HY Market Weekly Minutes: Court Drama Meets Consumer Confidence...High Yield Rallies On Legal Victory (June 2, 2025)

A Brief Recap of Last Week's High Yield Market Performance

🚨 Connect on Reddit | Twitter | Threads | Instagram | Bluesky

Something new is coming.

Built for people who actually care about credit. If you want a first look before it opens up, join the early access list (limited spots)

Now that’s more like it.

High yield roared back with a +0.74% gain in the shortened holiday week as a federal court ruling against Liberation Day tariffs sent investors scrambling back into risk assets. The decision to halt duty collection within 10 days sent spreads tightening 16bps to 315bps and yields plummeting 24bps to 7.46%, effectively erasing most of the prior week’s tariff-induced damage. Even better, consumer confidence posted its biggest monthly surge in four years, jumping 12 points to 98.

The legal victory couldn’t have come at a better time. While the administration immediately appealed and secured a temporary pause on Thursday, the initial ruling reminded investors that not all tariff threats are created equal. The market seized on the uncertainty with both hands, driving CCCs to outperform once again as yield-chasing behavior returned with a vengeance. We’re now looking at five consecutive weeks of fund inflows totaling with this week adding to the momentum.

But here’s the kicker: the primary market barely slowed despite the holiday, with five deals pricing for $3.1 billion and making May the largest monthly total since September 2024. OneMain Finance expanded their transaction on investor enthusiasm, while New Flyer delivered one of the week’s strongest executions with pricing tightening significantly. When deals are getting that kind of reception during a court battle over tariffs, you know the technical bid is real.

The sector rotation tells the whole story. Auto spreads compressed as investors piled back into the most tariff-sensitive names. Meanwhile, communications names led the laggards as SATS continued its descent on coupon payment concerns and broader satellite sector weakness.

This week brings the real test with $8 billion in expected new issue volume and a packed economic calendar. Friday’s jobs report takes center stage amid signs the labor market is finally cooling, while ISM data will show whether the manufacturing sector can sustain its recent bounce. The tariff uncertainty isn’t going away, but for now, the legal system has given high yield exactly the breathing room it needed.

Weekly Performance Recap

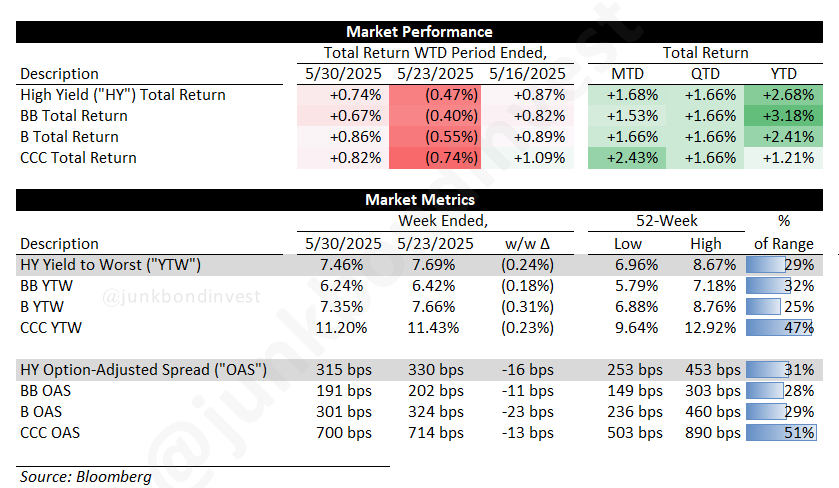

The numbers paint a picture of a market that’s regaining its footing. Overall HY returned +0.74% for the week, with broad-based strength across ratings buckets:

BBs gained +0.67%, pushing MTD returns to +1.53% and maintaining YTD leadership at +3.18%

Bs climbed +0.86%, recovering to +1.66% MTD and +2.41% YTD

CCCs also gained +0.82%, extending their recent outperformance with +2.43% MTD and +1.21% YTD

The overall picture showed meaningful improvement:

Index yields dropped 24bps to 7.46%, moving back to 29% of the 52-week range

Spreads tightened 16bps to 315bps, with all sectors participating in the compression

BB spreads narrowed to 191bps, while B spreads compressed to 301bps and CCCs tightened to 700bps

Most encouraging, the move was broad-based rather than concentrated in any single factor, suggesting genuine risk-on sentiment rather than just technical squeezes. The holiday-shortened week didn’t prevent meaningful price discovery, with Friday’s session capping a week where every rating category posted solid gains

Primary Market Activity

The primary market delivered impressive execution despite the abbreviated week, with five deals totaling $3.1 billion pricing ahead of the holiday weekend:

OneMain Finance’s $800 million senior unsecured deal started at 7.25% price talk, was upsized from $500 million, and priced at 7.125% before trading up on the break

New Flyer Group’s $600 million second lien bus manufacturing deal saw such strong demand that pricing walked in to 9.25% and traded up on the break

Civitas Resources priced $750 million of senior notes at attractive levels for the energy sector

Goodyear Tire brought $500 million of senior unsecured notes at 6.6%, showing continued appetite for consumer discretionary exposure

Cascades Inc completed a $400 million materials sector deal at 6.8%, rounding out a diverse week of issuance

The execution quality was remarkable: four of five deals priced at the tight end or inside of talk, with multiple upsizes demonstrating the strength of underlying demand. New issue volume in May reached ~$31 billion, making it the largest monthly total since September 2024 and setting up June for potentially strong activity.

Secondary Market Dynamics

The sector breakdown revealed the clear beneficiaries of tariff relief:

Consumer discretionary names led the charge, with multiple credits posting strong gains as tariff fears receded

Auto sector saw broad-based compression as Liberation Day relief drove spreads tighter across the board

Energy credits participated in the rally, with several names posting solid gains on improved sentiment

Communications faced continued headwinds, with SATS bonds among the week’s worst performers on coupon payment concerns

Technology names showed mixed performance, though overall sector sentiment improved

Top performers included SAGLEN (+8.3 points), NFE (+6.6 points), and ENCIAC (+6.5 points), while bottom performers were concentrated in communications with SATS and DISH leading the declines. The broad nature of the rally, with relatively few sector laggards, suggests underlying strength rather than just technical factors.

Looking Ahead

The legal victory has bought the market some time, but bigger tests lie ahead. While the Court of International Trade ruling temporarily halted Liberation Day tariffs, the administration’s appeal and Thursday’s pause show this battle is far from over. The case will move quickly through the appeals process, potentially reaching the Supreme Court, creating ongoing headline risk.

This week brings a critical economic calendar:

ISM Manufacturing Monday expected to edge up as trade tensions eased in May

JOLTS job openings Tuesday will test whether labor demand is truly cooling

ADP employment and ISM Services Thursday could show broader economic resilience

Friday’s payrolls report takes center stage, with expectations for just 125K jobs added amid growing hiring caution

The consumer backdrop adds complexity to the outlook. Consumer confidence surged 12.3 points to 98 in May, the biggest monthly gain in four years, as roughly half the survey responses came after the U.S.-China tariff agreement. However, the survey closed before the latest EU tariff escalation and court rulings, meaning June’s reading could tell a different story.

The housing market remains on ice with pending home sales slipping 6.3% in April and mortgage rates stuck near 7%. Durable goods orders also disappointed, falling 6.3% as core capital goods orders posted their largest decline in six months.

Primary issuance momentum is expected to accelerate this week. The robust pipeline suggests issuers are racing to take advantage of improved conditions before potential volatility returns.

Technical factors remain supportive with the fifth consecutive weekly inflow. Heavy June coupon and calendar-call season should provide additional technical support, even if secondary market sentiment faces challenges.

The key question isn’t whether high yield can handle continued legal uncertainty around tariffs, but whether the fundamental economic backdrop can support current valuations if growth continues to slow. For now, the court victory has given investors permission to focus on technicals rather than headlines, but that luxury may not last long.

Find the most recent JunkBondInvestor posts below

Disclosure: The information provided is based on publicly available information and is for informational purposes only. While every effort has been made to ensure the accuracy of the information, the author cannot guarantee its completeness or reliability. This content should not be considered investment advice. Any investment decisions made based on the information provided are at your own risk. It is essential to conduct your own research and consult a qualified financial advisor before making any investment decisions. Investing involves risks, and past performance is not indicative of future results. By using this information, you acknowledge that you are responsible for your own decisions and release the author from any liability. Always seek professional advice tailored to your financial situation and objectives.