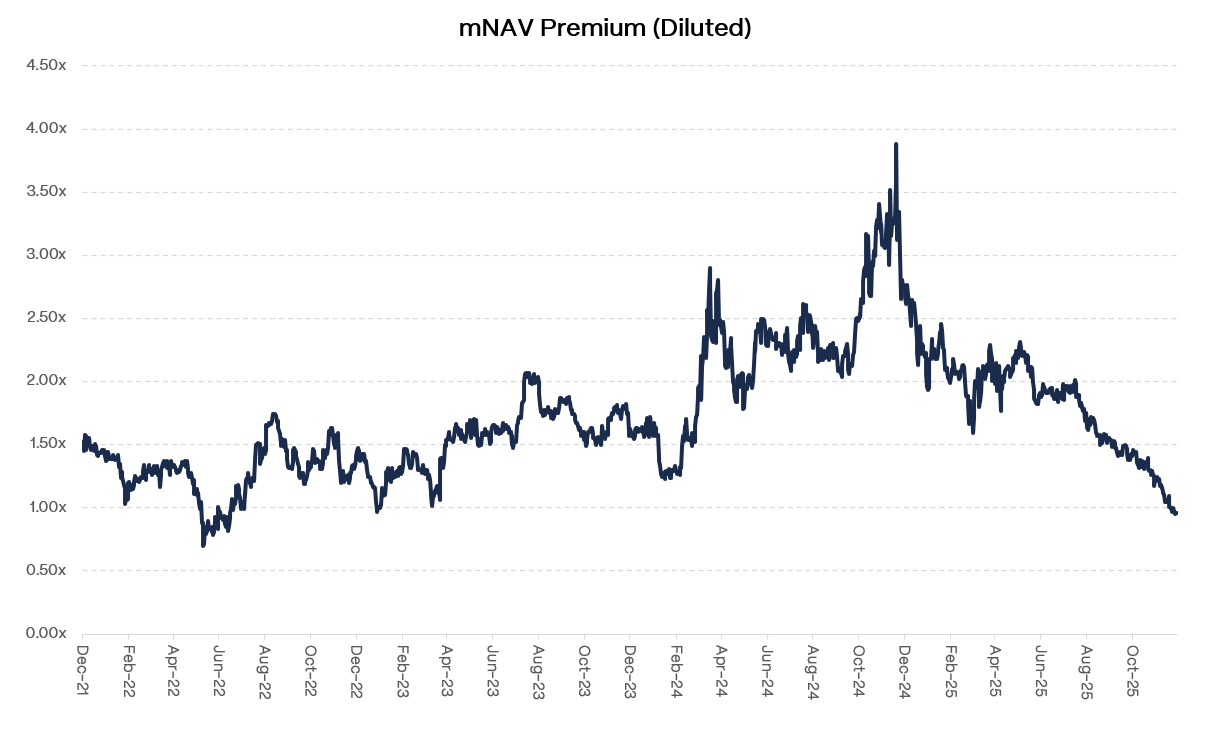

That is the key question. The software business is irrelevant. The stock is hovering around NAV. And while BTC is always a liquidity lever, selling coins would blow up Saylor’s entire “never sell” identity.

So how does he fund this? Or does he eventually do what more people are starting to assume he will do, which is cut the preferreds and instantly save $736mm a year? How you answer that determines whether any of these distressed preferreds or converts are actually worth owning here.

This piece is Part 2 of my MicroStrategy (now just Strategy) series. Last week’s post covered the premium flywheel. This one covers the liabilities below it and whether any of this paper is actually worth owning.

Before we getting into the funding math or the survival scenarios, you need to know what you’re actually buying. The converts and the preferreds are not interchangeable. They each behave differently depending on where the equity trades and whether the premium ever comes back.

Let’s start with the converts.

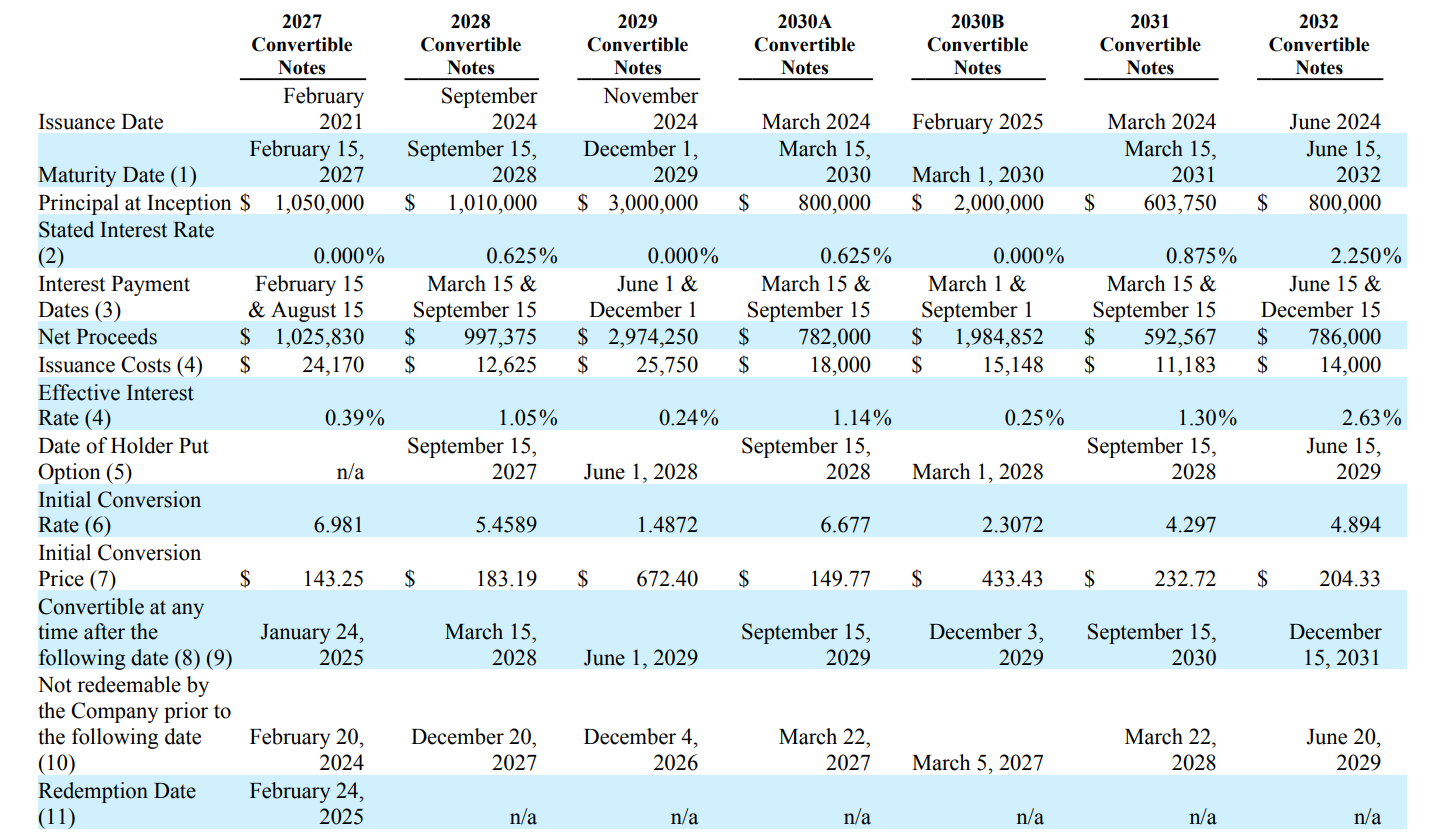

The key item to focus on is the conversion price. The closer a convert’s strike is to today’s stock price, the more it trades like equity. The further out-of-the-money (OOTM) it is, the more it trades like a stressed bond with a long-dated call stapled to it.

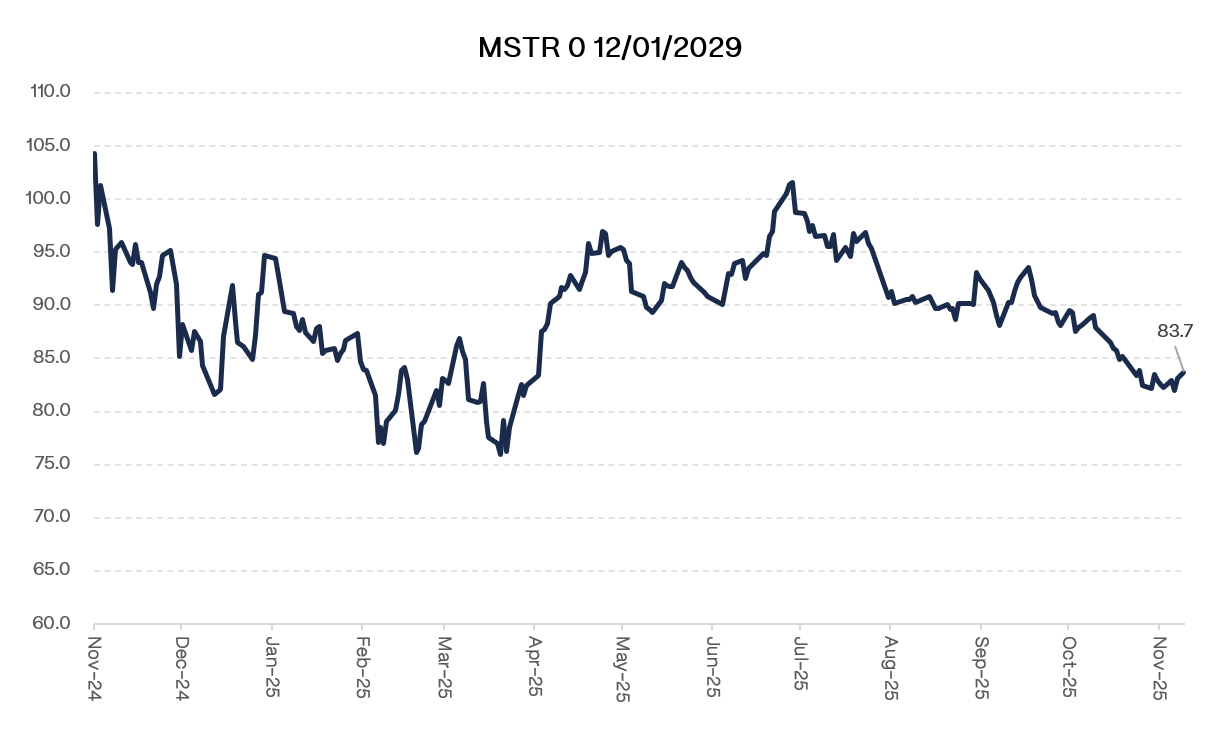

The 2029s highlight this clearly. The strike is $672, miles above the current share price of $178, so the notes behave like high yield credit, trading around 83 or ~375 bps STW. On the other side you have the in-the-money (ITM) 0.625s 2030s with a $150 strike that trade around 140 because the embedded option is essentially all equity. They run at 80 delta and move almost share-for-share. Convert-arb funds buy the bond, short the delta amount of MSTR, and capture credit, carry, and vol. Everything else in the convert stack just slots somewhere between “straight bond with optionality” and “equity in disguise.”

Now the preferreds.

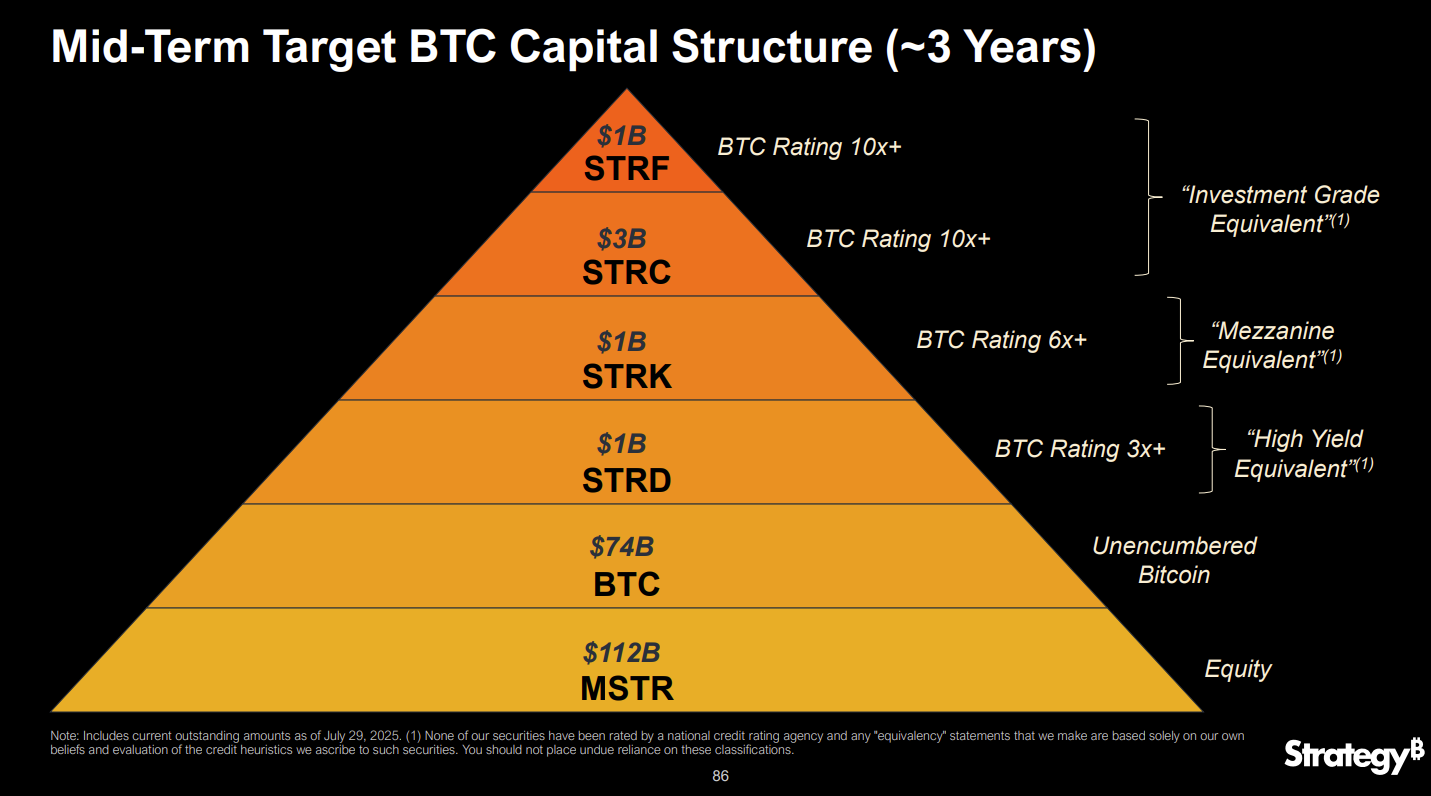

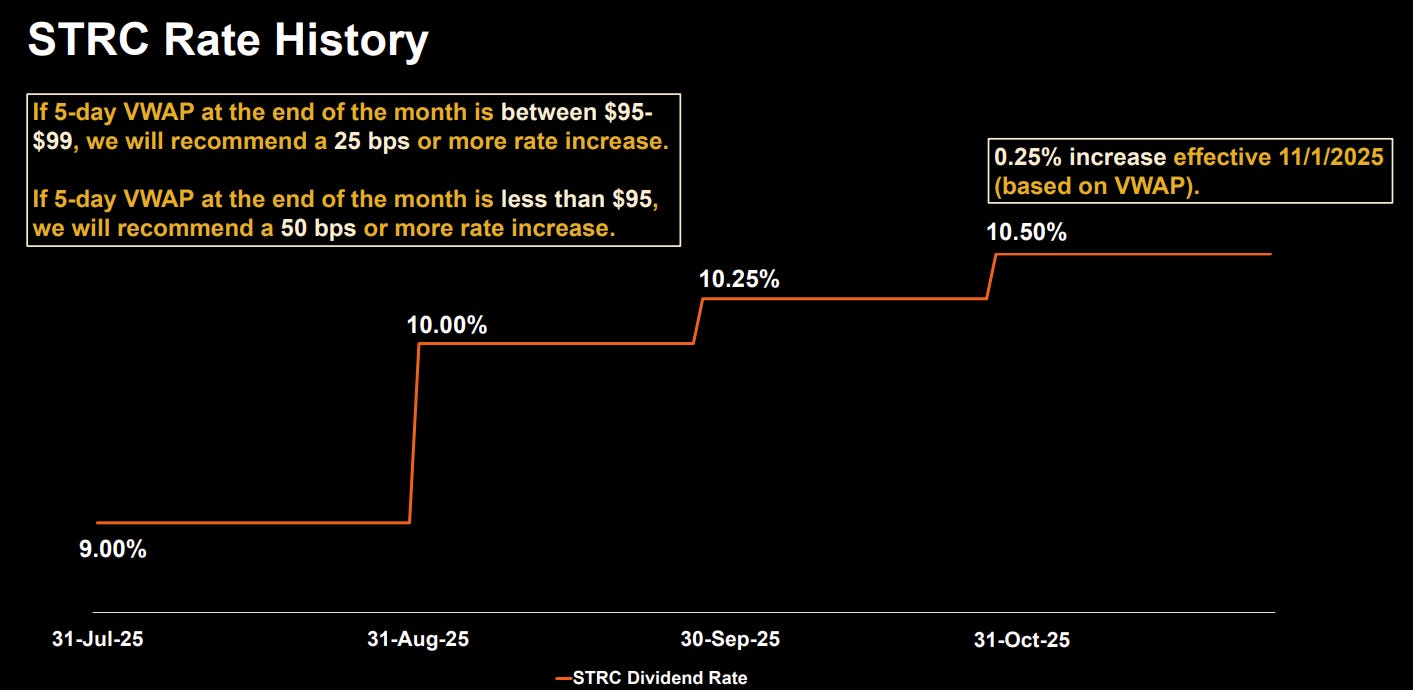

At the top sit STRF and STRC. STRF is the senior income piece: 10% fixed on $100 par, cumulative, no conversion, paid in cash, with arrears that must be made up before any other preferred series or the common sees a penny. STRC sits right below it. It is also cumulative and non-convertible, pays monthly, and the board adjusts its rate to keep it anchored near par. It trades like a yield-stabilized income product for funds that want cash flow and low volatility rather than upside.

In the middle sits STRE. STRE is the recently issue euro-denominated cumulative series issued at €80 for a 12.5% current yield. It pays a 10% coupon on €100 par, accumulates arrears, and steps up as high as 18% if dividends are missed. It must be paid before STRK and STRD but only after STRF and STRC are current. It is built for euro-based income buyers who want BTC exposure with explicit protections around missed dividends.

Below that sits STRK. STRK pays 8% and is cumulative, but its real purpose is the conversion feature into MSTR at a high strike. You give up 200 bps of coupon for a long-dated call option on the equity if the flywheel ever returns. It is not a credit instrument. It is a hybrid designed for people who want structured upside more than income.

At the bottom sits STRD. STRD pays 10% but is non-cumulative and non-convertible. It is fully junior within the preferred layer. The board can skip STRD dividends without ever catching them up. That is why it trades at the biggest discount and highest implied yield. You are being paid for board-discretion and signaling risk, not collateral seniority.

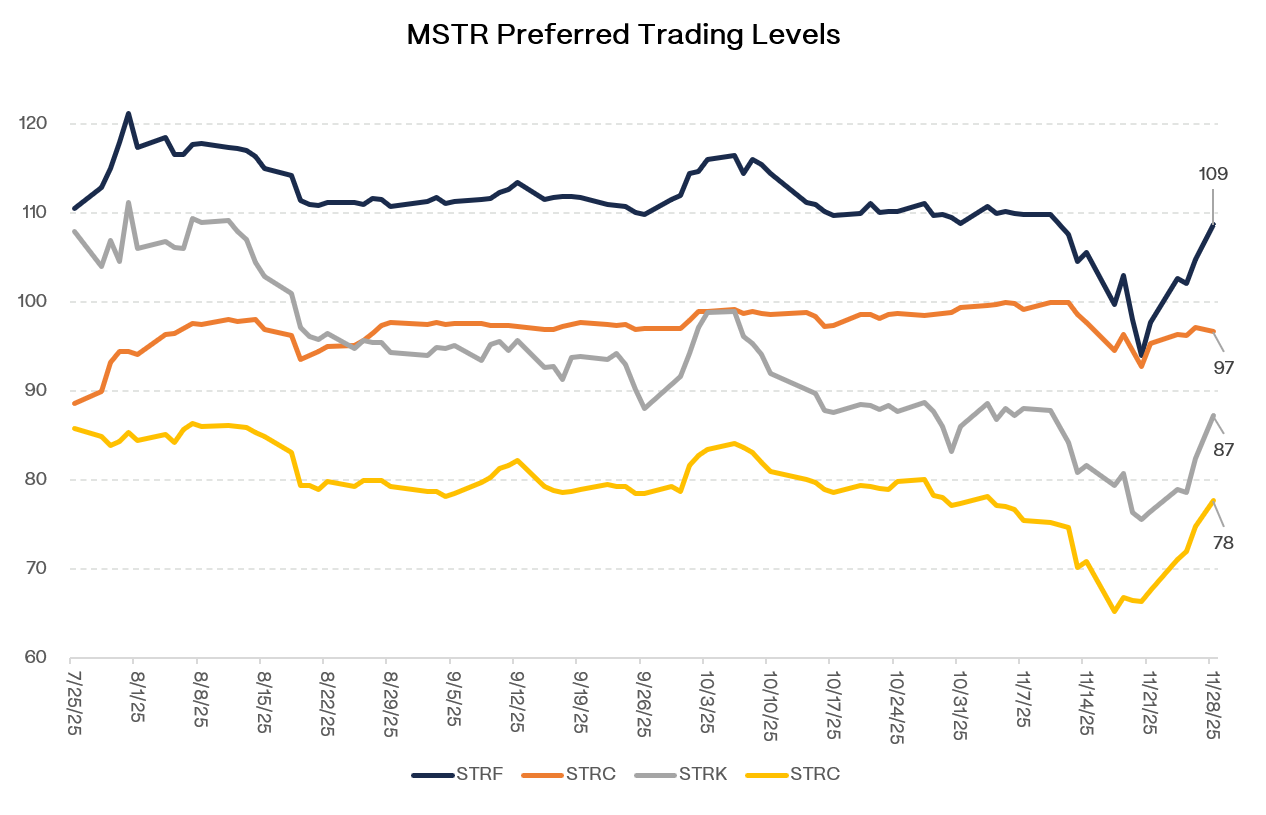

Put simply: STRF and STRC are the senior income workhorses, STRE is the middle cumulative EURO line with step-up protection, STRK is the equity-optional hybrid, and STRD is the high-octane yield piece at the bottom. The reality of this waterfall is reflected in the preferred trading levels as shown below.

Whether you actually get paid is a different question. Let’s find out.