High Yield Market Weekly Minutes: Credit Calls Powell's Bluff (November 3, 2025)

A Brief Recap of Last Week’s High Yield Market Performance

🚨 Connect on Twitter | Threads | Instagram | YouTube

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list — limited spots.

TL;DR

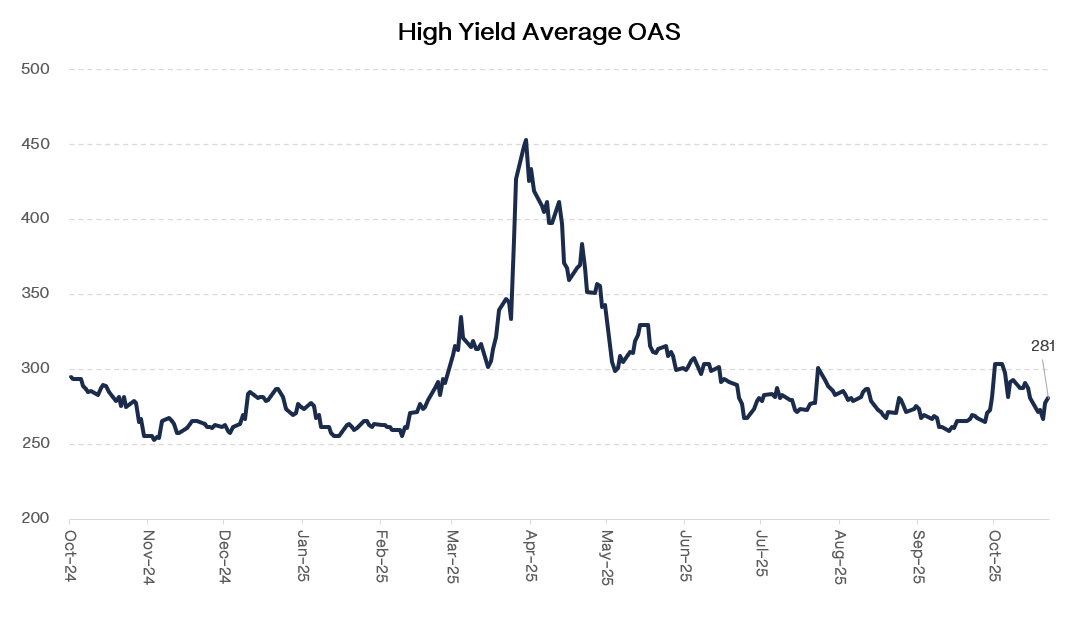

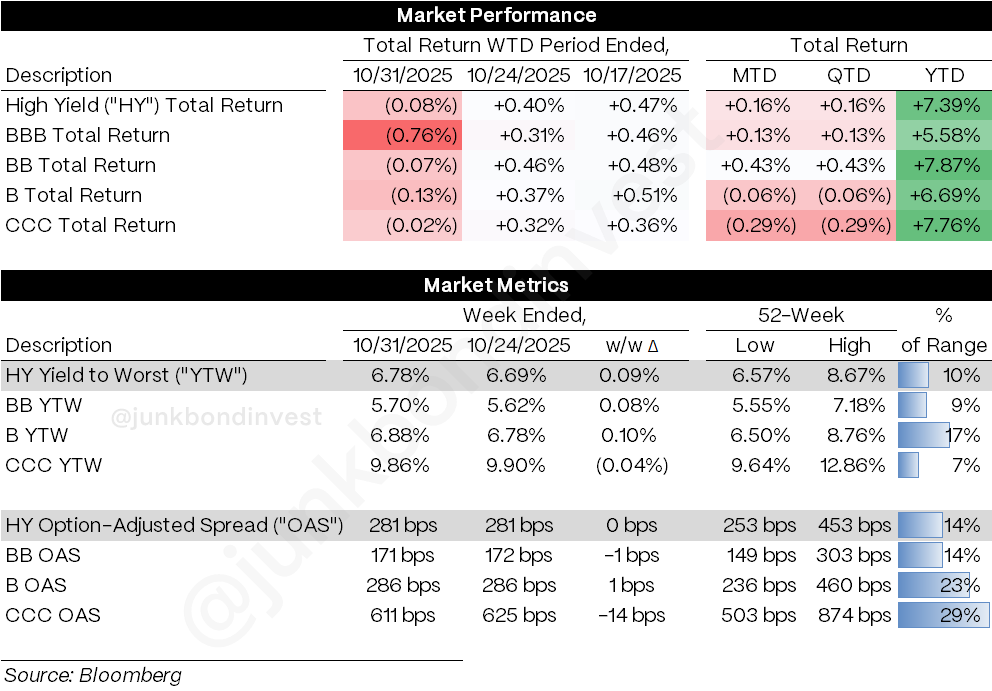

High yield flat at -0.1% as Fed cuts 25bps but Powell kills December hopes. Yields +9bps to 6.78%, OAS flat at 281bps. Uniform performance across ratings = rate move, not credit. VoltaGrid prints $2bn; White Cap only CCC deal. Powell’s fog comment > actual data.

The Fed delivered the 25bp cut everyone expected Wednesday, then Powell tried to tap the brakes on December by warning it’s “not a foregone conclusion.” Market reaction was immediate. Treasury yields spiked, the dollar rallied, and the odds of another cut for December collapsed from 90% to 65%.

Credit’s response? Essentially nothing. High yield ended the week down a tenth of a percent after you account for month-end index rebalancing. Spreads didn’t widen. They actually compressed a basis point to sit just above 280bps. Think about that for a second. The Fed Chair explicitly pushes back on further easing, rates back up across the curve, and high yield just sits there.

That’s a meaningful shift in market psychology. Six months ago, that kind of Fed communication would have triggered 10-15bps of spread widening as positioning adjusted to a less accommodative path. Now it generates a collective shrug. The Fed’s influence over credit sentiment is waning. Investors have moved on to caring about company fundamentals, sector trends, and earnings visibility. Powell can drive in whatever fog he wants. Credit’s navigating by different landmarks now.

Weekly Performance Recap

The uniformity across ratings reveals more than the direction:

BBs: -0.1%, +7.3% YTD

Bs: -0.1%, +6.6% YTD

CCCs: -0.1%, +7.8% YTD

Identical -0.1% across BB, B, and CCC means this was a rate move, not a credit call. The quality trade isn’t working. Investors aren’t paying up for safety or demanding concessions for risk. They’re standing pat, waiting for earnings to clarify business conditions.

Sector dispersion was modest:

Utilities: +0.1%

Energy: -0.1%

Financials: -0.1%

Basics: -0.3%

Consumer Non-Cyclicals: -0.2%

Another sign this was rate noise, not credit rotation. The underperformance in basics and consumer staples stems from early earnings showing margin pressure from tariffs hitting input costs while volumes soften.

Primary Market Activity

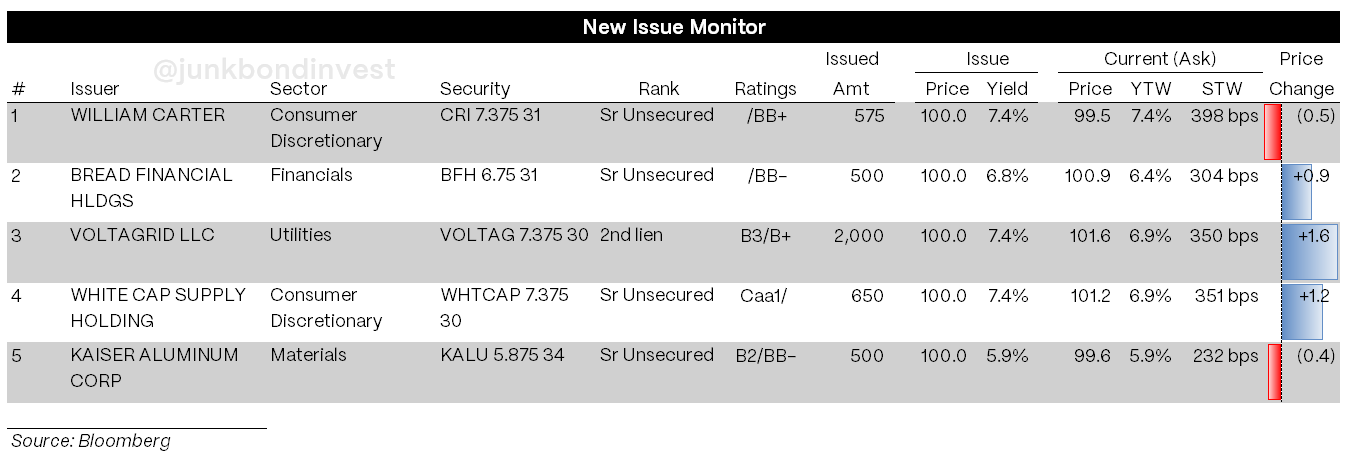

Issuers sprinted before Powell spoke. Roughly $4.2 billion cleared Monday and Tuesday, then silence. October closed at 18 deals for $18 billion. Middle-of-the-fairway credits got done. Edge cases stayed stuck.

VoltaGrid’s $2 billion second lien dominated. Orders exceeded demand for second lien paper, clearing at 7.375%. That kind of demand for second-lien paper shows how hungry investors are for AI infrastructure exposure. The premium for AI adjacency isn’t fading. Data center power likely needs hundreds of billions in financing over the next few years, and VoltaGrid just proved the market will absorb it in size.

White Cap returned after four years and still tightened from initial whispers. The CCC cleared $650 million at 7.375% versus 7.5% area talk. When a CCC can disappear that long and return to a receptive market, it confirms the technical bid remains powerful. But this was pure refinancing. The market will finance CCC maturity extensions. It won’t finance growth or M&A. That distinction becomes critical in 2026 as more lower-rated credits face maturities.

Bread Financial cleared $500 million at 6.75%, low end of talk, despite being consumer finance in an environment where that sector faces scrutiny. The execution quality shows investors are differentiating. Bread’s tech platform and prime-tilted book insulate it from subprime concerns. Kaiser hit midpoint. William Carter upsized $75 million while maintaining pricing.

Secondary Market

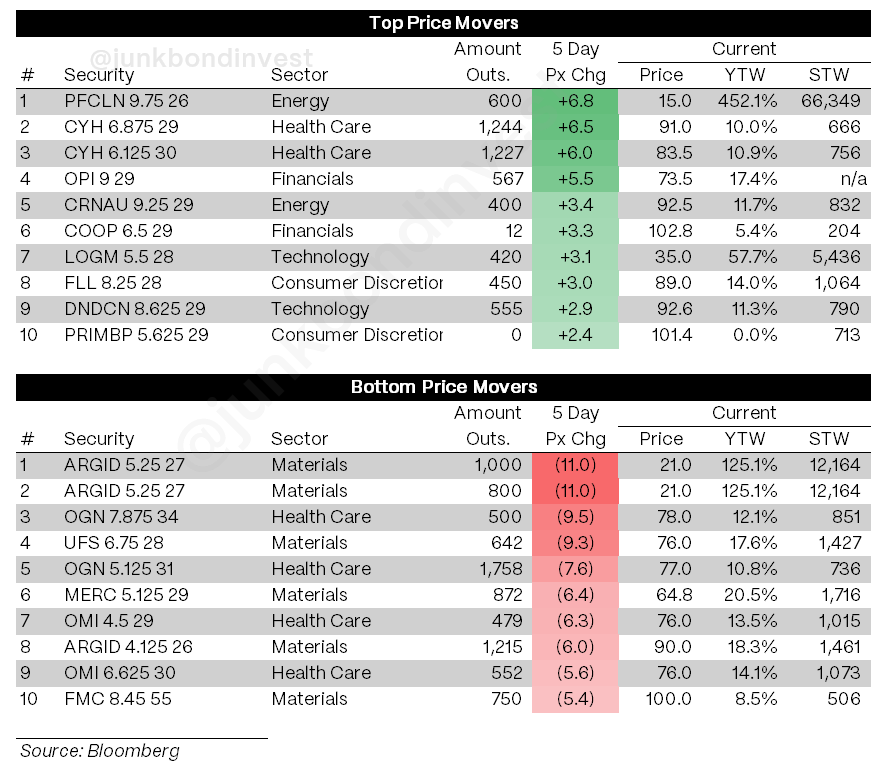

Materials got repriced hard. Mercer lost another 6.4 points as pulp and paper fundamentals deteriorate. FMC fell 5.4 points as ag chemical margins compress. The complex is being marked for weaker 2026 demand. These are high fixed-cost businesses with commodity exposure that can’t flex capacity. When volumes soften and input costs stay elevated, margin compression accelerates. The bond market is extrapolating current weakness forward. If materials are the canary, cyclical exposure faces real fundamental risk over the next 6-12 months.

Healthcare split on idiosyncratic stories. Community Health rallied 6-6.5 points on strategic alternative speculation. Organon collapsed 7.6-9.5 points after disclosing improper Nexplanon sales practices that cost the CEO his job. Owens & Minor fell 5.6-6.3 points on distribution pressure. Three unrelated developments moving bonds 5-10 points. Sector label means nothing; execution means everything.

Technology diverged on company specifics. Dye and Durham climbed 2.9 points after clarifying liquidity. Transparency gets rewarded when investors are hypersensitive to balance sheet questions. Consumer discretionary saw Full House rally 3.0 points ahead of earnings. Regional gaming should hold up better than destination resorts. Live entertainment remains resilient as other discretionary categories weaken.

The rotation away from cyclicals is accelerating. Earnings drive performance now, not Fed policy.

Looking Ahead

Powell’s “driving in the fog” comment captures it. The shutdown continues with September employment data still unreleased. The Fed cut rates while admitting it has no visibility on labor.

Earnings matter more than usual. Homebuilders first: did rate cuts spark demand recovery? How much incentive spending to move inventory? What are margins doing as lumber tariffs hit? Building products face rising tariff costs and softening volumes. Companies that can’t pass through costs will see margin compression accelerate.

Warner Bros Discovery reports Thursday amid M&A speculation. Consolidation keeps some media credits bid. Several TV broadcasters report this week. If management pushes back on M&A timelines, bonds might reprice lower. Altice faces scrutiny on net adds and 2027 maturity wall communication.

Economic calendar remains uncertain. ISM might show if lower rates help, but may not publish. Initial claims remain the only reliable labor read. Markets are flying blind while the Fed eases.

Primary calendar looks light through year-end. Issuers with flexibility wait. Those with urgent needs pay up. The hung deals stuck in today’s market show marginal credits can’t clear at any price.

The resilience suggests positioning isn’t defensive. Whether that’s justified depends on what companies say over the next two weeks. If earnings confirm most are navigating successfully, spreads around ~280bps look reasonable. If earnings reveal widespread margin pressure and demand weakness, current levels look too tight.

Find the most recent JunkBondInvestor posts below

Disclosure: The information provided is based on publicly available information and is for informational purposes only. While every effort has been made to ensure the accuracy of the information, the author cannot guarantee its completeness or reliability. This content should not be considered investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release the author from any liability. Always seek professional advice tailored to your financial situation and objectives.