Monday Morning Minutes: HY Market Recap (September 2, 2024)

A Brief Recap of Last Week's High Yield Market Performance

🚨 Connect with me on Twitter / Instagram / Threads | Estimated Read Time: 4 Minutes

💡 Got a job post or credit pitch to share? I’m open to having you publish— drop me a message!

🚀 We’re expanding! Interested in part-time or internship opportunities? Get in touch!

Last week marked a quiet end to August in the high yield market, with no new primary issuances. Despite the lull in activity, the market continued its trend of tightening. As we wrap up this long holiday weekend, it’s time to prepare for what promises to be a busy fall season!

Weekly Performance Recap:

The high yield market concluded last week on a positive note, returning +0.20% for the week ended August 30, 2024. While this performance is more modest compared to prior weeks’ returns, it contributes to the broader positive trend we’ve seen recently in the high yield space. High yield bond yields remained flat while spreads tightened modestly last week by 7bps to 305bps. High yield spreads are well inside the August wides and yields are near the lowest levels since June 2022.

Breaking down performance by rating category, we see that CCCs led the pack with returns of +0.40% for the week, outpacing both Bs (+0.21%) and BBs (+0.17%). This outperformance of lower-rated credits suggests a continued risk-on sentiment in the market, with investors reaching for yield in the more speculative segments of the high yield universe.

The strong performance of the high yield market in August is particularly noteworthy. The high yield index is up +1.63% for the month, with CCCs (+1.95%) similarly outperforming BBs (+1.58%) and Bs (+1.52%). YTD, the high yield index has delivered an impressive +6.28% return, with CCCs (+7.91%) continuing to lead BBs (+5.70%) and Bs (+5.80%).

Underpinning this performance has been the US economy which continues to balance moderating inflation with robust growth. July’s core PCE price index rose a modest 0.16% m/m, with the 3-month annualized rate at 1.7%, indicating progress on inflation. Consumer spending remains strong, with real spending up 0.4% in July, leading to upward revisions in Q3 GDP and consumer spending forecasts.

However, business activity presents a mixed picture. Business equipment shipments have softened, and surveys indicate caution in the corporate sector. The labor market is showing signs of cooling, with business demand for labor moderating. The personal saving rate’s decline to 2.9% is also a potential concern, as it could constrain future spending if labor conditions worsen.

Powell’s recent comments suggest a potential shift towards a more neutral policy stance, with speculation about a rate cut as soon as September. The August jobs report next Friday could be decisive in determining the Fed’s next move, with implications for both monetary policy and market dynamics.

Primary Market:

The primary market was quiet last week, with no new high yield bond issues priced. This lack of activity contrasts with the previous week, which saw one $300 million US primary deal. The absence of new issues is not unusual for the final week of August, as many market participants are typically away ahead of the Labor Day holiday.

Despite the quiet week, August issuance totaled $19.6 billion, nearly matching the $19.7 billion seen in July. This robust issuance activity, even in a traditionally slow month, underscores the continued strength and attractiveness of the high yield market.

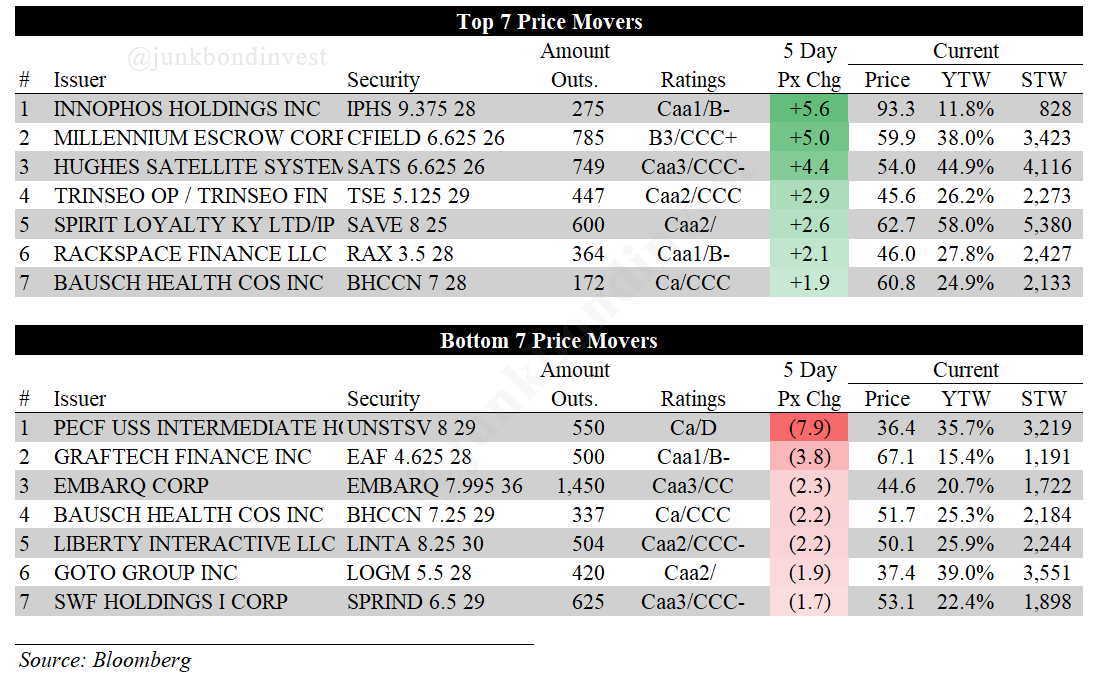

Secondary Market:

United Site Services made headlines with its liability management exercise (LME) announcement. The company closed a series of financing transactions, raising $300 million in new liquidity, amending covenants, capturing a $154 million discount on debt, extending maturities, and issuing approximately $2.2 billion in new secured debt through a new subsidiary to refinance existing term loans and notes.

Find the most recent JunkBondInvestor posts belo

Disclosure: The information provided is for informational purposes only and should not be considered as investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release me from any liability. Seek professional advice tailored to your financial situation and objectives.