Monday Morning Minutes: HY Market Recap (September 9, 2024)

A Brief Recap of Last Week's High Yield Market Performance

🚨 Connect with me on Twitter / Instagram / Threads | Estimated Read Time: 6 Minutes

💡 Got a job post or credit pitch to share? I’m open to having you publish— drop me a message!

🚀 We’re expanding! Interested in part-time or internship opportunities? Get in touch!

The high yield market is officially back! Robust primary issuance set the tone for the week, with deal flow surging to levels not seen since late 2021. Amidst broader market volatility, CCCs emerged as the standout performers, significantly outpacing higher-rated counterparts (remember when everyone was “moving up in quality” last year?) This outperformance was particularly pronounced in the telecommunications sector, which saw notable gains on the back of M&A speculation and debt restructuring news. Let’s dive in.

Weekly Performance Recap

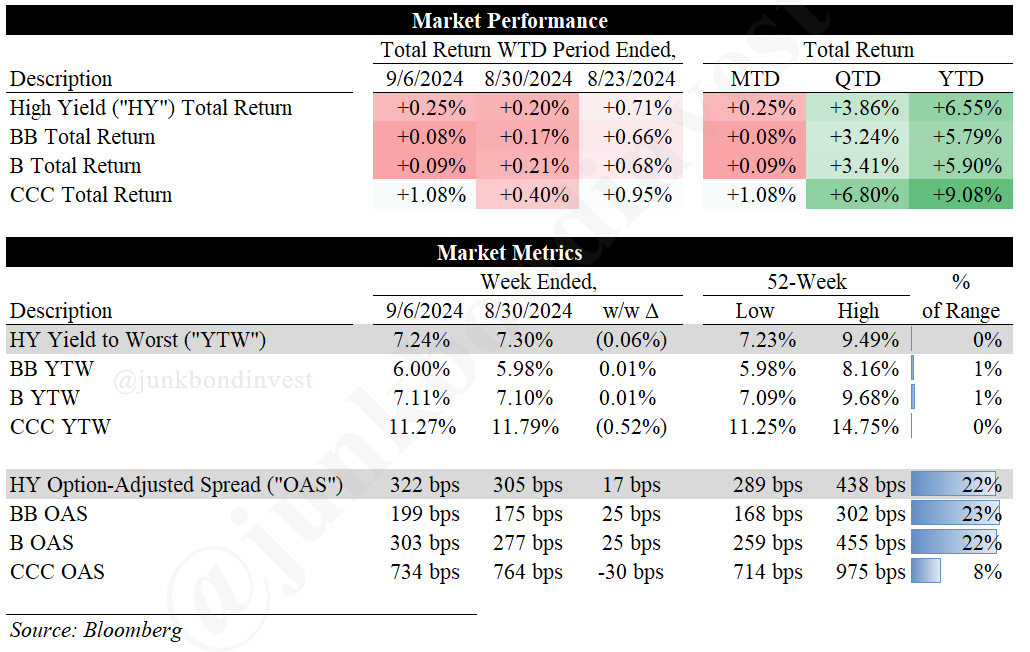

In a week marked by conflicting economic signals, the high yield (HY) market demonstrated remarkable resilience. The index closed the week ended September 6th up +0.25% despite credit spreads widening slightly to 322bps. Notably, the overall yield to worst (YTW) for the HY market declined 6bps to 7.24%, reaching its lowest level since June 2022. However, this compression was entirely driven by a rates rally as credit spreads widened modestly by 17bps. This dichotomy highlights the market’s struggle to reconcile dovish Fed expectations with concerns about economic growth.

Drilling down into rating categories reveals a nuanced picture:

BBs eked out a 0.08% return, pushing YTD performance to 5.79%

Bs also managed a modest 0.09% gain, with YTD returns now at 5.90%

CCCs outpaced their higher-rated counterparts, surging 1.08% and propelling YTD returns to an impressive 9.08%

The outperformance of CCCs is particularly striking, suggesting a growing appetite for risk among investors. However, this broad-brush view belies significant dispersion within the CCC space, with a stark divide between thriving and distressed credits.

Noteworthy Market Metrics:

Five US borrowers combined to sell over $4 billion on Thursday (9/5), marking the busiest session in four weeks. This surge in activity signals a strong return from the late-summer lull.

CCC spreads tightened by 30 bps, the most significant weekly compression since March 2024.

Energy sector bonds lead YTD returns at 9.5%, outpacing the broader HY index by nearly 300 bps. The sector’s strong performance comes despite volatile oil prices.

Nearly two-fifths of HY bonds are now trading above par, compared to a quarter at the year’s outset, reflecting the strong rally in HY debt prices.

YTD total return for the HY market has reached 6.55%, outpacing investment-grade corporates by over 200 bps.

The yield gap between BB and CCC bonds narrowed to 535bps, its tightest level since November 2023.

Primary Market Activity

As expected, the post-Labor Day period witnessed a surge in issuance, with $7.6 billion priced across 11 tranches. This flurry of activity was fueled by a confluence of factors: cooling inflation data, softer-than-anticipated employment figures, and mounting expectations for Fed rate cuts. Consumer discretionary and industrial sectors dominated, accounting for over 60% of the total volume.

This robust issuance has catapulted YTD volumes to $207 billion, an 89% jump compared to the same period in 2023. Historically, September has been the busiest month for HY issuance, averaging >$30 billion over the last decade. Current trends suggest September 2024 could surpass this benchmark.

While refinancing activities constituted the majority of proceeds, there was a notable uptick in M&A and dividend recapitalization deals. This shift signals growing confidence among issuers and financial sponsors, despite economic uncertainties.

As we enter the traditionally busy fall issuance season, market participants are keeping a watchful eye on the upcoming FOMC meeting and potential volatility surrounding the November presidential election. Many issuers are accelerating their funding plans to capitalize on the current favorable conditions before any potential market disruptions.

Standout Transactions:

TransDigm Inc (Ba3/BB-) tapped the market for $1.5 billion of senior secured notes due 2033, priced at 6.0%. The proceeds, earmarked for a dividend recapitalization, underscore the company’s robust FCF generation.

MGM Resorts International (B1/BB-) upsized its offering to $850 million, pricing 6.125% senior unsecured notes due 2029 at par. The deal’s expansion and tight pricing reflect strong investor appetite for well-established leisure names.

Performance Food Group (B1/BB) successfully placed $1 billion of 6.125% senior unsecured notes due 2032 at par. The proceeds will finance the acquisition of Cheney Brothers, representing one of the larger M&A-driven transactions in recent memory.

Hilton Domestic Operating Company (Ba2/BB+) priced $1 billion of 5.875% senior unsecured notes due 2033 at par. The sub-6% coupon is a rarity in this year’s HY market, being only the third such instance.

Gulfport Energy (B3/BB-) capitalized on strong demand to upsize its offering to $650 million, pricing 6.750% senior notes due 2029 at par. The deal’s expansion reflects robust appetite for energy sector credits in the current environment.

Primary Market Insights:

New issue volume in 2024 is on pace to be the highest since 2021, currently 89% above the same period last year, reflecting favorable issuance conditions and strong investor demand.

The week’s new issue volume of $7.6 billion marks the highest total for this period since November 2021.

Non-refinancing transactions accounted for 46% of issuance, a significant uptick from earlier in the year.

An overwhelming 82% of deals (9 out of 11) were structured as drive-by offerings, highlighting issuers’ ability to swiftly capitalize on favorable market windows.

Investor demand remained discerning yet robust, with 4 deals tightening from initial price talk and 5 pricing in line with guidance.

Secondary Market Dynamics

The secondary market saw brisk activity as investors grappled with a slew of economic data releases. Of particular note were Wednesday’s ADP employment report and Friday’s nonfarm payroll figures, both of which came in below consensus expectations. These data points fueled speculation about potential rate cuts, driving a rally in treasuries but also prompting some spread widening as investors reassessed growth prospects. The dichotomy between rate expectations and credit concerns led to some unusual price action across the HY spectrum, particularly in the telecommunications sector.

Notable Movers:

Lumen Technologies (LUMN): Bonds rallied on the announcement of exchange offers for new super-priority 10% senior secured notes.

CSC Holdings (ATUS): Altice USA’s bonds gained ground following Verizon’s $20 billion bid for Frontier Communications, sparking speculation about further telecom sector consolidation.

Uniti Group (UNIT): Bonds surged ahead of the proposed merger with Windstream. The 10.5% secured notes due 2028 touched a new high of 105.25, gaining 2.5 points over the week.

As we look ahead, market participants remain fixated on upcoming inflation data and the Federal Reserve’s next policy meeting. The tension between rate cut expectations and concerns about economic growth is likely to drive market volatility in the coming weeks, potentially creating both risks and opportunities for fixed income investors.

Find the most recent JunkBondInvestor posts below

Disclosure: The information provided is for informational purposes only and should not be considered as investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release me from any liability. Seek professional advice tailored to your financial situation and objectives.