GameStop ($GME): The Meme Stock Hiding a $9bn Balance Sheet

An Institutional Credit Perspective on America’s Most Misunderstood Stock and What Its Convertible Bonds Are Really Pricing In

🚨 Connect: Twitter | Threads | Instagram | Reddit | YouTube

Everybody who shorted GameStop knew they were right.

That’s the thing. They were so damn sure.

Physical retail dying. Digital distribution winning. No moat. No pricing power. No path to growth. Management asleep at the wheel. This was Blockbuster 2.0, a layup, the kind of short you put on and watch grind toward zero.

Then 2021 happened.

Roaring Kitty posted. Reddit mobilized. The stock went parabolic. Hedge funds blew up. Hollywood optioned the movie rights. And somewhere inside that chaos, Ryan Cohen quietly raised billions to turn the company into something else entirely.

Four years later the stock trades with a $10bn+ market cap. The smartest guys in the room have been wrong for four years. GameStop barely resembles the company everyone still argues about on the internet. Yes, it sells video games. People still walk into stores. But that’s not the narrative anymore.

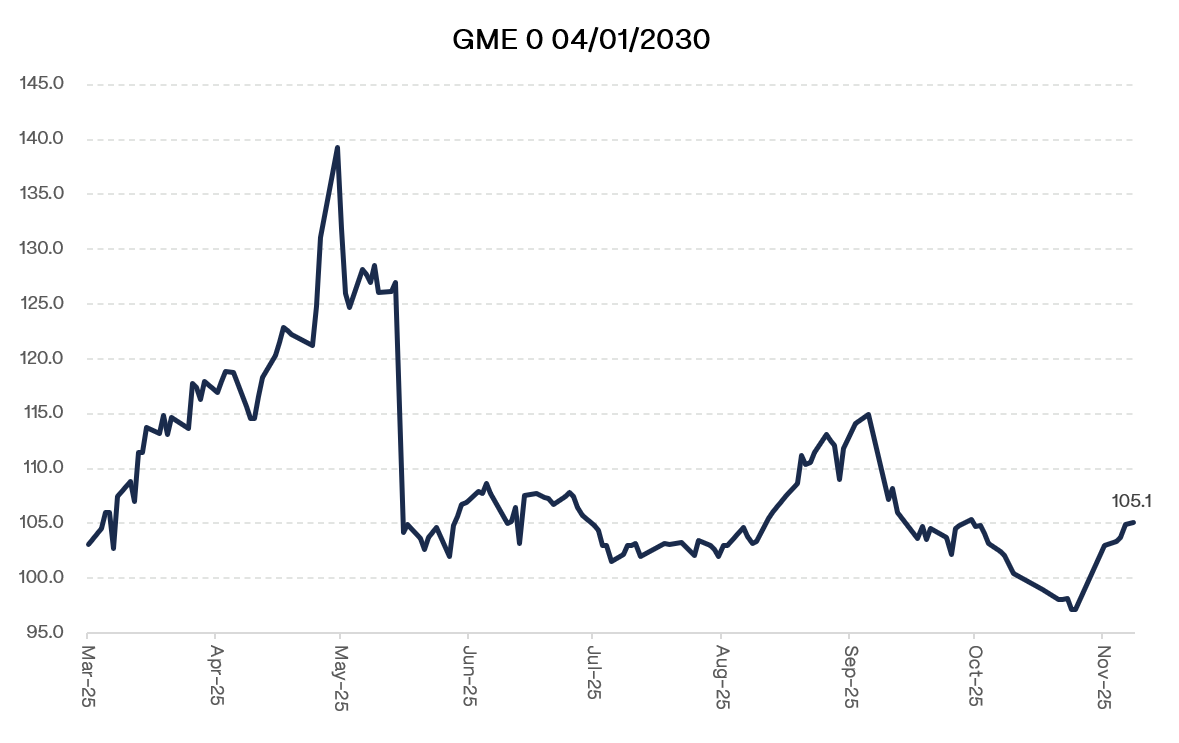

Here’s what you may have missed. GameStop just raised $4.2bn of 0% senior unsecured convertible debt this year. For a video game retailer. In 2025. When nobody buys physical video games.

But someone just lent the company $4.2bn at 0% interest. And the debt trades above par. That’s the part worth paying attention to.

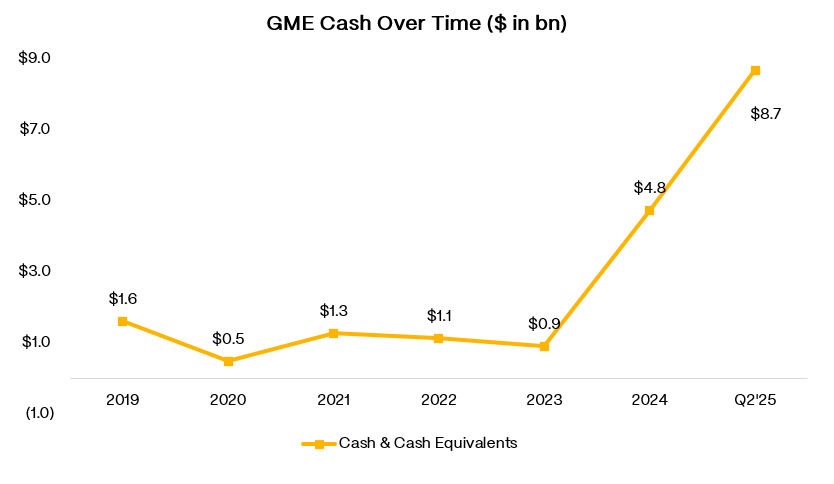

Because underneath the noise sits an entirely different situation. GameStop has $8.7bn of cash. 4,710 bitcoin. A retail footprint that has been cut down to the point where it actually generates cash. Cohen spent four years turning a dying retailer into something else: a cash fortress with a treasury policy that lets him do almost anything. Buy equities. Buy crypto. Buy companies. Or sit on his hands. The board handed him the keys and walked away.

The credit isn’t complicated. The only question is what Cohen does next and whether the market is overpricing that uncertainty or underpricing it.

In this piece, I’ll walk through the business, the balance sheet, and whether there’s an opportunity in the company’s convertibles bonds.

Situation Overview

GameStop is a specialty retailer that sells video game hardware, software, and collectibles through a network of U.S. stores. For most of its history, the model was simple. Customers bought physical games and consoles, traded in used products for credit and browsed stores that acted as community hubs for players. That model has been in structural decline for more than a decade as the industry shifted toward digital downloads, subscription services, and direct distribution.

The company became a household name in 2021 when retail traders triggered a massive short squeeze. The episode, however, gave management a unique opportunity to raise billions of dollars at valuations disconnected from fundamentals. Between 2021 and 2024, GameStop issued multiple ATM offerings and went from liquidity constrained to one of the most overcapitalized companies in specialty retail.

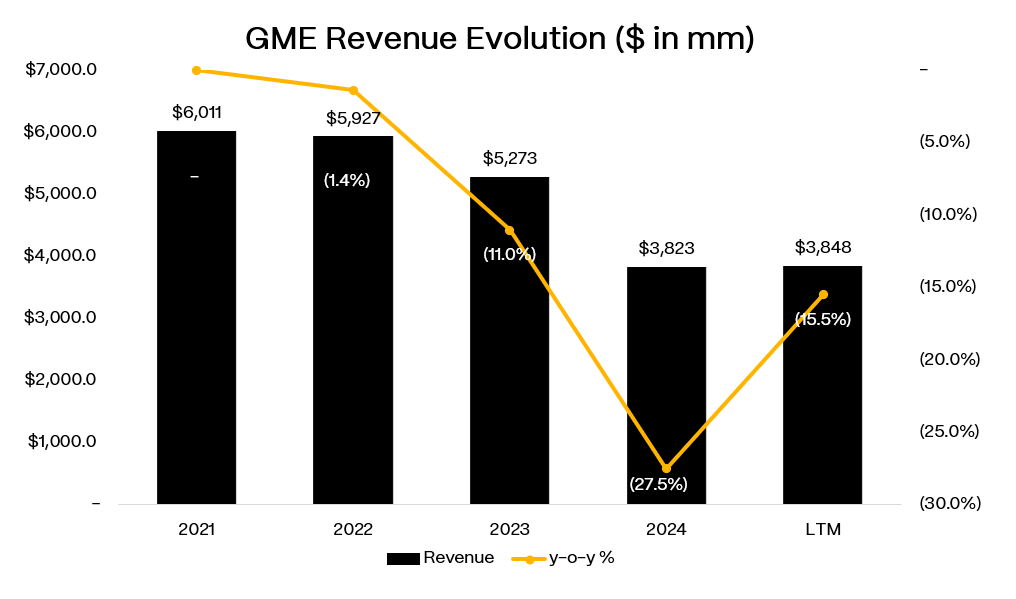

Today, GameStop operates roughly 2,700 U.S. stores, down from more than 5,000 at peak. International operations are basically gone. Revenue in FY’25 was $3.8bn and continues to decline. Yet the balance sheet tells a different story: $8.7bn of cash and another 4,710 bitcoin worth $420 million at today’s prices. The gap between a contracting retail business and the size of the capital base is the defining feature of the credit.

Core Retail Business

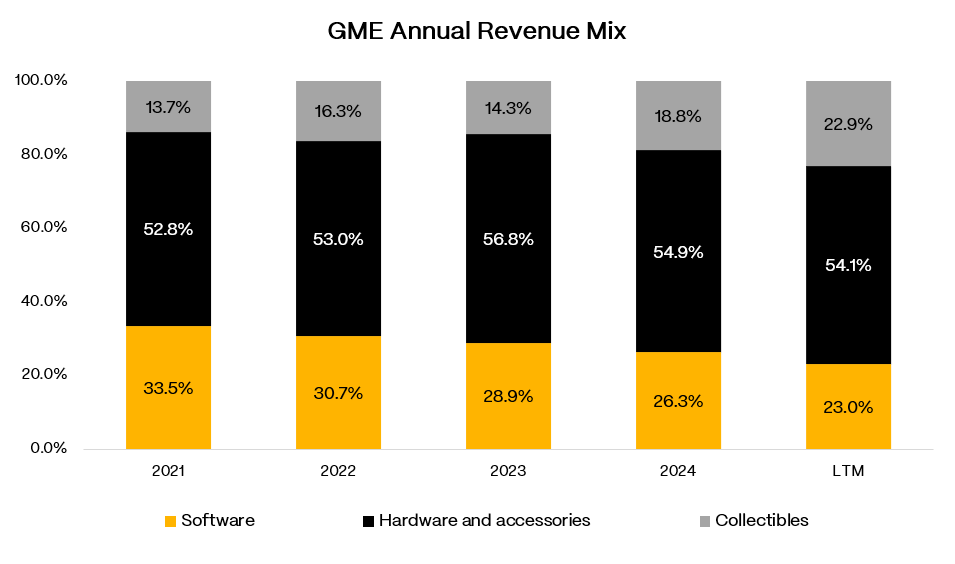

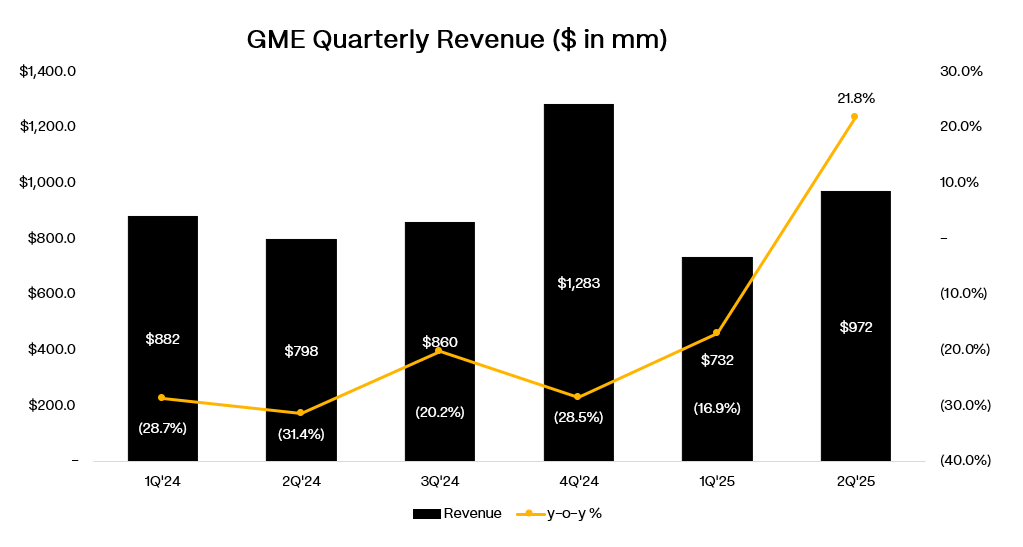

The retail operation continues its long-running contraction. Hardware is roughly 50% below 2019 levels. Software has fallen from more than 35% of revenue to the low-twenties as digital distribution and subscription ecosystems took over. 1Q’25 and 2Q’25 continued this pattern, down 27% y/y.

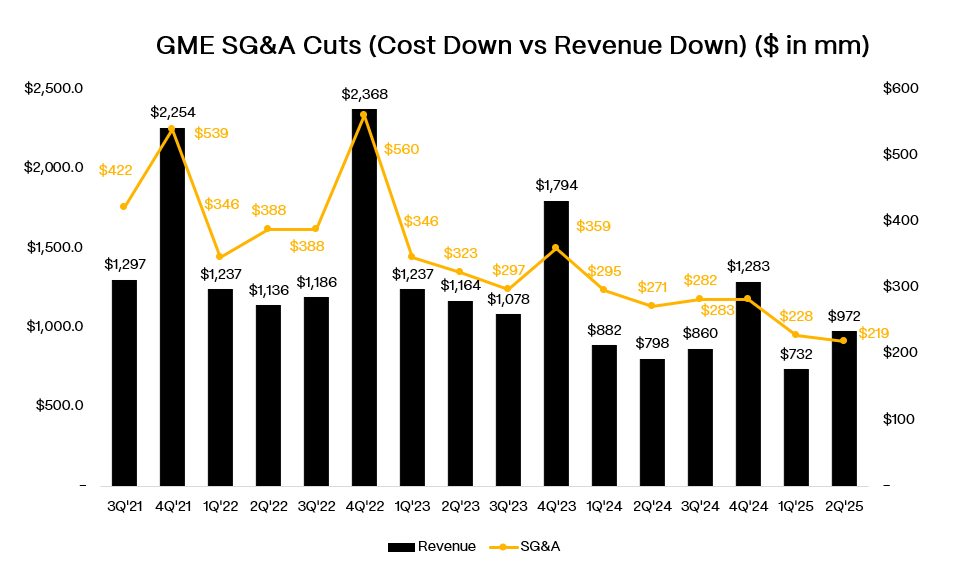

Management has aggressively reduced SG&A through store closures, headcount reductions and the removal of international overhead, which is why the U.S. segment still produces cash despite a smaller revenue base.

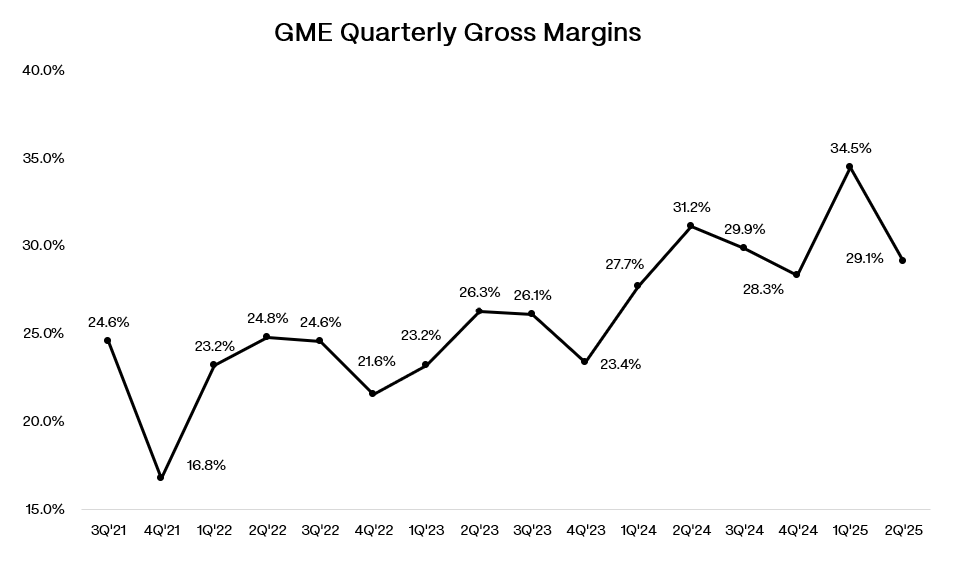

Gross margins have also improved as the mix shifts away from low-margin hardware and toward collectibles. Quarterly gross margin has climbed from the high teens and low 20s in 2021 to the high 20s and low 30s, with spikes above 34% in periods where collectibles outperformed. The combination of higher mix margins and SG&A reduction explains how the business remains cash generative despite contracting revenue.

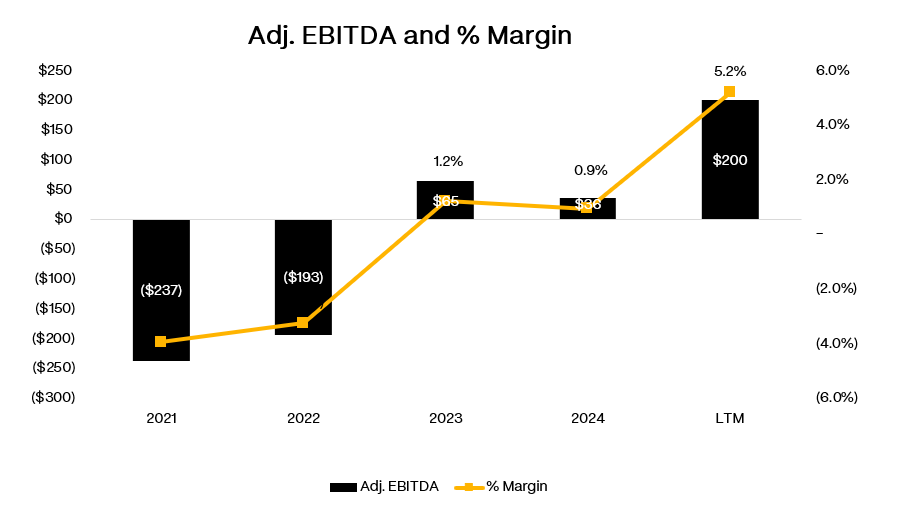

Adj. EBITDA has followed the same pattern. The business went from deep losses in 2021 and 2022 to breakeven in 2023 and slightly positive in 2024, with margins improving from negative to LSD as the footprint shrank and mix shifted toward higher gross margin categories. The LTM Adj. EBITDA figure is understated by international losses that have now been removed from the model.

International was part of the problem. The segment never earned its cost of capital and has been dismantled. Italy, Ireland, Switzerland, Germany, Austria, Canada and France are all exited or in wind-down. By 2026 the company will be U.S. only, eliminating a persistent drag and reducing fixed obligations.

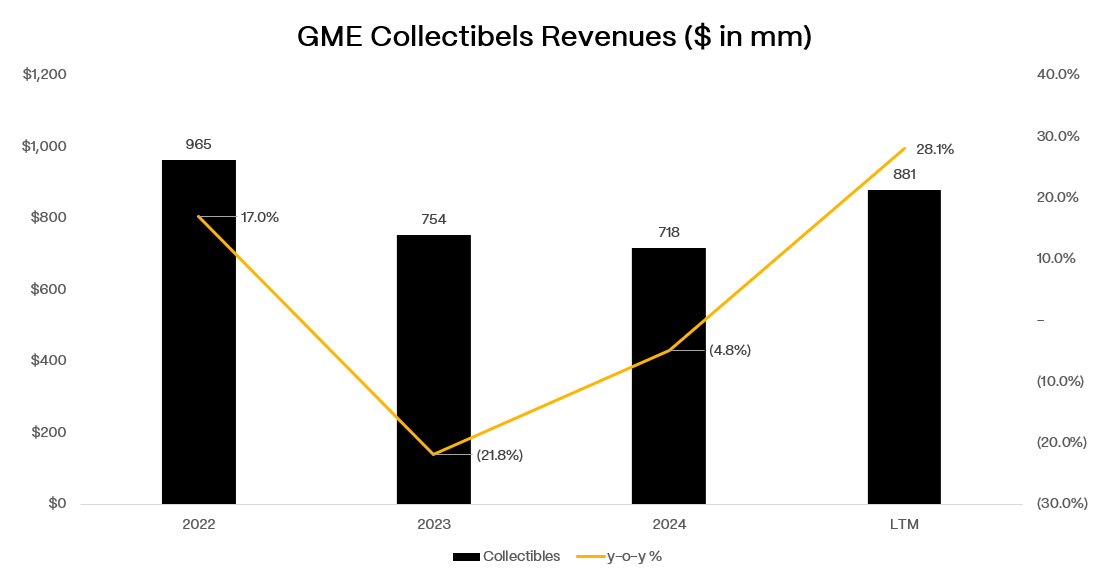

Collectibles have emerged as the stabilizer. The category grew sharply through the first half of 2025 and now represents close to 30% of revenue at mid-30s gross margins. Trading cards and graded memorabilia benefited from the PSA partnership, the rollout of Power Packs and broader collector interest. It is the only segment posting consistent organic growth and now offsets some of the decline in physical gaming.

2Q’25 revenues received a temporary boost from the Switch 2 launch. Hardware surged during the first full quarter of the cycle, producing the company’s first revenue increase in years. The improvement was timing-driven rather than structural and will fade as the cycle normalizes.

Across the last two quarters, the picture is consistent: a retail business that is smaller, more concentrated and increasingly reliant on collectibles. The stores generate cash and support ecommerce fulfillment and loyalty engagement, but they no longer determine enterprise value.

Ryan Cohen

Ryan Cohen built the current version of GameStop. He began accumulating shares in 2020 through RC Ventures, forced changes at the board and executive levels and ultimately became CEO. The meme stock rallies allowed him to raise capital at valuations far above intrinsic value, resetting the balance sheet and giving the company a multi year financial runway.

For background, Cohen founded Chewy and sold it for $3.5bn. His investment history includes large positions in Alibaba and activist engagements at several major companies. His focus is digital platforms, customer retention and capital allocation.

Since taking control, he has removed noncore geographies, resized the U.S. footprint to a cash generative level and tested digital initiatives ranging from NFT marketplaces to in-game currencies. None have scaled, but they signal his priorities. Cohen still holds a substantial stake through RC Ventures, tying his economics to long term equity value rather than quarterly performance.

Balance Sheet and Capital Structure

The balance sheet now defines the company more than the stores do. GameStop holds $8.7bn of cash and 4,710 BTC worth roughly $430mm at current pricing. In 2025, the company issued two series of zero coupon senior unsecured converts totaling $4.2bn.

Shortly before the convert, GameStop rewrote its treasury policy to allow investment in public equities, corporate credit and cryptocurrency. Bitcoin purchases followed immediately. The policy gives Cohen broad discretion to deploy capital without additional approvals. Combined with the converts, the balance sheet has become a strategic instrument for future investments rather than a liquidity buffer for retail operations.

In October 2025, GameStop distributed warrants to common shareholders and convert holders. One warrant for every ten common shares or equivalent as converted interest, with a $32 strike and a one year life. If the stock rallies, this structure enables up to $1.9bn of equity capital without a visible follow on process.

Strategic Positioning

GameStop is now a hybrid. One side is a smaller, cash generative U.S. retail operation anchored by collectibles, trading cards and PowerUp Rewards. The other is a large balance sheet with broad investment flexibility and a CEO whose instincts run toward digital and capital allocation strategies. The stores provide stability. The liquidity provides optionality. The key variable is how Cohen uses it.

Evaluating the credit requires underwriting both sides. The retail stub provides a floor. The balance sheet provides protection. The risk is how these resources are deployed as the company transitions toward a model that looks nothing like the one that made GameStop famous in the first place.

What matters now is simple. The next move is Cohen’s, and the converts will live or die by it. So the question becomes: what exactly are investors underwriting when they buy this paper?