High Yield Market Weekly: Back to Business...HY Shrugs Off Volatility as Primary Market Delivers

$8.5bn Weekly Volume Proves Demand Remains Intact

🚨 Connect on Twitter | Threads | Instagram | Bluesky | Reddit

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list — limited spots.

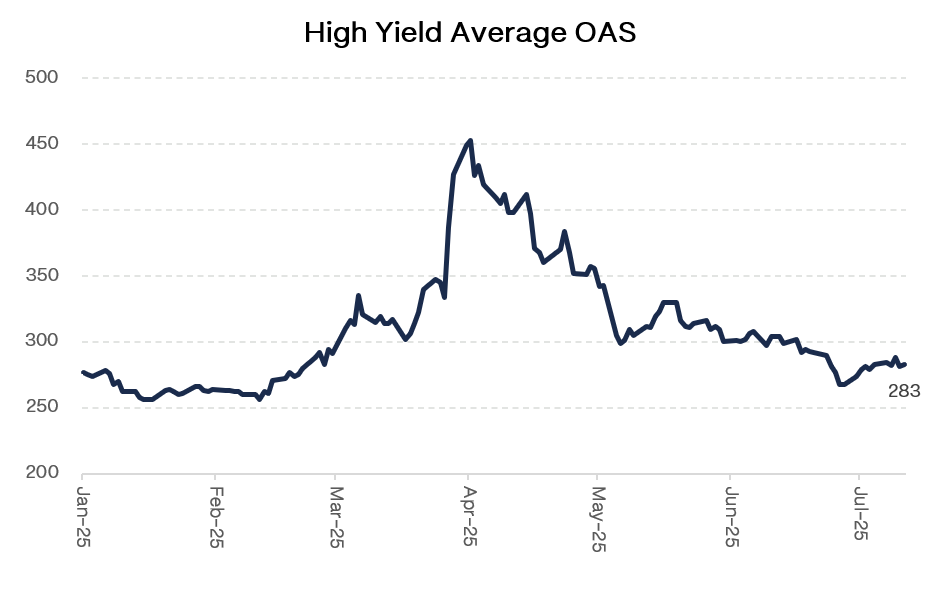

Just like that, we’re back. High yield rebounded +0.14% last week, shaking off the previous week’s rate-driven decline and proving once again that technical strength trumps temporary volatility. The market’s resilience was on full display as cooler-than-expected CPI (0.2% vs 0.3% forecast) and supportive PPI data helped stabilize Treasury yields, paving the way for risk assets to regain their footing.

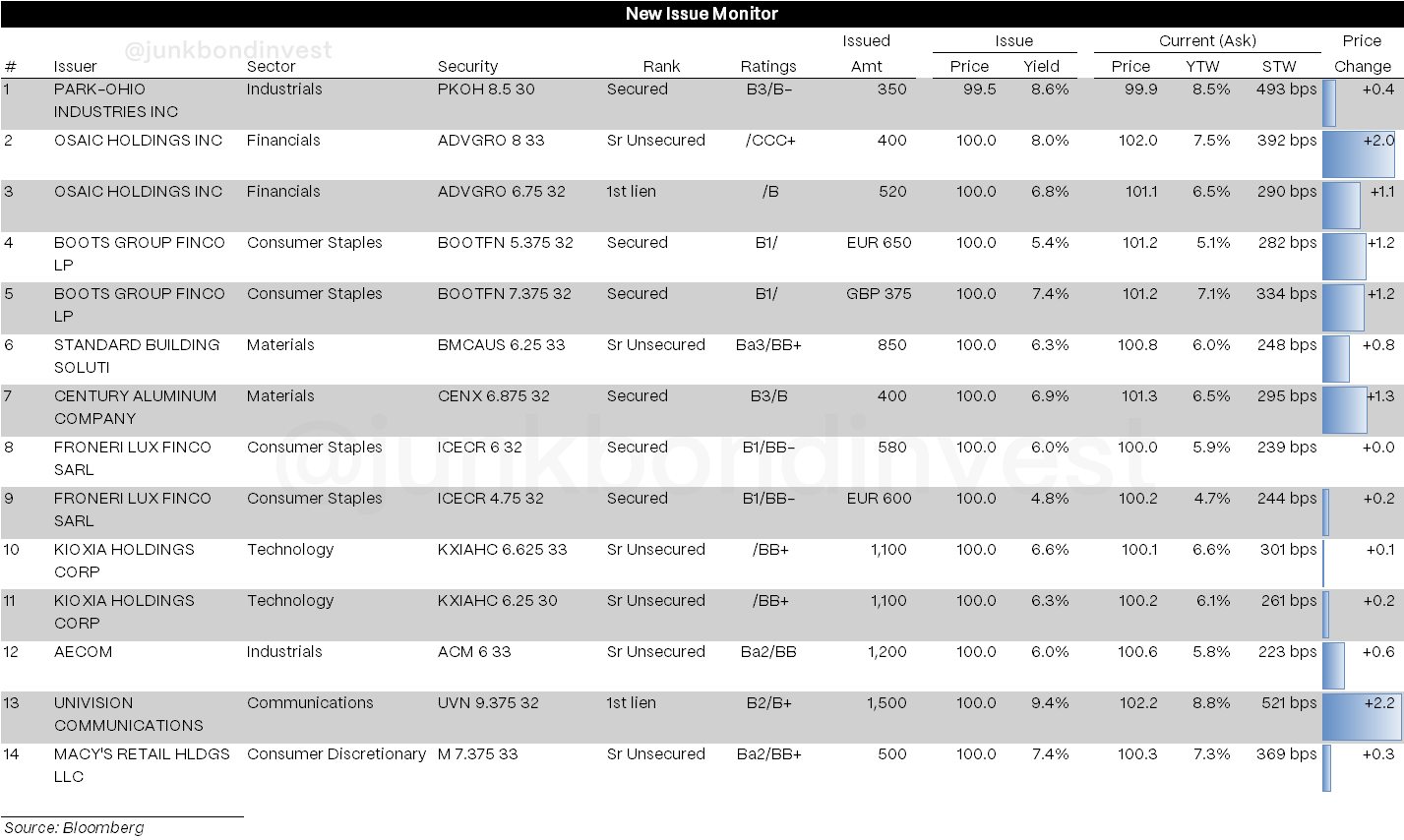

The primary market told the real story. Nine deals totaling $8.5 billion cleared with ease, bringing July’s issuance to over $20 billion. When Standard Industries can price $850 million at 6.25%, while Froneri executes a massive dividend deal at just 6.00%, you know demand remains robust despite recent jitters.

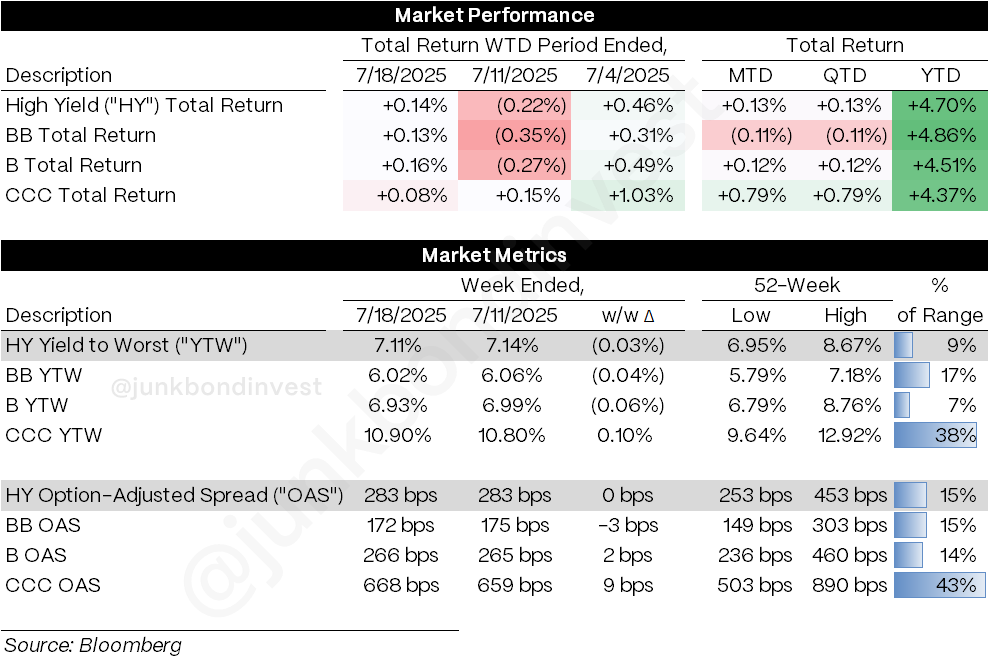

CCCs posted their weekly +0.08% gain but showed some technical divergence with spreads widening 9bps to 668bps and yields rising 10bps to 10.90%. Despite this, month-to-date CCCs still lead with +0.79% returns versus -0.11% for BBs, continuing the year’s risk-on theme.

The week’s volatility around Fed independence concerns proved to be nothing more than noise. Trump’s quick walk-back of Powell removal speculation reminded markets why fighting the technical backdrop remains a losing strategy. With the 11th inflow in 12 weeks, and primary execution consistently strong, the path of least resistance remains higher.

Weekly Performance Recap

The numbers reveal a market that’s learned to navigate volatility with confidence. HY gained +0.14%, marking seven wins in the last eight weeks

Bs led the charge at +0.16%, continuing their steady momentum throughout 2025

BBs followed at +0.13%, showing resilience despite rate sensitivity concerns

CCCs posted +0.08%, modest on a weekly basis but extending their monthly dominance to +0.79% MTD

The technical picture showed continued underlying strength:

Overall index yields declined 3bps to 7.11%, remaining near multi-year lows despite recent rate volatility

Spreads held remarkably steady with the index unchanged at 283bps—a sign of technical support when rates are moving

Rating-specific moves varied: BBs tightened 3bps to 172bps, Bs widened 2bps to 266bps, CCCs widened 9bps to 668bps

The mixed CCC signals warrant attention. While CCCs posted positive weekly returns (+0.08%), spreads widened and yields rose, suggesting total return was driven by carry rather than spread compression. The month-to-date leadership (+0.79%) continues, but the technical picture shows some differentiation from the pure risk-on narrative.

Primary Market Activity

The primary market fired on all cylinders, with nine deals (USD) totaling $8.5 billion—demonstrating continued issuer confidence and investor appetite:

Standard Industries dominated execution quality with $850 million of 8NC3 notes at 6.25%, upsizing by $350 million and pricing at the tight end of talk

Froneri’s cross-border dividend deal set the week’s tightest print at 6.00% for both $580 million USD and €600 million tranches, supporting a massive €4.4 billion dividend

Kioxia’s debut offering brought $2.2 billion across dual tranches (5NC2 and 8NC3) at the tight end of talk, notable for lacking Moody’s ratings but achieving BB+ at S&P

Univision’s refinancing cleared $1.5 billion at 9.375% (tight end of 9.50%-9.75% talk), addressing 2027 maturities

Osaic’s complex dual-tranche structure offered both secured ($520mm at 6.75%) and unsecured ($400mm at 8.00%) tranches, both pricing tight of talk

Execution quality remained exceptional. The ability to achieve consistent pricing at or inside guidance, frequent upsizing, and immediate secondary market stability suggests the technical bid remains intact despite recent rate volatility.

Secondary Market Dynamics

Secondary trading revealed clear sector preferences and continued technical strength:

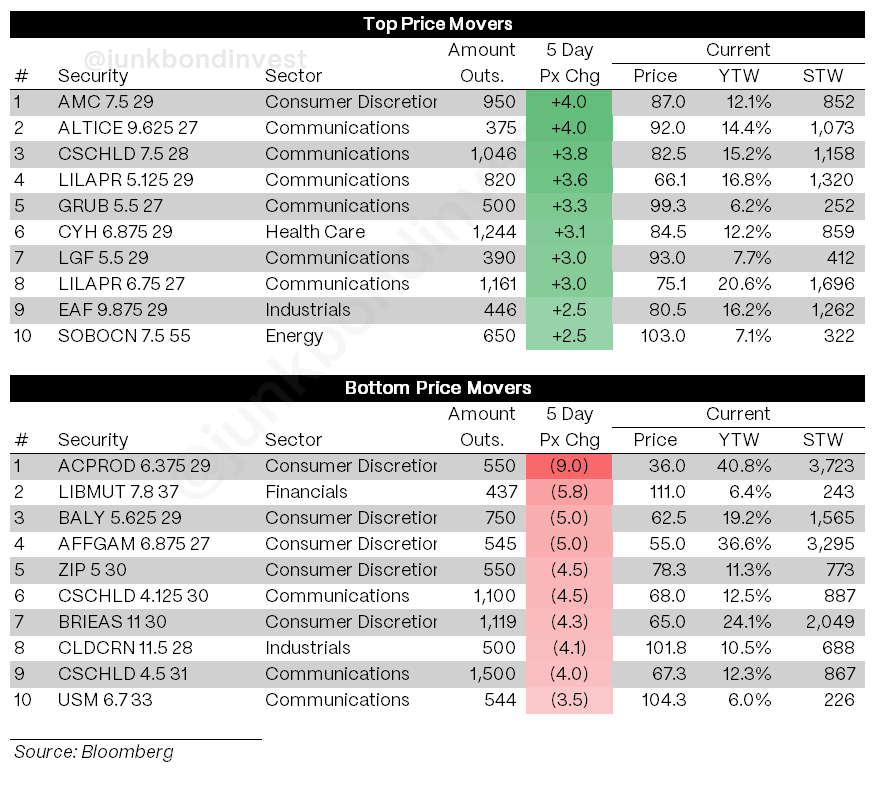

Top Performers:

Communications dominated the weekly leaderboard with AMC (+4.0pts), ALTICE (+4.0pts), and CSCHLD (+3.8pts) leading broad-based sector strength

Healthcare showed resilience with CYH (+3.1pts) continuing its recovery from earlier pressures

Energy maintained momentum with SOBOCN (+2.5pts) and other sector names finding support

Bottom Performers:

Consumer Discretionary faced selective pressure with ACPROD (-9.0pts) and BALY (-5.0pts) giving back recent gains amid consumer uncertainty

Financials saw modest weakness with some names retreating after strong recent performance

Communications showed dispersion with CSCHLD declining in some tranches despite overall sector strength

The sector rotation patterns suggest tactical positioning rather than fundamental concerns. When communications can post the strongest weekly performance while also appearing in the decliner list, it points to name-specific factors and active portfolio management rather than broad sector themes.

Looking Ahead

The setup for this week brings a lighter macro calendar but plenty of earnings catalysts that could determine whether the recent rebound has staying power. With PMIs Thursday and the FOMC meeting next week, this period offers a relatively quiet window for markets to digest recent moves.

Key developments to monitor:

Earnings season accelerates with multiple high-yield credits reporting, providing fundamental context for continued spread compression

Primary calendar expected to remain busy as issuers take advantage of receptive conditions following last week’s successful execution

Flow dynamics continue supporting technicals with the 11th inflow in 12 weeks suggesting institutional appetite remains strong

Fed independence concerns appear resolved after Trump’s quick clarification, removing a potential overhang

Most importantly, July’s ~$21 billion of issuance demonstrates that primary market momentum shows no signs of slowing. When issuers can consistently achieve favorable terms and investors continue absorbing large volumes, the technical backdrop remains powerfully supportive.

The flows data tells the positive story, with inflows marking the 11th positive week in the last 12. When institutional money continues flowing in at this pace, technical support remains robust despite periodic spread/yield volatility.

The week ahead tests whether this momentum can continue without major macro catalysts. Given the consistency of recent primary execution, continued inflows, and the market’s ability to navigate volatility spikes, the technical foundation appears solid for further gains.

The message from last week was clear: don’t fight the flow. When markets can rebound from rate-driven weakness while absorbing $8.5 billion of new supply, the path forward becomes increasingly obvious for those paying attention to what’s actually happening rather than what should be happening.

Find the most recent JunkBondInvestor posts below

Disclosure: The information provided is based on publicly available information and is for informational purposes only. While every effort has been made to ensure the accuracy of the information, the author cannot guarantee its completeness or reliability. This content should not be considered investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release the author from any liability. Always seek professional advice tailored to your financial situation and objectives.