High Yield Market Weekly Minutes: Labor Cracks, Inflation Sticks, and Credit Widens (November 10, 2025)

Spreads +15 bps, OAS near 300, and buyers are getting selective fast.

🚨 Connect on Twitter | Threads | Instagram | YouTube

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list — limited spots.

TL;DR

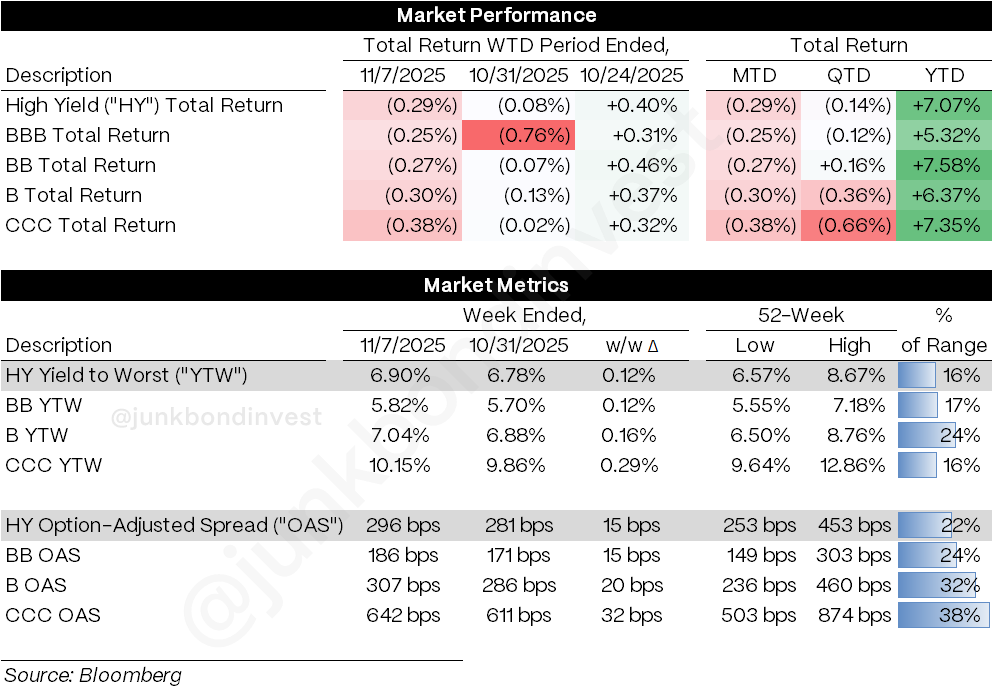

HY down -0.29% as inflation sticks and layoffs spread. Yields +12 bps to 6.90%, spreads +15 bps to +296. CCCs lag (-0.38%) as risk appetite fades. 11 deals for ~$9bn priced, led by Tenet, Cipher Compute, and Nielsen. Shutdown resolution near, but tone defensive heading into CPI and NFIB data.

The week began with faint optimism that October’s data would confirm a soft landing. Instead, it delivered another reminder that inflation is sticky and the labor market is cracking. Private indicators showed the largest monthly layoff total in over 15 years, led by Amazon and Target. ADP’s +42k headline gain did little to change the story. Official reports remained frozen as the government shutdown stretched past forty days, leaving investors to piece together an incomplete picture that looked increasingly fragile.

Markets traded risk-off. Equities slid, led by the Nasdaq’s steepest weekly drop since April. Credit followed. HY returns turned negative as spreads widened 15 bps and yields climbed to 6.90%. Treasuries moved only slightly, suggesting the repricing came from credit risk rather than rates. Even as spreads cracked the 295 area, new issuance surged to the highest level since September. Borrowers raced to lock in funding before volatility worsens, while investors proved willing to buy quality stories but not stretch for yield.

Weekly Performance Recap

Performance turned decisively negative, driven by rising default fear and weaker technicals. BBs lost roughly -0.27%, Bs -0.30%, and CCCs -0.38%. Spreads for BBs moved to +186, Bs to +307, and CCCs to +642. Higher-beta names carried the pain, with CCCs widening nearly 30 bps as liquidity dried up in riskier pockets. Duration and quality now dominate allocation decisions.

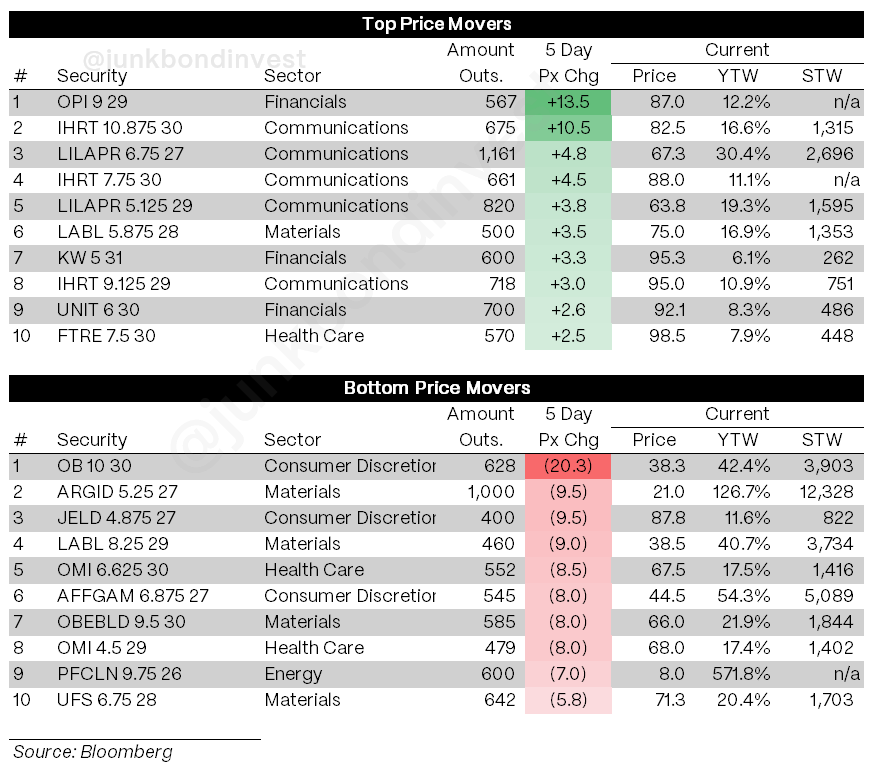

Sectors tracked the macro divide. Consumer and tech names underperformed after layoff headlines, while healthcare and utilities held steady. Autos were mixed. Building products weakened as margins compressed under tariff pressure. Energy stayed quiet into earnings.

Despite the widening, the market remains functional with normal trading volumes. The deterioration is structural, less conviction, not less liquidity.

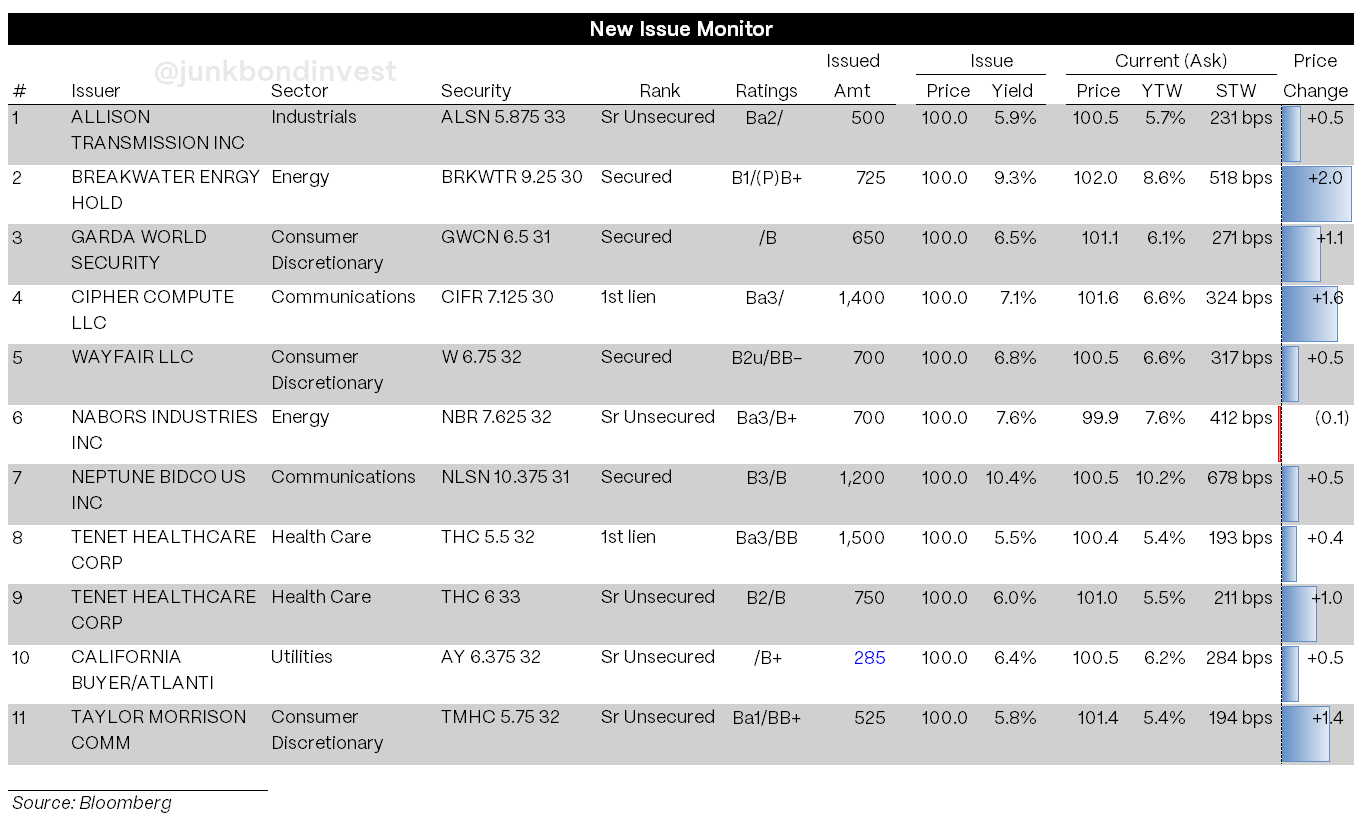

Primary Market Activity

The new issue tape was busy. Roughly $9bn printed across 11 deals, the heaviest week since September. Execution quality held up, with most transactions pricing through talk and trading above par. The calendar reflected both opportunistic refinancing and thematic new money issuance.

Tenet Healthcare set the pace with $2.25bn split across two tranches: $1.5bn 7NC3 first liens at 5.5% and $750mm 8NC3 seniors at 6.0%. Both priced at the tight end of talk and were upsized on strong demand. It was the tightest seven-year healthcare coupon since early 2022, signaling investors’ continued preference for scale, liquidity, and recurring cash flow.

Cipher Compute priced $1.4bn 5NC2 secured notes at 7.125%, tight of talk, to fund development of a Barber Lake data center. The deal followed TeraWulf’s green bond and demonstrated that AI-infrastructure adjacency still commands sponsorship, even when the underlying business is crypto-related.

The message: the market still rewards scale, transparency, and use-of-proceeds discipline. Quality paper trades fine; marginal stories pay for the privilege. AI, healthcare, and industrial names with hard collateral remain the sweet spot. Cyclicals and small caps face pushback.

Secondary Market

Trading was softer but orderly. The index fell -0.29% as spreads drifted wider each day with equities under pressure. Volumes held steady and bid-ask spreads remained contained, suggesting a measured de-risking. Communications and Media were standouts. Healthcare followed Tenet’s lead. Its legacy paper firmed 1-1.5 points and Bausch Health rose slightly into its investor day. Energy softened as crude prices pulled back. Refiners and LNG names saw modest profit-taking after strong October performance. Consumer and Retail saw uneven moves.

The week closed with the index yield near 7% and OAS just under 300 bps. Credit remains tight by long-term standards but clearly fatigued. Public markets are disciplined and liquid, repricing risk rationally rather than reactively.

Looking Ahead

A shutdown resolution finally looks imminent. Over the weekend, the President backed a bipartisan deal to reopen the government, with votes expected early this week. If passed, it would end the 41-day closure, restore economic releases, and give the Fed data to work with ahead of its late-month meeting. A brief relief rally could follow, though attention will quickly pivot to inflation and growth.

The macro data slate stays thin. Tuesday’s NFIB Small Business Optimism Index is expected around 98.2, down from 98.8, reflecting growing unease among small firms about tariffs and financing costs. Inflation pressures remain, while hiring and expansion plans soften. Combined with October’s private payroll stagnation and record layoffs, the backdrop points to a labor market losing traction but not yet breaking.

Earnings will keep driving dispersion.

Homebuilders will show if lower mortgage rates are reviving orders.

Building products names face questions about margin compression as tariffs inflate inputs.

Consumer finance issuers must prove loss curves are contained.

Media and tech will test the durability of AI-related spending against advertising softness.

With HY spreads near 300 bps, tight by long-term standards but meaningfully wider from the lows, the market sits in a fragile equilibrium. Rates have stopped falling, inflation data remain uncomfortable, and credit spreads are now reacting to fundamentals instead of ignoring them. Liquidity is sufficient to prevent disorder, but conviction is fading.

The near-term question is whether CCCs can stabilize. If low-quality paper tightens while higher-rated names hold steady, the market may have found its floor. If CCCs continue to drift wider, the next leg could test 350bps on the index. Duration and quality are outperforming; beta trades are being unwound quietly, not violently.

For now, public high yield remains open and orderly. Technicals still outweigh fundamentals, but that balance is shifting. The easy-money phase of 2025 is ending, and investors are finally pricing uncertainty instead of ignoring it.

This week’s test is simple. When official data return, they will either confirm that the Fed is out of room or that the market overreacted to headlines. Either way, 300 bps on OAS has become the new line in the sand.

Find the most recent JunkBondInvestor posts below

Disclosure: The information provided is based on publicly available information and is for informational purposes only. While every effort has been made to ensure the accuracy of the information, the author cannot guarantee its completeness or reliability. This content should not be considered investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release the author from any liability. Always seek professional advice tailored to your financial situation and objectives.