Xerox Holdings ($XRX): The Office Dinosaur's Last Stand

A "reinvention" program can't hide the fact that nobody prints anymore

🚨 Connect: Twitter | Threads | Instagram | Bluesky | Reddit

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list (limited spots).

Quick, name the last company that sent you a fax.

Can’t do it, can you?

That’s because fax machines went extinct, and copy machines are next. Xerox built a $6 billion business on the radical idea that people would always need to make physical copies of digital documents. Turns out that was a terrible bet.

Last year’s revenues down 10%. Margins collapsing. Product launches botching. Their unsecureds now trade anywhere from 50-75 cents despite generating over half a billion in EBITDA. The market gets it. Management? Not so much.

But they're fighting back with checkbook therapy. $1.5 billion in acquisitions over 18 months. ITsavvy, Lexmark, and promises they’re now a “technology solutions company.” They just issued 13.5% second-lien notes (I’m not making this up) to fund the latest deal. They want to sell cloud services to the same customers who are canceling their copier leases.

The desperation is palpable.

Meanwhile, the unsecured notes yield 13-18%, pricing in distress for a business that’s not technically distressed. Yet.

So here’s the question: in a secularly declining business loaded with debt, where do you want to sit in the capital structure, if at all?

I. Situation Overview:

Xerox is stuck in the middle of a business model that worked great in 1985. What started as the company that invented photocopying has devolved into a leveraged rollup trying to convince investors that selling IT services to mid-market clients will somehow offset the secular decline of print.

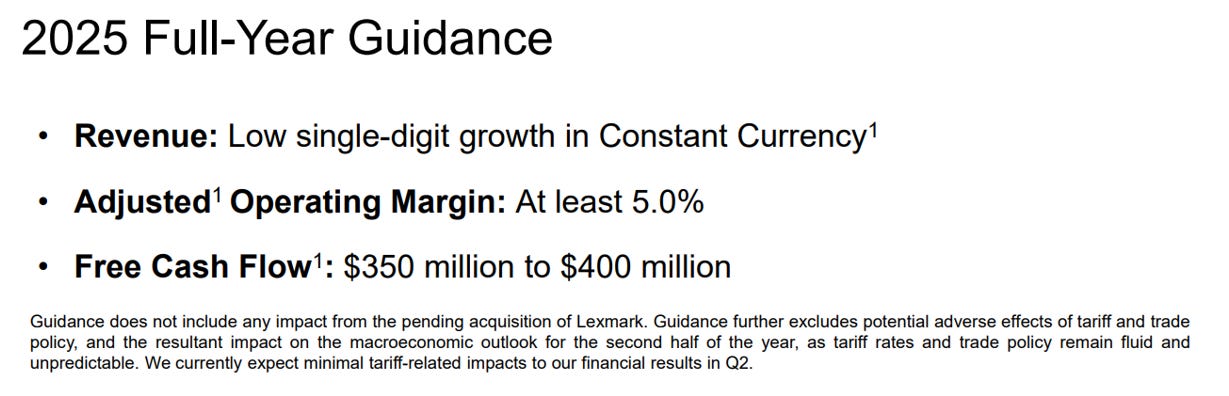

The numbers tell the story: revenues down -9.5% in 2024, gross margins compressed from 40% historically to 32%, and leverage sitting at 6x+ despite $700 million in “reinvention” cost saves. Management keeps talking about their three-year transformation plan, but after two years of organizational chaos, product launch delays, and sales force disruption, they’re still guiding to barely 5% operating margins.

Here’s the uncomfortable truth: people don’t print like they used to. The pandemic accelerated a shift that was already happening. Physical documents are going digital, hybrid work means fewer office printers, and AI is making document workflows even more electronic. Xerox’s core print business is declining at high single digits organically, and no amount of financial engineering changes that math.

Management’s answer? Acquire ITsavvy for $450 million and pivot to selling “Network as a Service” to the same mid-market clients who rent their copiers. The thesis sounds reasonable in PowerPoint: leverage existing relationships, expand wallet share, target a $700 billion IT services TAM growing at high single digits. You know the drill.

But execution has been messy. The sales force reorganization in 1Q’24 crushed productivity for months. Product launches got delayed because they couldn’t manage inventory transitions. Even with ITsavvy’s contribution, they’re still guiding to flat-to-declining organic revenue.

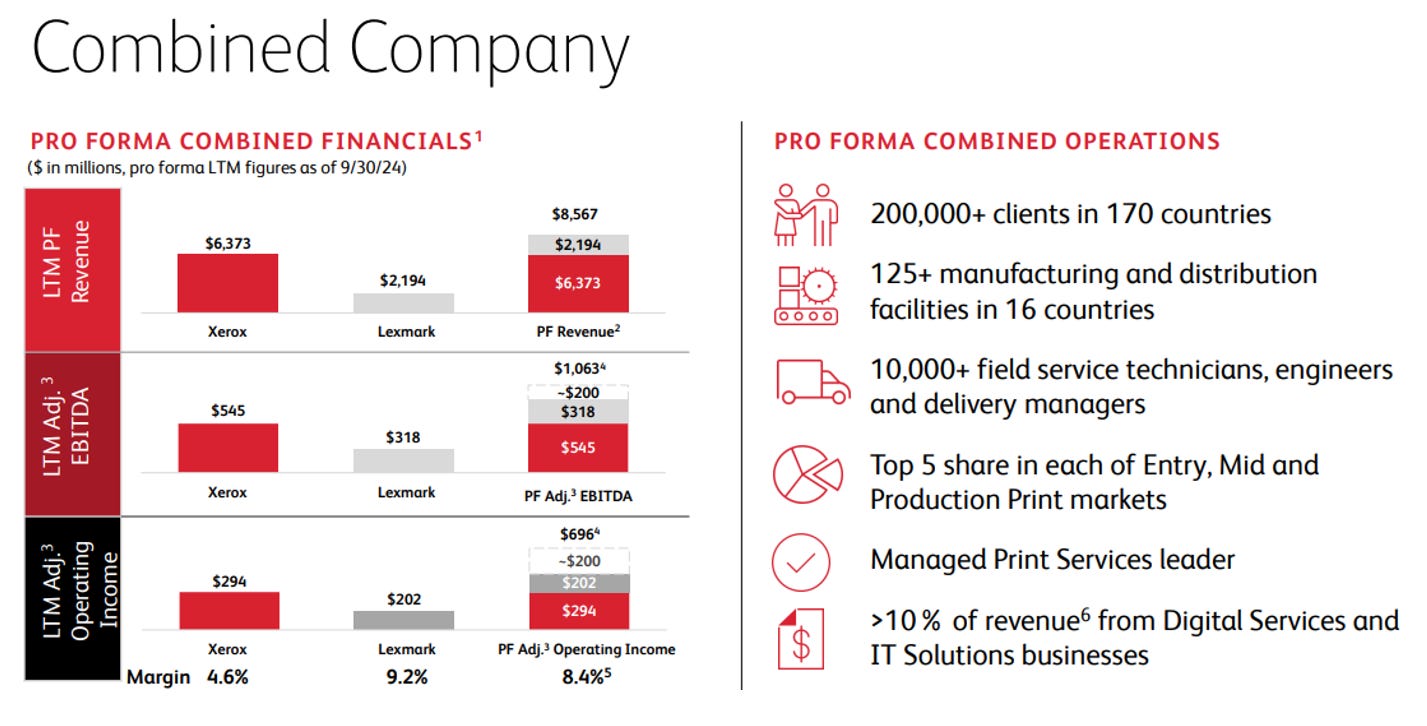

Now they’re doubling down with the $1.5 billion Lexmark acquisition, paying 4.8x EBITDA (pre-synergies) for a manufacturer that gives them vertical integration in A4 printers and exposure to growing Asian markets. Sounds amazing, right?

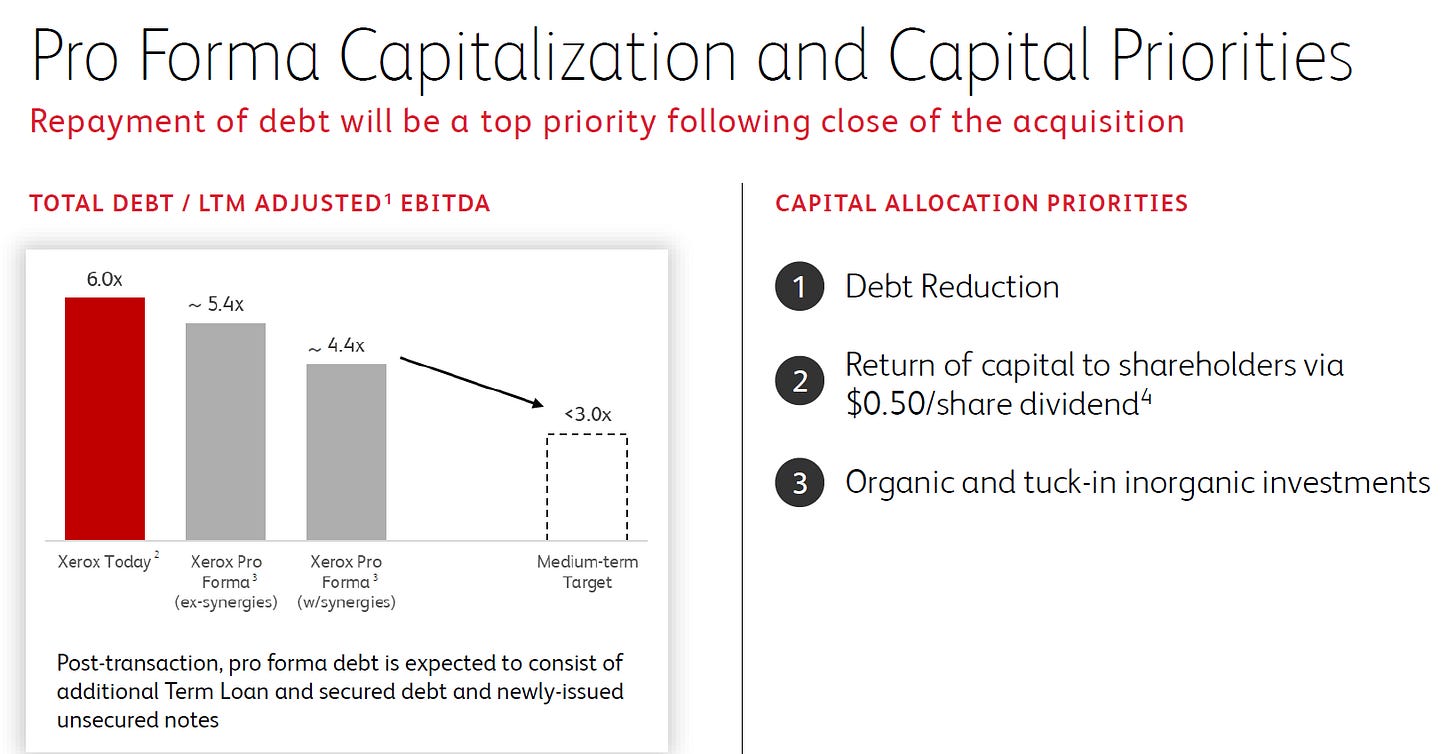

The deal is expected to close in 3Q’25 after receiving regulatory approvals, with Ninestar’s shareholder vote scheduled for June and Chinese securities exchange approvals expected shortly after. Pro forma levearge (ex-synergies) is expected to improve to ~5.4x with medium-term ambitions to get under 3.0x.

To nobody’s surprise, the deal financing was more expensive than expected. Xerox had to issue $400 million of 10.25% first-lien notes and $500 million of 13.5% second-lien notes after their equity cratered nearly 50% and unsecured bond yields spiked to 15%+, making the originally planned unsecured issuance impossible. They’ll also need $350+ million of incremental term loan (with existing Lexmark TLA lenders rolling into the new facility) and $250 million of 14% PIK-toggle notes to complete the financing—though there’s already drama with the $225 million private placement commitment that one lender is trying to exit (see below).

The underlying problem hasn’t changed however: Xerox operates in a secularly declining industry with high fixed costs, trying to transform into a services company while carrying +$4 billion of debt. Their “reinvention” has delivered cost cuts but hasn’t stabilized the revenue trajectory.