Carter's Inc. ($CRI) Credit Analysis: $575M Refinancing as Tariffs Hit

Tariffs, falling birth rates, and an outdated distribution model

🚨 Connect: Twitter | Threads | Instagram | Reddit | YouTube

Carter’s just priced BB+ rated bonds at 7.375% at par. They’re quoted down on the break.

Not a disaster, but not what you want to see either. At 7.375%, that’s already a meaningful coupon for BB+ paper. The fact they’re not trading up tells you something. The market has questions.

Tariff headwinds. Pricing pressure. 150 store closures coming. A wholesale channel that’s outperforming their own retail stores.

Management keeps talking about pricing power and better second halves. But the bond market just voted. And right now, they’re not convinced.

Situation Overview

Carter’s sells onesies and toddler pajamas. That’s basically it. The business model is parents need clothes for kids from newborn to age 12, and Carter’s is there with the basics. They run about 808 stores in the U.S. and another 257 in Canada/Mexico under the Carter’s and OshKosh B’gosh brands, which gets them roughly half their sales.

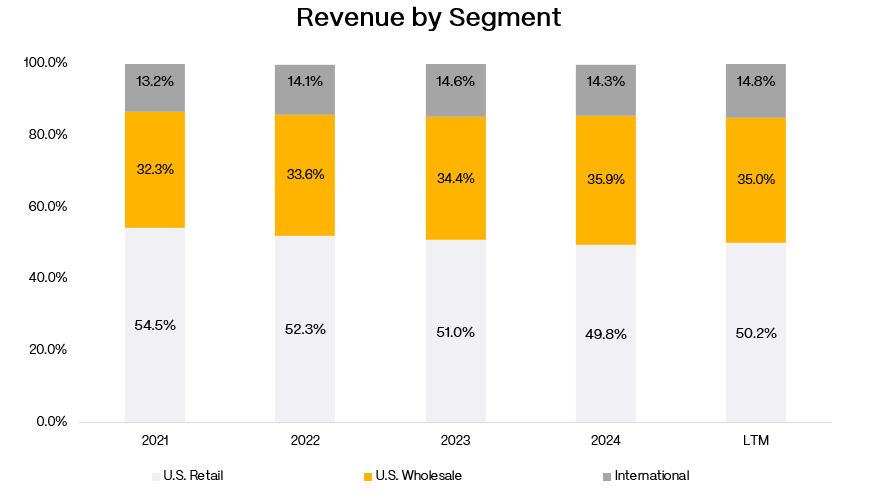

Another 35% comes through wholesale partners like Target, Walmart, and Amazon, hitting about 19,500 doors total. The remainder trickles in from international. Pretty straightforward.

Until recently, this looked like a boring but functional business. U.S. retail comps had been negative for three straight years, which wasn’t great, but wholesale was holding up and throwing off better margins. Steady enough to service the debt and keep the dividend checks flowing.

Then tariffs showed up. Management disclosed an estimated gross annual tariff impact of $200mm to $250mm, with Q4 net impact expected at $25mm to $35mm. That’s roughly 5% of total sales. Or 400 to 600bps of gross margin pressure if you want to think about it that way. Either number is bad.

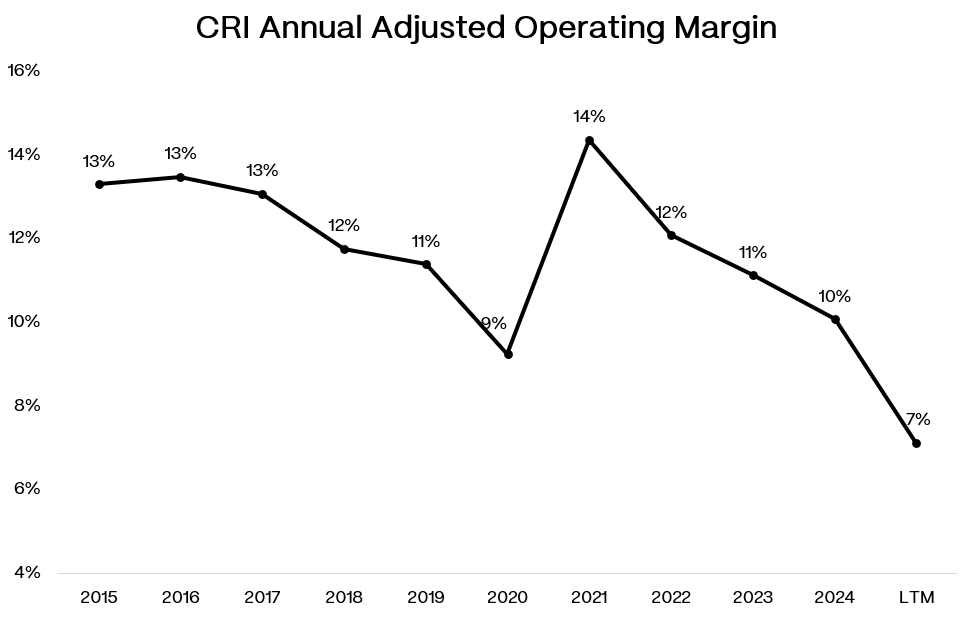

But the tariffs didn’t create the problem. They just made it impossible to ignore. Carter’s built a distribution model for 2008, with hundreds of stores and thousands of wholesale doors through department stores and mass retailers. That worked when department stores had traffic and parents shopped in person. Then department stores collapsed. Birth rates dropped 15% since 2015. Younger parents shifted online and discovered brands through Instagram, not Babies “R” Us. By the mid-2010s, Carter’s was everywhere: Macy’s, Kohl’s, Walmart, Target, Amazon, their own website and outlets. Each channel demanded lower prices. Consumers learned to wait for 40% off. The brand went from trusted baby apparel to discount commodity. EBIT margins dropped from the low teens pre-2018 to roughly ~7% today.

The dividend got axed in May. Down 70% from $0.80 to $0.25 per share, saving about $100mm annually. FCF has gone from around $300mm pre-COVID to an estimated $100mm for FY’25 and FY’26. The whole plan shifted from returning cash to hoarding it.

The company needed a reset. Here’s what the new management team is betting on.