HY Market Weekly Minutes: Primary Market Surges as Year-End Approaches (December 13, 2024)

A Brief Recap of Last Week's High Yield Market Performance

🚨 Connect with me on Twitter / Instagram / Threads / Bluesky | Estimated Read Time: 5 Minutes

🚀 We’re expanding! Interested in full-time or internship opportunities (Summer 2025)? Get in touch!

💡 Got a job post? I’m open to having you publish here—drop me a message!

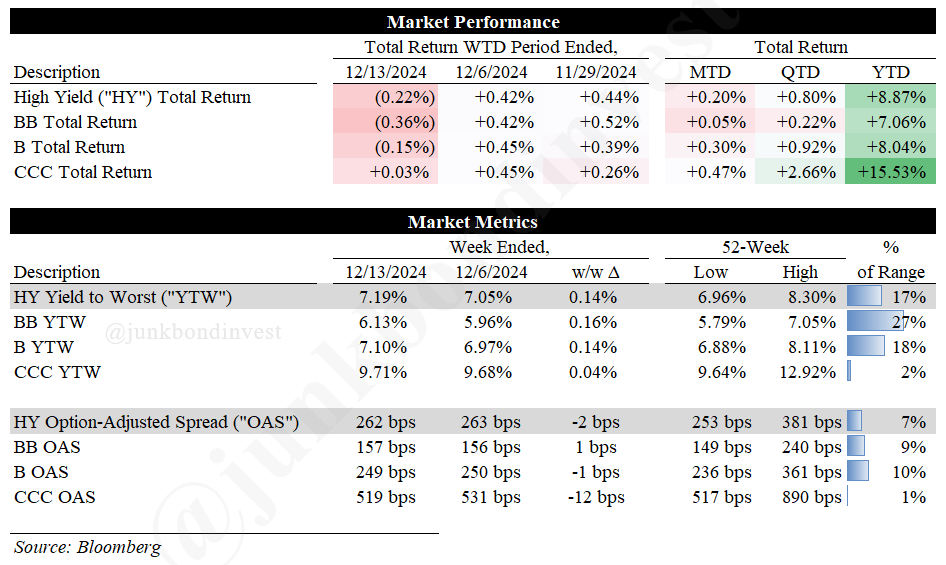

The high yield market took a modest step back last week amid robust primary market activity. Yields edged up 14bps to 7.19% while spreads tightened slightly to 262bps, resulting in a -0.22% weekly decline. High yield cash bonds generally traded down as market liquidity began to thin ahead of year-end. Nonetheless, the technical backdrop remained supportive, with $5.85 billion of new supply clearing the market across five distinct transactions.

What stood out wasn’t just the volume, but the quality of execution. Barnes Group $750 million LBO financing attracted orders approaching $4 billion, while Saks’ landmark $2.2 billion acquisition financing for Neiman Marcus demonstrated the market’s appetite for size. Meanwhile, OneSky Flight’s inaugural $550 million offering drew an oversubscribed order book, underscoring persistent demand even as year-end approaches.

On the economic front, markets largely took November’s hotter-than-expected PPI print (+0.4% MoM) in stride. Rather than triggering inflation concerns, investors remained focused on the Fed’s upcoming meeting, where rate cut expectations have reached 93% according to Bloomberg.

Let’s dive in.

Weekly Performance Recap

The market’s first negative week after three consecutive gains saw varying performance across rating buckets:

BBs unsurprisingly led the decline at -0.36%, though maintaining solid YTD returns of +7.06%

Bs showed more stability, dipping just -0.15% with YTD gains of +8.04%

CCCs continued their outperformance, eking out a +0.03% gain and extending their impressive YTD return to +15.53%!

The yield picture reflects growing differentiation, with the index YTW rising to 7.19%. BB yields have pushed higher to 6.13%, while CCC yields remain relatively stable at 9.71%, suggesting investors are maintaining their risk appetite despite the broader market pause.

Primary Market Activity

Five distinct transactions totaling $5.85 billion highlighted last week’s robust primary calendar. Deal flow spanned both M&A and refinancing objectives, with particularly strong execution across the board.

Standout transactions included:

SFA Issuer LLC (Saks) placed $2.2 billion of B3-rated secured notes at 11.0% to support its Neiman Marcus acquisition

Windstream executed a $1.4 billion add-on to its existing paper at 103.75

GOAT HoldCo LLC (Barnes Group) priced $750 million of B2-rated secured notes at 6.8% backing its Apollo-sponsored LBO

Diebold Nixdorf completed a crucial $950 million post-bankruptcy refinancing yielding 7.75%, with proceeds refinancing its existing Exit Facility

Primary volume has now reached $277 billion year-to-date, significantly outpacing 2023’s $166 billion. December’s average yields have improved materially, dropping to 7.0% from November’s 7.9%.

Secondary Market Dynamics

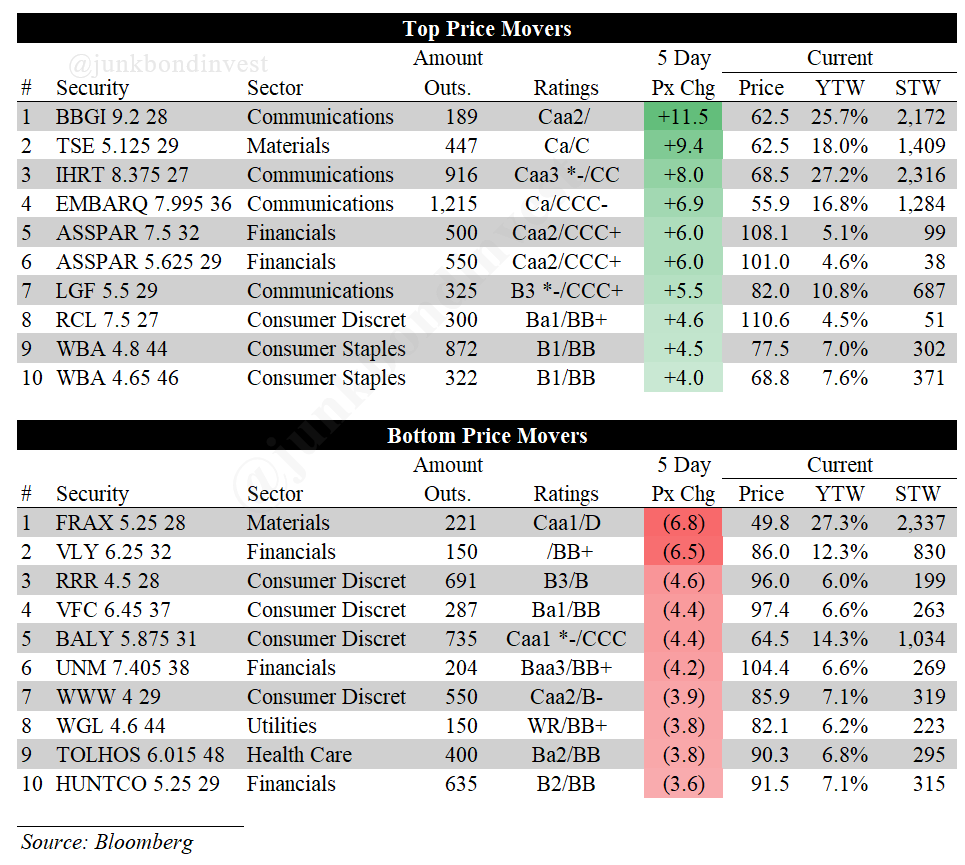

The secondary market saw dramatic moves last week, particularly in select sectors. The insurance broker sector saw notable strength after AssuredPartners announced acquisition details, with bonds surging 6-7 points on the news and lifting peer credits higher. Walgreens bonds experienced significant volatility following reports of Sycamore’s potential privatization bid. The long-end of the curve rallied 6-7 points while front-end paper declined about a point as investors debated the potential transaction structure.

New issues showed mixed performance in secondary trading. Diebold Nixdorf’s secured notes stood out, trading up 2.8 points to 102.8. However, Barnes Group’s LBO financing saw modest weakness, dipping 0.5 points below issue price despite strong initial demand.

Looking Ahead

The market faces a consequential week with the Fed’s final meeting of 2024 taking center stage. While a 25bp cut appears 93% priced, Powell’s comments on the 2025 rate path will be crucial for market sentiment. The dot plot revisions and updated economic projections could significantly impact Treasury yields, which have shown increased volatility in recent weeks. Wednesday’s stronger-than-expected core CPI print of 31bps suggests persistent inflation pressures, while this week’s data calendar is particularly heavy, with core PCE inflation, retail sales, and industrial production all providing important reads on the economy’s trajectory. The recent uptick in jobless claims to 242k adds another layer of complexity to the Fed’s deliberations.

The technical picture remains at an interesting crossroads heading into year-end. While primary market activity suggests robust demand, with spreads at multi-year tights of 262bps, mounting near-term challenges have emerged. Recent negative fund flows and record leveraged loan issuance suggest potential pressure on valuations, particularly given BB spreads of 157bps and CCC spreads of 519bps offer minimal cushion. Several key catalysts bear watching: a potential refinancing wave from over $100 billion in bonds trading near call prices, accelerating M&A activity, and the kickoff of Q4 earnings season. As year-end liquidity constraints take hold, the sustainability of these historically tight spread levels will likely depend on whether strong corporate fundamentals can continue to outweigh any macro uncertainties— from election-year dynamics to escalating geopolitical tensions.

Stay tuned.

Jobs in Credit:

💡 Have a job opening you’d like to share here? Shoot me a message.

Find the most recent JunkBondInvestor posts below

Disclosure: The information provided is based on publicly available information and is for informational purposes only. While every effort has been made to ensure the accuracy of the information, the author cannot guarantee its completeness or reliability. This content should not be considered investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release the author from any liability. Always seek professional advice tailored to your financial situation and objectives.