O-I Glass Inc. ($OI): Can They Cut Fast Enough?

What credit investors need to know about the F2W story

🚨 Connect: Twitter | Threads | Instagram | Reddit | YouTube | Jobs

Situation Overview

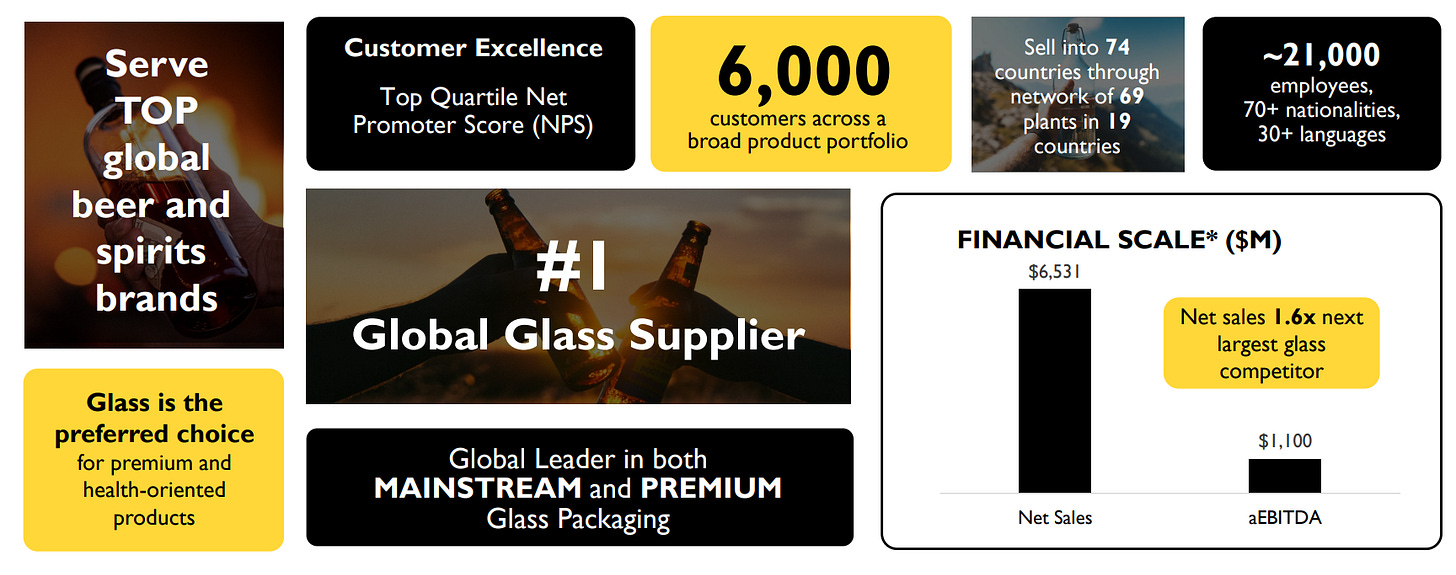

O-I Glass is the world’s largest glass container manufacturer, holding a 30%+ global market share and the #1 position in 19 of the 22 countries where it operates.

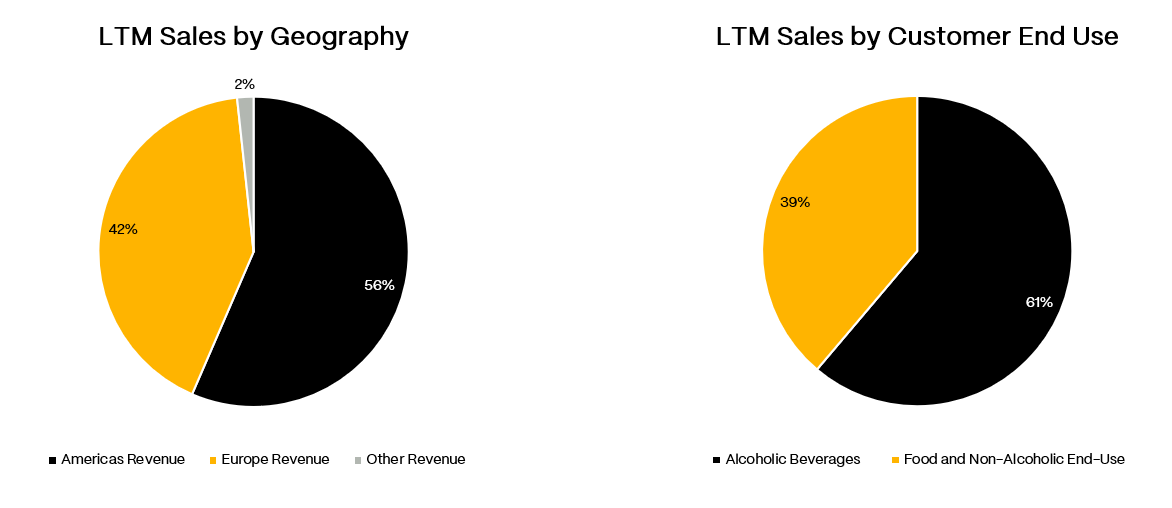

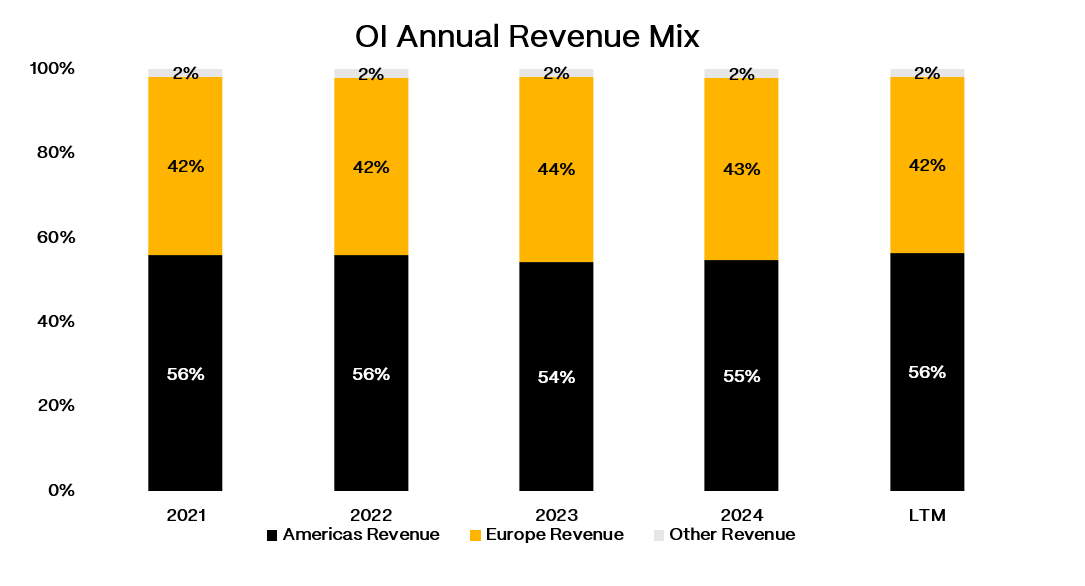

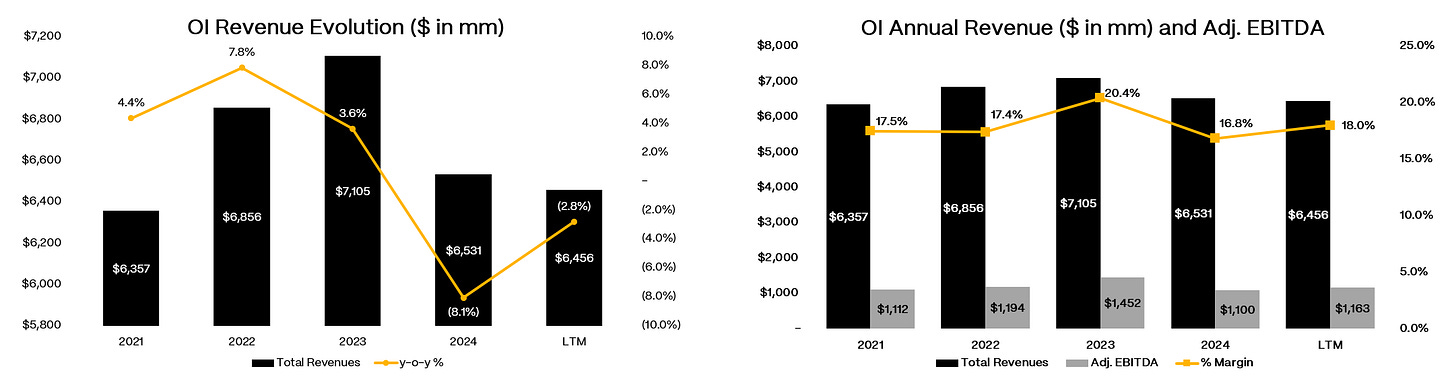

The company is a pure-play glass packaging business generating roughly $6.5 billion in annual revenue, split ~56% Americas and ~42% Europe, serving end markets including beer, wine, spirits, food, and non-alcoholic beverages.

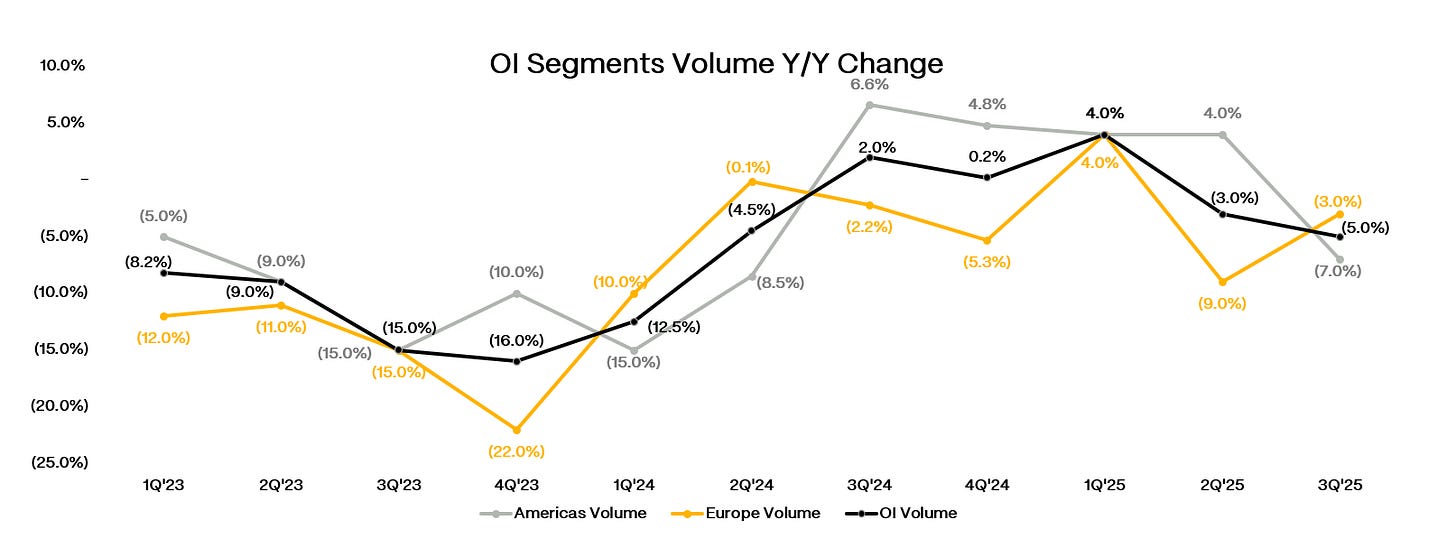

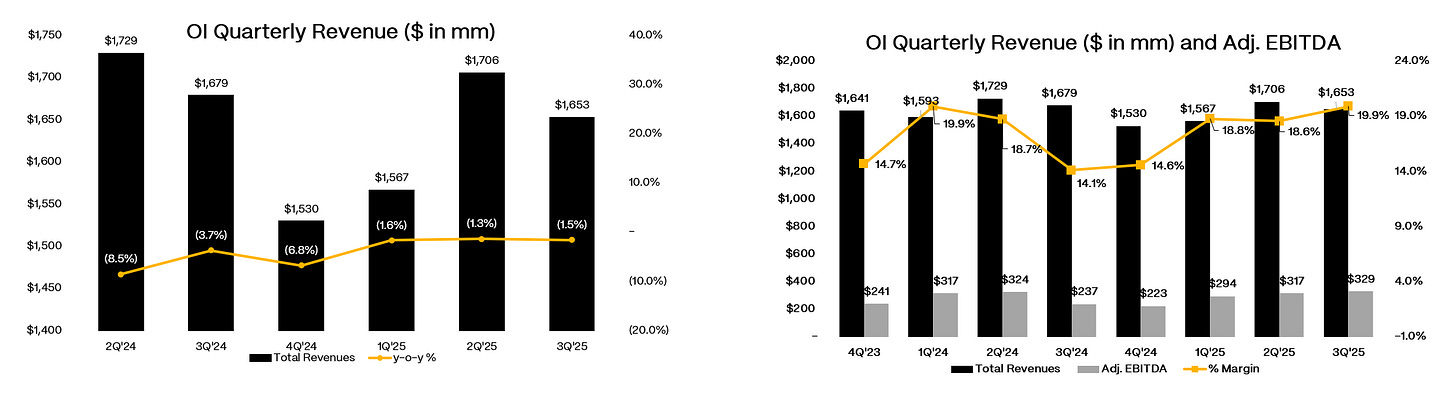

The central investment debate at OI is whether a comprehensive cost-reduction program called “Fit to Win” (F2W) can generate sufficient EBITDA improvement to offset persistent volume headwinds and enable meaningful deleveraging. Glass packaging faces structural challenges in developed markets, including secular share loss to aluminum cans (particularly in beer), weak consumer spending, and declining alcohol consumption trends. The company guided to -2% volumes for 2025, with Q3 volumes down -5% year-over-year as the Americas saw -7% shipment declines from lower consumption, inventory destocking, and management’s deliberate exit of unprofitable customer relationships.

Despite these volume pressures, OI has delivered consecutive earnings beats through aggressive cost execution under F2W.

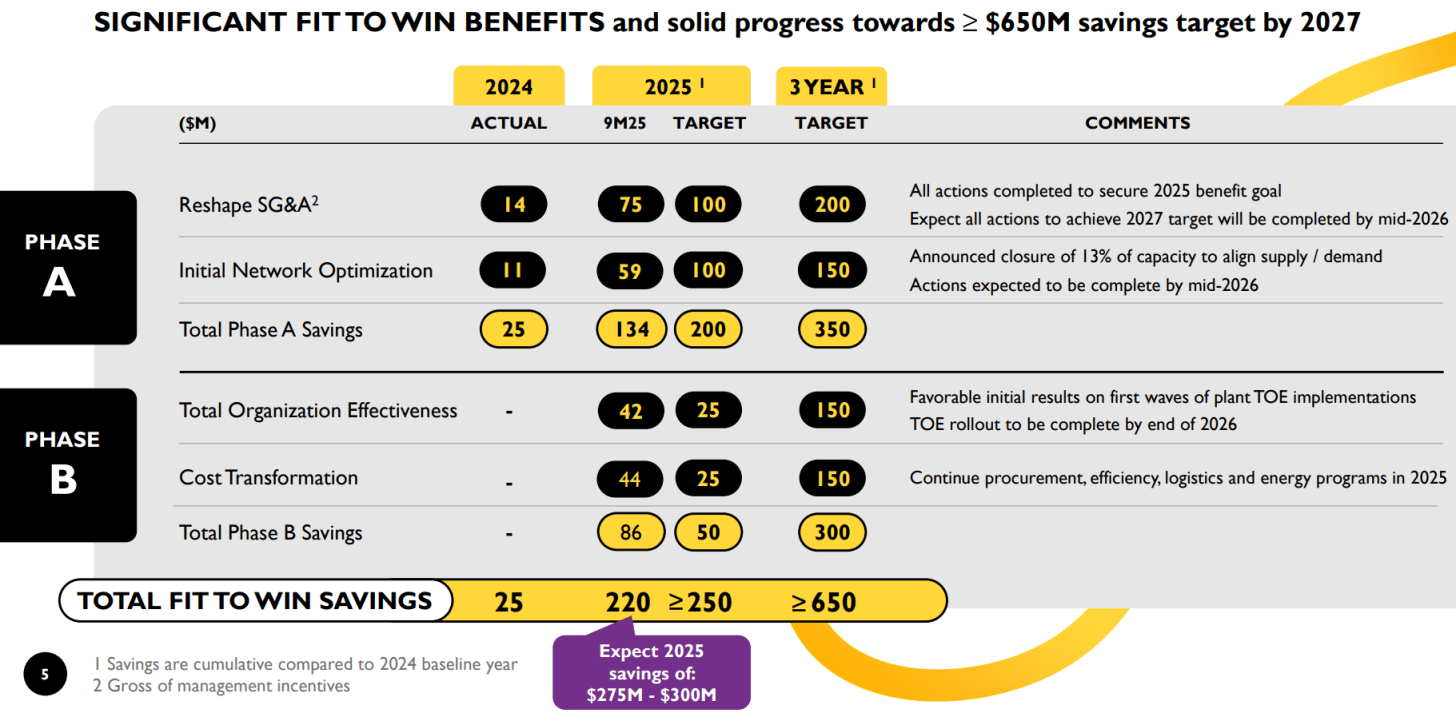

The program is structured around SG&A rationalization (Phase A, with $100 million already achieved) and manufacturing productivity improvements rolled out across approximately 30 plants (Phase B).

Management raised the FY’25 savings target to $275-300 million from an initial $250 million guide, and expects cumulative savings of $650 million+ by 2027. The company has closed 8% of production capacity year-to-date and plans to shutter an additional 5% by early 2026, with closures weighted toward the Americas.

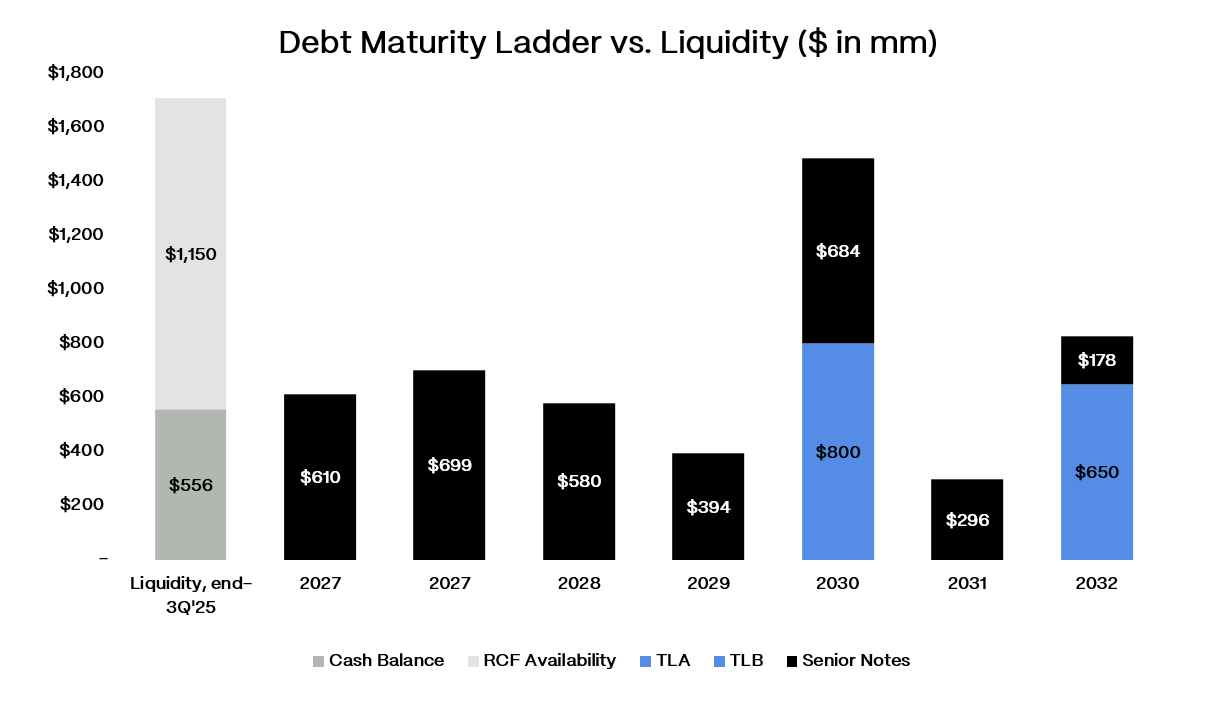

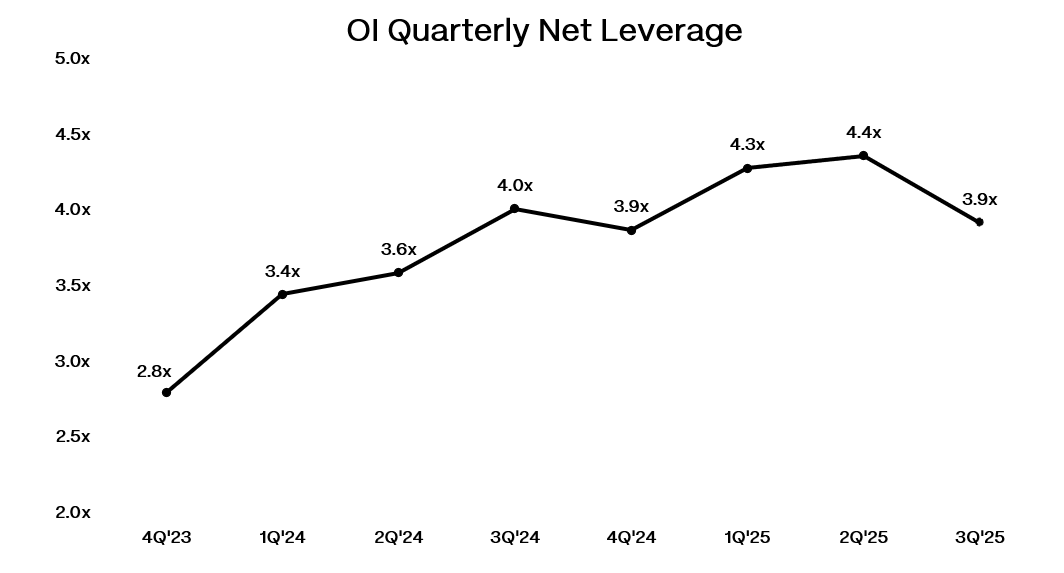

From a credit perspective, OI carries approximately $4.5 billion in net debt, translating to roughly 3.9x net leverage on LTM EBITDA of approximately $1.2 billion. The capital structure includes $3.4 billion of secured debt (term loans and secured notes rated Ba3/BB) and $1.6 billion of unsecured notes (rated B3/B+) maturing between 2027 and 2032.

Management is targeting deleveraging to the low-3x range by year-end 2026 and mid-2x by 2027, with near-term excess cash directed to debt reduction and potential shareholder returns only after leverage targets are met. FCF is guided at $150-200 million in 2025, depressed by restructuring charges, with expectations of improvement as one-time costs roll off.

2026 shapes up as an important test year. The company faces a roughly $150 million headwind from European energy hedge resets, and the plan assumes incremental F2W savings more than offset that drag. Major restructuring actions are expected to be completed by mid-2026, with EBITDA targeted to grow toward mid-$1.3 billion and eventually $1.5 billion+ by 2027.