Battle for Braemar Hotels & Resorts: Reviewing $BHR's Cap Stack Amidst Activist Shake Up

Assessing What’s Next for Braemar and Its Investors

🚨 Connect with me on Twitter / Instagram / Threads | Estimated Read Time: 15 Minutes

💡 Got a credit long/short idea to share? I’m open to hearing your pitch and having you publish— drop me a message!

🚀 We’re expanding! Interested in part-time or internship opportunities? Get in touch!

This week, I’m looking into Braemar Hotels & Resorts Inc. (“BHR”). This REIT has several tranches of securities, including busted converts (low 90s context), semi-distressed preferred stock (~55-75 cents on the dollar), and common equity (<$250 million market cap).

What put this name on my radar was the recent involvement of an activist investor. Despite a nasty public campaign, the two parties settled last month in a bizarre transaction where BHR would finance the activist’s purchase of its own stock!

Anyways, I’ll examine the cap stack to see if anything looks interesting post settlement—whether it’s the converts, preferred, or equity.

Situation Overview:

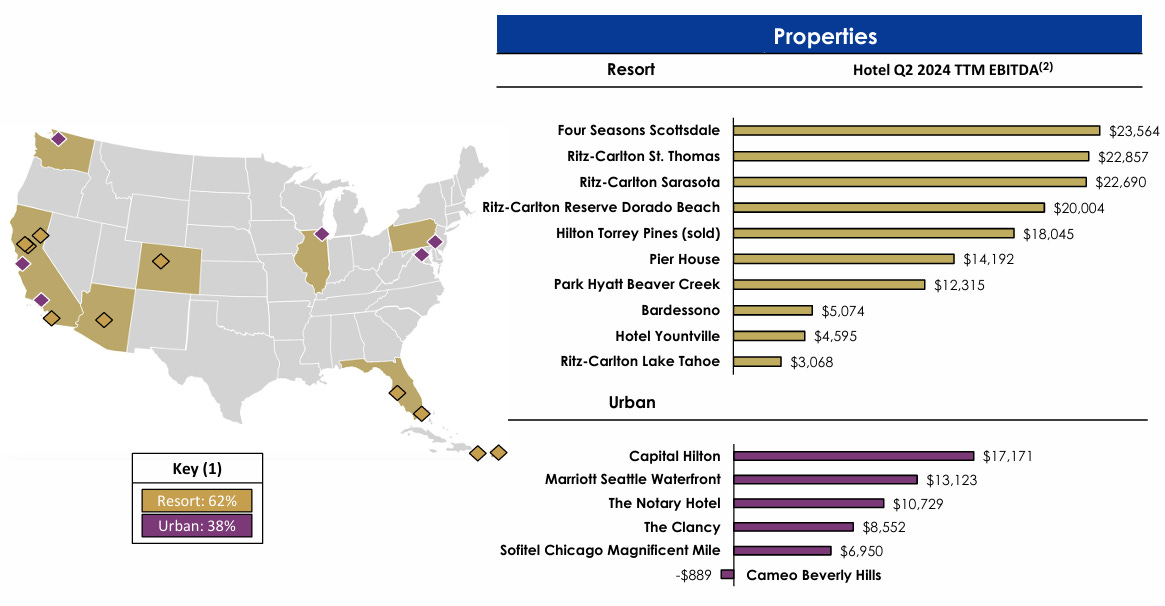

Founded in 2013 as a spin-off from Ashford Hospitality Trust, Braemar Hotels & Resorts Inc. (“BHR”) is a REIT focused on investing in luxury hotels and resorts. As of July 2024, BHR owned 15 hotel properties with a total of 3,667 rooms across 7 states. The company’s portfolio includes high-end brands such as Ritz-Carlton, Four Seasons, and Hilton (75%+ affiliated), with a strategy centered on owning properties with RevPAR at least 2x the US national average.

Portfolio Performance and Recent Results

Like many in the hospitality industry, BHR was significantly impacted by the COVID-19 pandemic, experiencing sharp declines in occupancy and RevPAR during 2020. However, the company’s focus on luxury and resort properties positioned it well for the subsequent recovery.

As travel restrictions eased and pent-up demand for high-end leisure experiences surged, BHR’s portfolio rebounded strongly. By Q2’24, the company’s RevPAR had not only recovered but substantially exceeded pre-pandemic levels, reaching $305 compared to $206 in 2019 (+48% increase). This recovery was primarily driven by robust ADR growth, which stood at $452 in Q2’24 versus $296 in 2019.

Notably, occupancy has lagged in its recovery, with Q2’24 levels at 67.5% compared to 78.9% in 2019. Management attributes this to a combination of changes in travel patterns, ongoing caution among some travelers, and strategic decisions to maintain higher rates at the expense of occupancy.

Despite the occupancy shortfall, the company’s RevPAR of $305 sits at the highest among publicly traded lodging REITs and well above the full-service peer average of $196. The company’s hotel EBITDA per key of $49,200 in FY’23 also surpassed peer averages of $35,700.

Capital Structure and Recent Refinancing Activity

Like many REITs, BHR has faced challenges from an elevated interest rate environment and high leverage. As of Q2’24, the company had $1.2 billion of debt outstanding at a blended average interest rate of 8.1%. Approximately 77% of the debt was effectively fixed through interest rate caps, with the remaining 23% floating. Net leverage stood at 46.4% of gross assets, above management’s 35.0% target but below the 55.0% covenant limit.

BHR has been proactive in addressing near-term maturities and improving its debt profile. In August 2024, the company closed on a significant $407 million refinancing involving five hotels. The new facility has a two-year initial term with three one-year extension options and bears interest at SOFR + 3.24%. This refinancing addressed several 2024 and 2025 maturities while extending the company’s weighted average maturity profile. As illustrated below, the company nonetheless has several large unaddressed maturities over the next couple of years.

Asset Sales and Portfolio Optimization

As part of its efforts to optimize its portfolio and strengthen its balance sheet, BHR has strategically sold assets. Most recently, in July 2024, the company completed the sale of the Hilton La Jolla Torrey Pines for $165 million ($419,000 per key). The transaction represented a 11.9x LTM EBITDA / 7.2% all-in cap rate and allowed BHR to address its last remaining 2024 debt maturity.

Management has indicated it is evaluating the potential sale of two additional properties, targeting completion in 2024 and 2025. These dispositions are expected to further improve the company’s leverage profile and potentially fund high-ROI capital projects or opportunistic share repurchases.

Activist Battle and Resolution

Here’s where it gets interesting. Despite the company’s high quality asset base and decent operational performance vs. peers, the company’s share price has been an absolute disaster. Since inception, BHR has returned -73% (including dividends), translating to an -11.7% annualized return!

Unsurprisingly, BHR has drawn considerable attention from activist investors due to the company’s share price underperformance. Recently, Blackwells Capital disclosed its stake in Braemar and began advocating for strategic changes, including a potential sale or other measures to enhance shareholder value.

This culminated in a heated proxy contest in 2024, with Blackwells Capital challenging BHR. Despite initially holding only a small stake, Blackwells sought to replace half of BHR’s 8-member board and raised concerns about the advisory agreement between BHR and Ashford Inc. The activist campaign also involved public criticism of BHR’s long-time Chairman Monty Bennett and allegations of conflicts of interest. The proxy battle escalated with BHR filing a lawsuit to block Blackwells’ board nominations, claiming violations of company bylaws and SEC rules.

Things took a turn on July 2, 2024, however, when the two sides conceded and reached a settlement agreement. The key terms of the settlement included:

Blackwells agreed to withdraw its director nominations and cease its proxy solicitation.

BHR committed to adding an independent director to its board with input from Blackwells.

Blackwells agreed to purchase 3.5 million shares of BHR stock, partially financed by the company.

Both parties agreed to dismiss pending litigation and refrain from public attacks.

What’s Next?

While BHR has made progress in addressing near-term maturities and resolving the activist situation, the company still faces challenges. Leverage remains elevated relative to management’s target, and the potential for further interest rate increases poses a risk given the amount of floating-rate debt. The success of planned asset sales and ability to drive RevPAR growth in a potentially softening economic environment will be crucial to BHR’s near-term performance.

However, the company’s luxury-focused portfolio and exposure to strong leisure markets provide some insulation against broader industry headwinds. Management’s ability to execute on its refinancing initiatives, portfolio optimization strategy, and operational improvements will be closely monitored by investors in the coming quarters.

In the next section, I’ll review the pro forma capitalization, financials, and evaluate if any part of the capital structure looks interesting.

Disclosure: The information provided is for informational purposes only and should not be considered as investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release me from any liability. Seek professional advice tailored to your financial situation and objectives.