High Yield Market Weekly Minutes: Greenland Framework Defuses Tariffs, CCCs Lead the Relief Rally (January 26, 2026)

Greenland Resolved, CCCs Rally, But Technicals Softening

🚨 Connect: Twitter | Instagram | Reddit | YouTube | Jobs

TL;DR

High yield returned +0.10% as the Greenland tariff standoff resolved at Davos. CCCs led at +0.30%, tightening 26bps. But the broader index widened 5bps as BBs and Bs gave back ground. Primary roared back with $11 billion across 14 tranches; Asurion upsized twice. Fund flows stayed negative. Technicals are softening with street inventory elevated and IG outperforming. FOMC holds this week.

What a difference a few days makes.

Last Monday we were staring at the worst losses in months. By Friday, markets had stabilized and CCCs were ripping. The catalyst was straightforward: Trump struck a framework on Greenland, details still scrace, and the tariff threat evaporated. Risk assets exhaled.

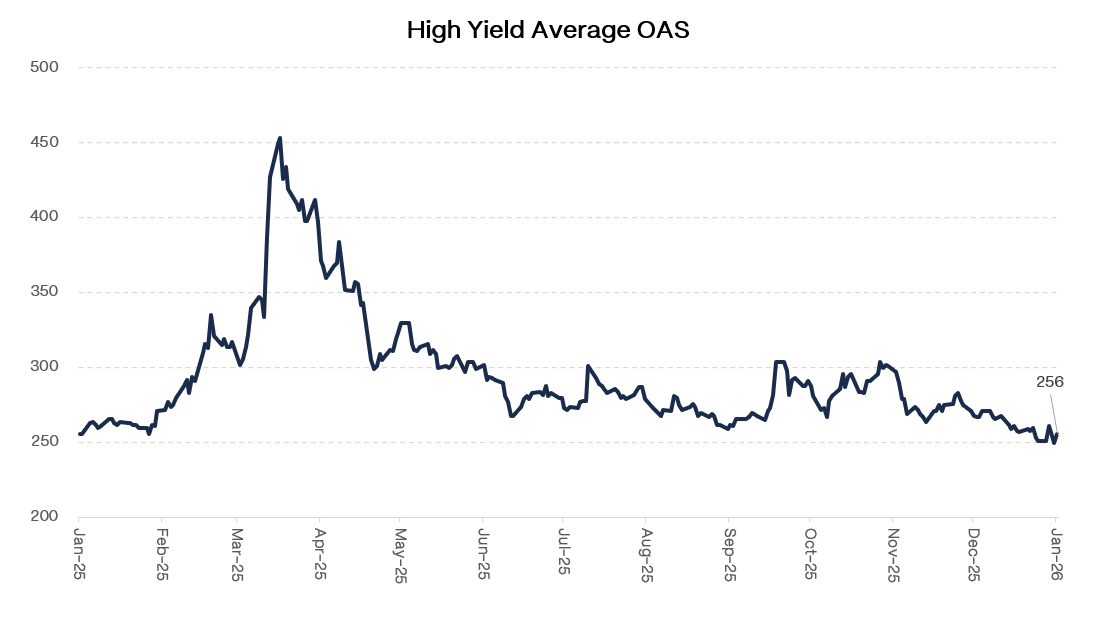

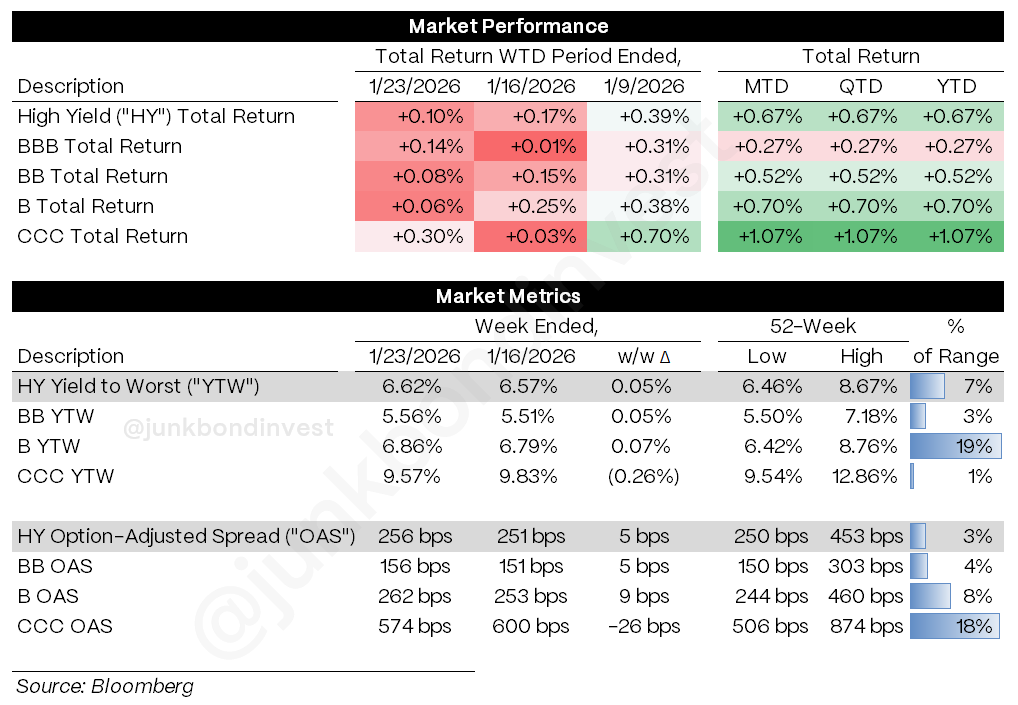

The quality split was notable. CCCs returned +0.30% and tightened 26bps to 574. But BBs managed just +0.08% and widened 5bps to 156. Bs returned +0.06% and widened 9bps to 262. The index overall widened 5bps to 256. Yields rose to 6.62%. The relief rally showed up in the lowest-rated credits while higher quality treaded water.

Primary came roaring back. After last week’s $2.7 billion trickle, issuance jumped to $11.4 billion across 14 tranches. More than a quarter was M&A or LBO related. Execution was exceptional. Asurion upsized twice to $3.3 billion at pricing. Investors are not just accepting paper; they are demanding it.

But the technicals are softening. Fund flows stayed negative for a second straight week. The Russell gave back much of its January outperformance on Friday, dropping 1.8% while the S&P was flat. The rally in CCCs is real, but the broader index is not confirming it.

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list.

Weekly Performance Recap

CCCs led at +0.30%, tightening 26bps to 574. Bs returned +0.06%, widening 9bps to 262. BBs lagged at +0.08%, widening 5 bps to 156. Index spreads widened 5 bps to 256. Yields rose 5bps to 6.62%, except CCCs which fell 26 bps to 9.57%. Fund flows negative again. YTD returns now at +0.67% for the index, +1.07% for CCCs.

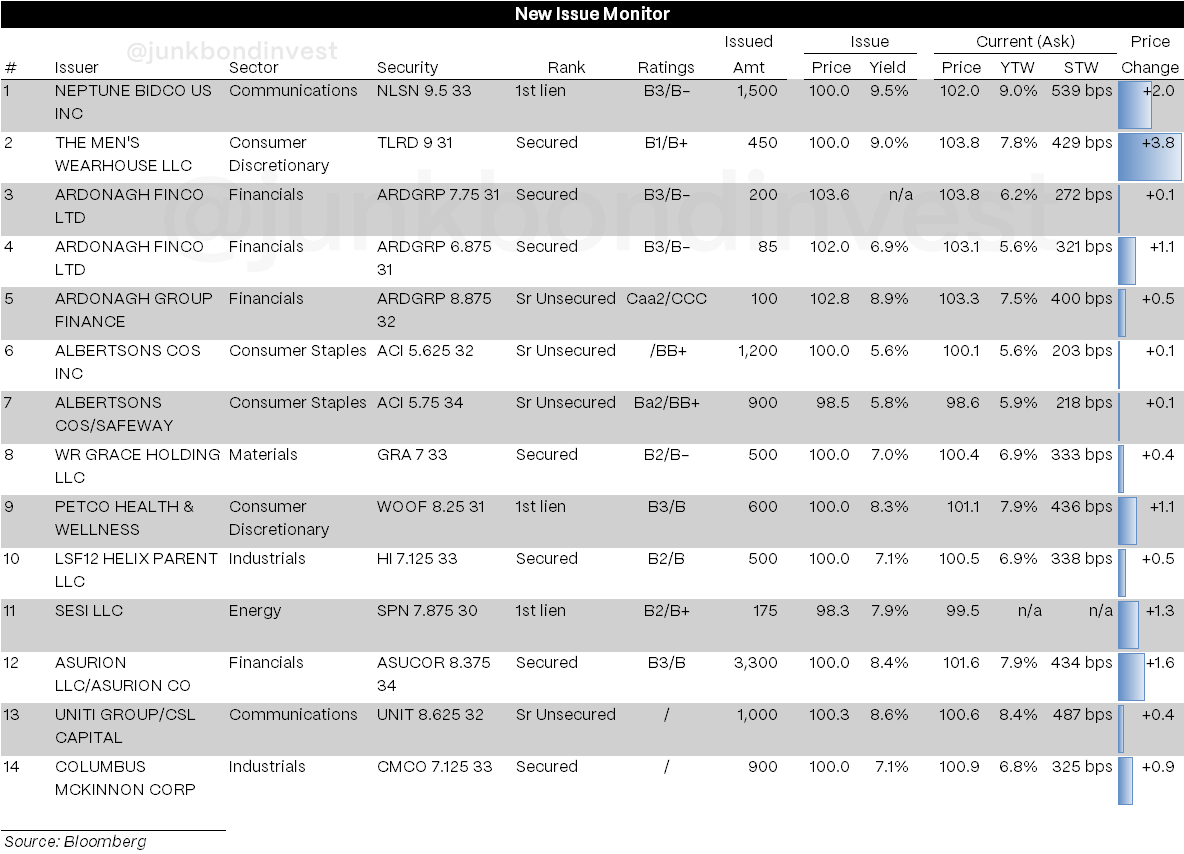

Primary Market Activity

Supply more than quadrupled to $11.4 billion across 14 tranches. Execution was strong across the board. All but one tranche priced at talk or better; half priced at the tight end. More than 25% of volume was M&A or LBO related, including the first HY LBO financing since July.

The standout was Asurion, which upsized twice on its way to a $3.3 billion 8NC3 second lien deal at 8.375%. Books were multiple times oversubscribed. That kind of demand for a large second lien print tells you where appetite sits.

The other signal: issuer-friendly structures are clearing without pushback. Multiple deals came with shortened call protection, and investors accepted it to get paper. When buyers are willing to give up optionality just to participate, the supply-demand imbalance is obvious.

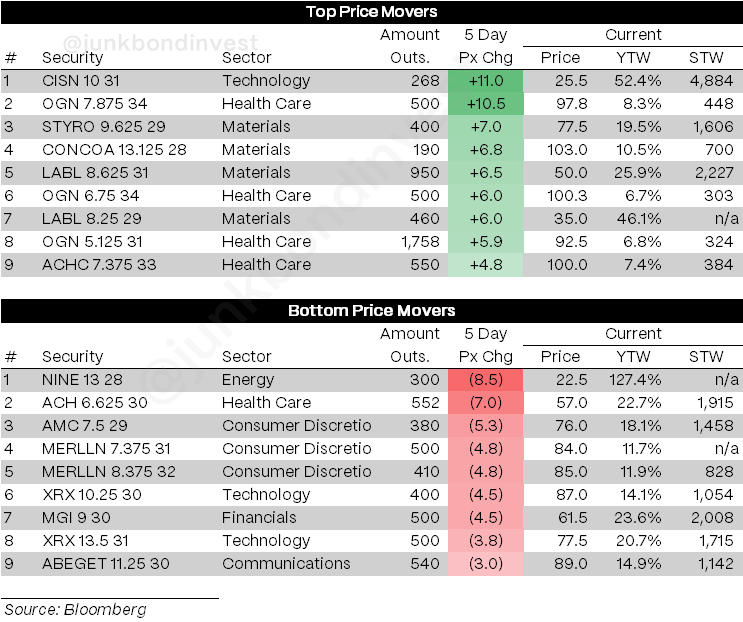

Secondary Market

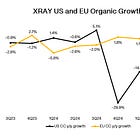

Sector dispersion was evident, with commodity-sensitive credits outperforming while growth-oriented sectors lagged. Energy and Chemicals each tightened on the back of company-specific catalysts, including a favorable arbitration and refinancing speculation in European levered chemicals. Utilities were modestly tighter.

Media and Technology went the other direction. M&A speculation continues to drive headlines in media, but actual flow has not followed the noise. The AI infrastructure theme is gaining traction as investors digest fundraising news out of Davos and position ahead of hyperscaler earnings; capex guidance will be the focus.

Financials remain tethered to affordability headlines. Consumer lenders and housing-exposed credits saw elevated interest as policy initiatives around homeownership continue to percolate. The BDC space may see pressure after a BDC disclosed NAV cuts tied to e-commerce aggregator and home improvement losses late Friday. Building products stayed active on M&A speculation.

Looking Ahead

The FOMC meets Tuesday and Wednesday, and no one expects a move. The market is pricing fewer than two cuts for 2026, with the first not fully priced until June. The question is whether the statement or Powell’s press conference shifts that calculus.

On the data front, things have been supportive on the margin. Real consumer spending rose 0.3% in both October and November while core PCE came in at 0.2% for each month, putting the three-month annualized rate at 2.3%. Inflation is moving in the right direction, but December likely saw a bounce back, which could push the year-over-year rate to 3.0%. Not disastrous, but not progress either.

The consumer is holding up but stretching, with the personal saving rate dropping to 3.5%, a three-year low, and income growth not keeping pace with spending. Tax relief should help later this year, but households are drawing down buffers in the meantime.

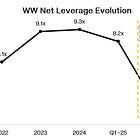

What concerns me more is the technical backdrop. Fund flows have been negative for two straight weeks while IG pulled in ~$9 billion. Street inventory is elevated. Friday’s Russell selloff was a warning sign. When positioning gets this stretched and flows are not confirming, rallies get harder to sustain.

Primary is pricing like it’s 2007. Maybe that is justified. But issuers getting aggressive on structure, investors accepting less call protection, and funds seeing outflows while deals upsize twice is a late-cycle pattern. It works until it does not.

Durable goods Monday. FOMC Tuesday-Wednesday. PPI Friday. Employment next Friday. Plenty of catalysts to test whether this tape can keep grinding tighter or whether technicals finally catch up.

Find the most recent JunkBondInvestor posts below

Disclosure: The information provided is based on publicly available information and is for informational purposes only. While every effort has been made to ensure the accuracy of the information, the author cannot guarantee its completeness or reliability. This content should not be considered investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release the author from any liability. Always seek professional advice tailored to your financial situation and objectives.