Delivery Hero ($DHER): A "Busted" Convertible Bond Opportunity?

Analyzing the Risk-Reward of DHER's Convertible Bonds Amid a Push Towards Profitability

🚨 Connect on Twitter / Instagram / Threads 🚨 Read time below = 16 minutes 👇

💡 Got a job post or credit pitch to share? I’m open to having you publish— drop me a message!

🚀 We’re expanding! Interested in part-time or internship opportunities? Get in touch!

Situation Overview:

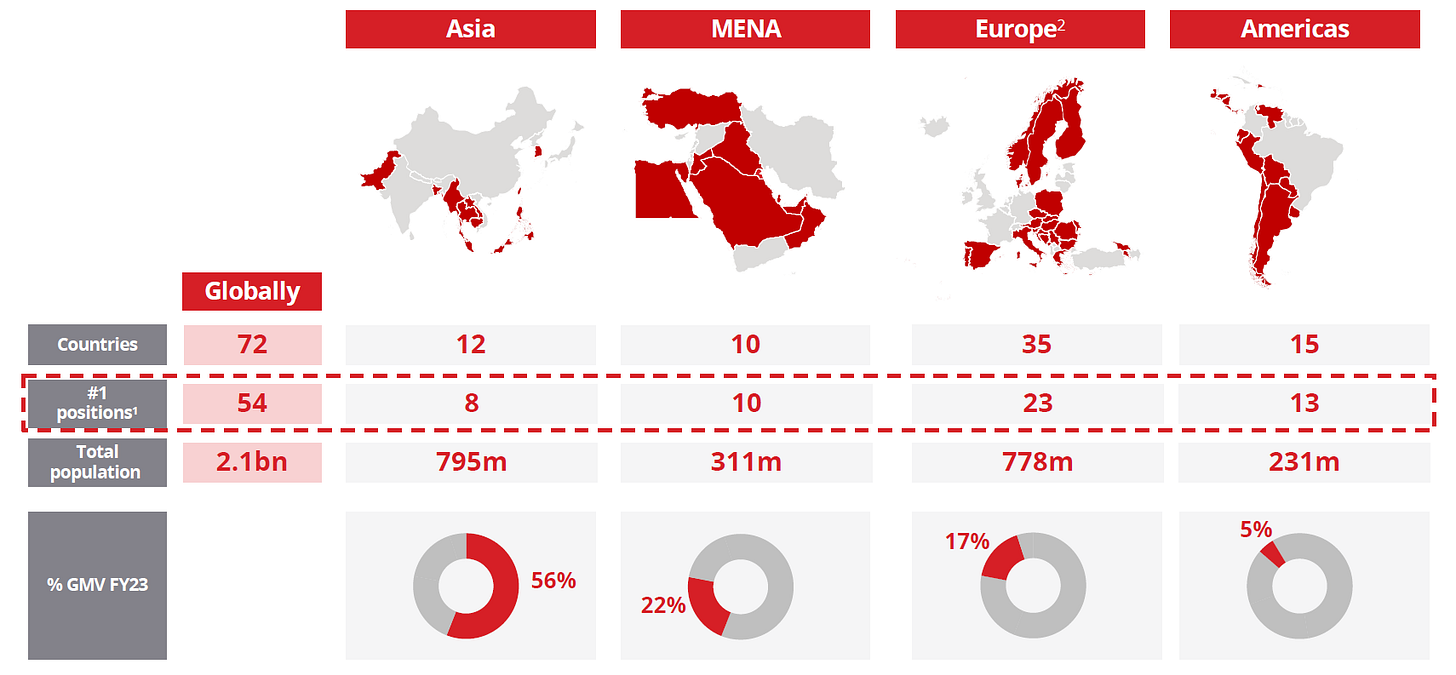

Founded in 2011 and headquartered in Germany, Delivery Hero SE (“DHER”) is a multinational online food delivery and quick commerce platform. DHER is one of the top 3 global food delivery companies (alongside DoorDash and Uber), operating in 70+ markets across Asia, the Middle East and North Africa (MENA), Europe, and Latin America. DHER’s business spans traditional restaurant delivery, quick commerce, and an emerging AdTech segment, with a #1 positions in quick commerce across MENA, Asia (ex-China), and South America (ex-Brazil). The company’s brand portfolio includes Foodpanda, Talabat, Baemin, and Glovo, among others.

Acquisition Strategy and Profitability Challenges:

Historically, DHER pursued an aggressive growth-at-all-costs strategy, fueled by significant M&A activity. Key acquisitions included the €5.7bn Woowa Brothers deal in 2021 and the €2.3bn Glovo acquisition in 2022.

Unfortunately, this approach also led to a staggering €2.8 billion cash burn since early 2021, leaving DHER saddled with a bloated balance sheet and operational complexities. Recently, the company has pivoted towards a more balanced approach, prioritizing profitability and cash flow generation. This shift appears to be bearing fruit, with recent results suggesting DHER may be nearing an inflection point: 1H’24 Adj. EBITDA reached €240 million, up from just €9 million in 1H’23, and FY’24 guidance projects €725-775 million in Adj. EBITDA and positive FCF.

Balance Sheet and Convertible Bonds:

DHER’s rapid expansion has been largely debt-fueled, resulting in a complex capital structure dominated by convertible bonds. As of June 2024, net leverage stood at a lofty 8.1x LTM Adj. EBITDA. However, management has shown a proactive approach to liability management, extending its term loan, retiring near-term converts at a discount, and better aligning its debt currency with revenue sources. The company’s converts, while not distressed, trade at notable discounts to par, reflecting both fallen equity valuations and the broader rise in rates.