Leslie’s Pool Supplies: A Controlled Descent

What the market’s pricing in, what lenders control, and how this story likely ends.

🚨 Connect: Twitter | Threads | Instagram | Reddit | YouTube

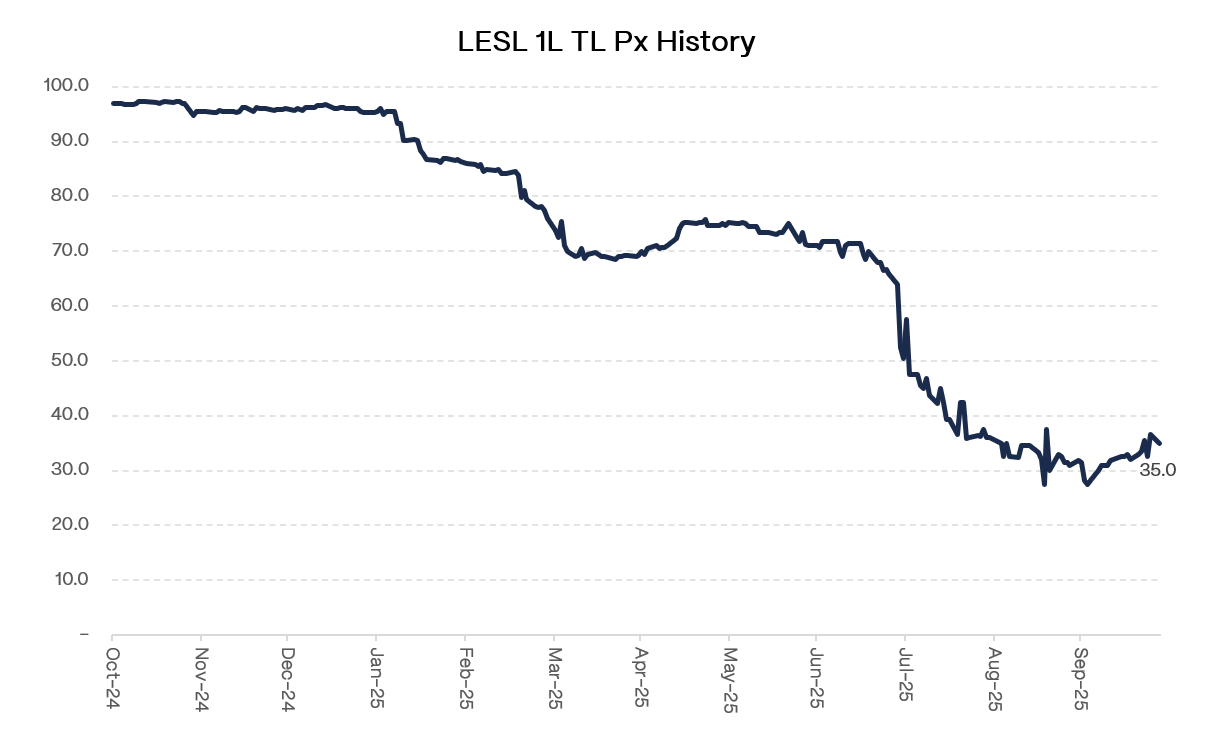

Remember when I said to avoid Leslie’s at 70 cents? The term loan just hit 35. Even I didn’t think it would get cut in half this fast.

For a business that still runs 1,000 stores and generates $82 million of EBITDA during peak season, that’s quite distressed. It’s the kind of level that says the market expects a bankruptcy filing, meaningful principal impairment, and a lot of uncertainty about what comes out the other side. The equity has been effectively zeroed out, down 91% year-to-date. Management cut full-year EBITDA guidance by 50% in August and the CFO seat has turned over twice in twelve months.

So the question is simple: at 35 cents, is this now a buy?

The answer isn’t obvious. On one hand, you have a lender group that’s organized and motivated to execute a clean restructuring. The business still generates meaningful cash during peak season. The operational issues seem fixable with the right cost structure and balance sheet. On the other hand, you have a retailer facing structural headwinds in an e-commerce era, a guidance track record that’s been abysmal, and potentially restructuring where process execution will determine whether you make money or lose it.

This is a pure recovery play on the credit side, not a yield story. Whether you make or lose money depends entirely on two variables: how messy the bankruptcy gets, and whether this business can stabilize earnings above the current trough.

In this memo, I’ll lay out the potential path to restructuring, and build a framework for thinking about recovery value at different levels of execution risk.

But first, let’s review where things stand.

Note: This analysis is based entirely on public information. I do not have a position in Leslie’s and am not privy to any lender or company discussions.

I. Situation Update

The Earnings Meltdown

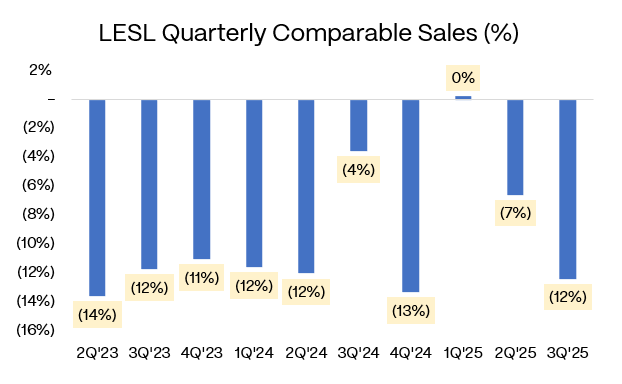

Leslie’s has delivered one of the sharpest earnings resets I’ve tracked this year. When I last wrote about this after Q1’25, the cracks were already showing. What’s happened since has been worse than even the bears expected.

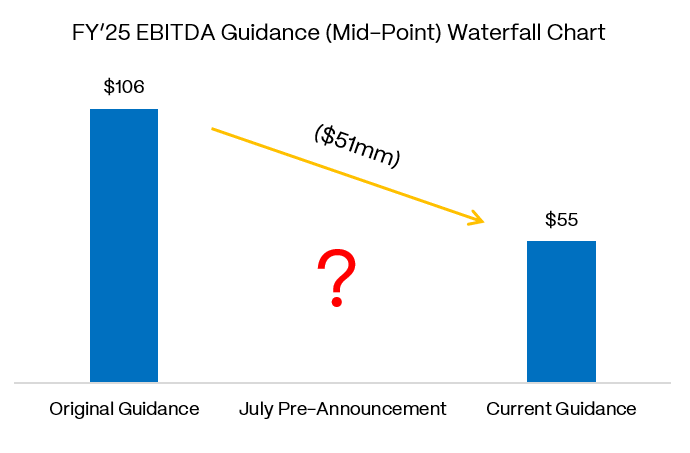

The company entered 2025 guiding to FY’25 EBITDA of $96-116mm. By the time Q2’25 rolled around (March quarter, early pool season), management was already walking that back. Sales came in softer than expected, traffic was weak, and promotional intensity was picking up. Investors started getting nervous. But management held the line on full-year guidance, insisting the summer peak would bail them out.

It didn’t.

In late July, management issued a negative pre-announcement for Q3 (the critical summer quarter) and withdrew full-year guidance entirely. No updated targets, just “things are worse than we thought.” The stock got cut in half in a day. The term loan, which had been trading in the high 60s, dropped into the low 40s.

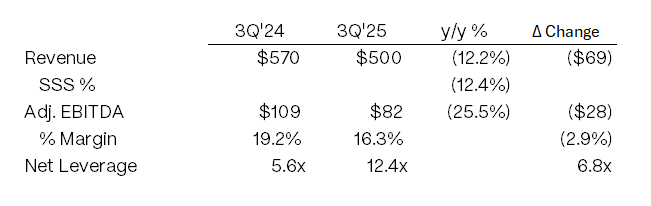

Then came the Q3’25 print on August 6, and it confirmed the damage: sales down 12% y/y to $500mm, EBITDA down 25% to $82mm, margins compressed 290 bps to 16.3%. Same-store sales fell 12% on an 11% traffic decline. Gross margin contracted 60 bps to 39.6%.

Management provided new full-year guidance: $1.21-1.24bn revenue (down 7-9% y/y) and $50-60mm EBITDA. The midpoint of $55mm represented a 52% cut from the original $96-116mm range. This was a complete reset.

Management blamed cool weather, weak traffic, and aggressive competitor promotions. Weather played a role, sure. But an 11% traffic decline during peak season and continued share loss suggest structural issues beyond seasonal noise. Customers aren’t just waiting out bad weather but going elsewhere.

The Response

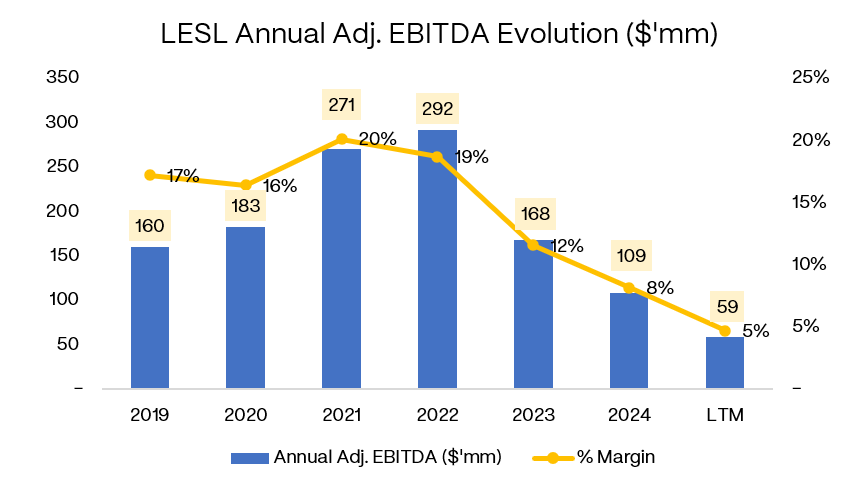

Management announced plans to reduce inventory by at least $20mm, cut annual capex to approximately $30mm (down from historical $50mm+ levels), and target $5-10mm of incremental cost saves beginning in FY’26. Debt reduction was cited as the top capital allocation priority. But with EBITDA at $50-60mm and negative free cash flow, organic deleveraging isn’t happening. LTM EBITDA now sits at $59mm vs. $168mm in FY’23. The business has lost more than half its earnings in two years.

Capital Structure Stress

With approximately $757mm of debt outstanding, leverage spiked to roughly 12.5x on the new guide, compared to 7-8x at the start of the year. Even if EBITDA somehow recovers to $85-100mm in FY’26, there’s no path below 7-8x without a balance sheet fix.

Leslie’s disclosed $43mm of cash at Q3 quarter-end. Notably, the company paid down $20mm on its revolver post-quarter, leaving $23mm of cash on the balance sheet. The revolver is now fully undrawn at $250mm capacity.

Leadership Chaos

On August 21, just 15 days after the disastrous earnings print, interim CFO Tony Iskander announced his resignation effective October 4. This was the second CFO departure in twelve months. The timing raised obvious questions about the quality of financial forecasting and internal controls.

On September 17, Leslie’s appointed Jeff White as CFO and Treasurer. White previously served as CFO of Sportsman’s Warehouse, another specialty retailer that faced its own operational and financial challenges. Iskander agreed to stay in an advisory capacity through January 2026 to assist with the transition.

Notably, the CFO appointment press release made no mention of reaffirming or updating the FY’25 guidance provided in August. Management stated it would provide more comprehensive updates at the November earnings call.

Market Pricing

The term loan is currently trading at approximately 35 cents on the dollar, down from 70 when I last wrote about it. The equity underwent a 20-to-1 reverse stock split and now trades around $4.00 per share (post-split basis), implying a market capitalization of roughly $38mm.

When prices get this distressed, control shifts from management to creditors. And in this case, the creditors have already organized. According to Debtwire, holders of over 95% of the first-lien term loan have signed a cooperation agreement.

That’s where things stand today. Here’s what I think happens next: