Superior Industries ($SUP): Anatomy of a Levered Equity Stub

Perfect Execution vs. Reality in Auto Supply

🚨 Connect with me on Twitter / Instagram / Threads / Bluesky | Estimated Read Time: 14 Minutes

🚀 We’re expanding! Interested in full-time or internship opportunities (Summer 2025)? Get in touch!

I recently posted a question on Twitter asking for levered equity stub ideas that could offer interesting convex upside.

Superior Industries, Inc. (“SUP”) caught my attention in particular. The company had been on my radar for some time given maturing bonds that had previously traded at stressed levels. However, a recent refinancing this August extended those maturities to 2028 and seemed to remove the immediate overhang. Despite buying breathing room through this refinancing, the stock now trades at $2.17/share—lower than pre-refinancing levels.

The combination of a successful liability management exercise, ongoing operational transformation in Europe, and depressed equity value makes this situation worth examining more closely. Let’s dig into what’s really happening at Superior.

Situation Overview

Headquartered in Southfield, Michigan, Superior Industries (“SUP”) manufactures aluminum wheels for global automotive OEMs through manufacturing facilities in North America and Europe.

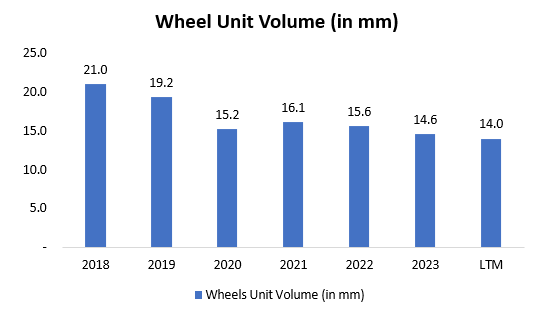

The company’s current form stems from its ill-timed 2017 acquisition of Uniwheels AG. The €715 million debt-funded deal, which included €250 million of Senior Notes and $150 million of preferred stock issued to TPG Growth, left Superior overleveraged just before multiple industry shocks (COVID, supply chain issues, semis shortages, etc.) hit the automotive sector. The company’s wheel volumes collapsed from over 20 million units pre-COVID to approximately 14 million currently, with light vehicle production in key markets still 15% below pre-COVID levels.